In our busy lives, it is easy to miss paying a bill.

However, your lenders won’t accept excuses for why they you didn’t pay them as you agreed to do. For example, your bankcard company cannot make excuses for being late in paying the merchants where you made your purchases.

When you don’t pay, they still have to pay on your behalf.

Missed payments can have a severe impact on your credit scores. And lower credit scores will often penalize you with higher interest rates – which can end up costing you tens-of-thousands of dollars throughout your life.

So here are five strategies to help you build the best credit scores:

1. Never miss making a payment.

One of the best ways to establish a great credit history is to demonstrate that you can manage credit and pay all of your bills as agreed.

Late payments will likely cost you in penalties and can cause your interest rate to rise significantly.

But, when you miss an entire payment for the month, it will be reported in your credit history and can have a terrible impact on your credit.

So, even if it is only the minimum amount, make a promise to start paying every bill on time. You see, paying your bills as agreed shows that you’re trustworthy and diligent in paying off debts.

When you want to apply for new services, companies will want to do business with you. They will trust you to be a good customer and are more likely to offer you their best rates and lowest down payments. And, companies will want to hire you because you have demonstrated that you manage your finances well and will likely be a good manager of their resources.

Strategies to help you pay your bills on time:

- Set-up auto payments with your bank

- Use an online calendar to set-up alerts to remind you to make payments

- Schedule an email to be sent to you when a bill is due

2. Reduce your debt on “revolving credit” accounts.

You probably know that your credit scores are impacted by the amount of debt you owe.

You probably know that your credit scores are impacted by the amount of debt you owe.

But you may not know that when lenders consider doing business with you, they are going to analyze your utilization rate.

That’s just a fancy term that informs lenders how much debt you have vs. the amount of credit available to you.

For example, if you owe $5,000 on a credit card and have a credit limit of $10,000, you’ve used up 50% of your available credit. That means you would have a 50% utilization rate, which is very high and likely to hurt your credit scores.

Work on reducing to your debt so that you’re utilization rate is under 30% on all your revolving credit accounts. Ideally, you should only charge what you can pay in full each month which means you aren’t using credit to live beyond your means.

Steps to help you find credit cards with high utilization rates:

- Review the last credit card billing statement for each card

- Write down the credit card debt owed

- Find out what your credit limit is for each card

- Divide your credit card debt by your credit limit (and then multiply by 100)

- Calculate your utilization rate for each card, and identify any cards over 30%

3. Keep older credit card accounts active.

Some people make the mistake of closing old credit accounts simply because they aren’t using the accounts anymore.

Some people make the mistake of closing old credit accounts simply because they aren’t using the accounts anymore.

But older credit accounts with good history can actually help you build your scores over time.

Closing the account will mean that great credit history will get deleted after 10 years, which could actually drop your score.

So keep older, good credit accounts live.

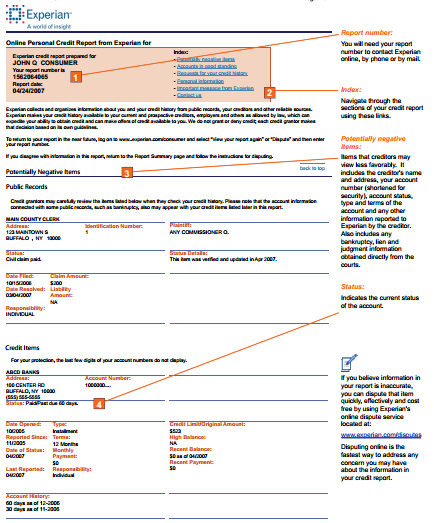

4. Audit your credit report to make sure it’s accurate.

Many people don’t realize that they are able to access their credit report for free from each credit bureau every year.

Many people don’t realize that they are able to access their credit report for free from each credit bureau every year.

This means you could pull your credit report every 4 months from a different bureau to look for signs of fraud.

It is important to review your credit report regularly to make sure your identifying information is correct so that all of your accounts can be correctly linked to you.

You also want to make sure your accounts are being reported correctly by your lenders.

How to get your free credit report and dispute any errors:

- Go to annualcreditreport.com and verify your identity by answering authentication questions to access your credit report for free. If you can’t pass authentication, you will be provided instructions on how to write.

- Review your credit report and look for any errors (accounts that do not belong to you, delinquent payments that were not late.)

- Dispute any errors as instructed and allow up to 30 days for the account to be verified with your lender

- If the lender changes the status of their account, they will also report the update to any other credit reporting company to which they provide their data.

5. Communicate directly with your lender

If you have a delinquent payment listed and you don’t agree that it was late, you may want to check directly you’re your lender to find out why their records do not agree with yours. If they have misapplied a payment, you may need to provide them proof of your payment.

Remember that your goal is not just to make sure that your credit report is accurate with Experian. You want to make sure that your information is correct with the source so that it won’t impact your terms with that lender and that it will be reported correctly by that lender to all who check your credit references.

It takes time to build a great credit history, and there are no shortcuts.

By following these five strategies, you can begin the process of building a great credit history, which will produce great credit scores.

Recommended Reading:

- How to Dispute Credit Report Information Easily

- 7 Stubborn Credit Score Myths & Misconceptions Debunked

- What You Should Know About Credit Repair Companies

>> Subscribe to the Experian Blog by Email for More Credit Tips

Photo: Shutterstock