All posts by Experian Health

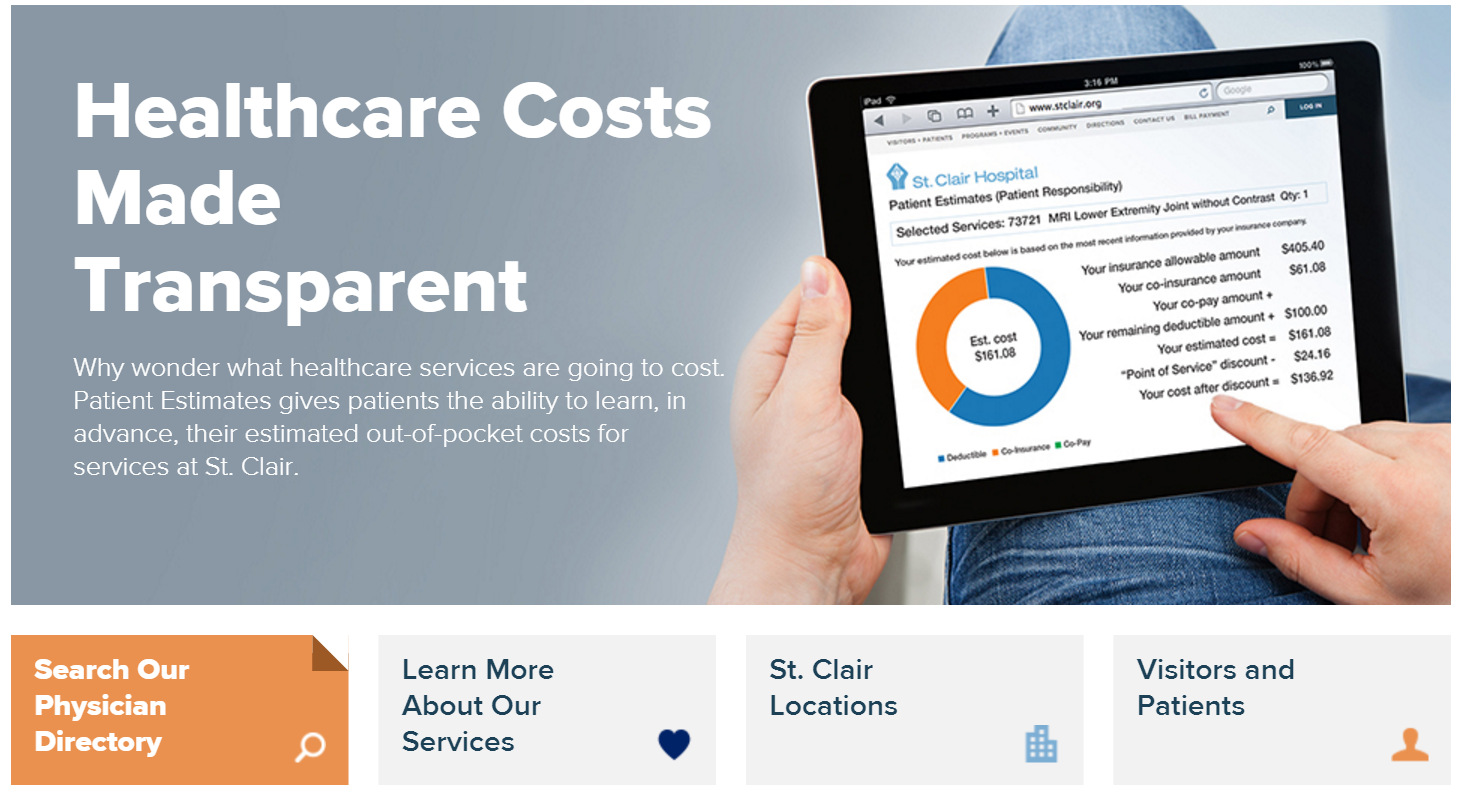

Experian Health is pleased to announce that we went live with Patient Estimates at St. Clair Hospital located in Pittsburgh, PA on February 22, 2016. A true representation of vendor and hospital collaboration and commitment, the Patient Estimates cost transparency tool gives St. Clair a competitive edge as the first hospital in its region to offer patients cost estimates in advance. Patient Estimates is not a list of charges, but an interactive and user-friendly tool that provides information that is highly specific to the individual. Estimates are designed to determine, in advance, each patient’s out-of-pocket costs (deductibles, co-pays and co-insurance) for services at St. Clair based upon his/her insurance coverage. The estimates also incorporate St. Clair’s discounts for payment on the date of service and for those without insurance. The estimates remain in the system and can be recalled for future reference. Patient Estimates is simple to use and is conveniently available 24/7 at www.stclair.org. On the home page, patients will select the “Financial Tools” option, then click on Patient Estimates. They will then enter their health insurance information before choosing one of the 100 listed clinical services (e.g., a procedure, treatment or diagnostic test) from the drop-down menu. The tool then provides a customized estimate of their out-of-pocket expenses. Patient Estimates is designed to help insured and uninsured patients get clear, real-time, easy-to-understand cost estimates for St. Clair’s services so patients can make informed decisions about their care. Below are some of the press mentions of St. Clair Hospital's implementation of Patient Estimates: Pittsburgh TRIBLIVE https://bit.ly/1oxlKna Pittsburgh Post-Gazette: https://bit.ly/219dqfd Pittsburgh Business Times: https://bit.ly/1QWfqNa

The title of Best in KLAS is a highly coveted recognition of outstanding efforts to help healthcare professionals deliver better patient care. It is reserved for vendor solutions that lead the software and services market segments with the broadest operational and clinical impact on healthcare organizations. ~KLAS Enterprises LLC Last month, Experian Health’s eCare NEXT® platform was awarded the highest score in the Patient Access category of the 2015/2016 Best in KLAS: Software & Services report. This is the 5th straight year Experian Health has received the highest ranking in the patient access category—3 years as Category Leader in Patient Access – Eligibility Checking and now 2 years Best in KLAS in the broader Patient Access category. The KLAS award confirms our strong commitment to continually provide advanced technology and revenue cycle products for our clients, and consistently develop enhancements and new solutions with them. We are proud of the collaboration between our progressive clients and our dedicated employees to ensure clients provide the best patient care experience, and achieve payment certainty for every patient. It’s a great honor that our clients continue to hold Experian Health’s solutions in such high regard that we have been recognized consistently by KLAS year after year. View Press Release View full list of Best in KLAS winners and Category Leaders

Episode management, particularly the 30-90 days post-discharge, is incredibly important for all types of healthcare entities seeking to succeed under value-based reimbursement. Millions of dollars in revenue, shared savings, and bundled payment contracts are at-risk when hospitals, ACOs, bundled payment conveners, and others don’t have visibility into their patient’s care after hospital discharge. Leading health care organizations are realizing the solution is not simply to hire an army of care managers, but rather, to supplement a care management team with focused automation to double or triple their productivity by sharing workflow and care management with the patient’s community providers, including independent MD offices, skilled nursing facilities (SNFs), home health agencies (HHAs), and others. Having the right care solutions in place is critical to ensuring successful episode management. View our on demand webinar to learn care coordination best practices and find out how Experian Health’s innovative solutions can help your organization: Reduce readmissions and manage episode/post-acute costs Maximize Medicare reimbursement, minimize Medicare penalties and, hopefully, earn bonuses Profit at and contract for bundled payments Maximize commercial reimbursement Improve outcomes and lower costs for greater fee for value (FFV) in the future Learn how Experian Health can help you success in the new FFV environment. Access our on demand Episode Management webinar.

In the 1930s, Ovaltine offered listeners of the Little Orphan Annie radio program a membership badge with a decoder ring that allowed listeners to replace numbers with letters and figure out secret messages – which usually urged them to drink Ovaltine.. Fast forward to 2015, and a decoder ring can be bought online for under $20. Unfortunately, these trinkets aren’t sophisticated enough to help practices and hospitals decipher reimbursement contracts and identify underpayments. Providers today require robust analytics and automated workflows, coupled with a level of support that goes far beyond an instruction manual to include continual updates to contract terms by skilled contract analysts. According to the American Hospital Association, combined Medicare and Medicaid underpayments were $51 billion in 2013. Private payers further contribute to underpayments, totaling a hefty financial gap for providers, regardless of care setting. It is imperative that providers across hospitals and medical groups take proactive measures to ensure they are paid fully and fairly for the care and services delivered. Incorporating automated solutions enables providers to fully decode the hidden “catches” in contracts while recovering underpayments. Understand how proposed contracts with payers affect your revenues When a payer assures you that proposed contract changes will benefit your organization, are you skeptical? Using contract analysis and modeling, you can accurately predict how a change in any of the hundreds of variables in third-party contracts will affect reimbursement for your precise mix of services. Not only can contract analysis let you see the overall impact of an individual contract, it also lets you precisely model revenues so you can see the gains or losses for each individual specialty, provider or service. By assessing which factors have the greatest impact on your reimbursement, you can refine your bargaining strategy to negotiate better-performing contracts. Verify the accuracy of payment received from third-party payers Ensuring your contracts are as advantageous as possible is just half the battle; you still have to confirm that payments follow the guidelines of the contract. Complicating this process is the move to new reimbursement structures that bundle payments or base them on value rather than services. Verifying payment accuracy can easily bog down your team–unless you put the benefits of automation to work for you. Contract management and analysis solutions streamline workflow by auditing claims so you spend time only on those that require intervention. Through data-driven insight, you can conduct contract-based appeals and recover lost revenue. Together, these solutions assist in reviewing and modeling contracts, and then accurately identifying, appealing and recovering underpayments. With the ability to value the claims you file and evaluate overall contract performance, you decode the information locked away in data. All without a decoder ring. Don’t miss our upcoming webinar, "Overcoming the Three Ps: Payers Who Pay Poorly” Featured Speakers: Kristen Prenger, Director of Managed Care, Lake Regional Health System Rebecca Charo, Product Director, Experian Health Date: Thursday, May 21, 2015 Time: 11 a.m. PT/1 p.m. CT/2 p.m. ET Register now!

Significant changes in health insurance coverage are delivering a good and bad news report for providers. The good news is the continuing decline in the number of uninsured Americans. As of January 2015, the current uninsured rate is at an historic low of 12.9%. Much of this decrease can be attributed to the Affordable Care Act (ACA), with 7.1 million people enrolled in a plan on the federal marketplace, as well as an estimated 2.4 million people who obtained insurance through state exchanges. Add to that young adults staying on their parents’ plans (3 million), another 10 million people who are covered through Medicaid and Children’s Health Insurance Plan (CHIP), job-based coverage and plans outside of the marketplace, and the picture should seem rosy. However, the bad news comes when these newly insured people begin using their benefits and are faced with deductibles, coinsurance and copays. Providers are seeing more patients with insurance coverage who find it challenging to handle these additional out-of-pocket expenses. Compounding the challenge is the increase in high-deductible health plans (HDHP) and/or health savings accounts. The number of people with HDHPs has risen from 19.2 percent in 2008 to 33.4 percent in 2014, as reported by the Centers for Disease Control and Prevention. Tackling the problem Healthcare providers not only have a mandate to provide care, most also are deeply committed to providing charity care when it is needed. However, in order to remain solvent, providers must protect their financial well-being by actively seeking reimbursement and payment when it is available and applicable. But, how can organizations strike the right balance? As a first step, having a system in place for assessment, enrollment and case management will not only help you maximize reimbursement by enrolling self-pay patients in Medicaid or qualifying them for internal charity care, it can also be used to document your facility’s charitable services. Key components to a well-orchestrated charity program include: Screen for financial assistance using the most up-to-date qualification guidelines for Medicaid and other financial aid and charity programs. Ensures patients who are eligible for charity care, Medicaid and other assistance programs receive needed financial support. Determine a patient’s propensity to pay, so that you can evaluate payment risk, identify the most appropriate collection route and initiate targeted financial counseling discussions. Organizations can then maximize reimbursement dollars from Medicaid and other financial assistance programs and reduce uncompensated care and bad debt write-offs. Verify patient identity to reduce fraud risk, claims denials and the rate of returned mail – expediting reimbursement. This process streamlines the financial assistance screening and enrollment process to increase staff productivity as well as patient satisfaction. Through these strategies, organizations can more effectively identify patients eligible for charity, combatting ongoing patient financial responsibility challenges – or the bad news – while still capitalizing on the good news of more patients receiving coverage. Learn more about charity care initiatives by registering for our upcoming webinar, “Financial Screening in the age of the Affordable Care Act,” on March 11, featuring Brandon Burnett discussing Kaiser Permanente’s experience and initiatives and Kim Berg from Experian Health.

As discussed in part one of this blog series, technology such as patient portals are changing the way physicians are interacting with patients and how those patients access their medical information. An article in USA Today quotes the American Academy of Family Physicians on usage: 41% of family practice physicians use portals for secure messaging Another 35% use them for patient education About one-third use them for prescribing medications and scheduling appointments While intuitively it might seem that online interactions would distance physicians and patients, the reverse is actually true. Researchers found that patients who had online access to their physicians and other healthcare professionals increased their use of in-person and telephone clinical services, according to a study published in The Journal of the American Medical Association. Increases in patient engagement can carry over into patient billing portals. Take Cincinnati Children’s Hospital Medical Center (CCHMC), for example. The organization decided to update its patient billing portal two years ago in the hopes that a better interface and more functionality would increase the number of families using the portal. With only a one-time notice in a paper statement, CCHMC saw adoption rates soar more than tenfold in the first year after implementing the new platform. CCHMC, which is consistently ranked in the nation’s top five children’s hospitals, also experienced an increase in collections of 10-15%, and a five-fold increase of online payments, up from $200,000/month to $1 million/month. The patient-friendly portal now has more than 22,000 families using its self-service functions. The portal gives users 24/7 online account management, along with the ability to schedule appointments, pay bills and access lab results. Families now have anytime, anywhere access to their account, an important benefit for busy families trying to cope with a sick child. In conjunction with the online portal modernization, CCHMC also gave its printed patient statements a facelift. Not only did patients find the previous multi-page statements confusing, it had become increasingly expensive and time consuming to make even minor information changes and updates. Altering something as simple as a phone number or office hours could cost thousands of dollars in custom programming fees. The adoption of a new patient statement solution has given CCHMC the ability to make statement changes in house, eliminating custom programming while also reducing mailing expenses. In the first year, CCHMC saved $70,000 on their monthly invoicing due to lower printing and mailing costs, reducing the statement size from two pages to one and receiving discounts on postage. With patient experience and engagement a top priority for providers, it’s critical to consider a similar approach that works for your organization—an approach that will help patients be more active participants in their health, as well as support your clinical and financial goals. CCHMC will discuss its experiences with patient engagement, administrative savings and lessons learned at our January 28 Webinar, “Improving the Patient Billing Experience Through Online Customer Self-Service.” Register now to attend.

Rudyard Kipling famously wrote, “Oh, East is East, and West is West, and never the twain shall meet.” That was once true of care delivery and medical payments; they were two separate departments encountered at different stages during a physician or hospital visit, and each was siloed to the activities of the other. Today, patients are avid participants in their care and are more engaged and concerned with where their healthcare dollars are spent. With that in mind, savvy providers are collaborating with patients not only on a clinical level, but also on the financial side to better navigate their options. This new approach gives patients the power to make informed financial decisions about their care, with discussions taking place prior to treatment, rather than after when an unexpected bill or lack of understanding around financial obligations can negatively impact a patient’s overall perception of their care and the organization itself. While it’s no surprise that patients are taking on greater financial responsibility for their healthcare costs due in large part to the rapid rise of high-deductible health plans, the statistics are overwhelming. In 2006, only 55 percent of covered workers had an annual deductible, which averaged $584. In 2014, according to the Kaiser Family Foundation, that deductible has more than doubled to an average of $1,217 for 80 percent of the covered workforce. When you consider that slightly over half of covered workers have an annual out-of-pocket maximum of $3,000 or more, that creates a gap that providers can’t ignore for the sake of their fiscal health, or that of their patients. At the heart of achieving better patient engagement on the financial side is accurate, real-time information. Advanced technology gives providers the ability to provide patients with a more comprehensive picture of financial information and to present them with financial options that fit their needs. Three key steps to achieving higher payments and better patient satisfaction include: 1) Be proactive – Talking to patients prior to receiving care not only results in higher patient engagement and satisfaction, it also substantially increases the amount providers can expect to collect. For example, showing online full-disclosure of billing data builds trust among patients. 2) Provide accurate estimates – Patients deserve the right to make informed decisions based upon the cost of care. For example, providers should be able to quickly – and easily – review expected costs and explain insurance coverage. Offering patients tools, such as the ability to request a real-time estimate online, gives them more control over the financial side of their healthcare. 3) Offer choices – Payment plans designed in cooperation with patients, such as the ability to set up automatic payments, not only empowers them, it improves payments and reduces administration burdens. Implementing these initiatives creates a more informed patient, which leads to a positive care experience and eases financial stressors. Patients are able to make educated choices and, if necessary, structure a payment plan that meets their needs or identify potential financial assistance programs. Providers also see benefits, such as increased patient loyalty as well as an improved revenue cycle and decreased administrative burdens when it comes to collections and follow up. Mr. East, meet Ms. West. By integrating the clinical and financial sides of healthcare, patients are more engaged with their care, leading to better health for the patient and improved financial outcomes for providers.

The evolution from paper to online medical records is an opportunity to engage patients more fully in their care while making healthcare organizations more efficient. However, while patients enjoy the convenience of self-service access to all of their medical information, the portals offer cybercriminals a one-stop-shop for identity theft as well. According to Identity Theft Resource Center in San Diego, medical identity theft is the fastest growing type of identity theft, increasing at 32% annually. In fact, healthcare-related data breaches are already 10 times more frequent than data breaches in the financial services sector. And unlike stolen credit card information, which is often detected within a few transactions, medical identity theft often goes undetected for over a year. The comprehensive data contained in patient portals is especially lucrative to fraudsters, demanding a premium price in the underground market. While a stolen credit card number may sell for a dollar, a full set of medical records can command hundreds of dollars. The breadth of data within a patient portal offers fraudsters multiple opportunities to “cash in.” Compounding the problem is the level of detail presented on patient portals, often including unmasked insurance IDs, full images of patients’ insurance cards, problem lists, prescription histories. Stolen medical identities are used by criminals in two ways: obtaining medical care under the victim’s identity and using the identities to fraudulently bill for services or durable goods, which were never delivered. Problem lists, which are a mandated component of patient portals, are particularly useful to criminals, because they allow classification of each victim by the type of fraud which their identity could support. The problem lists typically use standard terminology, which makes them particularly useful for classification purposes. Using malicious software, criminals can search the lists for “key words” describing conditions that demand specific types of services or durable goods. This targeted approach would make fraud more personalized to the victim’s profile and harder to detect. Most patient portals use simple password protection, which can be easily captured by key-logging malware. This type of malware lays dormant on the victim’s machine, waiting for the victim to log into a patient portal site. When the patient logs in, the malware wakes up and captures the victim’s username and password. Using the stolen credentials, the criminals can get into the site, and once in can collect extensive information about the victim. Medical identity theft has severe consequences for both patients and providers. Patients are faced with the financial costs of covering fraudulent bills and medical costs stemming from treatment of other individuals. Comingling of the victim’s and the criminal’s medical records can also put the patient in life-threatening situations if treated or diagnosed incorrectly. Providers face steep financial costs from retribution payments and HIPAA violation fees up to $1.5M per violation, however arguably the most significant consequence they face is damage to reputation. Complicating matters is the fact that security measures cannot be so onerous that they dampen consumer adoption. Towards that end, use of covert technologies to analyze the identities and devices enrolling into a patient portal or logging in to it can increase security without impacting user experience. Precise ID® with FraudNet for healthcare portals provides healthcare organizations with a way to confidently authenticate patients and reduce risk during enrollment and ongoing access to healthcare portals. It does so in a streamlined manner without burdening patients with increased wait times and complexities. Together, these solutions identify fraud, authenticate patients and validate devices – all in a single platform. To learn more, view Experian Health’s complimentary on-demand webinar, “The Hidden Risks of Healthcare Portals,” or download the new white paper, “The Pitfalls of Healthcare Portals,” where we outline why your portal may be more vulnerable than you think.

It’s only natural to want to be fairly, fully and quickly reimbursed for services – it’s the basic foundation of business. Yet only in healthcare does attaining this basic transactional norm become challenging. Healthcare providers must be vigilant at all stages in the revenue cycle to ensure the amount they receive is timely and accurate. Achieving this deceptively simple goal is dependent upon insight – the ability to discern the true nature of a situation and to respond appropriately. Applying insight at critical points in the claims lifecycle can make a marked difference in reducing denials and accelerating payment. The foundation of a successful claims management strategy begins with contract management, where advanced analytics and data-driven insight can help you quickly and easily pinpoint payment variances and validate reimbursement accuracy for each of your third-party payers. Ensuring compliance with contract terms allows you to identify recurring issues so they can be promptly addressed, while providing the ability to strategically evaluate overall contract performance. Once you achieve visibility of the contract process, you can apply those findings to other areas, such as claim scrubbing. Boosting the first-time pass through rate eliminates costly, time-consuming rework and speeds reimbursement. A strong claims scrubbing approach involves taking time, prior to submission to the appropriate payer or clearinghouse, to ensure the claim is complete, accurate and meets individual payer requirements. Once the claim is submitted, it’s not a matter of “out of sight, out of mind.” Tracking claim status early in the adjudication process – rather than waiting for a denial to appear on your desk – helps improve cash flow and maintain a healthy revenue cycle. An online payer portal provides instant insight into the status of each claim and gives you the ability to determine if a claim is lost, denied, pending or being returned. Regardless of how well you scrub claims before submission, it’s likely that a certain percentage will be denied. You can optimize and accelerate payments by quickly and efficiently identifying denied claims for analysis and re-submission. Use technology to ensure denied claims aren’t overlooked and streamline the workflow associated with claims management. Finally, taking a comprehensive look at all pending claims and denials allows you to prioritize claims and denials so that your staff can work the highest impact accounts first to improve efficiency and increase revenues. Advanced technology that provides insight into contracts, payer requirements, claims status and denials holds the key to reducing the claims processing errors that add an estimated $1.5 billion in unnecessary administrative costs to the nation’s health system. Few healthcare organizations can afford to receive less than their fair reimbursement for the care they provide. By implementing a strategic approach that grants insight into each component of the process, healthcare organizations can bolster the bottom line and streamline efficiencies along the way. To learn more about how to turn these strategies into tangible results, register for our Dec. 3 Webinar, “5 Ways to Accelerate Your Claims Payments."