All posts by Gary Stockton

Experian and BBVA will be discussing how small businesses can build strong credit to gain access to capital in an upcoming webinar.

Corporate Pledge Experian pledges to continue to help small businesses manage their risk, grow their business, and navigate their financial health during and after these turbulent times. We are offering small business owners 20% off their initial business credit report and 50 percent off a one-year subscription to monitor their business credit score. Going through this unprecedented time takes strength, and we pledge to support small businesses. https://www.smartbusinessreports.com/godaddy/ Experian is proud to have served and continue serving the small business community for over 70 years. We have learned a lot, as we have stood with small business through the best and worst of times. Most importantly, we understand that as the economy faces challenges, so do the ambitions and dreams of small business owners – and we have tailored our solutions with this in mind. Our credit data is an integral ingredient in the success of any business. An accurate view of financial health help businesses better evaluate trading partners, tap into new markets and make real-time decisions. It’s important that every small business owner knows where they stand and how others see them, especially during the times when they may need access to new capital. To ensure that small businesses have additional resources at their disposal to make informed decisions at this critical time, we are providing discounts on our 1-year monitoring service subscriptions. We also feel a deep obligation to our clients, the lenders, trade creditors, utilities, insurance underwriters, and more as they strive to support small businesses during this time. To further help small businesses gain access to capital they need, Experian also launched its free COVID-19 U.S. Business Risk Index to assist lenders and government organizations in understanding how to make lending options available to the business segments that need it the most. This new risk index can help business risk professionals better understand the impact that the pandemic may have on commercial operations based on several key factors. We hope that our data and advanced analytics enable our clients to offer fair and responsible lending to small businesses that need it most during this time. We encourage small business owners and partners to hold fast to your original visions and leverage our experience. No dream is too big, whether you are a company of one or one hundred, we’re here to support you. And together, we can create a better tomorrow. Hiq Lee, PresidentExperian Business Information Services #OPENWESTAND

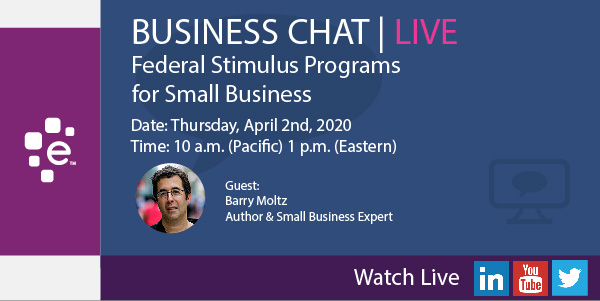

Federal Small Business Stimulus Programs In response to the economic impact of the Coronavirus, President Donald Trump signed legislation that will allocate $2.2 trillion in federal small business stimulus funding to support the U.S. economy, small businesses are among those that will benefit.The Small Business Administration, under the stimulus package, will oversee the Paycheck Protection Program, and the Economic Injury Disaster Loans and Loan Advance program which combined will distribute $350 billion to small businesses that can be partially forgiven if the companies meet certain requirements.To help clarify the programs, we have invited small business author and expert Barry Moltz to share what small businesses need to know about these programs.

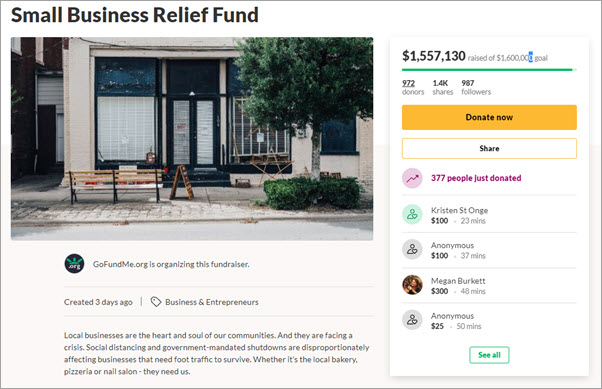

As the infections of Coronavirus continue to escalate unabated, millions of small businesses are closing and laying off workers. Others send the majority of their staff to work from home, as in our case here at Experian. If you are a business who can pivot to virtual selling Covid-19 may just be a temporary setback, but for other non-essential retail businesses laying off staff and closing their doors, workers have few options. I got a little burned out from watching all of the bad news as I flipped around cable the other night so I retreated to the den to read articles and saw that three days ago GoFundMe had set up a Small Business Relief Fund for businesses impacted but Covid-19. The goal of the fund is to raise $1.6 million, and as of this writing had raised $1.557,130 with major donations coming from Intuit Quickbooks, Yelp and GoFundMe. Hats off! Small Business Relief Fund The site is filled with over 80,000 businesses looking for donations. As I sat reading the stories about businesses here in Orange County, California, I was struck by the outpouring of support and the heartwarming comments left by customers. Many of the campaigns are launched by business owners who want to do right by their people while their businesses are struggling to remain open. Orange County businesses fight to survive A nurse from Children's Hospital Orange County picks up from Blue Bowl Teague, Ish, and Craig from Veteran-owned Blue Bowl Superfoods in Orange, California have a target of $50,000 from which a portion will go to feeding healthcare workers from nearby CHOC and St. Joseph hospitals. Their campaign description is a defiant open letter addressed to COVID-19 which reads "We are a veteran-owned small business fighting to keep our lights on because of you. You will not destroy our jobs and you will not destroy what we do." As of this posting his campaign had raised $11,548. Blue Bowl Superfoods GoFundMe Campaign I reached out to Blue Bowl and spoke with the company co-founder Teague Savitch. Teague got the idea for the company while deployed to Afghanistan in 2014, telling me “Towards the tail end of my deployment experience I was working in a team that was doing 24-7 operations and on-call all the time, always eating on the go. It was the first time in my life where for an extended period I was getting very little sleep and a lot of stress. When I came home, I started going to juice bars and really paid more attention to what I put in my body. That's when I kind of really got interested in the superfood movement. And from that Blue Bowl Superfoods was born.” When asked why he started a GoFundMe he responded “We're fighting to try and keep our doors open, and keep a paycheck going for our team, and it just so happens that our first location that we opened just over four years ago is right in the backyard of two major Orange County hospitals - Children's Hospital, Orange County and Saint Joseph Hospital. Both of those hospitals have been very key to our early success, spreading the word about our company and what we do. It's been a really popular item with hospital staff that need a meal that's healthy performance-enhancing nutrient-dense where they can come in quickly grab and go, get in and out of there and get back to doing their rounds in the hospital.” Solopreneurs turn to GoFundMe Cali Creechers GoFundMe Campaign Emily Creech of Cali Creechers, a pet sitting and dog walking business, is using GoFundMe to raise $3,500 to offset cancellations saying "most of my clients have had to cancel trips, work from home and isolate themselves from other humans in order to stay healthy." The impact of Covid-19 not only threatens her livelihood, but also her housing situation. I reached out to Emily to ask how she heard about the GoFundMe idea and she said: “I actually got an email from QuickBooks because I have QuickBooks for my business which is to keep everything organized, and they said they were sponsoring or helping promote the idea that you can start to go fund me for a local small business.” Emily says things started to change in her business around the 13th of March when she had one really big booking get canceled saying “I think people are canceling their trips because they have to, they're scared or they're elderly and they don't want anyone coming in their home to pick up their dog.” Cali Creechers got started after Emily started walking people’s dogs in her free time, picking up gigs using the Rover app. She said “You pass a background check and create a profile and people who need dog care can kind of narrow down their searches and get someone to care for their dog. So, I did that and I had a lot of really good response and I realized that it’s something I'm good at.” But Rover understandably charged a 20% fee on all of her business, so one day she decided to set-up an LLC so she could earn 100% of what she makes. Non-essential service-based businesses suffer sudden closures Team 12 GoFundMe Campaign Josh Boyd founded Costa Mesa-based Team 12 Group Training in 2013. He tells us that when the State ordered all non-essential businesses closed he had to lay off his 37 employees. He's hoping GoFundMe can help him raise $60,000 to help his employees, all out of work. Josh explained in his campaign profile, the revenue for his business is 100% Subscription-based and now that training sessions are on hold, they have no revenue to pay employees. I asked Josh if he thought Covid-19 would do any lasting damage to his business he said, "Once this is over the public will flock to gyms and have a deeper appreciation for the service based industry because they realize how hard it is to get motivated on their own.” Adding “You truly don’t value things as much until you actually lose it!”

In celebration of International Women's Day (March 8th, 2020), Experian spoke with Stephanie Eidelman, CEO of the IA Institute, a media company that produces news, events, education for the credit and collections industry. She is an influencer in the world of consumer debt and a strong advocate for Women in business. Her company hosts the Women in Consumer and Commercial Finance Conference. Gary: So if you could tell me a little bit about when you were starting out in your career, did you set out to become a CEO and business owner or was that the trajectory that you thought that you would take? Stephanie: My trajectory is nothing like I expected originally, I started my career in the theater. I was originally a theater major at school and that goes back to fifth grade when I started doing props in elementary school and I loved it and I really thought that what I would be was a stage manager and I wanted to ultimately be a Broadway producer. Gary: So, you said recently that you are “calling women up versus calling men out?” What did you mean by that? Stephanie: Yeah, well, you know, I think in a lot of areas it's not, it can be fun and sort of cathartic to have a, a sort of a gripe session, you know, or a, oh, woe is us or, or to talk about things that are our problems. But, you know, as it relates to men and women take to get a whole bunch of women together and call men out or complain. Again, it, it may be satisfying to some degree, but it's not useful and it's not going to move people forward. And so, the calling women up is really more about focusing on how we can get from here to there, what are the positive steps that we can take? What are the ways that we can influence our own behavior? and not necessarily depend on men to allow us or, or do it for us or with us but just focusing on the more positive aspect. Gary: I'd say in the last few years, women in business, and women really taking their place in business, I know at Experian, we really champion women business leaders. We've got employee resource groups allocated to women, but the men are invited to those meetings too, and we get something out of it as well. I think it's a partnership really. Would you agree with that? Stephanie: Absolutely. I mean, I think it's, you know, it doesn't really matter. Again, you know, anybody who is passionate about developing women or developing anybody, you know, ought to be involved in that. Plenty of men have daughters or wives or sisters or whatever and would like to see them succeed, just as, you know, just as much as their sons or brothers or, or whatever. So, I absolutely believe that we do, one thing you might be alluding to is, we started a Women's Conference last year and, it's, it's not for men and maybe it will become for men at some point. And we've certainly had men ask about it, but you know, there is an element to creating a space that women do feel safe and the ability, the ability to, to share things that maybe they wouldn't share in front of men. And so, it's not so much about leaving them out as creating a space where women do feel comfortable to take that first step. And I can see that different conversations happen, and we have other conferences that have men too, and they're also great. but, but the character of the conversation is different. Gary: So if you overheard a conversation on the train about with a woman considering starting her own company and going into business for herself today in 2020, do you have any advice for her on what would set her off on a good footing? Stephanie: Gosh, you know, I would suggest it for anybody, woman or, man, it's interesting. I am a woman business owner and I don't know that I would tell you a story of how I've not had opportunities, if I've been slighted as a woman, maybe it's happened and I haven't noticed it, or maybe my threshold for it is different than others. But I would certainly, for anyone looking to start a business, I would give the advice that it's not easy. You have to be prepared for the fact that nobody's going to care about it as much as you do, you know? Cause you're the owner and the buck stops with you, however, we can't do it alone. All right. So, there's a real balance there. And I would just say go for it woman or man, I think if you have a passion for something and you're willing to work hard at it, then you should do it. And what I find is it's amazing how easily you can become an authority in something these days by just putting effort into it. That alone surpasses often 90% of the competition. Gary: Yes. In the data that we've studied on women business owners, there seems to be a reliance on personal credit. That's one of the trends that we've seen the last few times that we've done the study and a reluctance to shop for credit. You work in credit and collections in your industry, why do you think that is? Is it a confidence issue or maybe an education issue in terms of knowing what credit products are out there for business owners? Stephanie: Well, I bet it is an education issue, and matching the right type of credit, to what you need. It may also be an overestimation of what you need, how much is needed. People may think they need millions of dollars to start a business and you know, that may be true in certain types of businesses, but probably not in most, and for that matter, bootstrapping it is probably a great way to go. When you're not beholden to somebody else you really have more ability to do what's right for the business and not just what that creditor is demanding. So, I guess it might be. I will say in full disclosure, I didn't really have to do a lot of shopping for credit because we have been able to fund the business through the cash, through operations of the business. So, I haven't had to raise money. Gary: I'd heard this a of your company, and that's admirable. The thing that we are noticing when we study the credit profiles of women business owners and men business owners, there are different industries obviously, where you have a lot more groupings of businesses for women versus men. But generally, the credit profiles are quite comparable. So, it's interesting that when you look at the breadth of credit and the types of credit, trade lines women business owners are accessing versus men that they're not tapping trade-credit earlier in the life of the business. Setting up terms with leasing for office equipment or getting terms from distributors, whether it's office supplies, you know, these are some of the things opening a business credit card versus using personal credit. These are some of the things that we were hoping can change over time. But generally, we see women are a good credit risk and they're starting businesses in record numbers. Stephanie: You know, it's a great point as I think about my not only credit for the need to raise money but credit for the need to get more credit basically to open accounts. My business really was a spinoff of a business that my parents started in the late 1980s. And so before I spun it out and needed to get my own lease and my own phone bill and all those things, I realized, yeah, the business had been established for quite a while, but not by me. And the credit that I was surprised to find how thin the credit file was for my business because a lot of those accounts had been established under the prior parent company. And so, it did take a few years to get that going. But it wasn't really an impediment. I was able to do everything I needed it to do. I probably just needed to personally guarantee or, you know, put my personal information a little more than I would have thought originally, but it never really held me back. Gary: So, is this a good year for your company? The economy seems stable. We had some worries of a recession there earlier in the year, but that seems to have kind of leveled out. Are you feeling confident about 2020 and moving into the next year or, or are you seeing uncertainty with things like trade and, those things impacting business? Stephanie: Well, for my business, it’s what affects it most is the environment for my clients, which includes regulatory uncertainty. That's, you know, in the last few years has been a little bit more favorable for our industry. Going forward, there's certainly going to be uncertainty about what's going to be in the coming years. And yeah, I would say that I'm optimistic about the coming year and next year as well. And in part it's really because we've done a lot of work on focusing on differentiating ourselves and just kind of staying in our lane or creating our lane and then staying in it. I think personally, this isn't exactly the question you just asked, but personally, what I've learned a lot as a business owner - it's so easy to become obsessed with what everyone else is doing. You know? The competitors, you certainly need to be aware of the competitive environment, but to focus too much on that and what you can't control is really a large distraction. And focusing on what you do best and what you can do and doing it the best that you can, is going to make you more successful than trying to be on top of everything for everybody you compete with, you know, everyone else in the space. And so that, that's been a, what's most important for us and what exactly the macro economic factors are, don't have to be noise that's as impactful, especially for a smaller business. Gary: Excellent advice. So, Stephanie, if our women viewers of this content would like to find out more about your institution and you mentioned your conference how would they go about doing that? Stephanie: So our website is www.theiainstitute.com and there you can find all the different things that we do, including our Women in Consumer and Commercial Finance Conference, but our other initiatives as well are all summarized there. Gary: Well, thank you very much for taking time out to speak with us today, Stephanie. Stephanie: Thanks, Gary. I really appreciate it.

Experian is partnering with the Federal Reserve to conduct its annual Small Business Credit Survey for both pre-start and existing businesses, and we’d like you to participate. This short survey will take approximately 10 minutes and will ask about business conditions, financing needs, and credit experiences. Summary results will be shared with you in the Spring, and all responses are confidential. The survey highlights the experiences of small businesses nationwide and provides critical information that service providers, policymakers, and lenders use to improve programs for small business owners. Please click the button below to complete the survey. Thank you for participating.

This week's guest post is by small business tax expert and best selling author, Barbara Weltman of Big Ideas for Small Business. Barbara shares ideas on how small businesses can remain competitive with health care benefits to attract employees in a tight labor market. With the cost of healthcare premiums rising, and a tight labor market, small businesses are looking at all options to attract employees, and benefits are one way to remain competitive. So, in this post I thought it would be timely to share some ways employers can deal with offering health coverage without breaking the bank. As P.T Barnham famously said “The foundation of success in life is good health,” so let’s start with a quick dose of reality then get down to the business of assessing your options for 2020 . It’s estimated that premiums for large employers in 2020 will be on average 5% higher than 2019 (statistics on premiums for small employers are not available). Small business owners are tasked with the challenge of offering health coverage to their staff that is within their budget. Fortunately, there are several ways for employers to deal with health coverage, and the tax law provides breaks to help defray the cost. Here is a summary of health coverage options and a brief discussion of the tax breaks that result. Employer mandate Despite repeal of the individual mandate, the employer mandate requiring certain employers to “play or pay” continues to apply. If you have at least 50 full-time and full-time equivalent employees, you are an applicable large employer (ALE) and must offer minimum essential health coverage that’s affordable (meaning the employee share of premiums doesn’t exceed a set percentage of their household income) or pay a penalty. In deciding whether to play or pay, keep in mind that the penalty amounts (there are different penalties) are increasing for 2020. And if you play, there are cost management initiatives—shopping around, increasing deductibles, using virtual care—to help keep premium costs down. Small employer options Even if you aren’t an ALE, small companies want to offer their employees health coverage. They want their workers to be healthy. And in today’s tight job market, health coverage is an important benefit, with the majority of employees saying that their coverage is a key factor in deciding whether to stay with the company. Here are some affordable options to consider: Health savings accounts (HSAs). If you offer employees a high-deductible health plan (HDHP), which is a low premium policy that requires employees to pay out of pocket up to their policy’s deductible before coverage kicks in. The HDHP is then combined with an IRA-like savings plan called a Health Savings Account (HSA). You can decide whether to contribute to an employee’s HSA or let the employee do so. If you make the contributions, they are tax deductible and as a tax-free fringe benefit are not subject to payroll taxes. Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs). Instead of having the company obtain a group plan, a small employer (one that is not an ALE) can reimburse employees up to a set dollar amount for their individually obtained health coverage. Reimbursement limits for 2020 have not yet been announced. For 2019, they were $5,150 for self-only coverage and $10,300 for family coverage. Individual Coverage Health Reimbursement Arrangements (ICHRAs). Starting in 2020, employers of any size can reimburse employees for their personal health coverage premiums. The employer—not the government—sets the reimbursement limit. The ICHRA must be offered on a nondiscriminatory basis. And the arrangement must meet other requirements, including notice of the plan and verification of coverage by employees in order to receive reimbursement. Sounds similar to the QSEHRA, but there are some important differences. Excepted Benefit Health Reimbursement Arrangements (EBHRAs). Also starting in 2020, employers that want to offer certain extra coverage up to $1,800 to help employees pay for non-covered expenses (e.g., vision or dental care) can do so with an EBHRA. This is a supplement to and not a substitute for group health coverage. Association Health Plans (AHPs) In 2018, the U.S. Department of Labor issued a final rule permitting chambers of commerce, trade associations, and other groups to band together to offer their members affordable group health coverage. The groups, referred to as Association Health Plans (AHPs), would be treated as a single large employer and, due to economies of scale, would be able to command favorable premiums. Tax incentives Premiums paid by employers are fully tax deductible. What’s more, employer-provided health coverage is a tax-free fringe benefit exempt from payroll taxes, but employers must report it on employee W2’s. Instead of a deduction, small employers that purchase coverage through a government Small Business Health Options Program (SHOP) (or through an insurer where there is no SHOP) may be eligible for a 50% tax credit for the premiums they pay for their staff. Details of this tax credit are in the instructions to Form 8941. Final thought Because of the wide array of options for obtaining health coverage, small business owners have a lot to think about. But they must do so soon so they can select their option and shop around now to have coverage in place by January 1, 2020. About Barbara Weltman Called the “guru of small business taxes” by the Wall Street Journal, Barbara Weltman is a prolific author with such titles as J.K. Lasser’s Small Business Taxes and J.K. Lasser’s Guide to Self-Employment and a trusted advocate for small businesses and entrepreneurs. She has appeared on numerous radio shows and television programs, including Fox News, CNN, and The Today Show. She has been named one of the 100 Small Business Influencers in the U.S. five years in a row. Learn more by visiting Big Ideas for Small Business.

Experian has just released the Women in Business credit study, a three year study of around 2.8 million credit files for small business owners. One of the key findings in this study was women business owners, in particular, are reliant upon personal forms of credit, and they may be at a disadvantage through this practice. In the below video, Experian talked with Sarah Evans, owner of Sevans Strategy, a digital PR agency and Linda Waterhouse, owner of WSI Web Systems, to get their perspectives on managing credit, and some of the insights revealed in the Experian study. Click below to learn more about the Women in Business credit study.

Experian Business Information Services was delighted to participate in a #CreditChat tweet chat recently. For the chat, we compiled some answers to frequently asked questions about business credit. Why should you separate business credit from personal credit? How do you establish business credit? Is it possible to build business credit with poor credit How do you get a business credit report? How are business credit scores determined How do you correct or dispute information on your business credit report? How do you get higher limits for your business credit? Five tips for establishing, building and monitoring business credit. Why should you separate business credit from personal credit If your business ever becomes at risk your personal credit score becomes at risk as well. And so maintaining separation can protect your personal credit profile should a financial mishap occur in the company or vice versa. Building separation between the two can also help your business develop the credibility that matters the bank's, lenders, suppliers and partners. How do you establish business credit? One of the first things you can do to establish small business credit is to file your business with your State by forming a corporation or LLC to operate your business under and obtain a FIN or EIN number from the IRS. Of course, comply with the business credit market requirements by obtaining proper licenses state and federal requirements for your business. Also, act as a business by establishing accounts (telephone utilities, leases, loans) all under the business name, not your personal name. Even if you operate as a sole proprietor or as a home-based office, prepare financial statements and a professional business plan. Be visible. Find companies willing to grant credit to your business without a personal guarantee. This is typically referred to as Trade Credit. Ensure that your good payment behavior is reported to Experian. Ask suppliers and other businesses that extend your business credit or payment terms to consistently report your payment history to Experian. Also, borrow and then pay on time. Manage your debt, stay current to your terms by making on-time payments and don't rely just on small business credit cards. Secure terms from suppliers or take out a commercial loan. And lastly, monitor your business credit report regularly check and correct outdated information. Be alert to important credit changes in your company's name. Is it possible to build business credit with poor credit? If you have poor credit, you know, it's never too early to enable healthy management behaviors of separating personal from business credit risk and building business credit. But in the early startup stages, you may need to personally guarantee payments. But, the more you act like a business by establishing accounts in your business name, the more likely it is that you'll be able to negotiate and secure good credit terms without personal guarantees. How do you get a business credit report? Experian offers instant online access to business credit reports at the following websites: Experian.com/mybusinesscredit SmartBusiness Reports.com These sites easily help you monitor your own report or access a report on other businesses you can purchase a single report as needed or save with a subscription to a plan. How are business credit scores determined Experian collects business credit data from a wide range of sources such information is used to create a score that illustrates how your businesses historically met its financial obligations. This helps creditors to decide whether to extend credit to your company. Some of those sources include State Filing Offices, Public Records, Credit Card Companies, Collection Agencies, Corporate Financial Information, and Marketing Databases. If you are curious about the behaviors that impact your credit score you can always access our Score Planner Tool. This is a free tool that Experian offers. You can get in there and do what-if scenarios, modeling your current credit behavior and how that impacts your business credit score. It is a very useful tool and helps you build smart business credit. How do you correct or dispute information on your business credit report? First, you must have a copy of your business credit report. You can download that instantly at Experian.com/mybusinesscredit or SmartBusinessReports.com. Of course, review the details circling any incorrect information and you would submit that to BusinessDisputes@experian.com for investigation. That will open a ticket for your case and return to our self-service Web sites for future access and alerts on the case. How do you get higher limits for your business credit? You should monitor your business credit report and manage the factors that drive a good business credit score. And doing so can help you boost your credit score and improve your credit terms. Five tips for establishing, building and monitoring business credit. Act as a business by maintaining a distinctly separate business credit profile from your personal credit. Avoid surprises. Be proactive in monitoring your business credit score. Stay current on payments to creditors. It seems simple but it is great advice that just pay those bills on time. Don't let them go delinquent Ensure that your good payment history is reported to the credit bureau. Establish some good strong trade credit lines and make sure you're doing business with partners who are reporting to the credit bureau. Use business credit reports to limit your risk of doing business with others such as your business customers suppliers and vendors and partners. We hope these business credit answers have been helpful!