Financial Services

Marketers are keenly aware of how important it is to “Know thy customer.” Yet customer knowledge isn’t restricted to the marketing-savvy. It’s also essential to credit risk managers and model developers. Identifying and separating customers into distinct groups based on various types of behavior is foundational to building effective custom models. This integral part of custom model development is known as segmentation analysis. Segmentation is the process of dividing customers or prospects into groupings based on similar behaviors such as length of time as a customer or payment patterns like credit card revolvers versus transactors. The more similar or homogeneous the customer grouping, the less variation across the customer segments are included in each segment’s custom model development. So how many scorecards are needed to aptly score and mitigate credit risk? There are several general principles we’ve learned over the course of developing hundreds of models that help determine whether multiple scorecards are warranted and, if so, how many. A robust segmentation analysis contains two components. The first is the generation of potential segments, and the second is the evaluation of such segments. Here I’ll discuss the generation of potential segments within a segmentation scheme. A second blog post will continue with a discussion on evaluation of such segments. When generating a customer segmentation scheme, several approaches are worth considering: heuristic, empirical and combined. A heuristic approach considers business learnings obtained through trial and error or experimental design. Portfolio managers will have insight on how segments of their portfolio behave differently that can and often should be included within a segmentation analysis. An empirical approach is data-driven and involves the use of quantitative techniques to evaluate potential customer segmentation splits. During this approach, statistical analysis is performed to identify forms of behavior across the customer population. Different interactive behavior for different segments of the overall population will correspond to different predictive patterns for these predictor variables, signifying that separate segment scorecards will be beneficial. Finally, a combination of heuristic and empirical approaches considers both the business needs and data-driven results. Once the set of potential customer segments has been identified, the next step in a segmentation analysis is the evaluation of those segments. Stay tuned as we look further into this topic. Learn more about how Experian Decision Analytics can help you with your segmentation or custom model development needs.

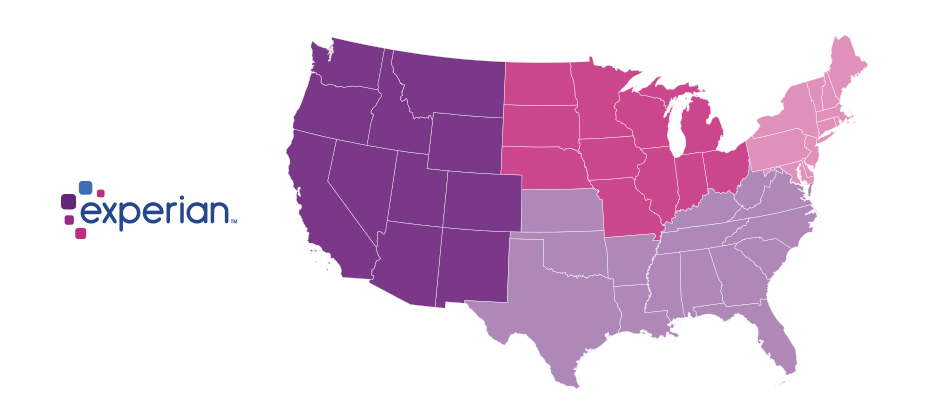

In the credit game, the space is deep and diverse. From super prime to prime to subprime consumers, there is much to be learned about how different segments are utilizing credit and navigating the financial services arena. With 78 percent of full-time workers saying they live paycheck-to-paycheck and 71 percent of U.S. workers responding that they live in debt, it is not surprising a sudden life event can plunge a solid credit consumer from prime to subprime within months. Think lost job, divorce or unexpected medical bill. This population is not going away, and they are seeking ways to make ends meet and obtain finances for needs big and small. In many instances, alternative credit data can shed a light on new opportunities for traditional lenders, fintech players and those in the alternative financial space when servicing this specific consumer segment. In a new study, Clarity analyzed the trends and financial behavior of subprime loan users by looking at application and loan data in Clarity’s database, as well as overlaying VantageScore® credit score insights from Experian from 2013 to 2017. Clarity conducted this subprime trends report last year, but this is the first time it factored in VantageScore® credit score data, providing a different lens as to where consumers fall within the credit score tiers. Among the study highlights: Storefront single pay loan customers are becoming more comfortable with applying for online loans, with a growing percentage seeking installment products. For the first time in five years, online single pay lending (payday) saw a reduction in total credit utilization per customer. Online installment, on the other hand, saw an increase. While the number of online installment loans increased by 12 percent and the number of borrowers by only 9 percent, the dollar value grew by 30 percent. Online installment lenders had the greatest percentage increase in average loan amount. California and Texas remain the most significant markets for online lenders, ranking first and second for five years in a row due to population size. There has also been growth in the Midwest. The in-depth report additionally delves into demographics, indicators of financial stability among the subprime market and comparisons between storefront and online product use and performance. “Every year, there are more financial lenders and products emerging to serve this population,” said Andy Sheehan, president of Clarity Services. “It’s important to understand the trends and data associated with these individuals and how they are maneuvering throughout the credit spectrum. As we know, it is often not a linear journey.” The inclusion of the VantageScore® credit score showcased additional findings around prime versus subprime financial behaviors and looks at generational trends. Access Full Report

With 16.7 million reported victims of identity fraud in 2017 (that’s 6.64 percent of the U.S. population), it was another record year for the number of fraud victims. And as online and mobile transaction growth continued to significantly outpace brick-and-mortar growth, criminal attacks also grew rapidly. This past year, we saw an increase of more than 30 percent in e-commerce fraud attacks compared with 2016. As we’ve done over the past three years, Experian® analyzed millions of online transactions to identify fraud attack rates for both shipping and billing locations across the United States. We looked at several data points, including geography and IP address, to help businesses better understand how and where fraud is being perpetrated so they can better protect against it. The 2017 e-commerce fraud attack rate analysis shows: Delaware and Oregon continue to be the riskiest states for both billing and shipping fraud. Delaware; Oregon; Washington, D.C.; Florida; and Georgia are the top five riskiest states for billing fraud. Delaware, Oregon, Florida, New York and California are the top five riskiest states for shipping fraud, accounting for 50 percent of total fraud attacks. South El Monte, Calif., is the riskiest city overall, with an increase in shipping fraud of approximately 230 percent. Shipping fraud most often occurs near major airports and seaports due to reshippers and freight forwarders that receive domestic goods and often send them overseas. When a transaction originates from an international IP address, shipping fraud is 6.7 times likelier than the average, while billing fraud becomes 7.1 times likelier. Where is e-commerce fraud happening? Typically, the highest-risk areas for fraud are in ZIP™ codes and cities near large ports of entry or airports. These are ideal locations to reship fraudulent merchandise, enabling criminals to move stolen goods more effectively. Top 10 riskiest billing ZIP™ codes Top 10 riskiest shipping ZIP™ codes 97252 Portland, OR 97079 Beaverton, OR 33198 Miami, FL 33122 Miami, FL 33166 Miami, FL 91733 South El Monte, CA 33122 Miami, FL 97251 Portland, OR 77060 Houston, TX 97250 Portland, OR 33195 Miami, FL 33166 Miami, FL 97250 Portland, OR 97252 Portland, OR 97251 Portland, OR 33198 Miami, FL 33191 Miami, FL 33195 Miami, FL 97253 Portland, OR 33192 Miami, FL Source: Experian.com Source: Experian.com What’s more, many of the riskiest ZIP™ codes and cities experience a high volume of transactions originating from international IP addresses. In fact, the top 10 riskiest ZIP codes overall tend to experience fraudulent activity from numerous countries overseas, including China, Venezuela, Taiwan and Hong Kong, and Argentina. These fraudsters tend to implement complex fraud schemes that can cost businesses millions of dollars in fraud losses. Additionally, the analysis shows that traffic coming from a proxy server — which could originate from domestic and international IP addresses — is 74 times riskier than the average transaction. The problem The increase in e-commerce fraud attacks shouldn’t come as a huge surprise. The uptick in data breaches, merchants’ continued adoption of EMV-enabled terminals to protect against counterfeit card fraud and the abundance of consumer data on the dark web means that information is even more accessible to criminals. This enables them to open fraudulent accounts, take over legitimate accounts and submit fraudulent transactions. Another reason for the increase is automation. In the past, criminals needed a strong understanding of fraud methods and technology, but they can now bring down an entire organization by simply downloading a file and automating the submission of thousands of applications or transactions simultaneously. Since fraudsters need to make these transactions appear as normal as possible, they often leverage the cardholder’s actual billing details with slight differences, such as e-mail address or shipping location. Unfortunately, the mass availability of compromised data and the abundance of fraudsters makes it increasingly challenging to identify and separate legitimate customers from attackers across the country. Because of the widespread prevalence of fraud and data compromises, we don’t see billing fraud concentrated in just one region of the country. In fact, the top five states for billing fraud make up only about 18 percent of overall fraud attacks. Top 5 riskiest billing fraud states Top 5 riskiest shipping fraud states State Fraud attack rate State Fraud attack rate Delaware 93.4 Delaware 195.9 Oregon 86.1 Oregon 170.1 Washington, D.C. 46.5 Florida 45.1 Florida 39.2 New York 37.3 Georgia 31.5 California 32.6 Source: Experian.com Source: Experian.com Prevention and protection need to be the priority As businesses get a better understanding of how and where fraud is perpetrated, they can implement proactive strategies to detect and prevent attacks, as well as protect payment information. While no one single strategy can address the entire scope of fraud, there are advanced data sets and technology — such as device intelligence, behavioral and physical biometrics, document verification and entity resolution — that can help businesses make better fraud decisions. Fortunately, consumers can also play a major role in safeguarding their information. In addition to regularly checking their credit reports and bank/credit card statements for fraudulent activity, consumers can limit the data they share on social networking sites, where attackers often begin when perpetrating identity fraud. While we continue to help both organizations and consumers limit their exposure to e-commerce fraud, we anticipate that criminals will attempt more sophisticated fraud schemes. But businesses can stay ahead of the curve. This comes down to having a keen understanding of how fraud is being perpetrated, as well as leveraging data, technology and multiple layered strategies to better recognize legitimate customers and make more precise fraud decisions. View our e-commerce fraud heat map and download the top 100 riskiest ZIP codes in the United States. Experian is a nonexclusive full-service provider licensee of the United States Postal Service®. The following trademark is owned by the United States Postal Service®: ZIP. The price for Experian’s services is not established, controlled or approved by the United States Postal Service.

Managing your customer accounts at the identity level is ambitious and necessary, but possible Identity-related fraud exposure and losses continue to grow. The underlying schemes have elevated in complexity. Because it’s more difficult to perpetrate “card present” fraud in the post–chip-and-signature rollout here in the United States, bad guys are more motivated and getting better at identity theft and synthetic identity attacks. Their organized nefarious response takes the form of alternate attack vectors and methodologies — which means you need to stamp out any detected exposure point in your fraud prevention strategies as soon as it’s detected. Experian’s recently published 2018 Global Fraud and Identity Report suggests two-thirds, or 7 out of every ten, consumers want to see visible security protocols when they transact. But an ever-growing percentage of them, fueled in no small part by those tech-savvy millennials, expect to be recognized with little or no friction. In fact, 42 percent of the surveyed consumers who stated they would do more transactions online if there weren’t so many security hurdles to overcome were — you guessed it — millennials. So how do you implement identity and account management procedures that are effective and, in some cases, even obvious while being passive enough to not add friction to the user experience? In other words, from the consumer’s perspective, “Let me know you know me and are protecting me but not making it too difficult for me when I want to access or manage my account.” Let’s get one thing out of the way first. This isn’t a one-time project or effort. It is, however, a commitment to the continued informing of your account management strategies with updated identity intelligence. You need to make better decisions on when to let a low-risk account transaction (monetary or nonmonetary) pass and when to double down a bit and step up authentication or risk assessment checks. I’d suggest this is most easily accomplished through a single, real-time access point to myriad services that should, at the very least, include: Identity verification and reverification checks for ongoing reaffirmation of your customer identity data quality and accuracy. Know Your Customer program requirements, anyone? Targeted identity risk scores and underlying attributes designed to isolate identity theft, first-party fraud and synthetic identity. Fraud risk comes in many flavors. So must your analytics. Device intelligence and risk assessment. A customer identity is no longer just their name, address, Social Security number and date of birth. It’s their phone number, email address and the various devices they use to access your services as well. Knowing how that combination of elements presents itself over time is critical. Layered passive or more active authentication options such as document verification, biometrics, behavioral metrics, knowledge-based verification and alternative data sources. Ongoing identity monitoring and proactive alerting and segmentation of customers whose identity risk has shifted to the point of required treatment. Orchestration, workflow and decisioning capabilities that allow your team to make sense of the many innovative options available in customer recognition and risk assessment — without a “throw the kitchen sink at this problem” approach that will undoubtedly be way too costly in dollars spent and good customers annoyed. Fraud attacks are dynamic. Your customers’ perceptions and expectations will continue to evolve. The markets you address and the services you provide will vary in risk and reward. An innovative marketplace of identity management services can overwhelm. Make sure your strategic identity management partner has good answers to all of this and enables you to future-proof your investments.

Millions of Americans placed a credit freeze or restricted access to their credit file in recent months to keep identity thieves at bay. Credit freezes keep any new creditors from seeing a consumer’s credit file, which makes it nearly impossible for hackers to open new accounts fraudulently. But a credit freeze can also be problematic for consumers when they are finally ready to consider new credit products and loans. We’ve heard from credit unions and other lenders about sharing best practices to help streamline the process for consumers who want to permanently or temporarily lift the freeze to apply for a legitimate line of credit. Following are the three ways to help clients with a frozen Experian report quickly and efficiently allow access. Unfreeze account: This will remove the freeze entirely from the consumer’s credit report so that it may be accessed with the consumer’s permission. To do this, the consumer will need to contact Experian online, by phone or mail and provide his unique personal identification number (PIN) code—provided when the consumer froze his account—to un-freeze the report. Thaw account: An action that will temporarily remove the freeze for a timeframe determined by the consumer. The consumer should contact Experian online, by phone, or mail and provide his unique PIN code to thaw the report. Grant a creditor one-time access: A consumer may provide a different/temporary PIN to a lender to access the report just once. The PIN can be emailed to the consumer, presented on screen if the consumer is online, or provided on the phone or by mail. Typically, a consumer’s request to thaw or un-freeze his credit file online or by phone will thaw or un-freeze the file within minutes. Download Checklist Experian can be reached: Online: www.experian.com/freeze Phone: 888-397-3742 Mail: P.O. Box 9554, Allen, Texas 75013 Remember, if a consumer has a frozen credit file with all three credit reporting agencies, he will need to contact each agency to enable access to his report.

As the world celebrates International Women's Day on March 8, we want to shine a light on a few of the female leaders who shape, inspire and grow Experian. From sales to strategy, to people management, big data and beyond, women are a driving force in every industry - and their stories deserve to be told. Throughout the week, meet some of the "Women of Experian." Today, we feature Laurie Jerome, an executive leading Experian's initiatives around talent, diversity and inclusion. Learn about her career journey, learnings and sources of inspiration as it pertains to leadership. What do you do at Experian? What’s a typical day like for you? I lead all talent initiatives across North America, (6,000 employees located across 24 offices and over 900 remote workers). In addition, it’s critical that we partner with our global talent teams for alignment and integration of brand, culture, leadership and succession management. In very simple terms, we are here to create a great employee experience and provide leaders with the tools, training and resources to do just that. The overall outcome is to ensure our workforce is engaged and retained. How do you motivate yourself and stay motivated? I have a motto that “If you love what you do, then you’ll never have to work a day in your life.” I found my niche early on and although I can’t say that every day I get to do what I love, I balance my day with networking, workouts and family. Work-life integration is so important for anyone who works full time. My days are full, but if they include some of those balanced elements then I feel fulfilled. One of my favorite things to do is pay it forward to others who are growing their career. I have several mentees and find so much joy in giving back and learning from them. I think it’s become more real to me now having two sons (one a recent grad and one in his second year at UCLA). With such a competitive environment for candidates and employers, I find it so rewarding to help others navigate their way. What are the most important values you demonstrate as a leader? I would have to say life-long learning no matter where you are in your career. With that comes humility and transparency in sharing what you know, and probably most importantly being vulnerable and confident enough to share what you don’t. I love to surround myself with others who bring very different skills, values and experiences to the team. It truly requires time and attention to ensure your team has a strong understanding of one another and values such differences. My team meets every other week and although some are virtual and in other locations, I insist on using video conference to keep us visually in touch and connected. There’s something about being present that matters. Oh, and speaking of presence, another important value I have is being available to my team and others no matter how busy I am. Well, I think I went over the request of providing the MOST important however they are all so related. What are some patterns you’ve noticed over the years about women at work, and things they could be doing better to advance their careers? The topic of mentoring comes up quite often. Everyone is looking for someone they can turn to and seek advice and council with on a range of topics. I think it’s great, but one piece of advice I give to those I’ve mentored is to find someone very different than yourself and capitalize on what they offer that you need. In some cases, it’s a male perspective. Like it or not, we see things through such a different lens and having that view can be very advantageous and insightful. Discover your gaps and find someone who demonstrates them well. Do you have a sponsor? Instead of selecting someone who can mentor and coach, find someone who can open doors for you and sponsor stretch assignments and new opportunities. Caveat… be prepared to be challenged and perform. It’s not for the weak of heart. I’ve always been an avid networker. It comes more natural to me. I’ve been told I have a “black belt” in networking. Women have traditionally been expected to devote more time to family and domestic responsibilities, thus lacking as much time as men to build networks. We’re starting to see more women networking. To be truly competitive in the networking arena, women may have to put more time into making contacts — and may have to ask their partners to take on a bigger share in juggling family life and work. Networking events are hard to juggle outside of work, but there are many more ways to view a network. Think about your gym buddies, those alumni groups, that stranger on the flight heading to another business meeting. You’ve got to get creative and get out of your comfort zone. And the greatest thing about networking is that it always has a mutually beneficial outcome. Go into it with a giving mindset and you’ll get so much out of it as well. Favorite authors/books? Reshma Saujani, founder of Girls Who Code and author of Women Who Don’t Wait in Life: Break the Mold, Lead the Way , offers some advice for how women can get ahead and be the ultimate leaders, even in a male-dominated environment. I love almost anything Ram Charan writes: Execution: The Discipline of Getting Things Done, The High Potential Leader, What the Customer Wants You to Know, Talent Wins: The New Playbook for Putting People First. And it wouldn’t be fair if I didn’t give credit to a woman that inspires me in all that she does – Sheryl Sandberg.

As the world celebrates International Women's Day on March 8, we want to shine a light on a few of the female leaders who shape, inspire and grow Experian. From sales to strategy, to people management, big data and beyond, women are a driving force in every industry - and their stories deserve to be told. Throughout the week, meet some of the "Women of Experian." Today, we feature Jennifer Leuer, president of Experian's Partner Solutions division. Learn about her career journey, learnings and sources of inspiration as it pertains to leadership. What do you do at Experian? I lead our Partner Solutions business within Experian Consumer Services. As a B2B2C business, we serve consumer needs through strong partnerships with our clients, providing white label and cobranded solutions. Today, we provide consumers with credit education and identity protection products. In the future, we will go into adjacent services with business units throughout Experian. Those products allow our clients to reinforce their core value propositions with their consumers and better engage and retain them. What’s a typical day like for you? I don’t really have a typical day, which is one of the things I love about my role. Sometimes I’m out traveling to meet clients, talking with them about how we can grow together or about specific challenges they are facing. Other weeks I’m in our Costa Mesa or Austin offices discussing operations, financial performance, contract negotiations, business planning, progress against our vision and strategy, and most importantly our talented people and culture. I always love 1:1 meetings when we spend time on career development and two-way feedback. I enjoy hearing feedback from my colleagues throughout our organization and I think it’s essential to regularly provide it as well. What are some patterns you’ve noticed over the years about women at work, and things they could be doing better to advance their careers? While I don’t like to generalize, I’ve definitely seen a few commonalities observing female teammates across different functions and organizations. Women are often quite humble about their accomplishments and will emphasize the team’s contributions to a win. Ladies, get comfortable with talking about your individual wins and the role YOU played in broader initiatives. Brag a little! You can acknowledge the teamwork while also highlighting the unique role you played. I hear from many female colleagues that they don’t like speaking in meetings. I strongly believe that hearing different perspectives assists leaders with making better decisions. So, in your next meeting, add a data point to support the conversation, comment on the market context, or offer an alternative point of view. Also, one thing we can all do is open the door in meetings for our quieter colleagues to contribute. Saying something like, “Jen, we haven’t heard your point of view on this issue. What are your thoughts?” can create space in the conversation for a colleague to share their perspective. Finally, I’m currently reading a great book, “Own It,” which reinforces the leadership qualities that many women naturally bring to the workplace: Emotional intelligence, collaborative style, strong communication skills, orientation for win/win solutions. These are all powerful traits that drive significant value to teams and that women can really “own” with confidence. What’s the most important business or other discovery you’ve made in the past year? Does Amazon Fresh count? Being able to order groceries via wifi on an airplane is a game changer! Actually, it’s also a great example of what it took to make disruption in that space work—other companies tried and failed with grocery delivery because key pieces of the equation were missing. I love finding professional ah-ha’s as a consumer. What is one characteristic that you believe every leader should possess? I’m going to cheat and give a two-part answer on this one! I believe great leaders are inspired by their teams…and work for their teams. There are many takes on this philosophy, sometimes called servant leadership. Simon Sinek’s book “Leaders Eat Last” gave an updated view of this. When a leader is focused on assisting her team to grow, learn and thrive, the organization aligns around high performance and continuous improvement. One characteristic that I am currently working on is relentless curiosity: Asking more questions, really listening to the answers, then asking follow-up questions! Often we get into patterns where we opine more than listen, and the process of deep discovery unlocks creative solutions and new viewpoints. What are your hobbies outside of work? I feel like I have two families—at work and at home. Making sure I’m leading and serving both is an important part of my life. I used to think I should have more hobbies to force myself to have work/life balance! I’ve since learned it’s really about work/life integration. I know that setting aside time to relax and recharge is most important for me, so I spend free time on activities that give me joy and that I can do with my family. My husband and I enjoy completing 10K and half marathon runs, so we train together on the weekends. That gives us a chance to catch up while also forming a healthy habit. I love gardening and luckily my two sons can usually be persuaded to assist. And over the past couple years, we’ve enjoyed learning more about the world of comics together (Marvel, DC, etc.). Did you know Thor’s hammer (known as Mjolnir for the purists reading this!) actually passed to a woman last year? I think it’s pretty cool that there was a Goddess of a Thunder on comic book shelves! Favorite authors/books? I love to read! I enjoy books (printed and Audible versions), podcasts, and magazines. I will often check out a book summary before committing to a book (some examples are below). And magazines are my go-to for airplane reading. Here are a few I’d recommend for International Women’s Day: Harvard Business Review magazine is a great way to challenge your thinking and stay up to speed on a variety of new concepts and advancements Mindful magazine has great articles and practices “Rising Strong” by Brene Brown “The Confidence Code” by Katty Kay and Claire Shipman “Great Leaders Ask Great Questions” by John C Maxwell “Barking up the Wrong Tree—How to be awesome at life” by Eric Barker “The Pursuit of Perfection” by Tal Ben-Shahar Check back to learn more about "Women of Experian" throughout the week.

June 2018 will mark the one-year anniversary of the National Institute of Standards and Technology (NIST) release of Special Publication 800-63-3, Digital Identity Guidelines. While federal agencies are the most directly impacted, this guidance signals a seismic shift in identity proofing across the entire ecosystem of consumers, private sector businesses and public sector agencies. It’s the clearest claim I’ve seen to date that traditional, and rather basic, personally identifiable information (PII) verification should no longer be trusted for remote user interaction. For those of us in the fraud and identity space, this isn’t a new revelation, but one we as an industry have been dealing with for years. As the data breach floodgates continue to be pushed further open, PII is a commodity for the fraudsters, evident in PII prices on the dark web, which are often lower than your favorite latte. Identity-related schemes have increased due to fraud attacks shifting away from card compromise (due to the U.S. rollout of chip-and-signature cards), double-digit growth in online and mobile consumer channels, and high-profile fraud events within both the public and private sector. It’s no shock that NIST has taken a sledgehammer to previous guidance around identity proofing and replaced it with an aggressive and rather challenging set of requirements seemingly founded in the assumption that all PII (names, addresses, dates of birth, Social Security numbers, etc.) is either compromised or easily can be compromised in the future. So where does this leave us? I applaud the pragmatic approach to the new NIST standards and consider it a signal to all of us in the identity marketplace. It’s aggressive and aspirational in raising the bar in identity proofing and management. I welcome the challenge in serving our public sector clients, as we have done for nearly a decade. Our innovative approach to layered levels of identity verification, validation, risk assessment and monitoring adhere to the recommendations of the new NIST standards. I do, however, recommend that any institution applying these standards to their own processes and applications ensure they place equal focus on comparable alternatives for those addressable populations and users who are likely to either opt out of, or fail, initial verification steps stringently aligned with the new requirements. While too early to accurately forecast, it’s relatively safe to assume that the percentage of the population “falling out of the process” may easily be counted in the double digits. It’s only through advanced analytics and technology reliant on a significant breadth and depth of identity data and observations that we can provide trust and confidence across such a diverse population in age, demographics, expectations and access.

As the world celebrates International Women's Day on March 8, we want to shine a light on a few of the female leaders who shape, inspire and grow Experian. From sales to strategy, to people management, big data and beyond, women are a driving force in every industry - and their stories deserve to be told. Throughout the week, meet some of the "Women of Experian." Today, we feature Monica Peace, a sales leader who connects daily with some of the biggest players in financial services. Learn about her career journey, learnings and sources of inspiration as it pertains to leadership. What do you do at Experian? What’s a typical day like for you? I lead the sales team for the West Coast Preferred Channel. Our clients are comprised of key regional banks, fintechs, online lenders and indirect automotive lenders. One of the things I love about my job is that my days vary greatly depending on client or team needs and activities. Typical activities include internal meetings on aligning our solutions with go to market strategy, customizing solutions for some of our larger client needs, and ensuring our sales team have the training or tools to do their job effectively. Along with the internal activities there are weekly client calls/meetings to ensure I stay close to their immediate and long term needs, as well as continue to build on established relationships. When I’m not working from our corporate headquarters in Costa Mesa, I’m either visiting clients or working from my home office in Los Angeles. Being a woman in this space, what has been your greatest challenge? Biggest win? In my 25 years in the financial services industry, there have been many times when I’m on the other side of a negotiation with individuals or groups who are predominately male. When I started in my career, I would wear my heart on my sleeve and even throughout my career there have been many times when my passion for something reflected in the form of emotion. I have made a conscious effort to remove emotions from business dialogue. As an individual who is deeply invested in my work life, it has been an evolving process for me to find a way to balance my authentic self, who values personal connections with peers and clients, with an approach that also removes the “personal” from the process to keep the wins and losses objective. One of the deals I am most proud of was an over year-long negotiation with a global credit card issuer to merge their transaction data with the Experian credit data in 2006. The opportunity of blending transaction and credit data was somewhat visionary at the time. I learned a great deal about what it takes to sell a new concept internally and externally. I had the opportunity to work across many business units at Experian, which was a great platform for getting to know the organization and build my career in its early stages. It also gave me exposure to complex negotiations and confidence in my ability to identify and nurture strategic opportunities between large organizations. What are the most important values you demonstrate as a leader? Compassion, integrity, courage. I feel it is important to avoid making assumptions, come from a place of understanding, and offer kindness, even when situations can feel adversarial. I believe in the power of taking risks, and that most things that we aspire for reside on the other side of our fear. I approach each day with the attitude of doing the most important thing first, even if it is the thing you want to do the least. I believe it is my responsibility to help individuals understand what is possible through adversity, determination and goal setting. Who inspires you? One of the individuals who inspired me most in my lifetime, was and still is my father. Even though he is no longer alive, he was absolutely a mentor and role model for me personally and professionally. He was a dreamer and someone who took many risks, failed many times, and kept an optimistic attitude, even through a difficult illness. He had the gift of connecting people, making people laugh and captivating an audience with his humor and story-telling abilities. He started his career as a teacher, and then spent the majority in agricultural sales. He shared with me the reason he valued sales is that there is a direct correlation between your skill and work efforts and your rewards. He shared the importance of continuous personal growth and sharing your knowledge with others. He also demonstrated the value of building long term relationships, and along with that, the importance of doing the right thing, even when there is no direct benefit to you. Favorite authors/books? Elizabeth Gilbert “Big Magic” Tererai Trent “The Awakened Woman” Tali Sharot “The Optimism Bias” Check back to learn more about "Women of Experian" throughout the week.

There are lots of reasons why people miss a bill payment. Unfortunately, the approaches for collecting those late payments tend to follow a one-size-fits-all approach. For example, a customer takes a long vacation and forgets to pay his credit card bill before he leaves. When he gets home ten days later he already has five phone calls and two official notices from the collections department. And the calls continue for the next few days until he has an opportunity to call them back to take care of the situation. How does this customer feel? Frustrated? Annoyed? Under-valued? The current collections process is outdated, especially in a world where personalized and relevant communications are becoming the norm. The collections process is driven by the measurement of delinquency and loss. Rarely does it consider the broader customer profile. Too often, this narrow view leads to one-size-fits all collections strategies and overly aggressive processes. Getting debt collection right is about more than the money. It needs to be about the customer. It’s about knowing the difference between a customer who has simply forgotten to make a payment or someone dealing with financial hardship. We recently released a paper on the collections process, looking at how common it is for overly aggressive collections to lead to account closures and erosion of customer lifetime value. In fact, we found 3 percent of 30-day delinquencies in card portfolios closed their accounts after paying their balance in full. Seventy-five percent of those closures came with the payment to bring the account current and the remaining 25 percent closed the account within the following 60 days. Our analysis also showed that people with the lowest balances and the lowest amount past-due had the highest incidence of paying off their debt and closing their accounts. That means that by being too aggressive over a fairly low dollar amount, you can damage the relationship with a customer who could bring a lifetime of more business. We also used our Mosaic® lifestyle segmentation system to do a deeper look into who was more likely to close their accounts. We found the likelihood to close accounts was four times higher in the young, urban, affluent population than it was with others. This particular segment usually has the greatest potential for lifetime value and are the hardest to attract. It seems counterproductive to let overly aggressive and perhaps unnecessary, debt collection end the relationship. However, if we become smarter about the collections process, it could be possible to not only keep the customer, but also strengthen the relationship. Consider this, the customer on that long vacation receives an email that says, “Hey we noticed you forgot to make your last payment. Can you email us back the reason why and when we should expect it?” This creates an opportunity to build the relationship with that customer and get a commitment to settle the payment by a particular date. Ten days later when he gets back from vacation, he receives a reminder to make the payment and takes care of it. Instead of feeling frustrated, annoyed or undervalued, the customer has a positive experience and continues doing business with a company who is focused on building relationships vs. simply collecting money. There is a real opportunity to take best practices around customer experience from earlier stages of the customer lifecycle and apply them to the collections stage. Sure, some situations may require a more aggressive approach, for others, the idea of an email and the option to log on to a virtual platform to handle the debt on their own terms is the preferred approach. Some customers may not need options other than a little more time to pay on their own terms. It comes down to knowing your customer and applying the insights we can uncover from data to handle debt collection. This will allow us to improve the customer experience and strengthen customer life-time value.

As the world celebrates International Women's Day on March 8, we want to shine a light on a few of the female leaders who shape, inspire and grow Experian. From sales to strategy, to people management, big data and beyond, women are a driving force in every industry - and their stories deserve to be told. Throughout the week, meet some of the "Women of Experian." Today, we feature Jennifer Schulz, group president of Experian's Health, Auto and Targeting businesses. Learn about her typical day, sources of motivation and perspectives on leadership and innovation. What do you do at Experian? What’s a typical day like for you? I’m Group President of Experian’s Health, Auto and Targeting businesses - definitely a diverse industry mix to manage. As such, no two days are alike, and that is one of the things I love most about my job. On some days I meet with clients or partners, and on others I dedicate my time to reviewing the progress of our growth strategies, or focusing on budget and risk topics. I love the variety of industries and topics that are involved in this job. It keeps things interesting. How do you motivate yourself and stay motivated? I stay motivated by remaining connected to my clients and employees. I'm always striving to understand how our products and company have helped the businesses and people we serve. What are some patterns you’ve noticed over the years about women at work, and things they could be doing better to advance their careers? I once had the opportunity to listen to Indra Nooyi, CEO of Pepsi, and she said something that really resonated with me. I'm paraphrasing, but basically she shared that women need to be more direct in their feedback with one another, always pushing each other to do better. Essentially, if you see a female (or male) colleague struggling or doing something that is undermining their impact (e.g. not speaking up in meetings) – reach out and help them. Give them that feedback in the moment so they can be more successful. Where do the great ideas come from in your organization? In all of the Experian's businesses, I’ve found the most consistent source of product ideas come from our clients. Our users provide great enhancement ideas, so we work to consistently capture that "voice of customer" feedback. With that said, I believe we have some of the most innovative employees as well. Every day, I see examples of our people thinking big and pushing ideas forward. What is one characteristic that you believe every leader should possess? Integrity. Check back to learn more about "Women of Experian" throughout the week.

I recently sat down with Kathleen Peters, SVP and Head of Fraud and Identity, to discuss the state of fraud and identity, the pace of change in the space and her recent inclusion in the Top 100 influencers in Identity by One World Identity. ----------- Traci: Congratulations on being included on the Top 100 influencers list. What a nice honor. Kathleen: Yes, thank you. It is a nice honor and inspiring to be included among some great innovators in the industry. The list includes entrepreneurs to leaders of large organizations like us. It’s a nice mix across all facets of identity. T: Tell me about your role. How long have you been at Experian? K: I lead the team that defines the product strategy for our global fraud and ID portfolio. I’ve been with Experian just over four years, joining soon after we acquired 41st Parameter®. T: What was your first job? K: My first job out of college was with Motorola in Chicago. I was an electrical engineer, working on advanced cellphone technology. T: They were not able to keep up with the market? K: The entire industry was caught by the introduction of the iPhone. All the major cellphone companies were impacted — Nokia, Ericsson, Siemens and others. Talk about disrupting an industry. T: Yeah. These are great examples of how the disrupters have taken out the initial companies. Certainly, Motorola, Nokia, those companies. Even RIM Blackberry, which redefined the digital or cellular space, has all but disappeared. K: Yes, exactly. It was interesting to watch RIM Blackberry when they disrupted Motorola’s pager business. Motorola had a very robust pager line. Even then they had a two-way pager with a keyboard. They just missed the idea of mobile email completely. It’s really, really fascinating to look back now. T: Changing the subject a little, what motivates you to get out of bed in the morning? K: One of my favorite questions. I’m a very purpose-driven person. One of the things I really like about my role and one of the reasons I came to Experian in the first place is that I could see this huge potential within the company to combine offline and online identity information and transaction information to better recognize people and stop fraud. T: What do you see as the biggest threat to organizations today? K: I would have to say the pace of change. As we were just talking about, major industries can be disrupted seemingly overnight. We’re in the midst of a real digital transformation in how we live, how we work, how we share information and even how we share money. The threat to companies is twofold. One is the “friendly fire” threat, like the pace of change, disrupters to the market, new ways of doing things and keeping pace with that innovation. The second threat is that with digitization comes new types of security and fraud risks. Today, organizations need to be ever-vigilant about their security. T: How do you stay ahead of that pace of change? K: Well, my husband and I have lived in Silicon Valley since 1997. Technology and innovation are all around us. We read about it and we hear about it in the news. We engage with our neighbors and other people who we meet socially and within our networks. You can’t help but be immersed in it all the time. It certainly influences the way we go about our lives and how we think and act and engage as a family. We’re all technically curious. We have two kids, and our neighborhood high school, Homestead High, is the same high school Steve Jobs went to. It’s fun that way. T: Definitely. What are some of the most effective ways for businesses to combat the threat of fraud? K: I firmly believe that nowadays it all needs to start with identity. What we’ve found — and confirmed through research in our recent Global Fraud Report, plus conversations I’ve had with clients and analysts — is that if you can better recognize someone, you’ll go a long way to prevent fraud. And it does more than prevent fraud; it provides a better experience for the people you’re engaged with. Because once you recognize an individual, that initiates a trusted relationship between the two of you. Once people feel they’re in a trusted relationship, whether it’s a social relationship or a financial transaction, whatever the relationship is — once you feel trusted, you feel safe, you feel protected. And you’re more likely to want to engage again in the future. I believe the best thing organizations can do is take a multilayered approach to authenticating and identifying people upfront. There are so many ways to do this digitally without disrupting the consumer, and this is the best opportunity for businesses. If we collectively get that right, we’ll stop fraud. T: What are some of the things Experian is focusing on to help businesses stop fraud? K: We’ve focused on our CrossCore® platform. CrossCore is a common access and decisioning capability platform that allows the combining and layering of many different approaches — some active, some passive — to identify a customer in a transaction. You can incorporate things like biometrics and behavioral attributes. You can incorporate digital information about the device you’re engaging with. You can layer in online and offline identity information, like that from our Precise ID® product. CrossCore also enables you to layer in other digital attributes and alternative data such as email address, phone number and the validity of that phone number. CrossCore provides a great opportunity for us to showcase innovation, whether that comes from a third-party partner or even from our own Experian DataLabs. T: How significant do you see machine learning moving forward? K: Machine learning, it has all kinds of names, right? I think of machine learning, artificial intelligence, data robotics, parallel computing — all these things are related to what we used to call big data processing, but that’s not really the trendy term anymore. The point is that there is so much data today. There’s a wealth of data from all different sources, and as a society we’re producing it in exponential volumes. Having more and more and more data is not useful if you can’t derive insights from it. That’s why machine learning, augmented with human intervention or direction, is the best way forward, because there’s so much data out there available in the world now. No matter what problem we’re trying to solve, there’s a wealth of data we can amass, but we need to make sense of it. And the way to make sense of massive amounts of data in a reasonable amount of time is by using some sort of artificial intelligence, or machine learning. We’re going to see it in all kinds of applications. We already are today. So, while I think of machine learning as a generic term, I do think it’s going to be with us for a while to quickly compute and derive meaningful insights from the massive amounts of data all around us. T: Thanks, okay. Last question, and I hope a little fun. How would you describe yourself in one word? K: Curious. T: Ah, that’s a good choice. K: I am always curious. That’s why I love living where I live. It’s why I like working in technology. I’ve always wondered how things work, how we might improve on them, what’s under the hood. Why people make the decisions they do. How does someone come up with this? I’m always curious. T: Well, thank you for the time, and congrats again on being included in the Top 100 influencers in Identity.

As the world celebrates International Women's Day on March 8, we want to shine a light on a few of the female leaders who shape, inspire and grow Experian. From sales to strategy, to people management, big data and beyond, women are a driving force in every industry - and their stories deserve to be told. Throughout the week, meet some of the "Women of Experian." Today, we feature Shannon Lois, a leader of our business and the senior vice president who meets with Experian internal and external clients of all sizes to understand their challenges around data, technology, risk and running a business. Read about her career journey, learnings and sources of inspiration as it pertains to leadership. What do you do at Experian? What’s a typical day like for you? I lead the consulting organization across Experian. We focus on bringing the value of industry and client expertise to the market and to our existing and prospective clients. We bring the business acumen to deliver all Experian solutions. I also lead go-to-market activities for Decision Analytics, creating market driven propositions and messaging for our internal and external clients. On a typical day, I am working with colleagues, business partners and clients, leading discussions across the Experian network to define and refine client solutions. That means lots of conversations about who we are, what we do and the value that consultants and Experian can bring to clients’ businesses. How do you motivate yourself and stay motivated? I have been motivated since I was a child in school by seeing a project or activity progress from its early stages to a successful completion. I’m a strong believer that hard work (personal or professional) pays off. I am driven by the satisfaction of everything from creating a delicious meal to a successful client delivery and seeing them use my team’s ideas to make their business better. I also enjoy watching my hand-selected team, who works just as hard as I do, create, develop and positively impact our clients, often with something that has never been done before. What are some patterns you’ve noticed over the years about women at work, and things they could be doing better to advance their careers? Women are steadily becoming more confident in their ability to manage their own success. While there have always been fewer women in the analytics and decisioning space, they are growing steadily stronger in assessing the value they contribute to their day-to-day work. The difference is evident as they bring new ideas and create unique, efficient ways of solving for client business problems. They are also asking for more opportunities, and the rewards that come with excelling and delivering on those initiatives. Confidence is key! There are many words of advice that I could offer (and that I constantly remind myself of), but the one that resonates the most is to understand the value you bring to each specific situation (day-to-day work, special project, new position) and don’t be afraid to own your success. What is one characteristic that you believe every leader should possess? I think being humble is critical. Everyone in the organization contributes in some way to the whole, and I have found that I can learn from them all. If you’re approachable and treat everyone with the dignity and respect they deserve, regardless of their position, it’s a huge benefit because people open up to you. Every day, I am challenged by others to think differently, strategically and tactically, and that helps me to be a better leader. What are your hobbies outside of work? I’m Italian and cooking is my passion! I have fond memories of helping my mother prepare fresh, authentic Italian food and gathering together for family meals. These are traditions I still carry on with my own family, and I love preparing traditional dishes like Roman gnocchi and homemade pasta. Check back to learn more about "Women of Experian" throughout the week.

“Who Moved My Cheese?” Perhaps you've heard of this popular book, released in 1998. If you haven't, it's a quick read and one that describes four fictional characters - two mice and two "little people" - on their quest to hunt for cheese. On their journey, they have to assess their routines and consider change - that word that makes so many of us uncomfortable. I bring this up because it is no secret that the consumer has changed dramatically over the years. Technology, the need for personalization, the demand for speed. Yes, the consumer has changed for sure, and everyone seems to recognize this but collections professionals. Look at any financial institution and you will hear and see leaders talking about and executing on digital acquisition and account management strategies. After all, digital is the medium that consumers desire when interacting with their financial service providers. Marketers know this and most have adapted, but when it comes to collections, the industry seems to be fixated on utilizing the tactics of the past. Today, collectors largely rely on calling consumers and sending out dunning letters. Right Party Contact rates continue to decline, and with 50 percent of consumers lacking land lines, the contact rates are only going to get worse. I say all this because if you want to see success, you must change. Offering your past-due customers a digital experience will not only increase your collections performance and recoveries, but simultaneously improve your customer experience and reduce costs. This is a huge opportunity if collectors would just embrace a digital collections strategy. And let me note that having a payment portal is not a digital collections strategy. If that was the case, digital marketers would be done with just a simple website, and then they can wish their consumers will land on the site. A digital collections experience is much more. Why stay stuck in the past? Change is good, let someone else look for that old cheese.

Traditional credit attributes provide immense value for lenders when making decisions, but when used alone, they are limited to capturing credit behavior during a single moment of time. To add a deeper layer of insight, Experian® today unveiled new trended attributes, aimed at giving lenders a wider view into consumer credit behavior and patterns over time. Ultimately, this helps them expand into new risk segments and better tailor credit offers to meet consumer needs. An Experian analysis shows that custom models developed using Trended 3DTM attributes provide up to a 7 percent lift in predictive performance when compared with models developed using traditional attributes only. “While trended data has been shown to provide additional insight into a consumer’s credit behavior, lack of standardization across different providers has made it a challenge to gain those insights,” said Steve Platt, Experian’s Group President of Decision Analytics and Data Quality. “Trended 3D makes it easy for our clients to get value from trended data in a consistent manner, so they can make more informed decisions across the credit life cycle and, more importantly, give consumers better access to lending options.” Experian’s Trended 3D attributes help lenders unlock valuable insights hidden within credit reports. For example, two people may have similar balances, utilization and risk scores, but their paths to that point may be substantially different. The solution synthesizes a 24-month history of five key credit report fields — balance, credit limit or original loan amount, scheduled payment amount, actual payment amount and last payment date. Lenders can gain insight into: Changes in balances over time Migration patterns from one tradeline or multiple tradelines to another Variations in utilization and credit limits Changes in payment activity and collections Balance transfer and debt consolidation behavior Behavior patterns of revolving trades versus transactional trades Additionally, Trended 3D leverages machine learning techniques to evaluate behavioral data and recognize patterns that previously may have gone undetected. To learn more information about Experian’s Trended 3D attributes, click here.