Testing the cloud migration

On March 11, CMS released a change request to display the list of telehealth services that were once available through the manual updates to now be displayed via a weblink going forward. CMS is also adding CRNAs to the list of Medicare practitioners who may bill for covered telehealth services. Lastly, the telehealth language has been removed from Pub 100.02, Medicare Benefit Policy Manual, Chapter 15, Section 270 and a reference added in text to see Pub 100.04, Chapter 12, Medicare Claims Processing Manual, section 190 for further information regarding telehealth services. Implementation date: April 11, 2016 Transmittal R3476CP here: https://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R3476CP.pdf Transmittal R221BP here: https://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R221BP.pdf MLN Matters article MM9428 here: https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/Downloads/MM9428.pdf

On March 11, CMS posted a transmittal stating it awarded Noridian Healthcare Solutions, LLC, a new contract for the administration of Medicare Fee-for-Service claims for DME, prosthetics, orthotics, and supplies in Jurisdiction A. The incumbent is NHIC, Corp. The Jurisdiction A DME MAC serves Medicare beneficiaries who reside in the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont, and the District of Columbia. Under this contract, Noridian will process and pay Medicare DMEPOS claims; process redetermination requests; respond to supplier inquiries; perform supplier outreach and education; and, review claims for medical necessity. Noridian will begin processing Jurisdiction A claims in May 2016 from its offices in Fargo, ND. Jurisdiction A includes over 8.2 million Medicare Fee-for-Service beneficiaries. The Jurisdiction A DME MAC will serve approximately 20,000 Medicare DMEPOS suppliers. This jurisdiction comprises nearly 18% of the overall national Medicare Fee-for-Service DMEPOS claims volume. The Jurisdiction A DME MAC contract includes a base year and four option years, for an anticipated duration of five years. The contract is a “cost plus award fee” contract; the award fee will be earned only if the contractor exceeds the base requirements of the contract. Effective date: December 16, 2015 Implementation date: July 1, 2016, for all cutover requirements outside of those related to system changes; July 5, 2016, for system changes View Transmittal R1634OTN here: https://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R1634-OTN.pdf View MLN Matters article MM9546 here: https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/Downloads/MM9546.pdf

CMS recently released an extensive revision of QIO Manual Chapter 9 related to QIO reviews in cases potentially involving sanction recommendations from the OIG for quality and EMTALA issues. The chapter has been renamed to include the reference to EMTALA. This update supersedes all the information in the October 3, 2003 version of Chapter 9, any previously issued Question & Answer guidance, and any previously issued TOPS, Standard Data Processing System, and Healthcare Quality Information System memos related to Chapter 9. Effective date: March 14, 2016 Implementation date: March 14, 2016 View Transmittal R139DEMO.

Pull Quote one

Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

Pullquote two

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

| Name | Details |

| Patient Summary | Keep the records of the patients to know their health details |

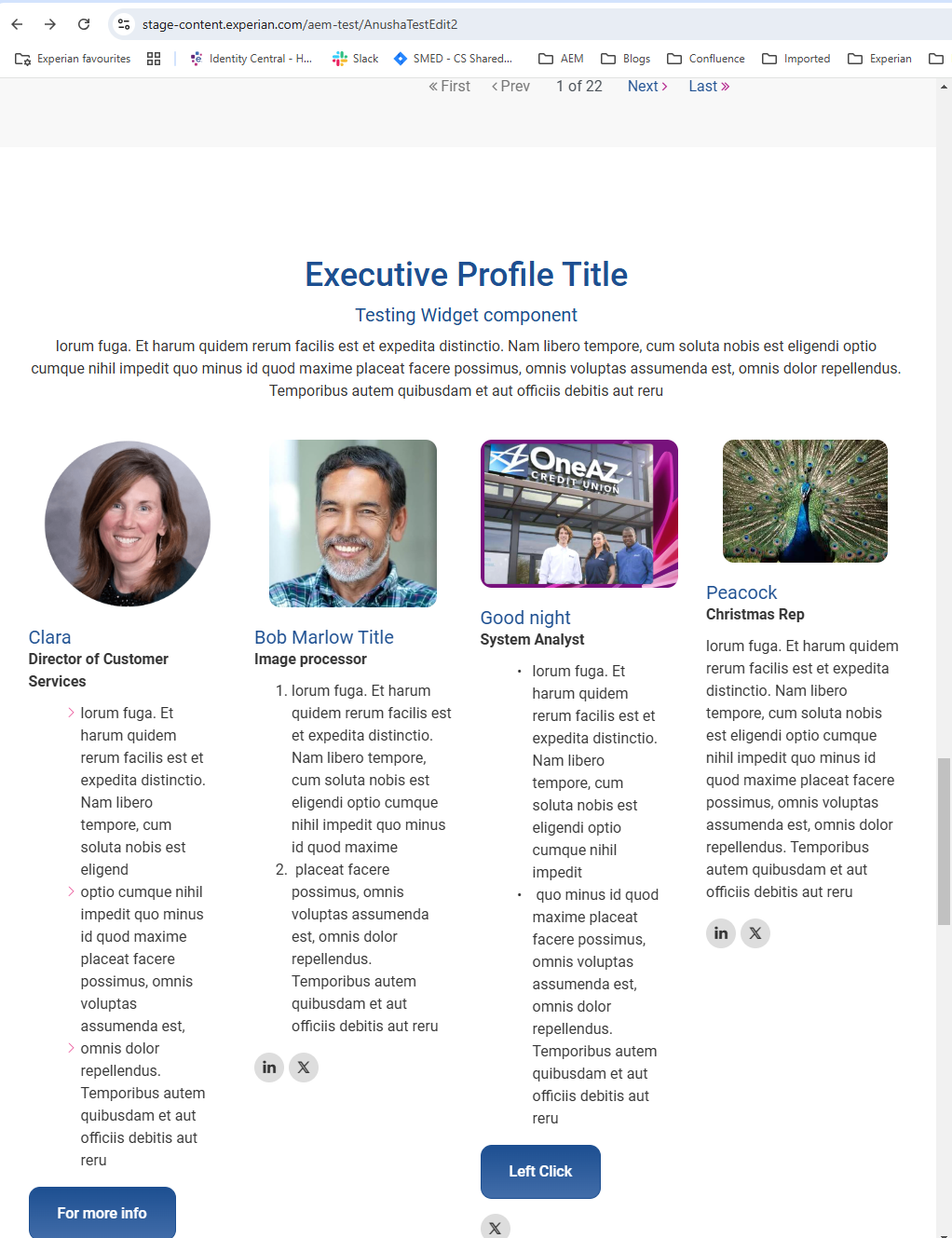

This is a component in AEM which is tested sprint 102 and released to Production.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou