Testing the cloud migration

Learn how technology-driven automated prior authorizations can improve patient care by reducing overall costs and enhance revenue.

Discover how artificial intelligence (AI) can help healthcare providers reduce claim denials and improve claims management processes.

Find out how healthcare organizations can remain profitable in an increasingly competitive market with personalized patient payment plans.

Pull Quote one

Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

Pullquote two

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

| Name | Details |

| Patient Summary | Keep the records of the patients to know their health details |

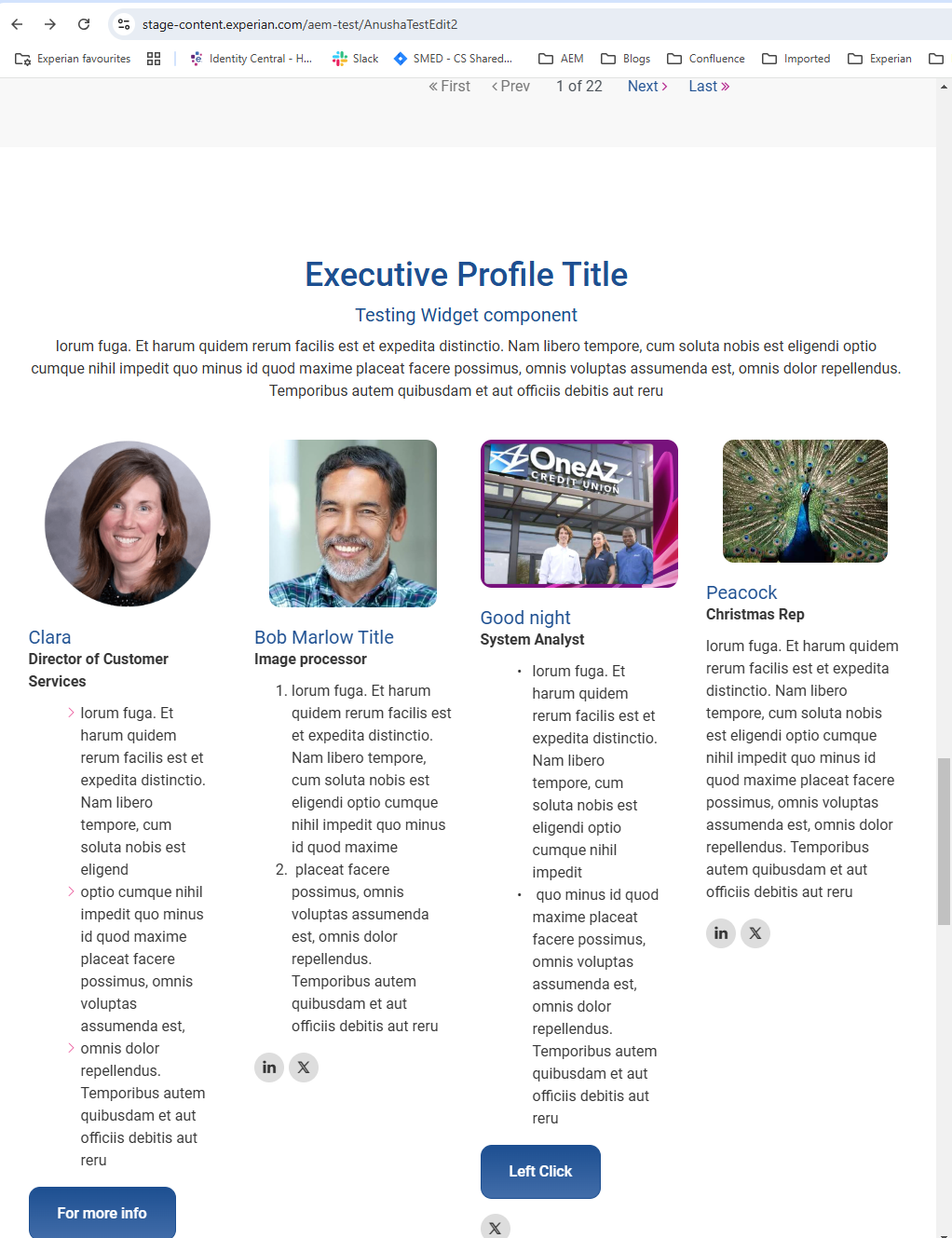

This is a component in AEM which is tested sprint 102 and released to Production.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou