Products referenced in this article:

Products referenced in this article:

- Social Determinants of Health

- Patient Schedule

- Member Match

- Coverage Discovery

- Patient Financial Advisor

- Patient Payment Solutions

With just a few clicks, patients can book appointments, speak to their doctor, access billing information and pay for care, all without leaving their homes. Online health services have been a lifesaver for many during the pandemic, and the reliance on digital tools has sky-rocketed over the last few months. But for some older consumers who may be less comfortable using digital devices, this shift towards “healthcare from home” feels daunting and isolating.

Many seniors are not immersed in the digital culture and navigate life just fine without a touchscreen. The sudden shift in healthcare delivery channels has demanded many to venture into unfamiliar technology in a rushed and urgent manner. Others face barriers related to things like dementia, hearing loss and vision loss.

Closing the digital divide

Whatever their age, those left out of the digital loop face a higher risk of missed appointments, delayed care and anxiety about how to get tests and treatment. Providers will want to ensure that all of their digital offerings are designed to help patients of every age access care in a way that works for them. That means creating a consumer experience with pathways and channels to suit different patient needs and expectations, including “analog” options for those who aren’t inclined to learn new technologies.

4 ways to make digital health technology more senior-friendly

1. Use data to determine what’s working and what’s not

The starting point for providers who want to improve seniors’ digital engagement is to understand how they’re actually using it (or not) right now. Non-clinical data can give insights on technology engagement, lifestyle and socioeconomic circumstances across all ages in a patient population. When providers know what patients are looking for, and where the gaps are, they can tailor their services to meet their patients’ needs.

For example, let’s say a proportion of an organization’s older members have smartphones or tablets, but aren’t using them to access their patient portals. It’s likely they have the skills so but may not be aware of the service. This can be solved with a simple omnichannel outreach campaign to provide step-by-step instructions explaining how to get started.

One way for providers to capture useful data is with “Z codes” — the ICD-10-CM codes included in categories Z55-Z65. These identify non-medical factors that may influence a patient’s health status. Utilizing Z codes will enable better tracking of seniors’ needs and identify solutions to improve their health and wellbeing.

Providers can also leverage data to better understand seniors’ activity in the continuum of care. Are older patients continually presenting for care at a facility that is out of network? A tool like MemberMatch can deliver these insights in real time, alerting care teams as early as possible so that they can rally around active episodes of care proactively and efficiently. This helps risk-bearing organizations optimize the quality and cost of member activity in the continuum of care, leading to better outcomes for patients and a better bottom line for organizations responsible for their health.

2. Give patients choices about how they access services

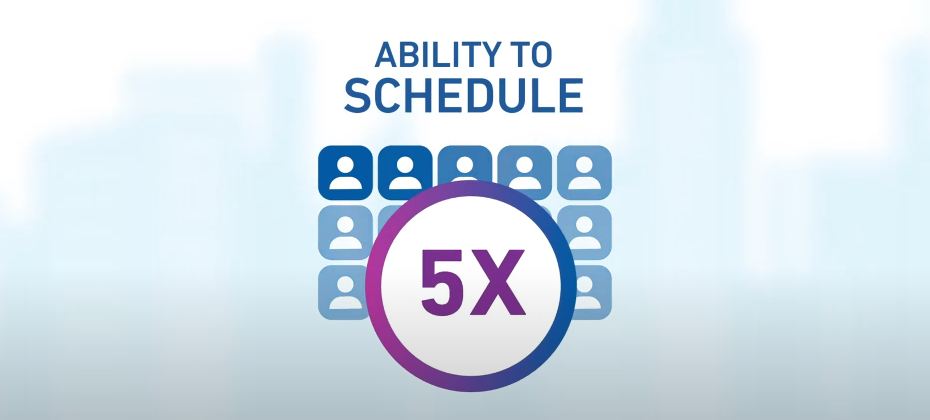

Adoption of healthcare technology is increasing among older adults: 76% of over 50 say they welcome services to help them “age in place”, or live in one’s own home and community safely, independently, and comfortably, regardless of age, income, or ability level. At CareMount Medical, 27% of primary care appointments made using Experian Health’s online scheduling tool are initiated by those aged 60 and over. The demand is there; support should follow.

That said, an omnichannel approach is still important. Given a choice, more than half of people aged 50 and over prefer their health be managed by a mix of medical professionals and technology. This means giving patients the option to easily schedule appointments by phone. Automated outreach and integration, combined with practice management systems, will ultimately make patient scheduling easier.

3. Make virtual care easier to use

More than half of seniors cancelled or delayed appointments due to COVID-19. Despite the promise of safety measures, many are hesitant to return. Virtual care may be the answer.

Providers are quick to learn that telehealth is not a panacea, in particular for the senior population. As some patients may not have the technology and skills to access telehealth, providers may want to consider a hybrid “facilitated telehealth” model where medical professionals visit patients’ homes to help them get set up for telehealth visits.

4. Create a smoother patient financial experience

As older patients become newly eligible for Medicare, many are unclear about their coverage status. To take the burden off the patient, providers should consider a tool such as Coverage Discovery, which allows staff to find MBI numbers quickly. This often proves helpful, particularly for new Medicare beneficiaries who may not have received their MBI card yet.

A way to ease the stress of payments is to offer more transparent pricing so patients know what to expect as they start their healthcare journey. Experian Health’s Patient Financial Advisor gives a breakdown of their bill and payment options, helping them feel financially confident and more in control of their ability to pay – resulting in fewer collections issues.

As older patients become more accustomed to paying for other everyday items through their smartphones or laptops, online patient payment solutions will become less foreign and more convenient, allowing them to manage medical payments in a time and place that suits them.

It’s never been more important to help older patients stay connected, access care and feel supported during their healthcare journey. Contact us to explore how Experian Health’s solutions can help you close the digital divide.