Test Business Information Page

New Report: Will the 2023 holiday season hinge on generosity? The latest Beyond the Trends report offers evidence it may.

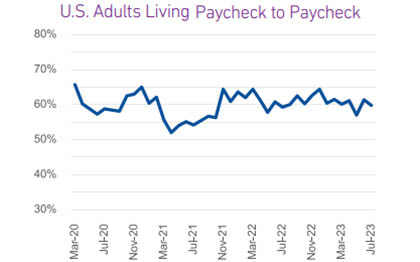

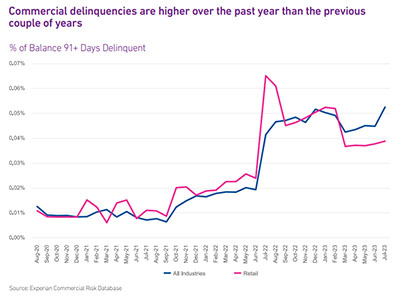

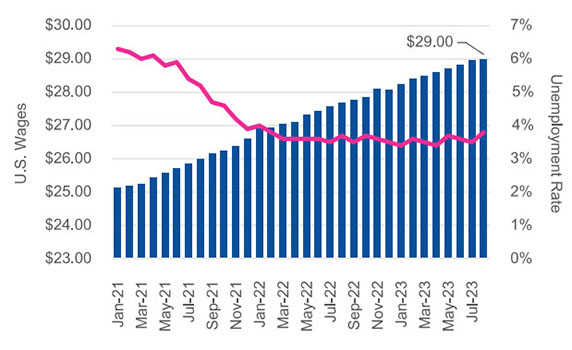

The labor market remains robust with low unemployment (3.8%) and 366K new jobs created in September. Job openings in the U.S. were 9.6MM as of the end of August, an increase of 690K or 5.8% since July. Retail sales in August had a month-over month increase for the fifth consecutive month. As we head into the holiday shopping season, despite headlines of large retailers struggling, the retail industry appears poised for success. It is likely that those retail businesses that survived the difficulties of the pandemic are the most financially sound and are driving the statistics. Over the past year, retailers are seeking less credit and taking on less debt than the previous few years. Despite inflation, consumers are still spending, and retailers are benefitting. Commercial delinquencies have been increasing over the past year. Delinquencies within the retail sector were trending above overall commercial delinquencies until just a few months ago when retailers exhibited lower rates than overall. These are all positive signs heading into the holiday shopping season which tends to make or break a retailer’s year. The September labor report was stronger than expected. Unemployment remained low at 3.8% and 366K new jobs were created which was the highest amount since January. In addition, the jobs created in July and August were revised upward significantly. What I am watching: With the labor market still tight, it will be interesting to see if the retail sector will be able to staff accordingly to support the holiday crunch. If staffing is difficult, retail stores may struggle to keep up with demand. Now that the student loan moratorium has ended, it will be important to monitor the impact to consumer spend. The increased expense of the student loan monthly payments will likely leave individuals with less discretionary income to spend on retail purchases. In addition, business owners who have student loans will have less money to invest in their business

These uncertain economic times are challenging for credit managers. Learn about the benefits of a holistic portfolio management approach.

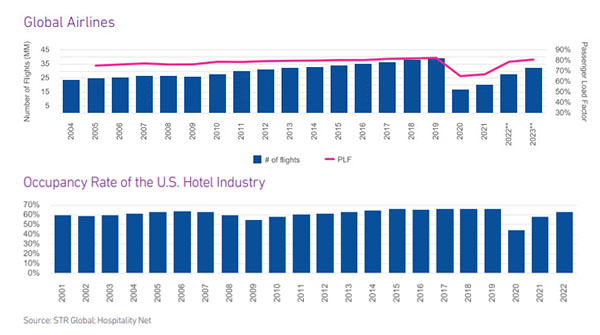

Now that most worldwide travel restrictions have been lifted, the industry is rebounding. It appears that travel businesses relied on more commercial credit to weather the storm of the pandemic and raised prices to help recove

Catch the latest brew on fraud strategy at our 15-minute Sip and Solve session hosted by Bonnie Gerrity, sharing best practices over coffee.

Small businesses have been opening at record rates during and following the pandemic. With so many new businesses seeking capital, and not all of them borrowing with good intentions, Experian thought it would be a good time to talk about mitigating fraud with one of the leading FinTech lenders. Ryan Rosett is the Founder and Co-CEO of Credibly, and he shares several valuable insights with us in this Business Chat. Watch Interview What follows is a lightly edited transcript of our interview. Gary Stockton: Hello, and thanks for joining us for this business chat. I'm Gary Stockton from Experian Business Information Services, and I'm here with our Vice President, Dominic DiGiuseppe, and also Ryan Rosett, the founder of Credibly, a fintech dedicated to helping medium and small-size businesses grow via funding decisions that are based on the holistic health and potential of a business.And we're here today to discuss fraud as it relates to FinTech in the small business space. Gentlemen, welcome to Business Chat. So Experian has recently released some interesting new statistics on the impact of fraud across several industries, notably that over 39% of recent FinTech inquiries were rated as high risk by our commercial first-party fraud score.And that's a predictive score that can predict the likelihood of first-party payment default and the credit bust-out scenarios that we see. These inquiries are projected to carry 62% of all first-party fraud risk within the population. And if you would like to see more on that analysis, we'll be including a link in the blog post for this business chat.So Dominic, I wanted to get your reaction to this statistic, given our mission to serve small businesses and considering small businesses make up the greater part of our economy and economic output.Dominic DeGuiseppe: Yeah, Gary, thanks for that. First and foremost, I want to give a shout-out to our data sciences and product teams for being able to continue to innovate in this space.But really, when you look at post-pandemic, the amount of businesses that have been created, it's, we were somewhat surprised by the numbers as well. But the amount of businesses that are being created, the mission that we have an experience making sure that we can help provide capital and we can provide funding and get that into the hands of business owners quickly.So if we take a look at some of the trends here, the amount of businesses that are being formed since the pandemic is pretty surprising. We've continued to see that trend. Rise and stabilize a bit, but it's still much higher than pre-pandemic levels. So when you think about businesses that are looking to understand the type of fraud that's being perpetrated or making sure that these types of businesses are actually legitimate as they're looking to make credit decisions and provide these companies with lending or funding decisions, these are the types of tools that have been that the team has been creating. Rapid new business formation during pandemic To make sure that we're assessing and helping folks determine the levels of risk that are associated with these businesses. I know we've talked about this in the past, a few times in different conversations, but can you tell the folks tuning in here a little bit about the Credibly origin story I find it super unique and interesting.Ryan Rosett: Oh, absolutely. So my partner and I started the business in 2010. If you think about 2010, it was a contrarian time to start a business. It was coming out of, the Great Recession of 2008/2009, and they were always talking about this double-dip recession, but it was actually an opportune time to start just because small businesses were really looking for access to credit.And what we are is that we're a cash flow lender. So, we look at the cash flow and make decisions and determinations in a very quick manner to provide working capital at an affordable rate for the customer. So that means, it's important to us that the business can sustain the payments that we're providing, and we can maximize the amount of money working capital that we can give them.So it's just something that we're focused on, and we've had the wind in our back for a, I would say, eight years. And then there's something called the pandemic hit, which was like, which, I didn't sleep for, I don't know, four months. But it was a period of time that was really like an interesting time for a small business lender, but then recognizing also that the government money really boosted up the small businesses, and it worked well for alternative lenders like ourselves.Gary Stockton: The pandemic did accelerate rapid digitization, and it does seem like an opportunity for FinTechs to address lending for small businesses digitally. This stat that we were talking about, it's really quite astounding that there were that number of businesses that sprung up during the pandemic.It makes a lot of sense, though, when you consider there were quite a lot of people that were transitioning from maybe a different industry into another industry, home businesses springing up. But with so many new businesses coming online and the impact of cybercrime on small businesses, Dominic, how do lenders know whether or not they are dealing with a real business when they onboard new customers digitally?Dominic DeGuiseppe: Yeah, I think that's certainly a challenge. And I think one of the things that we're looking to answer is, really, three things — is the business real? Is the business active? And is the applicant that's applying for the loan or the type of funding are they actually linked to the business?I think we can certainly answer for that, but I think, since we've got one of the top FinTechs in the space out there, Ryan what is Credibly doing to understand different fraud trends and combat what's happening within the space with fraud?Ryan Rosett: What I can say is that fraud is pervasive right now. And, as we're an online lender, we make decisions in under four hours from app to decision and fund same day. The amount of data alternative data that we're pulling in to make decisions is really quick. And so the risk that there's a fraud application coming through is something that we that you know, I'd say that's largely what we work on.I would say the three largest fraud patterns that we're seeing and you addressed earlier, was an application mismatch. Which is against the verified sources that they listed. And then, we also have just altered documentation associated with the bank statements.And again, that would be something that would be illegal historically, but we're a nonbank lender. And we're just trying to make decisions based on the data that we have. And we want to verify that the applicant is the owner of the business. So those are the types of frauds that we're seeing, I'd say, like a high level and then there are certain things that we do to combat that.So we will call it stipulations to fund. So we may offer to make an offer subject to them supplying additional information. Maybe it's the articles of a corporation. Maybe it's a tax return. And oftentimes, it's not to say whether you're profitable or not profitable, we're looking at who's the owner, who's getting K1s on the tax returns?Those are examples of things that we are looking at. And I know Experian has been an excellent partner of ours in terms of matching and using a number of different data sources that you provide.Dominic DeGuiseppe: How have you seen fraud evolve pre-pandemic to post-pandemic and continue to take shape and take a different shape, from what's been happening as to now?Ryan Rosett: Yeah, that's a good question. So on a pre-pandemic basis today, we're back to the same level of losses. Okay. But the fraud is becoming a little bit more advanced. Okay. Whether it's be it through cyber attacks, whether it's online applications, there's a number of different things that we're working on that we're constantly combating. So it's not it's not something that we put a fix in and then we move away. It's something that we're constantly evaluating, whether it's a submitting partner, or whether we have an affiliate that provides a certain number of lead applications.Those are things that we're constantly measuring to see what the loss rates are, where the fraud is coming from, and then making decisions. So from a pre-pandemic to a post-pandemic, I'd also say that with the PPP, small businesses got a taste of working with alternative lenders through the PPP process, and they became a little bit more comfortable with working with lenders similar to Credibly. So you're seeing like a little bit more comfortability with small businesses having the ability to interface with us and then they're layering in fraud and things of that nature. So it's a constant something we're combating on a daily basis, and it's something that we're thinking about, very often.Dominic DeGuiseppe: Yeah, because when you start to look at it and all the new businesses that are being formed that are coming into the market, working with alternative lenders and FinTech's like yourself, and you guys continuing to shorten the cycle around the app to approval and all the data points that are coming into it. You guys are different than a bank and are able to do those types of things and move quickly. So obviously, with that comes some additional risk; with the FinTech community being tight-knit, how have you been able to benchmark what Credibly is doing against some of the peers that you guys work with in the industry?Ryan Rosett: We have and that's really through public data through asset-backed securitizations; there's reporting relating to the losses that each lender is seeing, of our losses, approximately 10% of our losses we attribute to fraud. The other 90% is, it could be a business that legitimately goes out of business, which happens. So, it's not necessarily fraud. We do benchmark it based on some of our competitors that have asset-backed securitizations and we see the performance in their loss rates and charge costs and things of that nature.Gary Stockton: So, what are you seeing in terms of an amplifying effect on fraud rates with generative AI in the mix and allowing for spoofed content and more access to triangulated private information on business entities?Ryan Rosett: You know, that's a great question. One thing, you're seeing fraudulent IDs. You're seeing IDs that are becoming a little bit more difficult to track and see, because they're creating an identity of someone and they're able to do that through gen AI.So that, that's one aspect. You're also seeing bank statements. We use a number of different bank statements, parsing, and machine learning that looks at these bank statements. It's looking at font type size. There are a number of things when somebody is attributing and oftentimes, sometimes the fraudster is making grave errors also. They're putting data in where data wasn't supposed to be. You're able to detect that really quickly and that's on an automated basis. So that doesn't even touch a human. We see fraud, we kick it out. And, it's declined. So it's a, it's, when we see a, when we fund a fraud application and it's noted as a fraud that we've determined fraud, we then report it we have a, there's a data matching system that we report into so that business owner would never be eligible for. Business financing through an alternative lender. Again,Gary Stockton: Dominic, any closing thoughts?Dominic DeGuiseppe: Yeah, Gary, I would say just in terms of, generally speaking, fraud continues to evolve. There's a number of different things that we're looking at from a business perspective to be able to help our partners. But, Ryan's pointed out a number of those things today, but as FinTechs continue to evolve, fraudsters will continue to evolve and Experian is on our journey to continue to help understand how we can benefit our business partners, making sure that they can combat fraud and keep it out of the business.Gary Stockton: That's great. I think that's a great place to leave today's chat. Dominic, and Ryan, thank you so much for taking time out to share your perspectives on fraud in the commercial space on Business Chat. Thanks for watching, everyone. Related articles:

This post highlights recent commercial fraud insights from Experian and the advantages of taking a multi-layered approach to fraud strategy.

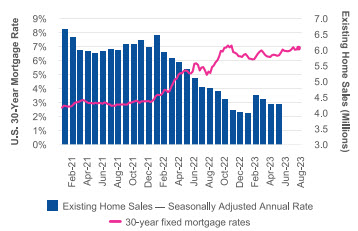

Since the height of the COVID-19 pandemic, the commercial real estate market is experiencing a paradigm shift as office professionals acclimated quite well to working from home, and many balk at going back to the office. As vacancy rates for offices hit record highs, supply of office space is greater than demand, reducing the value of many commercial properties. In parallel, The Federal Reserve’s 500bps of interest rate increases since March 2022 have made it more expensive for property owners to borrow and has left commercial real estate (CRE) lenders fearing greater risk of default will occur in the near future. August unemployment increased to 3.8% from 3.5% in July and is the highest since February 2022. Low unemployment continued to drive wages up with August wages reaching $29 per hour In anticipation of higher losses, CRE lenders are tightening their lending criteria, requiring higher down payments, shortening the loan term, and selling off or diversifying their CRE portfolios. Contrary to recent trends in office space pricing, and also contrary to impressions driven by media coverage focusing on increasing mall vacancies and mall closures, retail real estate appears to be rebounding since the pandemic. The average monthly rent per square foot for retail space has been increasing across the United States since the start of the pandemic. What I am watching There has been interest in re-purposing vacant commercial spaces into multi-family rental properties. As vacancies rise in office buildings and in some large urban malls, more CRE buildings are transitioning to hybrid residential/commercial spaces. A significant increase in residential living spaces should drive housing costs down, which would be a tremendous benefit to the public and help curb inflation. The labor market remains resilient but there are signs of weakening. While unemployment remained low at 3.8% in August, it is the highest since February 2022. The three-month moving average of jobs created in the U.S. declined to under 150K for the first time in a few years. If the labor market continues to weaken, employees will have less bargaining power and it is possible that employers will require workers to come back to work in-person in offices full time. If that comes to fruition, CRE owners and lenders will be in a much better position. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Since the height of the COVID-19 pandemic, new businesses are opening at a record pace. New businesses tend to be smaller based on number of employees as well as annual revenues. While new businesses make up a greater portion of new commercial credit accounts, they receive less credit.

Recession fears may be calming, but several indicators are still flashing for 2024. Experian and Oxford Economics have released the Q2 2023 Main Street Report, the report brings deep insight into the overall financial well-being of the small-business landscape, as well as provides commentary around what specific trends mean for credit grantors and the small-business community. Report Summary During Q2, lenders adjusted underwriting criteria to limit exposure as delinquencies remained elevated for consumers and small businesses. The markets dealt with inflation above target and customers reevaluated their discretionary spending and growth investment strategies. Not all segments of the markets were impacted by environmental forces. Technology-focused companies are leading investment and growth, while logistic, utility, and healthcare struggle, Supply chain disruptions are smoothing, but lighter forecasted demand is already impacting inventory reorders. The softer demand is hitting trucking and logistic companies hard as tonnage, and mileage are lighter than forecasted as consumers return to the in-person experience and engage with eroded purchasing power. The bright spot is consumer resiliency. This prolonged spending strength is fueled by a tight labor market, wage growth, and relief in energy and food costs.Another element is savings. Dwindling savings, increased reliance on unsecured debt to support spending behavior, reassumption of monthly debt servicing obligations (student loan payments), and prolonged inflation place downward pressure on the consumer. Recession fears may be calming, but several indicators are still flashing for 2024. Download Q2 2023 Main Street Report

The Federal Reserve’s efforts to tame inflation with aggressive interest rate hikes over the past 15 months appear to be working with July’s core inflation rate reaching the lowest level since October 2021. The U.S. labor market remains strong with low unemployment and 187K knew jobs created in July. As inflation eases and the economy continues to be strong, it is becoming more likely that we could experience a soft landing.

Gain insight on small business credit conditions by attending our quarterly webinar.