Testing the cloud migration

Learn how revenue cycle automation can help healthcare organizations simplify collections, reduce claim denials and more.

Discover how artificial intelligence (AI) can help solve common challenges in revenue cycle management (RCM) with just a single click.

Capturing revenues through the claims management process is burdensome and complex. Discover new strategies for claims acceptance success.

Pull Quote one

Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

Pullquote two

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

| Name | Details |

| Patient Summary | Keep the records of the patients to know their health details |

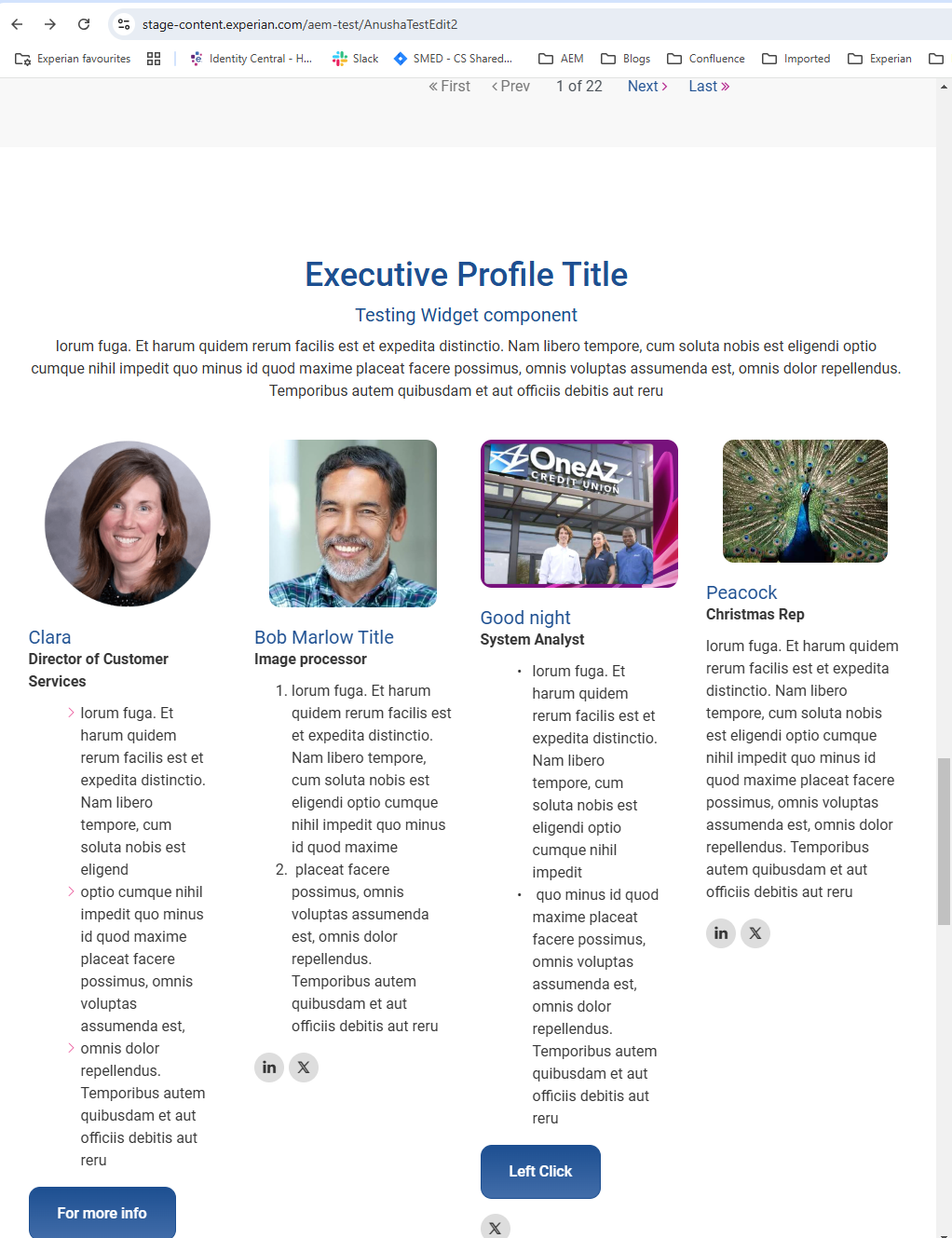

This is a component in AEM which is tested sprint 102 and released to Production.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou