Everyone seems to be keeping a closer eye on their finances these days and more people are becoming aware of how important it is to know what your credit report looks like.

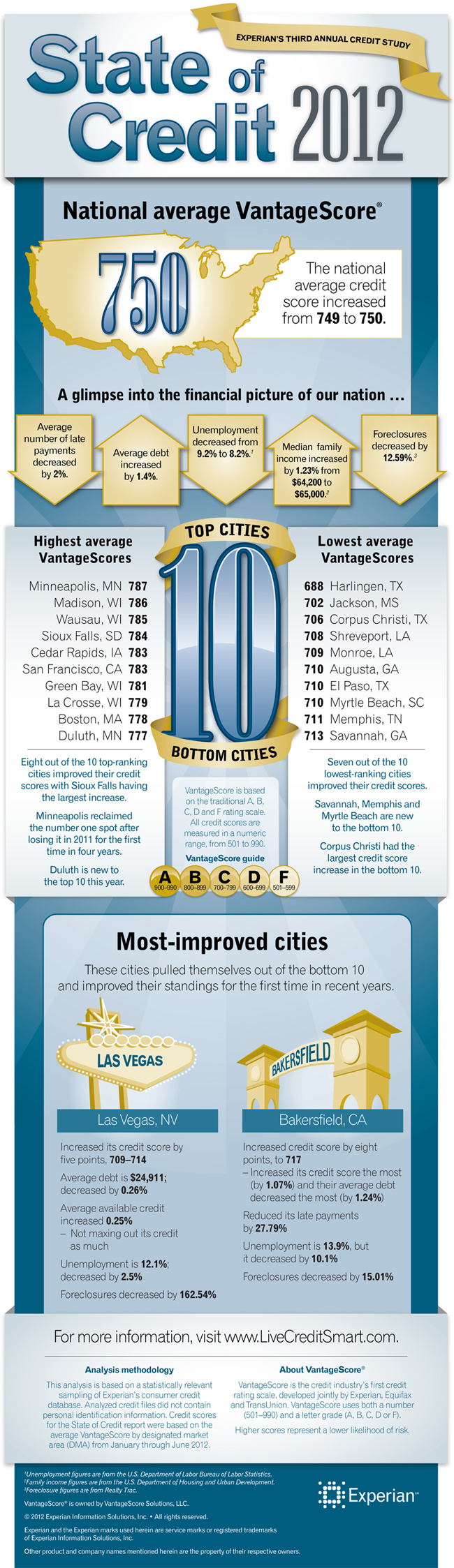

In the recently released Experian 2012 State of Credit report, we found that the national average credit score is currently 750, which is up one point from 2011.

We also crunched some numbers in more than 100 cities throughout the country and ranked the top 10 and bottom 10 cities according to credit score.

The infographic shown here reveals who came out on top (Minneapolis, MI) and bottom (Harlingen, TX) as well as everyone in between. There were also a few cities who are slowly, but surely pulling themselves up—those cities include Las Vegas and Bakersfield.

Credit scores can affect everything from your ability to open a credit card to determining your rates when buying a home or a car. Credit plays a key role in all of our lives and it’s never too late to start becoming more aware of the behaviors that influence your score.

Check out the full report to see where your city stands.