All posts by Gary Stockton

Nearly 9 in 10 consumers have read online reviews to determine the quality of a local business, and 39% do so on a regular basis.

We are celebrating National Small Business Week with CT Mobley from event sponsor ADP about how they are helping underserved small businesses.

Taking on debt can be a necessary part of growing a business, but it also comes with its fair share of risks. Rising interest rates, a decline in sales, and even unexpected global events like Pandemics and Supply Chain crises can change the dynamic of financial obligations we took on when things looked stable. So for this small business matter, we're going to talk about taking on debt with Christina Edel.

We dive into the Fed Report on Small Business with Emily Wavering Corcoran from the Federal Reserve Bank of Cleveland.

This article can help you decide whether business coaching is right for you, and offers tips to find a coach who can help you reach your goals.

Learn how to improve your small business's LinkedIn presence with Judi Fox, a top ten LinkedIn coach for 2021, and the creator of the LinkedIn Business Accelerator method. Watch the interview or subscribe to our podcast to hear her insights on posting the right content that resonates with businesses and professionals.

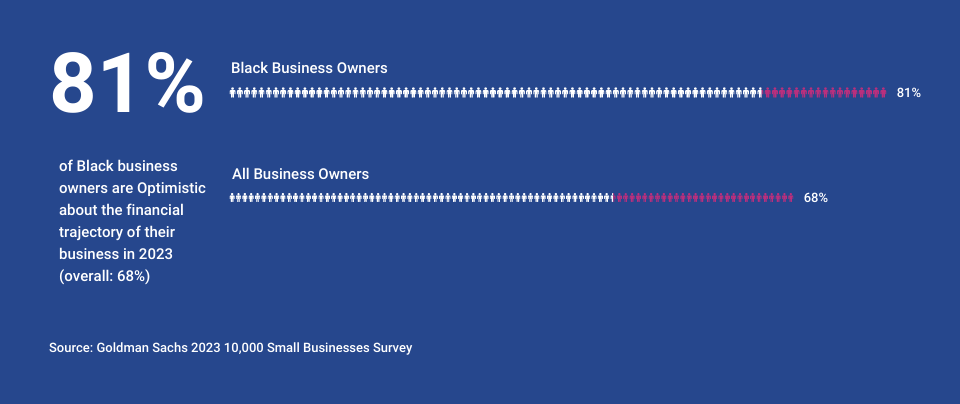

Confidence Soars Among Black Small Business Owners: New Goldman Sachs Survey Findings

In a very special Inclusion-Forward episode of Small Business Matters, we focus in on people living and working with disabilities in two great interviews. Usability Careers with Purpose and Belonging with Lynn Wehrman of WeCo On December 3rd, the World will celebrate International Persons with Disabilities Day. To celebrate, Experian has a special episode of the Small Business Matters podcast this week featuring a discussion with Lynn Wehrman of Minneapolis-based WeCo. WeCo specializes in providing high quality user experience testing focused on how individuals living with disabilities interact with electronic formats and the internet. Many of their employees are people living with visible and hidden disabilities. As you will hear in our interview, they are providing their employees with career opportunities and work that offers purpose and meaning. Forging New Pathways for Wheelchair Users We also share a discussion with Zack and Cambry Nelson, the creators of the "Not a Wheelchair," an off-road, bicycle-based apparatus that is now being used all over North America to help people with disabilities get off the pavement and deeper into nature. We dive into the challenges they faced starting a business during the pandemic, and hear their plans to help even more wheelchair users in the future. Find more episodes of the show over on our show page. FOLLOW US TwitterInstagramLinkedInYouTube

December 3 is International Persons with Disabilities Day. Our podcast this week featuring a discussion with Lynn Wehrman of Minneapolis-based WeCo.