Tag: automotive

Read Moreio55 Button 2- Learn more Primary button Secondary button Related Posts

Just as looking in the rear view mirror can help you navigate your next move, looking into recent trends can serve as a guide to where the industry should head in the future.

With that in mind, let’s take a step back and look at some of the trends in the automotive industry that finished off 2014. After all, it’s the insights from these trends that enable dealers, manufacturers, aftermarket retailers and lenders to take the right action to uncover growth opportunities and improve profitability.

Just as looking in the rear view mirror can help you navigate your next move, looking into recent trends can serve as a guide to where the industry should head in the future.

With that in mind, let’s take a step back and look at some of the trends in the automotive industry that finished off 2014. After all, it’s the insights from these trends that enable dealers, manufacturers, aftermarket retailers and lenders to take the right action to uncover growth opportunities and improve profitability.

Just how loyal are consumers to a particular make or model of vehicle?

A new Experian Automotive study answers this question by highlighting the loyalty behavior of consumers who got rid of their previous vehicle to purchase a new one.

The analysis showed that, overall, Ford owners had the highest percentage of loyalty when returning to market, with 60.8 percent purchasing another Ford vehicle. Rounding out the top five makes with the highest percentages of loyal consumers were Toyota, Subaru, Kia and Lexus, with 59.1 percent, 57.7 percent, 57.2 percent and 55.9 percent returning to buy another vehicle of the same make.

Just how loyal are consumers to a particular make or model of vehicle?

A new Experian Automotive study answers this question by highlighting the loyalty behavior of consumers who got rid of their previous vehicle to purchase a new one.

The analysis showed that, overall, Ford owners had the highest percentage of loyalty when returning to market, with 60.8 percent purchasing another Ford vehicle. Rounding out the top five makes with the highest percentages of loyal consumers were Toyota, Subaru, Kia and Lexus, with 59.1 percent, 57.7 percent, 57.2 percent and 55.9 percent returning to buy another vehicle of the same make.

If you’ve driven a vehicle in the past few months, then you’ve most likely had to stop by your local gas station. And, if you’ve filled up the tank while you were there, then you’ve probably experienced the sensation of the corners of your mouth forming a smile as the price for a tank of gas of has been lower than usual for quite some time. With that said, has the consistent drop in gas prices done more than just make us smile? Has it enticed consumers to go back to the gas-guzzling, high-powered vehicles of the past?

Over the last few years, there has been a plethora of attention around hybrid and electric vehicles, from both consumers and media alike. Whether it’s due to the fact that consumers have become more environmentally conscience, or that fuel economy standards have begun to take shape, alternative-powered vehicles have steadily risen in popularity. But as the rest of the automotive industry continues to develop more fuel-efficient vehicles, can we expect this “green” car segment to keep growing?

In honor of Earth Day, Experian Automotive released findings from an analysis comparing electric and hybrid* vehicles. Findings from the analysis showed that in 2013, more than 45 percent of hybrid car buyers were 56 years old or older, while roughly 26 percent of electric car buyers were of the same age. The greater percentage (55 percent) of electric buyers were between the ages of 36 years old and 55 years old. Additionally, nearly 21 percent of consumers purchasing an electric car had an average household income of $175,000 or more. Conversely, only 12 percent of consumers purchasing a hybrid had an average household income of the same level.

Over the years, one of the lessons that I’ve learned is, to prepare for the future you must understand the past. The same lesson can and should be applied to the automotive industry. As manufacturers, aftermarket companies and retailers continue to move their businesses into 2014 and beyond, it is always beneficial to take a moment and assess what happened in years past. For example, according to Experian Automotive’s Quarterly Report: A look back at the 2013 automotive market share trends, the overall automotive market decreased slightly, with approximately 900,000 vehicles taken off the road from a year ago. Additionally, there were 98 million vehicles within the aftermarket “sweet spot” (vehicles between model years 2002-2008), which means a good number of opportunities (vehicles out of warranty) are available for aftermarket companies. However, with a shortage of model year 2009 vehicles due to low sales volumes, we can expect this number to decrease next year.

Experian’s State of Credit report recently highlighted the credit savviness of four generational groups, and showed how differently they manage their financial obligations. As you’d expect, there were several intriguing findings, so we extended the research to see how these same generational groups would differ when it comes to buying a vehicle. In a recent analysis of market trends in the automotive industry, Experian Automotive looked at vehicle registrations, and examined the car buying habits of Millennials (up to 32 years old), Generation X (33-48 years old), Baby Boomers (49-67 years old) and the Silent Generation (68-85 years old).

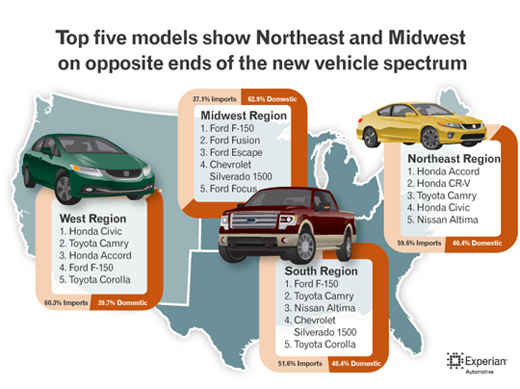

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.