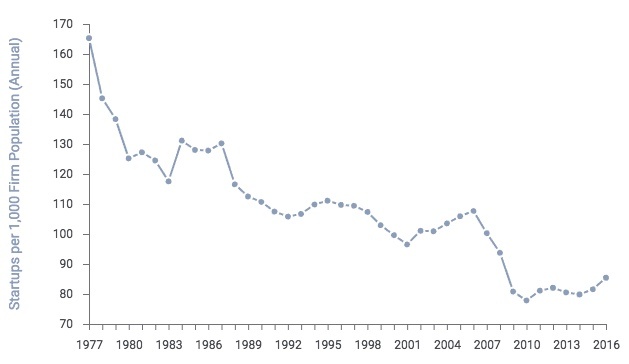

According to the Kauffman Foundation Index of Startup Activity, only 0.31 percent of U.S. adults ever starts a business. That’s 310 people out of every 100,000. That’s a shocking statistic for a country of 325 million people. In fact, new business starts have been in a slow, steady decline since the late 70’s.

Source: Kauffman Foundation

In 2015, just over 600,000 new businesses were established in the United States. These businesses created 3 million jobs, and because the average new business had roughly 4.5 employees, almost all fit the profile of an american small business.

In a July hearing by the House Committee on Small Business titled “Reversing the Entrepreneurship Decline“, Representative Steve Chabod of Ohio, and ranking member Nydia M. Velazquez of New York, along with members of the house panel, set out to understand why the number of startups is declining by hearing testimony from leading experts on the subject of entreprenurship to identify possible solutions.

The panel of experts included Dr. Gregory Crawford, President of Miami University’s Farmer’s School of Business, who told how Miami gets students involved with local startups by maintaining a permanent presence at Cintrifuse in Cincinnati. Cintrifuse is a start-up catalyst, a public/private partnership that exists to build a sustainable tech-based economy for the Greater Cincinnati region. Also, through the San Francisco Digital Innovation Program, which enables students to spend entire semestersliving in Silicon Valley. Four days a week, they are in an apprenticeship at a start-up. Like any nascent entrepreneur, they do everything from ideation to product development to cleaning up the office at the end of the day. It must be working, Forbes recently wrote an article titled “Why Ohio Is The Best State in America To Launch a Startup” featuring two Miami graduates who went on to found OROS Apparel.

Karen Kerrigan, President of the Small Business and Entrepreneurship Council cited several trends uncovered in a Gap Analysisstudy by SBE Chief Economist, Raymond J. Keating. The study found that over the course of the last decade, the economy has developed a gap of roughly 3.7 million businesses, businesses which would have existed, if only people had started them.

Joe Schocken, CEO of Broadmart Capital spoke about the effects of globalization and automation. The economy is struggling to absorb the impacts of automation and globalization, and now sees companies disappearing at a faster rate than new companies are forming.A recent study by Forrester Research projects that automation and robotics will displace nearly 25 million jobs, or 17 percent of the workforce by 2027, and cause a net job loss of 9.8 million.

During her opening remarks, Representative Velazques pointed out “in New York,nearly half the small businesses are owned by immigrants, and nationally, immigrants make up approximately 30 percent of new entrepreneurs.” Nationally, more than half of the startups valued at $1 billion or more were founded by immigrants, and more needs to be done to foster entrepreneurship

Access to capital was a constant during this hearing, being mentioned several times as a leading barrier to success in stimulating growth in startup creation. New businesses must spend a great deal of time and energy on finding capital, rather than executing their business plans, and too often this capital is simply unavailable. The problem is particularly pronounced for traditionallydisadvantaged demographics such as women and minorities. Representative Velazquez cited one study which noted if minorities started businesses at same rate as non-minoritieswe would have 1 million additional employers, generating 9.5 million more jobs for our local economy.

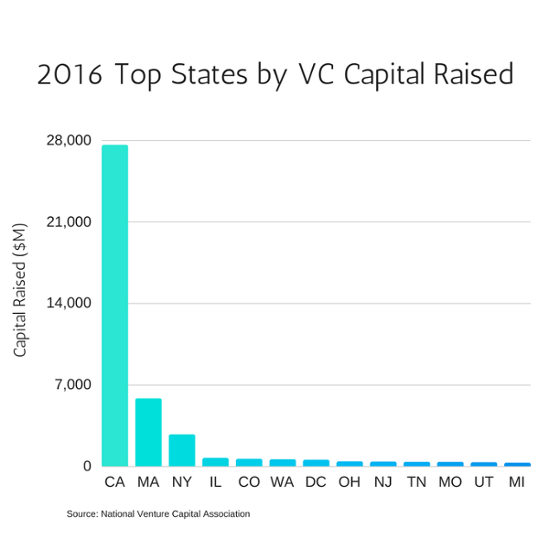

In recent years there has been a decline in the number of venture firms. Remaining firms have focused their efforts on a few key states. Since the 2008 recession, 50 percent of new businesses have originated in 20 of 3,100 counties scattered across the United States. In California, venture fundsincreased as a percentage of total U.S. fundraising from 57 percent in 2015 to 66 percent in 2016. More needs to be done in reaching entrepreneurs in other parts of the country.

The panel focused on several areas where Government could help, answering questions and offering suggestions.

Karen Kerrigan said regulatory relief, tax reform and improving access to capital were key areas where reform could help. An enrepreneur’s first touch with regulation mostly begins at the local and state level where they are met with licensing, zoning, registration, fees and other regulations that are often burdensome and costly for starting a business. She also said our tax code needs to be internationally competitive and designed to encourage growth. Growth breeds confidence, optimism and entrepreneurial opportunity. By improving access to capital byrelieving community banks of unneeded regulation, and modernizing and streamlining an array of Security and Exchange Commission rules and compliance requirements, small businesses and entrepreneurs will have a wider array of financing options in addition to new ways to finance their venture such as crowdfunding.

Mr Schocken offered several ideas focused on streamlining equity crowdfunding, removing barriers and restrictive regulations and also improving inter-agency cooperation on globalization and automation saying, most of the jobs that will replace jobs lost to automation would likely come from small business, so the formation of a special commission focused on the innovation economy would be a great idea.

You can watch the full video of the”Reversing the Entrepreneurship Decline” house panel session below.