The Small Business Credit Share is a “give-to-get” data consortium in which members provide more detailed data about the performance of the accounts in their portfolios. In exchange for expanded contribution, members get exclusive access to enriched information that is deeper in content than what is available to standard Experian clients or through competitive credit share programs. They benefit from the more comprehensive reports, business credit scores, attributes, and reporting that are available.

The Small Business Credit Share is open to all credit granting institutions, including financial institutions, companies that issue trade credit, telcos, utilities and others. The tradeline performance reporting from this broad swath of B2B companies helps drive the effectiveness of the products that are available to members. The Small Business Credit Share has firm qualification standards to insure consistent information and regular reporting guidelines are followed, to help protect the interests of all members.

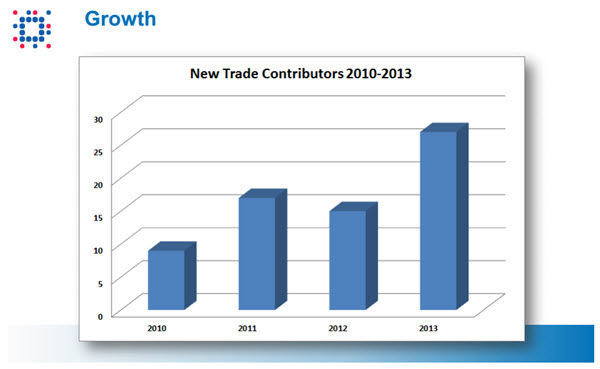

In the past two-plus years, there has been good growth in the member base of the Small Business Credit Share. While attracting new members from a variety of industries, there also continues to be growing interest from financial institutions who presently report to other data consortia about becoming Small Business Credit Share members.

Experian is working with them to highlight the advantages of reporting to multiple reporting agencies. In addition to increasing the likelihood that their interests will be protected if their customer’s obligations are more widely reported, they also give themselves more flexibility to manage the expense side of their operations. And when (not ‘if’) regulatory bodies shift their focus to the small business arena, some lenders are envisioning that broader reporting could become the rule. For example, the SBA is requiring that all SBA-backed loans be reported to commercial bureaus; whether that means to all commercial bureaus or to simply at least one is unclear. But the SBA’s rationale is clear: they want credit histories established for these companies so that SBA-backing should not be needed in the future.

There are some exciting new products in development for Small Business Credit Share participants. The first of these is the upcoming release of an additional set of attributes which have been developed based on consumer experience and which will add considerable insight for credit risk managers. To assess their information value, these attributes were overlaid into a proof-of-concept score. The resultant model showed a 22% lift in KS and a 29% increase the percent of ‘bads’ pushed into the bottom 10% of the score range. There is also an ongoing development effort to replace the current Small Business Credit Share acquisition score. The new score will clearly benefit from the availability of the new attributes, but will also benefit from being developed on a population booked over a 2-year span from a much more recent time period (Nov 2010 to Oct 2012). The new score will be a blended model, with a ‘commercial-only’ option for clients that do not want to consider any consumer data within the score. The model will also use bureau-leveled consumer attributes, which will allow the model to work not only with Experian consumer data, but with consumer data from Equifax and Trans Union as well.