Featured

Topics that matters most for revenue cycle management, data and analytics, patient experience and identity management.

Halloween might be over, but healthcare fraud – or simple input errors – can transform a patient’s identity into something completely different. The negative impacts are potentially far-reaching, haunting both patients and providers. Is the patient standing in front of you really who they say they are? Learn more about Experian Health's identity management solutions and how we can help you match, manage and protect patient data with:

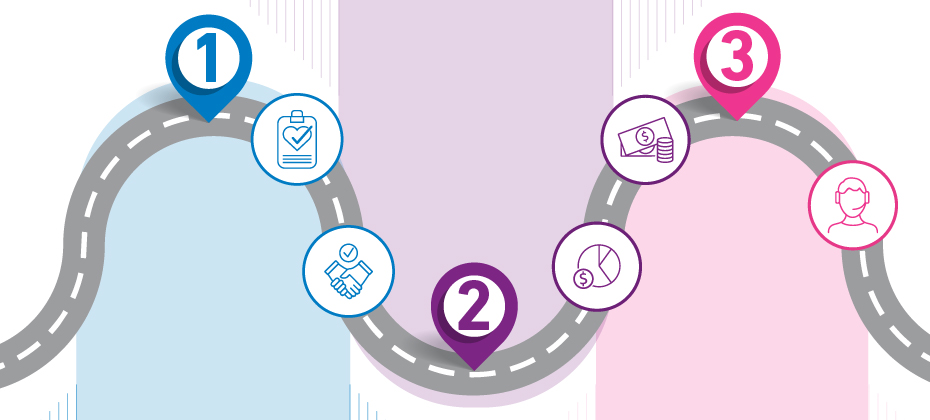

A consumer-first healthcare revolution has been simmering for years. Despite efforts to create more human-friendly services, the industry still lags behind other consumer-centric sectors. Patients want healthcare to be simple, convenient and on-demand, but a persistent lack of coordination, accessibility and affordability leaves many struggling to navigate the healthcare landscape with ease. Is this about to change? Has COVID-19 flipped the switch? The pandemic has prompted people to engage with their own care in a way the industry hasn’t seen before, with a surge in telehealth and virtual care. Infection-control forced much of the patient journey online, while providers were pushed to find new ways to communicate quickly and clearly. Now, those with an eye on the road to post COVID-19 financial recovery are optimizing these digital strategies to meet new consumer expectations and improve patient loyalty. Embracing digital technology and automation throughout the entire patient journey will be key to patient acquisition and retention. Where should providers focus first? 4 consumer-led strategies to keep patients loyal 1. Prioritize convenience across the entire consumer experience Eighty percent of patients would switch providers for convenience factors alone – ranking ‘convenient, easy access’ ahead of insurance coverage and quality of care. Creating a digital experience that gives patients the flexibility and simplicity they desire should be priority number one in any patient loyalty plan. Providers can start by reviewing their digital platforms. Encourage patients to use their patient portal to access information, book appointments and manage their healthcare when appropriate. Telehealth and virtual care solutions can be future-proofed with reliable identity protection, so patients can safely access care from home and not worry about cumbersome log-in procedures. 2. Make patient access…accessible The patient experience shouldn’t begin with time-consuming forms, long waits and error-prone manual intake processes. Rather, providers can make it easy for patients to complete as many tasks as possible BEFORE they set foot in the office by automating patient access. Online patient scheduling lets patients book, cancel and change appointments online – which 77% of patients say is very important. It has the potential to reduce delays and no-shows, and can minimize the administrative burden for provider staff. While patients remain concerned about the risk of infection during COVID-19, providers can ease their concerns by reducing face-to-face contact with online pre-registration. 3. Respond to affordability and pricing pain points One Experian Health study found that the top pain points in the consumer journey center on the financial experience, from shopping for health insurance to understanding medical bills. Patients may be unsure what their insurance covers, whether their deductible has been met and whether they can afford the out-of-pocket costs. By providing clear, upfront pricing information about coverage and financial responsibility, providers can protect their patients from unnecessary surprises and reduce the risk of missed payments. Self-service patient payment tools can simplify the payment process too: patients can settle their bills anytime, anywhere, and get advice on financial assistance and best-fit payment plans. 4. Personalize the patient experience from end to end A one-size-fits-all approach doesn’t cut it anymore. Patients are looking for communications and services tailored to their individual needs. That used to be both technically and logistically impossible, but not anymore. Providers today can use comprehensive data and analytics to personalize the entire healthcare journey, from customer relationship management to patient collections. By combining automation, self-service tools and accurate insights into the patient’s circumstances, providers can help consumers make better decisions about their care and how to pay for it. To ensure data reliability and integrity, providers should consider partnering with a trusted data vendor, who can translate robust, multi-source consumer and financial data into a competitive consumer experience. There is no question that COVID-19 has changed the way we do healthcare, but the industry is perfectly posed to harness the change in consumer behavior and shift towards greater patient engagement. By bringing together a myriad of digital tools, providers can create a healthcare experience that’s convenient, compassionate and in line with consumer expectations. Interested in learning more about how we can help your organization welcome new patients through its digital door, and boost loyalty among existing patients?

“It’s important to provide our patients with the absolute best access channels to quickly and seamlessly connect with the care they need. Experian Health’s solution guides our patients to the right care and digitally connects them with a confirmed appointment.” - Kaci Husted, Vice President, Benefis Health System It’s shouldn’t come as a surprise that patients today want their healthcare experience to mirror the flexibility and convenience that they are now accustomed to with other industries. Notably, patients want easier and faster access to care, and preferably without having to pick up the phone to call and make an appointment. Benefis Health System knew it needed to provide patients with a new and improved access experience. Patients were required to call the office during business hours to book an appointment, and while some may have been immediately connected with a scheduler, others would have to leave a voicemail or be placed on hold. The process was not only taking valuable time out of patients’ days but carried the risk of delaying care. With online self-scheduling in place, patients can schedule an appointment online with any of Benefis Health System’s 300+ providers, regardless of time of day. The solution leverages powerful decision support, which guides patients directly into the appointment type and provider necessary for the treatment they need. It’s good for patients and providers, as the solution’s accuracy prevents any misplacement of patients to the wrong provider or appointment type. Patients started using the self-scheduling solution almost immediately after it was available. Benefis Health System has since experienced the following results: Improved access to care. Patients of Benefis Health System have used the system to book many appointments outside of office hours, with 50% of its patient base booking after hours. Better access to urgent care. One of Benefis Health System’s urgent care centers has seen a large uptick in online self-scheduling. In fact, 52% of patients are scheduling appointments online for that location. Ongoing improvements with analytics. Benefis Health System is leveraging analytics to track how many patients use online self-scheduling and can identify when and where they might fall out. They can see the pitfalls and where improvements may be necessary and make those changes in real time to drive better conversion rates. Currently, 23.6% of patients who start the process are converting to a booked appointment. Interested to see how online self-scheduling can help your organization improve access to care?

In previous winters, anyone struck by a sore throat or fever might assume they had flu, and head to bed with a hot drink and some painkillers. This year, the looming specter of COVID-19 could prompt those with flu-like symptoms to seek medical care instead. Combined with a likely second wave of COVID-19 cases as lockdown requirements relax, healthcare organizations anticipate a surge in patients seeking tests and treatment this winter. To protect against a possible “twindemic”, where COVID-19 and winter flu season collide, providers will want to ensure the patient intake and access process is as easy and efficient as possible—and not just for regular appointments with a primary care physician or specialist, but for pandemic- and flu-related services like COVID tests, flu shots, and more. Online scheduling has been a game-changer during the pandemic: could it be the key to surviving a twindemic? With the right digital tools in place, providers can screen patients for their COVID-19 or flu risk before attending an in-person appointment, helping separate healthy patients from those suspected of having either illness. Providers can also leverage those same digital tools to streamline activity like flu shots, or even drive-through testing for COVID-19. Four ways to leverage digital scheduling for a twindemic These four steps could be key to protecting patients, streamlining workflows and reducing pressures on call centers during flu season as it collides with COVID-19: 1. Create screening questionnaires during patient scheduling As soon as the patient logs on to book an appointment, they are asked to answer a few short questions about their symptoms. A screening questionnaire can triage people wanting to get tested, while the answers inform providers of the likelihood of a patient having COVID-19 and if that individual needs to quarantine. After being screened, the system can direct patients through the correct channel of care based on the information provided. A similar questionnaire could be adapted during flu season for providers to assess and compare symptoms and risks ahead of time. Providers can even designate day and time slots available to patients for flu vaccinations, making it easy for patients to schedule on their own time and further minimizing the risk of unnecessary contact with other patients in office. 2. Direct patients to drive-through testing to minimize in-person tests Depending on the answers given during screening, patients may be directed to virtual and disease-specific care, such as drive-through COVID-testing. An online scheduling platform can easily be used to book appointments for tests, presenting patients with any available time slots, either same-day or a few days out. The platform can also record information about the patient’s vehicle to quickly identify patients and avoid bottlenecks in the drive-through. With so many patients hesitant to show for in-person visits today, a similar system for flu shots could serve providers well. 3. Use guided search to direct patients to the right virtual services Virtual care has proven both necessary and valuable during the current pandemic. Not only has it kept patients in close contact with providers and specialists, but it has helped providers capture revenue lost from the cancellation or delay of in-person appointments. Virtual care will be increasingly critical during a dual COVID-19/flu season. By asking the right questions during online scheduling, patients can be connected to the correct provider, whether virtual or in-person, for their needs and book an appointment quickly and easily. 4. Eliminate walk-through traffic at urgent care centers Urgent care centers are already known to be the ‘doctor of choice’ for many patients, but this could pose a few challenges for both patients and providers during a dual pandemic. Rather than be a gathering spot for patients with both illnesses, urgent care centers may want to consider switching to an appointment-only system, where appointments must be scheduled online or by phone. This can help reduce the number of in-person visits and walk-in traffic, which will not only help keep everyone safe and healthy but contribute to a far better patient experience as patients wouldn’t have to sit and wait to be seen by a provider. Interested in hearing more about how online scheduling could help your organization manage flu season as it collies with COVID-19?

While all hospitals and health systems will no doubt encounter revenue-specific challenges related to the pandemic, a solid foundation and targeted approach for improved collections can help speed up the road to recovery. In fact, it was Sanford Health’s unique approach to increasing patient collections that allowed it to both optimize collections during the pandemic and improve employee satisfaction and retention. Several years prior to COVID-19, Sanford took steps to improve collections with a patient-focused, hybrid approach that combines employee incentives with segmentation strategies. Leveraging Collections Optimization Manager and PatientDial from Experian Health, Sanford was able to quickly and easily streamline call center operations and increase collections in a myriad of ways – through new and updated patient addresses, patient-friendly billing statements, identifying new guarantors and more. With the above items in place, Sanford was already well positioned to seamlessly manage normal business operations during a pandemic. The organization was able to quickly adapt, and then build on that momentum to better serve its patients and staff, while also driving results. Since the start of COVID-19, Sanford has: Increased employee satisfaction with remote capabilities PatientDial allowed Sanford to seamlessly transition its call center team to work remote. Where about 30% of the workforce was remote prior to COVID-19, just shy of 99% of call center representatives are now remote. This has been a great source of employee satisfaction and safety and has aided in the system’s ability to keep the collections momentum going. Provided a more compassionate approach to collections Recognizing that this is a sensitive time for many, Sanford ensured the proper mechanisms were in place to identify those who required additional help, offering the best methods for collection possible. Sanford has not only created a billing indicator for patients affected by COVID-19, but Experian Health has provided additional insight with a weekly file of patients who are identified as possibly financially stressed. Improved collections during time of crisis While collections decreased for the quarter, Sanford saw a record increase in collections for the month of March -- $800K more than the system saw in March of 2019.

Before working with Experian Health, call center operations at Sanford Health were disparate and disjointed, with each call center operating on a different phone system with different carriers. While some centers saw high abandonment rates, others were waiting around for calls. Although Sanford attempted to create balance by placing accounts in a work queue, the process for managing outbound collection calls remained manual and it was impossible to identify and strategically contact patients based on ability to pay. Sanford took steps to improve collections with a patient-focused, hybrid approach that combines employee incentives with segmentation strategies. Since working with Experian Health, Sanford now has a focused approach to managing accounts receivable (AR) by identifying patients with a certain propensity to pay. Collections Optimization Manager allows Sanford to quickly identify a pathway and delivery to resolution of the patient’s balance. The analytical segmentation models within Collections Optimization Manager use precise algorithms that reveal those patients who likely are eligible for charity services, those who might prefer to pay in full at a discount, or those who might benefit from a payment plan. The solution then feeds segmentation data to PatientDial, which Sanford uses to route calls to 70 patient account representatives. Sanford also implemented a re-designed, more user-friendly patient statement format. The improved cover page offers easy-to-understand information about the bill including the available options for payment. In a larger effort to improve the patient experience, Sanford implemented an employee incentive program that appropriately rewards staff based on their collections’ performance. Since working with Experian Health, Sanford has seen the following improvements: Streamlined call center operations. With PatientDial in place, Sanford was able to consolidate its call center team members in 4 regions and seamlessly operate on centralized toll free and direct dial numbers. Where it used to take on average 56 seconds for a call to be answered, calls are now answered in 20 seconds or less. The system now comfortably manages an average of 12,000 inbound calls weekly. Increased collections. The model in place has allowed Sanford to improve collections in a myriad of ways. In addition to increased collections from calls made through PatientDial, Sanford was able to see an additional $2.5M in patient payments by ensuring patient statements were sent to the new or correct address. The system found an additional $60K by identifying new guarantors for accounts of deceased patients. The segmentation capabilities from Experian Health also enabled Sanford to identify patients struggling with bankruptcy, allowing staff to focus their efforts on collectible accounts and more efficiently direct individuals to charity options. Learn more about Sanford Health’s journey and how a similar approach could help your organization improve collections and employee satisfaction.

Four in ten Americans live with multiple chronic conditions. For these individuals, life is punctuated with physician appointments, visits to the pharmacy and referrals to different specialists. Their care should be coordinated with orchestral precision, but the reality is somewhat less harmonious. Snail-paced scheduling systems, poor communication and mismatched patient records can lead to a lack of proper support for patients, confusion about how the care plan is managed, and potentially dangerous (and costly) gaps in care. For health plans, quality markers are missed and incentive payments start to dwindle. To help close these gaps, health plans must embrace a more innovative, consumer-focused approach to care coordination. Digital scheduling platforms make it easy for call center agents to help members find and book appointments, eliminating the need for a three-way call between the member and provider. Members are much more likely to be placed with the right clinician, at the right time and for the right appointment, while health plan call centers can operate far more efficiently. The automation and data integrity of digital systems makes it much easier to track and book appropriate post-discharge appointments and routine care management. Digital scheduling has the potential to improve health outcomes, drive up operational efficiency and yield big savings down the line. It’s about more than just matching consumer expectations, though a great member experience is certainly a competitive advantage for health plans. Better coordinated care could be life-changing for patients with chronic conditions. And with more members switching plans and seeking call center support in light of COVID-19, there’s a short-term urgency to tighten up communications and direct members to the care they need. Could a digital scheduling platform help your health plan close gaps in care and create a better member experience?

Few of us would buy a new car or TV without checking the price tag first. Why should our healthcare be any different? Yet this is exactly what many patients are forced to do when they need medical tests or treatment. Following the breadcrumbs on a provider’s website is a time-consuming and confusing way for patients to piece together a price estimate. Even with a rough idea of the cost of care, variations in health plan pricing often bump up the final bill. The lack of transparency is stressful for patients and costly for providers, who end up chasing slow payments and losing revenue to bad debt. But could things be about to change? Many providers have been proactive in offering transparent pricing, and thanks to recent regulatory changes, this could soon be an industry-wide requirement. The CMS Price Transparency Final Rule mandates that by 1 January 2021, hospitals should publish consumer-friendly pricing information on certain ‘shoppable’ services, to help patients understand and plan their bills ahead of time. The proposed Health PRICE Transparency Act would similarly compel providers to publish real cash prices alongside rates negotiated with insurers. As households, businesses and public bodies grapple with the economic impact of COVID-19, any additional clarity around pricing that could help make a dent in healthcare-related debt is to be welcomed. Liz Serie, Director of Product Management and Patient Experience at Experian Health, says that regardless of changes to the regulatory landscape, pricing transparency is here to stay: “It’s great for the patient because they have visibility, transparency and clarity about what they owe. They can prepare financially before their visit, so they can focus on what matters most – healing. Providers are excited about price transparency tools because they let patients pick and plan payment options, reducing the total cost to collect. And with more reliable billing data, it’s a win from a decision-making perspective too.” Transparency is becoming the norm in other aspects of healthcare consumer experience, and billing should be no different. 4 steps to fast and simple patient-friendly pricing 1. Remove the guesswork with accurate, upfront pricing estimates No one wants to play detective with their deductibles. Giving patients pricing information upfront puts them in control of their payments, improving their engagement and increasing the likelihood of faster collections – a top priority for providers today as they continue to feel the effects of COVID-19 on the bottom line. A Patient Estimates tool can generate accurate, easy-to-understand estimates based on known treatment costs, payer rates and real-time benefits data. Estimates and secure payment options can be sent straight to the patient’s mobile device, improving the patient financial experience with a single text message. 2. Give patients 24/7 control through their online portal With COVID-19 pushing even more of our lives online, a 24/7 patient portal is a must for providers that want to stay competitive. Yale New Haven Health (YNHH) used PatientSimple to give patients a mobile-friendly, self-service portal through which they can generate price estimates, choose payment plans, and monitor payment information. Sharlene Seidman, Executive Director Corporate Business Services at YNHH says patients have welcomed online access: “ROI is not just tangible dollars in additional revenue, it’s patient satisfaction and improving the financial experience.” 3. Minimize delayed payments with quicker insurance checks Millions of Americans have experienced sudden job losses or changes to their insurance status in the wake of the pandemic, causing confusion about their current coverage. Payment delays and denied claims are an inevitable side-effect. Providers can help by offering fast, automated insurance eligibility verification, so patients can confirm coverage at the point of service and take the next steps with confidence. 4. Move to mobile for a more convenient patient experience Imagine if your patients could have all the information they need about their healthcare account, right there in their pocket. Patient Payment Solutions offer real-time pricing estimates based on provider pricing, payer rates and benefit information, so patients can review their bill at a time and place that suits them. There’s also the option to offer secure and contactless payment methods, so they can settle their bill at the click of a button. Estimates suggest that the average family of four could save up to $11,000 a year if they had the option to choose care on the basis of more transparent pricing. Savings on this scale mean that demand for clear information about out-of-pocket expenses is going to soar, whatever happens with price transparency regulations. Learn how Experian Health can help your organization support patients and improve collections through more transparent pricing.

The regulatory requirements for price transparency are in full effect. The Centers for Medicare and Medicaid Services (CMS) is moving forward with the OPPS Price Transparency Final Rule (CMS-1717-F2), which states that hospitals must provide transparency that will help consumers understand medical costs and make informed decisions. At this point, it is recommended that hospitals begin to form a strategy for price transparency. The concept behind price transparency is simple: provide transparency that will help consumers understand medical costs and make informed decisions. Experian Heath's commitment is simple: provide solutions that benefit the patient and the provider, that improve collections and patient satisfaction. Discover how Experian Health can help you succeed with price transparency.