What Is a Secured Credit Card?

Quick Answer

A secured credit card requires a security deposit, which reduces risk for card issuers. This makes secured cards easier to get than unsecured cards if you have poor or no credit, and can help you build or improve credit with responsible use.

A secured credit card is a type of card that requires a security deposit, which typically becomes your credit limit. If you stop making payments, the card issuer can take money from your security deposit to cover what you owe.

Secured credit cards can be used just like traditional—unsecured—credit cards, but are easier to get if you have poor credit or a limited credit history. Using a secured credit card responsibly can also help improve your credit score.

How Does a Secured Credit Card Work?

You can make purchases with a secured credit card just as you would with a regular, unsecured credit card. The difference: The card is secured by a deposit you make when you open the account. If you default on your payments, the card issuer can use your security deposit to pay the card balance. The deposit reduces risk for the card issuer, which can make it easier to get approved for a secured credit card even if you have poor credit or no credit history.

Here's a closer look at how secured credit cards work.

- Security deposit: To open a secured credit card, you make a refundable deposit that serves as collateral. The required security deposit typically starts at $200, but you may have the option to make a larger or smaller deposit. If you default on your credit card balance, the card issuer can use the deposit to pay themselves back. If you make timely payments, you'll generally get your deposit back when the card converts to an unsecured card or when you close the account.

- Credit limit: The credit limit is the maximum amount you can spend on your credit card and is usually equal to the amount of your security deposit. You may be able to increase your credit limit by adding to your initial security deposit or by making a certain number of on-time payments.

- Billing cycle: You're billed for your credit card purchases on a monthly cycle. When payment is due, you can opt to pay all or part of your balance, but you must make at least the minimum monthly payment required.

- Carrying a balance: Any balance you don't pay by the card's payment due date carries over to the following month and accrues interest at the card's annual percentage rate (APR).

Tip: You can't use your security deposit to pay your secured credit card bill. You'll need to make at least the minimum payment on time or risk damage to your credit scores.

Secured vs. Unsecured Credit Card

Secured and unsecured credit cards are both revolving credit and essentially work the same way. But there are some important differences, including the security deposit requirement, how your credit limit is determined and how easy it is to qualify for a card.

| Secured Credit Card | Unsecured Credit Card | |

|---|---|---|

| Deposit requirement | Refundable security deposit required | No deposit required |

| Credit limit | Amount of security deposit typically determines credit limit | Your credit history, credit score, income and other factors determine your credit limit |

| Accessibility | Can be easier to get than unsecured cards if you have poor credit or no credit history | Typically harder to qualify for if you have poor credit or no credit history |

| APR | May be higher than for unsecured credit cards | Usually lower than for secured credit cards |

Pros and Cons of Secured Credit Cards

Secured credit cards have both pluses and minuses you should consider before applying for one.

Pros

-

Accessibility: Your security deposit reduces the card issuer's risk, which can make secured credit cards easier to qualify for than unsecured cards, even if you don't have good credit.

-

May help improve credit: Using a secured credit card responsibly could help improve your credit score if the card issuer reports your payments to the three consumer credit bureaus: Experian, TransUnion and Equifax.

-

Potential to upgrade to unsecured card: Depending on the card issuer, you may be automatically upgraded to a secured credit card or may have the option to request an upgrade. You'll typically need to demonstrate responsible card use for six to 12 months before you're eligible to upgrade; check with the card issuer for details.

-

May offer rewards: Some secured credit cards offer rewards such as cash back on purchases, which can be a valuable perk.

Cons

-

Upfront deposit required: Making a security deposit to get a secured credit card could put a strain on your finances, especially if you want a higher credit limit. Check your card issuer's deposit refund policy to see when you'll be able to get your deposit back.

-

Low credit limits: Secured cards typically have low credit limits, which can reduce your financial flexibility. A low limit also makes it easy to use a high percentage of your available credit, which can negatively impact your credit score.

-

APR may be high: Because they're designed for people with poor or no credit, secured credit cards usually charge higher APRs than unsecured cards.

-

May charge fees: Some secured credit cards charge fees, such as annual fees, late payment fees or foreign transaction fees.

Learn more: Do Secured Credit Cards Build Credit History?

Should I Get a Secured Credit Card?

Because they typically have more lenient eligibility requirements than unsecured cards, a secured credit card might be right for you if:

- You're new to credit. If you're a recent immigrant, a young adult or simply have never used credit, you may not have a credit history. This could make it challenging to get an unsecured credit card. A secured credit card offers a low barrier to entry, making it a good first step on the road to building credit.

- You have a thin credit file. A credit report with fewer than five active credit accounts is known as a thin credit file and can limit your options. Adding a secured credit card can fatten up your thin file and diversify your credit mix, which could help improve your credit score.

- You're trying to rebuild your credit. Maxed-out credit cards, collection accounts and other negative marks on your credit report can make lenders wary. Secured credit cards pose less risk for card issuers, so they're typically more accessible even with bad credit. Once you've been approved, using the card responsibly can help repair your credit.

- Your applications for unsecured credit cards have been rejected. If you've been denied a credit card for whatever reason, the required deposit for a secured credit card can make approval more likely.

Learn more: What Is the Easiest Credit Card to Get With No Credit?

How to Get a Secured Credit Card

To get a secured credit card, follow these steps.

- Check your credit score. You can review your Experian credit report and get your FICO® ScoreΘ for free to see where you stand.

- Compare secured credit cards. Experian's card comparison tool matches you with secured credit cards based on your credit profile. As you compare secured credit card options, consider credit limits, security deposits and refund policies, APRs and fees. Also evaluate any cardholder perks such as cash back, points and miles.

- Confirm account reporting. Look for a card issuer that reports your account usage to all three major credit bureaus. Reporting to all of the credit bureaus will maximize your benefits from using your card responsibly.

- Complete an application. You can apply for a credit card online through Experian's card comparison feature or on the card issuer's website.

- Open your account. If approved, you'll need to pay your security deposit and any fees required to open your account. You can typically pay by debit or electronic transfer from your bank account. Have your banking information handy and make sure there's enough in the account to cover what you'll owe.

Tip: If you hope to eventually convert your secured credit card to an unsecured card, confirm that the card issuer offers unsecured credit cards before you apply.

Learn more: What to Do if You're Denied a Secured Credit Card

How to Build Credit With a Secured Credit Card

The following good habits can help you build credit with a secured credit card.

- Make small purchases each month. Using your card regularly and making payments on time demonstrates responsible credit use. Consider using the card to pay a small monthly bill, such as a streaming subscription.

- Pay your bill on time. Making timely payments can benefit your credit score, but late payments will hurt it. You may want to set up autopay for your credit card bill payments so you won't miss a due date. Be sure to keep enough money in your bank account to cover the payment.

- Keep credit utilization low. Your credit utilization ratio measures the percentage of your available credit that you're currently using. Lower is better for credit scores; a utilization rate over about 30% can have a greater negative effect on scores. If your secured credit card has a $300 limit, for example, aim to keep your balance below $90. Making multiple payments in a month can help keep your utilization down.

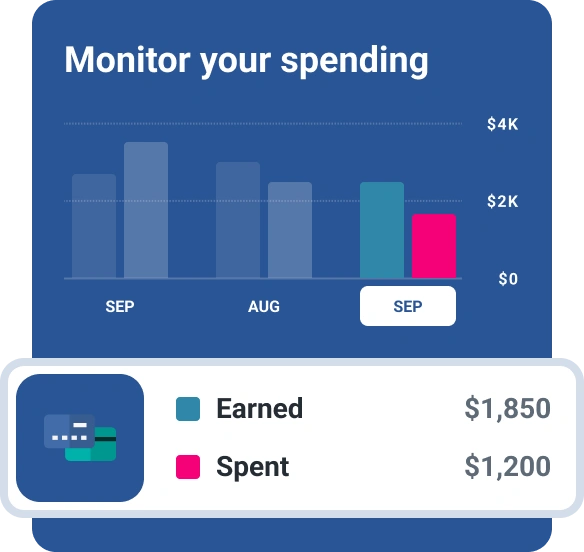

- Monitor your spending. Using your credit card provider's mobile app to keep an eye on your balance can help keep you from running up a high balance that could be difficult to pay off.

- Pay off your balance each month. Carrying a balance could push your credit utilization higher, potentially harming your credit score. It also incurs interest, which compounds daily and can quickly snowball.

- Keep tabs on your credit score. Some secured credit cards offer free credit monitoring. You can also sign up for Experian's free credit monitoring to track how using your secured credit card impacts your credit score.

Tip: Even if your credit improves enough to qualify you for an unsecured credit card, consider keeping your secured card account open. Closing a credit card reduces your available credit, which could negatively affect your credit scores.

Learn more: How to Improve Your Credit Score Fast

Frequently Asked Questions

The Bottom Line

A secured credit card can be a useful tool to improve your credit score, but if the idea doesn't appeal to you, there are other ways to build your credit. For example, you could ask a family member with good credit if they'll cosign on a credit card or add you as an authorized user on one of their credit cards.

You can also sign up for Experian Boost®ø, a free feature that adds your eligible utility, cellphone, insurance, rent and streaming service payments to your Experian credit report. If you make these payments on time, using Experian Boost could quickly increase your credit scores.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Karen Axelton specializes in writing about business and entrepreneurship. She has created content for companies including American Express, Bank of America, MetLife, Amazon, Cox Media, Intel, Intuit, Microsoft and Xerox.

Read more from Karen