All posts by Gary Stockton

With the Tax Cuts and Jobs Act of 2017 making dramatic changes in new tax law, business owners should be asking themselves how to plan for the future.

According to a new report women entrepreneurs still face significant obstacles starting and running a small business.

The commitment required to apply for a business loan may have you on the fence, unsure of whether or not to move forward. You’re not wrong to be cautious

Consumers are being urged to monitor and lock or freeze their credit profile, but how should small business owners respond? Will a freeze impact a business?

Man in the middle scams are on the rise, and art galleries and dealers have emerged as high value targets for this cyber crime.

Building and maintaining a strong business credit report takes time, and good fiscal discipline, but many business owners don’t know where to start on their road to establishing business credit. Business credit reports less regulated than consumer credit Business scoring is much less regulated than consumer credit scoring. The process of scoring your business is much more complicated and less clear than the consumer scoring process. For example, additional factors that can impact business risk models include the number of years a business has been operating and its industry type. Don't assume you have a business credit score Just because you have a business, don't assume you have a business credit score. Credit bureaus require a minimum amount of information before they can generate a report and score for your business. To establish your business credit history, encourage your vendors to report your payment history to the business credit bureaus. Many credit bureaus can provide you with information on suppliers who report to them. Keep business credit and personal credit separate Next – let’s talk for a moment about separating your personal and business credit. To build strong business credit, don't rely on your personal credit rating to finance your business. If your business becomes at risk, so will your personal credit score. Keep in mind that many creditors are now looking at scoring tools that consider both personal and business credit to predict small business risk. Business credit reports available to the public It is not widely known that access to business credit scores and reports is not as restricted as personal credit reports. Business credit reports are available to the public, and anyone - including potential lenders and suppliers - can view your business credit report. This makes it imperative to monitor your business credit score and report in an ongoing manner. Also - You can proactively manage your business credit score. Ensure your vendors are reporting your business payment history, and monitor your business' credit on a regular basis. For more information on business credit resources, plus articles and tips on this subject, go to BusinessCreditFacts.com. Learn more about establishing business credit by viewing our series of Business Credit Facts videos. Remember to subscribe to our channel for ongoing updates.

In the aftermath of Hurricanes Harvey and Irma, news outlets reported the FEMA statistic that 40% of small businesses never recover after a disaster. With 74% of small businesses closed after Hurricane Sandy, a 2015 Nationwide Insurance survey stated that 75% of small businesses still don't have a disaster plan in place. For overwhelmed small business owners, the possibility of a natural disaster may be a low priority compared to keeping customers happy and the bills paid. When an unfortunate and unplanned disaster strikes, they have to be creative when putting their lives and their businesses back in order. Savvy business owners who prepare in advance can usually mitigate potential damage to their business by being prepared and activating their business continuity plan. Small Business Disaster Planning With natural disasters, from hurricanes, flooding, tornadoes, earthquakes, or wildfires, there is a potential loss of: Office premises including equipment, supplies, furniture, and more. Records, paper or digital, that are necessary to keep the business running. Any goods or supplies needed to sell goods or services to customers. Employees' homes and the likelihood of their return to work. Suppliers or distributors who are unable to reach your place of business. Customers who may do business elsewhere if they are unable to reach your business. Office equipment and the like can be replaced eventually, but company and accounting records cannot. The U.S. Small Business Administration has created a Record Keeping for Small Business Guide to assist with the necessary records, such as contracts, licenses, leases, personnel information, and accounting records, for rebuilding your business. FEMA (Federal Emergency Management Agency) also has a Small Business Preparedness website for disaster planning. Helpful tips include storing records in the cloud, creating a threat analysis, purchasing business insurance, and the development of a continuity plan to include communication with employees, vendors and suppliers. The goal is to get back online as soon as possible so the loss of customers is minimal. Filling the gap Many business owners are finding out that their business insurance will only cover so much, and there is a significant gap between what is paid out in claims and what is needed. So many are forced to think up creative solutions to getting their businesses back online by borrowing from friends, family and investors. Entrepreneurs familiar with innovative financing options of startup capital are beginning to turn to relying on crowdfunding when disasters occur. Crowdfunding for Small Business Recovery Crowdfunding is a familiar source of capital to entrepreneurs with new or growing businesses. Many entrepreneurs relied on sites such as Kickstarter or Indiegogo to raise funds and a potential audience for their service or product. The 2017 University of Chicago Alternative Finance Benchmarking Report found that while equity-based crowdfunding decreased 7% last year, "Donation-based Crowdfunding grew by 60%, generating $224 million in 2016." The same report noted that over the past 3 years, donation-based crowdfunding has increased by 40%. This is good news to entrepreneurs who are also using crowdfunding to help raise funds after an unexpected natural disaster. Ashley Freeman, with Handy Ma'am home improvement services in Houston, TX, relied on Go Fund Me to help with her recovery in the aftermath of Hurricane Harvey. Ashley ran a campaign to replace tools and supplies that were damaged in the storm. Her goal was met but she's still recovering, "Go Fund Me was a great head start to getting back to where I need to be," says Ashley. "I'm so thankful for knowing so many people care as much as I do when other people are in need." Kiva, a non-profit organization dedicated to raising funds for entrepreneurs in 80 countries, is another crowdfunding platform being used by those affected by the September 2017 hurricanes. Jonny Price, a senior director with Kiva U.S., is proud of the work they're doing to support small businesses. "At Kiva, our aspiration is to leverage the generosity of our 1.6 million global lenders to expand financial access for entrepreneurs deemed too risky or expensive to serve by conventional lenders. Supporting small businesses hit by natural disasters like Hurricanes Harvey, Irma and Maria is one powerful and relevant example of how we hope to meet that aspiration. This loan to Matilsha in Puerto Rico was funded recently by 358 Kiva lenders. We hope that, through long-term reconstruction efforts, Kiva's sustainable lending model can complement the heroic work of more donation-based first responders like the Red Cross." Recovery Doesn't Have to be a Disaster 2017's hurricanes and wildfires have unfortunately put business owners on task to prepare for a worst-case scenario. FEMA and the U.S. Small Business Administration have created online guides for helping small businesses recover, and will also help financially through low interest loans. While businesses and residents await their turn in securing financing for rebuilding, more entrepreneurs and business owners are turning to alternative sources of financing to get back to the business of serving customers.

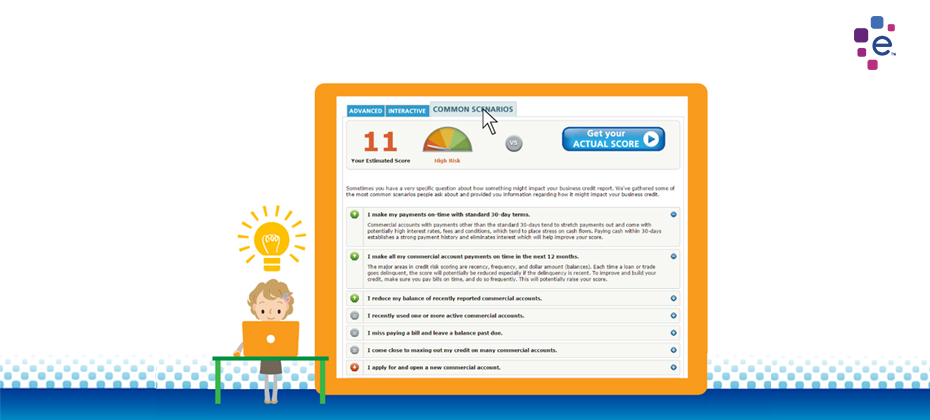

Experian has released a business credit score planner tool to help you run what-if scenarios. It helps you learn behaviors that build strong credit.

When a small business is damaged by a natural disaster — be it a hurricane, flood, earthquake or tornado — recovery presents its own set of hazards. There is, of course, the immediate cost of lost business. There are both short- and long-term physical dangers posed by weakened walls and ceilings, exposed power cables and mold. And then there are the threats posed by skilled disaster recovery scam artists who see small business owners as easy prey. Kenneth Citarella, CFE, knows all about these post-disaster scams. A former New York state prosecutor, Citarella now works for Guidepost Solutions LLC, which provides investigations, compliance, monitoring, and security and technology consulting solutions for clients in a wide range of industries. In the wake of Super Storm Sandy, which devastated large sections of coastal New Jersey, Brooklyn and Staten Island in 2012, Citarella served as a Guidepost Solutions “Integrity Monitor,” making sure contractors were in fact performing the work for which they were being paid. “The days and weeks following a natural disaster are times of great stress and confusion,” Citarella said. “This is the perfect breeding ground for scams of all kinds. Small business owners need to be aware of how they may be targeted and how to avoid being a victim.” How Fraudsters Find Their Marks While natural disasters are horrific events, they’re great for contractors and restoration companies for whom such events are their bread and butter. As soon as a disaster occurs, it’s not unusual for construction companies to descend on the affected site, blanketing the area with pamphlets and brochures, and stuffing mailboxes with business cards. While many contractors are legitimate, there can be a good number of storm chasers who are just out to make a fast buck. At a time when construction labor is at historic lows, small business owners may find themselves working with a firm with less than stellar credentials “The more enterprising scam artists will take the time to go door-to-door, offering low-ball prices or even offering to cut the business owner in on the fraud,” Citarella said. “For example, they’ll offer to do the $75,000 worth of restoration work that is actually required, bill the business owner’s insurance company for $100,000, and then split the difference. This is an obvious solicitation of fraud and should be reported immediately to the local police.” Common Types of Post-Recovery Fraud In addition to the insurance scam described above, Citarella discussed other forms of fraud a small business owner might encounter following a major disaster. “The most common type of recovery fraud involves a contractor who shows up to do the first two or three days’ worth of work, and then just disappears. Another type involves the use of lower-grade or otherwise substandard materials,” Citarella said. Citarella also noted that otherwise well-meaning contractors may buckle under the pressure a natural disaster creates, leaving the business owner out thousands of dollars and still unable to operate. “A small contractor can easily get in over his head,” Citarella stated. “He may not be able to get enough workers, have problems with his supply line, or be managing too many projects at once. There may be no criminal intent here, but the outcome is the same.” How to Avoid Contractor Fraud Find reliable, licensed contractors and validate their businesses before hiring them to help you rebuild. Experian’s ContractorCheck.com/Hurricane is being offered as a free resource to those affected during this time of recovery. This website enables you to find contractors and easily check the critical components of a contractor’s business background, including license, bond and insurance data (if an when available from state licensing boards). Click here to see a sample report. Also, the Better Business Bureau (BBB) offers a list of recommendations to business owners and anyone else looking to hire a construction contractor, among their recommendations: 1. Ask for Recommendations. Ask friends, relatives and fellow business owners to recommend contractors they have previously hired. 2. Check Their Track Record. Use bbb.org or other business review websites to get customer reviews, complaints and any notices of criminal violations. 3. Verify the Business License. Make sure the contractor under review has a valid license to do business in your state. 4. Get Multiple Quotes. Always get at least three quotes for any particular job. Any quote that is unusually low is probably one to avoid. Remember the old adage, “If something seems too good to be true, it probably is.” 5. Look for Signs of “Professionalism.” A reputable contractor will arrive in a vehicle that is clearly marked and branded, and may wear a uniform bearing his/her company name. 6. Request References. Ask the contractor for a list of previous customers you can contact and discuss their satisfaction with the contractor’s service. 7. Check Professional Affiliations. Ask if the contractor belongs to any trade organizations. Such companies are usually bound to operate according to a strict code of ethics. 8. Avoid Large Up-Front Payments. Pay by check or credit card for added protection. Avoid paying in cash. 9. Get Everything in Writing. Demand a written contract, and make sure to read it carefully, especially the fine print. Make sure the contract includes the contractor’s name, street address, telephone number, email address and state license number. Fill in any blank spaces. Don’t sign anything you don’t understand. “Document every step of the reconstruction progress,” Citarella added. “Take pictures every day to record the contractor’s progress. Smartphone pictures can be invaluable in the event of contractor misbehavior or if there is a challenge by your insurance carrier.” Citarella described four “gears” that run any reconstruction machine. “There’s the business owner, the adjuster, the carrier and the contractor. All four need to work together to get a job done right. However, the only one who has a stake in effective cooperation is the business owner. So if you have a business that needs post-disaster repair, take the time to make sure it’s done right.” If you are in the process of rebuilding following Hurricane Harvey or Irma and need to check the contractor you are working with, go to www.contractorcheck.com/hurricane to receive up to 15 free reports. Also, Sam Fenerstock of Credit Manager’s Association published an excellent article titled “How To Assist Your Customers To Stay In Business After Natural Disaster“, it contains lots of great information about disaster preparedness and working with your customers if they are impacted by a natural disaster.