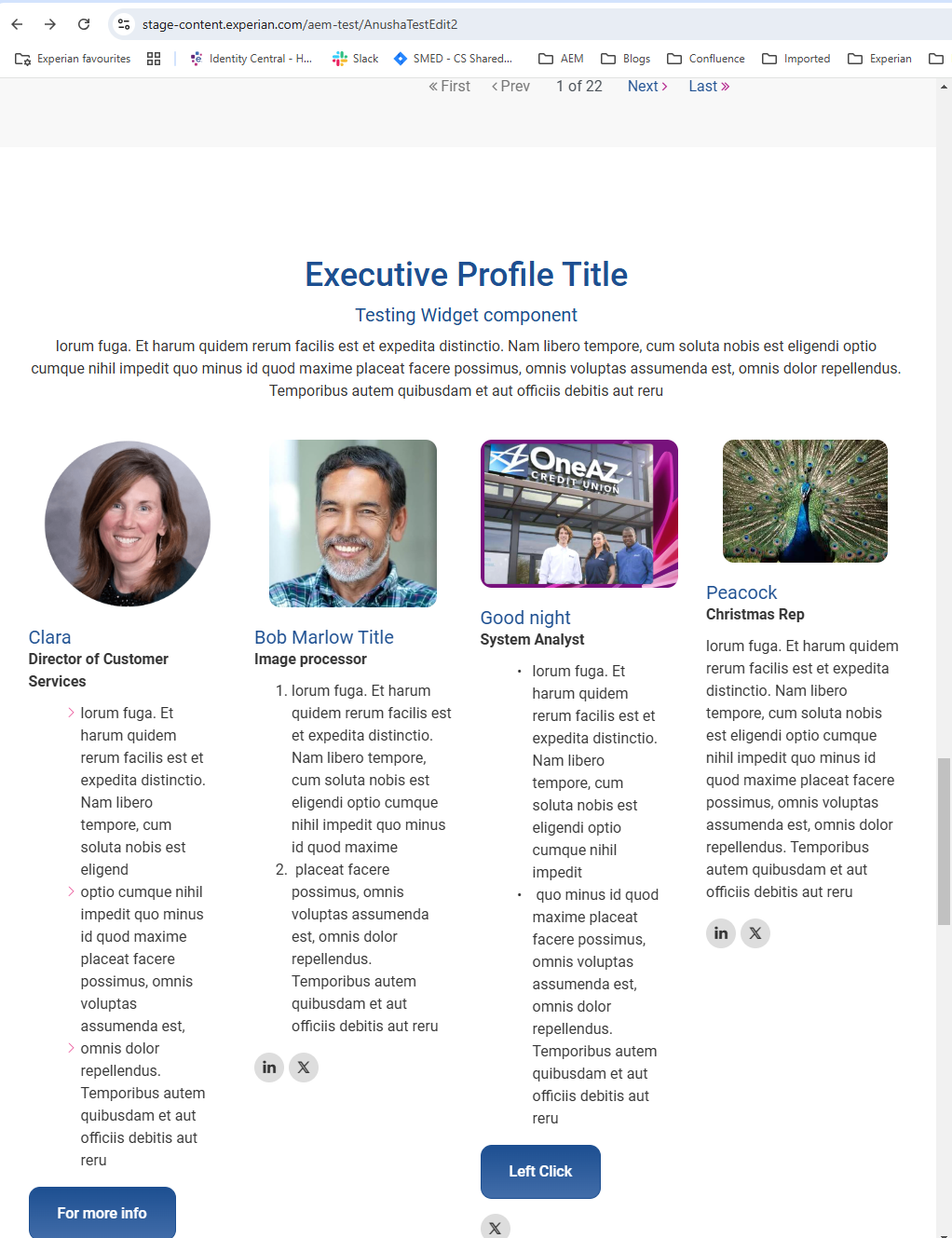

Testing the cloud migration

Learn how providing patient estimates can help your healthcare organization meet price transparency regulations, improve cash flow, and more.

Hattiesburg Clinic is Mississippi’s largest multispecialty clinic with over 450 physicians serving 19 counties. Claims management, patient collections and payer contract management are handled by the clinic’s Financial Services Department, which includes around 70 staff members. Challenge Hattiesburg Clinic in Mississippi sought to improve financial performance in the wake of the COVID-19 pandemic by focusing on reducing claim denials. The Financial Services Department had been hit by staffing shortages, which affected financial results. A more efficient digital claims management solution would attract and retain a high-performing virtual team, while supporting the shift away from existing paper-based systems. To submit more clean claims the first time, the Department set specific goals to: meet or exceed Epic benchmarks for primary denials maintain accounts receivable (AR) days at 42 or less process secondary and tertiary claims without waiting for the primary electronic remittance advice (ERA) to be posted. Solution Already impressed with Experian Health’s Contract Manager and Eligibility solutions, the Department chose another Experian product, ClaimSource®, to help reduce denials. Loretta McLaughlin, Assistant Director of Financial Services, said she was confident ClaimSource was a good candidate for the clinic’s claims platform: “ClaimSource seemed like the right fit for the department’s goals. The platform’s ability to customize edits, along with the level of customer support available, really set the solution apart from the alternatives.” ClaimSource uses scalable automation to prioritize claims, payments and denials. This allows staff to use their time as efficiently as possible, by working on the highest-impact accounts first. Using customizable edits and extensive national and local payer edits, it checks each claim for inconsistencies before the claim is submitted. ERA data is automatically integrated into Epic so that staff can check a claim’s status quickly and easily. With real-time reporting, staff gets insights from across the entire claim lifecycle to improve performance. Outcome The ability to integrate customizable edits was a big advantage for the clinic. They now have over 90 custom edits that help eliminate time-consuming errors, reduce denials, and allow staff to focus on the right accounts. As a result, Hattiesburg Clinic has achieved a 6.1% primary denial rate, which exceeds the Epic Financial Pulse benchmark. Despite staffing shortages, they’ve been able to accelerate receivables. They’re also seeing accelerated cash flow, now they can pursue claims from secondary and tertiary payers without awaiting the outcome of primary claims adjudication. ClaimSource is also creating a better staff experience: the tool eliminates the need for claims to be printed, so staff can work from any location. Now, over 50% of the team work from home. Thanks to automated workflows, output has been consistent despite a reduced workforce. Being able to submit clean claims the first time has a positive impact on AR days as well as staff workload. Loretta McLaughlin says: “Through ClaimSource’s automation and level of quality work, we have had to do less manual intervention.” To build on this success, the team intends to explore further opportunities to use automation to improve productivity. Options include automatically generating patient estimates, automating bad debt and refund workflows, and allowing patients to verify insurance eligibility through their patient portals. Find out more about how ClaimSource helps hospitals, health systems and physician groups reduce denials, protect profits and increase productivity through automated and scalable claims management.

Discover how healthcare providers can leverage automated collections software to streamline the billing and payments process in 2023.

Pull Quote one

Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

Pullquote two

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou

| Name | Details |

| Patient Summary | Keep the records of the patients to know their health details |

This is a component in AEM which is tested sprint 102 and released to Production.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humouThere are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humou