Testing the cloud migration

The role of consumer data and patient identity in healthcare and how SDOH can help payers improve population health and lower costs.

Patient engagement starts with a data-driven marketing plan. Here’s how to use consumer data to give patients the right content at the right time.

A UPI help states share data because it’s a real-time solution for the management of controlled substance prescriptions across state lines,

Pull Quote one

Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

Pullquote two

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

| Name | Details |

| Patient Summary | Keep the records of the patients to know their health details |

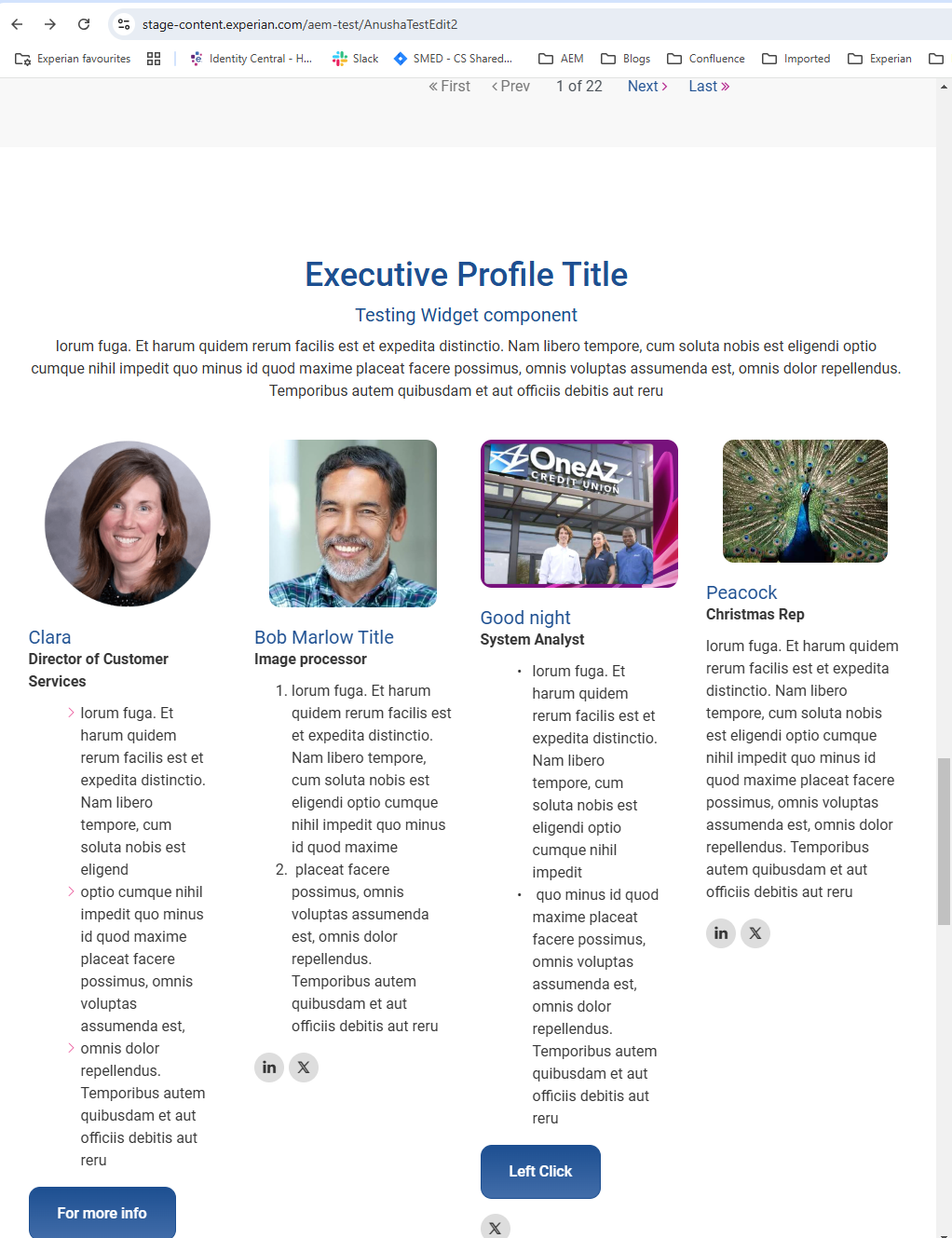

This is a component in AEM which is tested sprint 102 and released to Production.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou