All posts by Guest Contributor

Regardless of personal political affiliation or opinion, the presidential election is over, and the focus has shifted from debate to the impact the new administration will have on the regulatory landscape for banks. While many questions remain regarding the policy direction of a Trump administration, one thing is near certain: change is on the horizon. While on the campaign trail, Trump took aim at banking regulation: “Dodd-Frank has made it impossible for bankers to function. It makes it very hard for bankers to loan money…for people with businesses to create jobs. And that has to stop.” And in his first post-election interview, Trump outlined named financial industry deregulation to allow “banks to lend again” as a priority. Before Election Day, Experian surveyed members of the financial community about their thoughts on regulatory affairs. An overwhelming majority—85 percent—believed the election outcome would impact the current environment. Most surveyed are also feeling the weight of financial regulations established by the Obama administration in the wake of the severe financial crisis of 2008. Five out of six respondents feel current regulations have placed an undue burden on financial institutions. Three-quarters believe the regulations reduce the availability of credit. And less than half believe the regulations are positive for consumers. According to our survey, complying with Dodd-Frank and other regulations has a financial impact for most, with 76 percent realizing a significant increase in spend since 2008. Personnel and technology spend top the list, with an increase of 78 percent and 76 percent, respectively. Top regulations that require the most resources to ensure compliance: the Dodd-Frank Act (70 percent), Fair Lending Act (55), Bank Secrecy Act/Anti-Money Laundering (47) and Fair Credit Reporting Act (42). Specifically, the Dodd Frank and TILA-RESPA Integrated Disclosure were the two most frequently mentioned regulations requiring additional investment, followed by the Military Lending Act and Bank Secrecy Act/Anti-Money Laundering. What lies ahead? It’s difficult to determine how the Trump administration will tackle banking regulations and policy, but change is in the air.

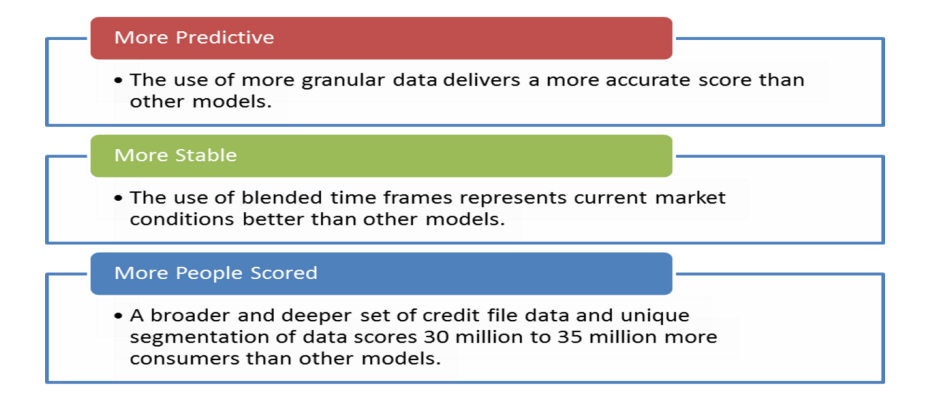

Looking to score more consumers, but worried about increased risk? A recent VantageScore® LLC study found that consumers rendered “unscoreable” by commonly used credit scoring models are nearly identical in their financial and credit behavior to scoreable consumers. To get a more detailed financial portrait of the “expanded” population, credit files were supplemented with demographic and economic data. The study found: Consumers who scored above 620 using the VantageScore® credit score exhibited profiles of sufficient quality to justify mortgage loans on par with those of conventionally scoreable consumers. 3 to 2.5 million – a majority of the 3.4 million consumers categorized as potentially eligible for mortgages – demonstrated sufficient income to support a mortgage in their geographic areas. The findings demonstrate that the VantageScore® credit score is a scalable solution to expanding mortgage credit without relaxing credit standards should the FHFA and GSEs accept VantageScore® credit scores. Want to know more?

As we kick off the holiday shopping season, let’s look at the increasingly popular smart voice/artificial intelligent assistant. Here are some insights from a recent Experian survey on how consumers are using one such device: 9% use their Amazon Echo in the kitchen and 33.5% in the living room. Echo users are overwhelmingly satisfied with Alexa’s voice recognition interface — with 39% planning to use it more frequently. Top tasks asked of Alexa are set a timer, play a song, read the news, set an alarm, check the time and tell a joke. Devices that use voice and messaging can significantly increase the accessibilities and usability of applications for consumers. Do you have the right strategy in place to support these new technologies? >>View inforgraphic

It’s that time of year — for turkey. During Thanksgiving 2015, 736 million pounds of turkey were consumed in the United States. Hungry for more turkey data? The average weight of turkeys purchased for Thanksgiving is 16 pounds. An estimated 46 million turkeys were eaten on Thanksgiving, 22 million on Christmas and 19 million on Easter last year. More than 212 million turkeys were consumed in the United States in 2015. From all of us at Experian, we wish you a very happy Thanksgiving! Courtesy of the National Turkey Federation

In order to compete for consumers and to enable lender growth, creating operational efficiencies such as automated decisioning is a must. Unfortunately, somewhere along the way, automated decisioning unfairly earned a reputation for being difficult to implement, expensive and time consuming. But don’t let that discourage you from experiencing its benefits. Let’s take a look at the most popular myths about auto decisioning. Myth #1: Our system isn’t coded. If your system is already calling out for Experian credit reporting data, a very simple change in the inquiry logic will allow your system to access Decisioning as a ServiceSM. Myth #2: We don’t have enough IT resources. Decisioning is typically hosted and embedded within an existing software that most credit unions currently use – thus eliminating or minimizing the need for IT. A good system will allow configuration changes at any time by a business administrator and should not require assistance from a host of IT staff, so the demand on IT resources should decrease. Decisioning as a Service solutions are designed to be user friendly to shorten the learning curve and implementation time. Myth #3: It’s too expensive. Sure, there are highly customized products out there that come with hefty price tags, but there are also automated solutions available that suit your budget. Configuring a product to meet your needs and leaving off any extra bells and whistles that aren’t useful to your organization will help you stick to your allotted budget. Myth #4: Low ROI. Oh contraire…Clients can realize significant return-on-investment with automated decisioning by booking more accounts … 10 percent increase or more in booked accounts is typical. Even more, clients typically realize a 10 percent reduction in bad debt and manual review costs, respectively. Simply estimating the value of each of these things can help populate an ROI for the solution. Myth #5: The timeline to implement is too long. It’s true, automation can involve a lot of functions and tasks – especially if you take it on yourself. By calling out to a hosted environment, Experian’s Decisioning as a Service can take as few as six weeks to implement since it simply augments a current system and does not replace a large piece of software. Myth #6: Manual decisions give a better member experience. Actually, manual decisions are made by people with their own points of view, who have good days and bad days and let recent experiences affect new decisions. Automated decisioning returns a consistent response, every time. Regulators love this! Myth #7: We don’t use Experian data. Experian’s Decisioning as a Service is data agnostic and has the ability to call out to many third-party data sources and configure them to be used in decisioning. --- These myth busters make a great case for implementing automated decisioning in your loan origination system instead of a reason to avoid it. Learn more about Decisioning as a Service and how it can be leveraged to either augment or overhaul your current decisioning platforms.

The best way to increase email open rates? Include a subscriber’s name in the subject line. A recent Experian study found that in addition to higher open rates, personalized subject lines have a27% higher unique click rate, an 11% higher click-to-open rate and more than double the transaction rates of other promotional mailings from the same brands. Other proven personalization tactics include: Customizing subject lines based on browsing behavior Dynamically populating product choices based on the past purchases of the subscriber Triggering emails based on Instagram or Pinterest selections, connecting social media choices to email opportunities In addition to personalization, companies should coordinate social media programs with email and mobile campaigns in order to optimize engagement across all channels. >> Consumer credit trends

Lenders are looking for ways to accurately score more consumers and grow their applicant pool without increasing risk. And it looks like more and more are turning to the VantageScore® credit score to help achieve their goals. So, who’s using the VantageScore® credit score? 9 of the top 10 financial institutions. 18 of the top 25 credit card issuers. 21 of the top 25 credit unions. VantageScore leverages the collective experience of the industry’s leading experts on credit data, modeling and analytics to provide a more consistent and highly predictive credit score. >>Want to know more?

For members of the U.S. military, relocating often, returning home following a lengthy deployment and living with uncertainty isn’t easy. It can take an emotional and financial toll, and many are unprepared for their economic reality after they separate from the military. As we honor those who have served our country this Veterans Day, we are highlighting some of the special financial benefits and safeguards available to help veterans. Housing Help One of the best benefits offered to service members is the Veteran’s Administration (VA) home-loan program. Loan rates are competitive, and the VA guarantees up to 25 percent of the payment on the loan, making it one of the only ways available to buy a home with no down payment and no private mortgage insurance. Debt Relief Having a VA loan qualifies military members for a Military Debt Consolidation Loan (MDCL) that can help with overcoming financial difficulties. The MDCL is similar to a debt consolidation loan: take out one loan to pay off all unsecured debts, such as credit cards, medical bills and payday loans, and make a single payment to one lender. The advantage of a MDCL? Paying a lower interest rate and closing costs than civilians and far less interest than paying the same bills with credit cards. These refinancing loans can be spread out over 10, 15 and sometimes 30 years. Education Benefits The GI Bill is arguably the best benefit for veterans and members of the armed forces. It helps service members pay for higher education for themselves and their dependents, and is one of the top reasons people enlist. Eligible service members receive up to 36 months of education benefits, based on the type of training, length of service, college fund availability and whether he or she contributed to a buy-up program while on active duty. Benefits last up to 10 years, but the time limit may be extended. Saving & Investing Money According to the Department of Defense’s annual Demographics Report, 87 percent of military families contribute to a retirement account. Service members who participated in the Thrift Savings Plan, however, are often unaware of their options after they separate from service, and many don’t realize the advantages of rolling their plans into an IRA or retirement plan of a new employer. Safeguarding Identity Everyone is a potential identity theft target, but military personnel and veterans are particularly vulnerable. Routinely reviewing a credit report is one way to detect a breach. The Attorney General's Office provides general information about what steps to take to recover from identify theft or fraud. Today is a great time to consider ways to support your veteran and active military consumers. They are deserving of our support and recognition not just today but continuously. Learn more about services for veterans and active military to understand the varying protections, and how financial institutions can best support military credit consumers and their families.

Experian is recognized as a leading security solution provider for fraud and identity solutions in order to protect customers and financial institutions

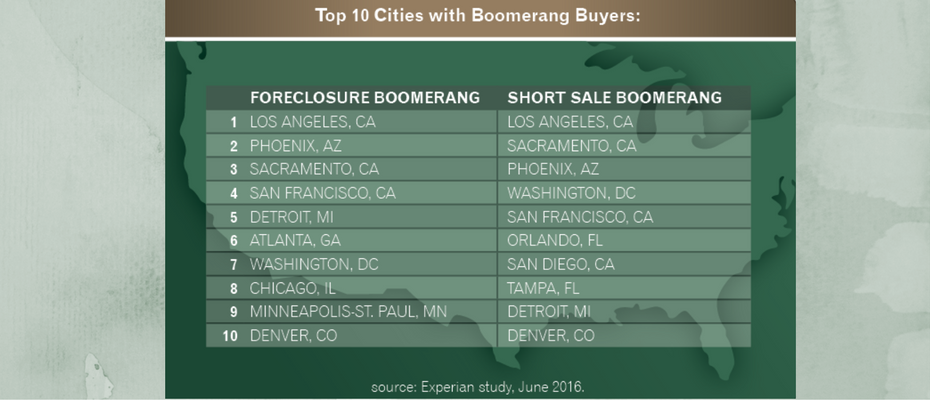

A recent Experian analysis shows that about 2.5 million consumers will have a foreclosure, short sale or bankruptcy fall off their credit report between June 2016 and June 2017 — with 68% of these consumers scoring in the near-prime or high credit segments. Additional highlights include: Nearly 29% of those who short-sold between 2007 and 2010 have opened a new mortgage. Delinquencies for this group are below the national average for bankcard and auto loan payments. More than 12% of those who foreclosed now have boomeranged (opened new mortgages). With millions of borrowers potentially re-entering the housing market, the trends are promising for both the mortgage seeker and the lender. Want to know more?

Late last year, our Third Annual Data Breach Industry Forecast predicted cybercriminals would continue to focus their attacks on healthcare institutions, inspired by the knowledge that the black market value of medical records continues to surpass the value of credit card numbers. Industry experts we interviewed also predicted employee missteps would be a source of healthcare breaches. Entering the final quarter of 2016, our prediction is playing out in the numbers; nearly half of all consumers affected by a data breach so far this year had their personal information exposed through a healthcare-related incident, according to information compiled by the Identity Theft Resource Center. In the first three quarters of the year, 256 medical and healthcare data breaches exposed more than 13.5 million records, the highest number of any sector the ITRC tracks. Records compromised in a healthcare breach accounted for 47.2 percent of all affected records in 2016. The healthcare sector has been a hotbed of attacks throughout the year, largely due to the continued value of medical records sold on the dark web. These records can be used for far more than just filing fraudulent medical claims. One lucrative use is filing fraudulent tax returns. CNBC reported the IRS expects, and has been bracing for, an increase in tax fraud linked to the high number of medical breaches this year. It’s easy to understand why medical records can be so profitable for hackers. While financial accounts such as credit cards may contain a limited amount of personal information, medical records are much more comprehensive. Typically, they contain a wealth of information far beyond mere account numbers. In addition to names, addresses and birth dates, medical records often contain Social Security numbers, which healthcare providers may use as patient identifiers. The employee factor Many of the mega-breaches of 2015 occurred through digital routes that the average consumer would find downright arcane. In 2016, we’ve seen an increase in smaller attacks with mundane origins such as stolen hardware, poorly secured employee email accounts or phishing attacks. Consider these examples reported in the HIPAA Journal: Four staff email accounts were compromised in a phishing attack on employees at City of Hope Hospital in California. To put it more bluntly, four hospital employees fell for scam emails and the result was, as ITRC reports, the exposure of more than 1,000 patient records. More than 200,000 patients of Premier Healthcare in Bloomington, Indiana, received notification letters after a password-protected but unencrypted laptop was stolen from the hospital’s billing department. A St. Louis, Missouri, not-for-profit healthcare system, BJC Healthcare, had to notify more than 2,300 patients their information was exposed after an employee mistakenly sent an email containing protected information to another medical organization. For healthcare institutions, the takeaway from 2016 should be the need to remain vigilant and proactive regarding the many ways in which data breaches can occur. While 2015 was the year of healthcare mega-breaches, 2016 has seen the emergence of smaller breaches that still have the potential to cause significant harm to organizations and patients. Learn more about our Data Breach solutions

$1.3 trillion. 41.1 million Americans. $31,590. These are the growing numbers associated with student loan debt in the United States: $1.3 trillion in outstanding student loans, spread across 41.1 million people, who are leaving college with an average balance of $31,590. The numbers are staggering, and for the first time student loan debt is playing a prominent role in a presidential election. For all of their differences, presidential nominees Hillary Clinton and Donald Trump seem to agree on one thing: student loan debt is a crushing burden. Both candidates have proposed solutions for student lending. Clinton’s “New College Compact” would allow borrowers to refinance their student loans at current rates available to students taking out new loans. She also wants to reduce interest rates on new student loans, and make it easier for borrowers to enroll in income-driven repayment programs that would cap monthly payments at 10 percent of discretionary income. Trump proposes giving more oversight to colleges to decide whether to grant loans to students based on their prospective major. The plan would also give private banks oversight over government-backed student loans—reversing a 2010 decision under President Obama to make the federal government the lender. Neither candidate, however, has outlined a solution for taming growing tuition costs. Tuition expenses are up 1,225 percent over the past 36 years, outpacing medical costs (634 percent rise) and the consumer price index (279 percent) over the same period, according to the Bureau of Labor Statistics. So it’s not surprising an Experian study shows the student loan rate has grown five percent in the past three years. What is surprising is the number of people and the average age of those people holding student loans. Experian found: 20 percent of people with a credit file hold a student loan that is being repaid or deferred. The average age of a consumer with a student loan is 37, with an average income of $47,200 compared to 53.8 and an average income is $44,500 for consumers without a student loan. The average age of a consumer with at least one deferred student loan is 32.7 with an average income of $32,900 compared to 38.7 and an average income of $53,200 for consumers with at least one non-deferred student loan. Candidate proposals aside, one thing is certain: student loan debt has a very real impact on the daily lives of people, many of whom have delayed buying homes, starting families, and saving for retirement. Until policymakers find a way to address bloated tuitions and student debt, it will take many longer to realize their dreams.

Call if you need to, but protect yourself from TCPA exposure first. Follow these steps when creating your dialing strategy: Obtain customer consent Determine if the number is attached to a landline or a wireless device Verify ownership Scrub your database Calling cell numbers can be a risky business, so be sure to set the proper workflow in motion to remain compliant. >>Learn more

Businesses believe that 23% of their customer or prospect data is inaccurate. Since 84% of companies have a loyalty or customer engagement program in place, poor data is a costly issue. The unfortunate reality is that 74% of companies have encountered problems with these programs — and 12% of revenue is believed to be wasted as a result. Is your loyalty program suffering from poor data? There is a cure. Think of data quality as preventative medicine for a costly and entirely avoidable illness. >>Learn more

Since 1948, International Credit Union Day – a time to recognize the credit union movement – has been celebrated the third Thursday of October. The day is the perfect time to remind your members and consumers about all of the services and benefits your credit union offers. This year’s theme, “The Authentic Difference,” celebrates what makes credit unions stand out. Here are 10 reasons CUs deserve a spotlight: Credit unions are non-profit cooperatives, owned and operated by its members. That means they emphasize consumer value to more than 217 million members worldwide. Profits go back to members in the form of reduced fees, higher savings rates and lower loan rates. Personal relationships are key. Credit unions pride themselves on developing relationships with their members, and CUs are typically staffed by friendly reps who know customers by name. Checking accounts are free. Roughly 80 percent of credit unions offer free checking accounts, compared to less than 50 percent of banks, according to economic research firm Moebs Services. Few ATM fees. Many credit union customers are able to avoid ATM fees because CUs typically give them access to a large network of ATMs by sharing branches and other resources. Savings rates are above average. Because credit unions don't have to pay dividends to shareholders and are exempt from federal taxes they can offer high rates on saving accounts. The average credit union offers CD, money market, and savings rates well above the national banking rates average. Lower interest rates. Credit unions offer lower interest rates on some loans. The difference between banks and credit unions was greatest in car-loan interest rates, according to a September report by SNL Financial. The average 36-month used-car loan interest rate offered by CUs was 2.67 percent compared to 4.45 percent for banks. For new-car loans, CUs offered an average interest rate for 48 months of 2.60 percent compared to 3.94 percent for banks. Invested in the community. A credit union’s core values are focused on its members and the communities where they live and work. Many provide financial education and outreach to consumers. It’s easier to get credit. CUs don’t have to abide by loan restrictions and qualifications mandated by a corporate office, so they have more flexibility to make loans when possible. Small-business support: CUs may know borrowers and are able to take into account intangibles like community reputation and accountability. Also, they understand the value to the community of a small business, its market and credit needs. Joining is easy. Many credit unions base eligibility simply on where you live, instead of restricting membership to a particular employer. Since expanding eligibility, credit union membership has grown by about two percent a year for the past decade.