Financial Services

Increased volume of fraud attempts during back to school shopping season Back to school shopping season will be the first time many consumers' use their chip-enabled credit cards and stores' new card readers. With the average K-12 family spending $630.36 per child in back to school shopping, and more than 1/3 shopping online, according to the National Retail Federation - is your fraud strategy prepared to handle the increased volume? And are you using a dynamic knowledge based authentication (KBA) solution that incorporates a wide variety of questions categories as part of your multi-faceted risk based authentication approach to fraud account management? Binary verification, or risk segmentation based on a single pass/fail decision is like trying to stay dry in a summer rain storm by wearing a coat. It’s far more effective to wear rubber boots and a use an umbrella, in addition to wearing a rain coat. Binary verification can occur based on evaluating identity elements with two outcomes –pass or fail – which could leave you susceptible to a crafty fraudster. When we recommend a risk based authentication approach, we take a more holistic view of a consumers risk profile. We advocate using analytics and weighting many factors, including identity elements, device intelligence and a robust knowledge-based authentication solution that work in concert to provide overall risk based decision. After all, the end-goal is to enable the good consumers to continue forward based, while preventing the fraudster from compromising your customer’s identity and infiltrating you’re your business.

Imagine the following scenario: an attacker acquires consumers’ login credentials through a data breach. They use these credentials to test account access and observe account activity to understand the ebbs and flows of normal cash movement – peering into private financial records – verifying the optimal time to strike for the most financial gain. Surveillance and fraud staging are the seemingly benign and often-transparent account activities that fraudsters undertake after an account has been compromised but before that compromise has been detected or money is moved. Activities include viewing balances, changing settings to more effectively cover tracks, and setting up account linkages to stage eventual fraudulent transfers. The unfortunate thing is that the actual theft is often the final event in a series of several fraudulent surveillance and staging activities that were not detected in time. It is the activity that occurs before theft that can severely undermine consumer trust and can devastate a brand’s reputation. Read more about surveillance, staging and the fraud lifecycle in this complimentary whitepaper.

Understanding shelf companies and shell companies In our world of business challenges with revenues level or trending down and business loans tougher than ever to get, “shelf” and “shell” companies continue to be an easy option for business opportunities. Shelf companies are defined as corporations formed in a low-tax, low-regulation state in order to be sold off for its excellent credit rating. Click on the internet and you will see a plethora of vendors selling companies in a turn-key business packages. Historically off-the-shelf structures were used to streamline a start-up, where an entrepreneur instantly owns a company that has been in business for several years without debt or liability. However, selling them as a way to get around credit guidelines is new, making them unethical and possibly illegal. Creating companies that impersonate a stable, well established companies in order to deceive creditors or suppliers in another way that criminals are using shelf companies for fraudulent use. Shell companies are characterized as fictitious entities created for the sole purpose of committing fraud. They often provide a convenient method for money laundering because they are easy and inexpensive to form and operate. These companies typically do not have a physical presence, although some may set up a storefront. According to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network, shell companies may even purchase corporate office “service packages” or “executive meeting suites” in order to appear to have established a more significant local presence. These packages often include a state business license, a local street address, an office that is staffed during business hours, a conference room for initial meetings, a local telephone listing with a receptionist and 24-hour personalized voice mail. In one recent bust out fraud scenario, a shell company operated out of an office building and signed up for service with a voice over Internet protocol (VoIP) provider. While the VoIP provider typically conducts on-site visits to all new accounts, this step was skipped because the account was acquired through a channel partner. During months one and two, the account maintained normal usage patterns and invoices were paid promptly. In month three, the account’s international toll activity spiked, causing the provider to question the unusual account activity. The customer responded with a seemingly legitimate business explanation of activity and offered additional documentation. However, the following month the account contact and business disappeared, leaving the VoIP provider with a substantial five figure loss. A follow-up visit to the business showed a vacant office suite. While it’s unrealistic to think all shelf and shell companies can be identified, there are some tools that can help you verify businesses, identify repeat offenders, and minimize fraud losses. In the example mention above, post-loss account review through Experian’s BizID identified an obvious address discrepancy – 12 businesses all listed at the same address, suggesting that the perpetrator set up numerous businesses and victimized multiple organizations. It is possible to avoid being the next victim and refine and revisit your fraud best practices today. Learn more about Experian BizID and how to protect your business.

Apple eschewed banks for a retailer focus onstage at their Worldwide Developers Conference (WWDC) when it spoke to payments. I sense this is an intentional shift – now that stateside, you have support from all four networks and all the major issuers – Apple understands that it needs to shift the focus on signing up more merchants, and everything we heard drove home that note. That includes Square’s support for NFC, as well as the announcements around Kohls, JCPenney and BJ’s. MasterCard's Digital Enablement Service (MDES) - opposite Visa’s Token Service - is the tokenization service that has enabled these partnerships specifically through MasterCard’s partners such as Synchrony – (former GE Capital) which brought on JCPenney, Alliance Data which brought on BJ’s, and CapitalOne which enabled Kohls. Within payments common sense questions such as: “Why isn’t NFC just another radio that transmits payment info?” or “Why aren’t retailer friendly payment choices using NFC?” have been met with contemptuous stares. As I have written umpteen times (here), payments has been a source of misalignment between merchants and banks. Thus – conversations that hinged on NFC have been a non-starter, for a merchant that views it as more than a radio – and instead, as a trojan horse for Visa/MA bearing higher costs. When Android opened up access to NFC through Host Card Emulation (HCE) and networks supported it through tokenization, merchants had a legitimate pathway to getting Private label cards on NFC. So far, very few indeed have done that (Tim Hortons is the best example). But between the top two department store chains (Macy’s and Kohls) – we have a thawing of said position, to begin to view technologies pragmatically and without morbid fear. It must be said that Google is clearly chasing Apple on the retailer front, and Apple is doing all that it can, to dig a wider moat by emphasizing privacy and transparency in its cause. It is proving to be quite effective, and Google will have to “apologize beforehand” prior to any merchant agreement – especially now that retailers have control over which wallets they want to work with – and how. This control inherits from the structures set alongside the Visa and MasterCard tokenization agreements – and retailers with co-brand/private label cards can lean on them through their bank partners. Thus, Google has to focus on two fronts – first to incentivize merchants to partner so that they bring their cards to Android Pay, while trying to navigate through the turbulence Apple has left in its wake, untangling the “customer privacy” knot. For merchants, at the end of the day, the questions that remain are about operating costs, and control. Does participation in MDES and VEDP tokenization services through bank partners, infer a higher cost for play – for private label cards? I doubt if Apple’s 15bps “skim off the top” revenue play translates to Private Label, especially when Apple’s fee is tied to “Fraud Protection” and Fraud in Private Label is non-existent due to its closed loop nature. Still – there could be an acquisitions cost, or Apple may plan a long game. Further, when you look at token issuance and lifecycle management costs, they aren’t trivial when you take in to context the size of portfolio for some of these merchants. That said, Kohls participation affords some clarity to all. Second, Merchants want to bring payments inside apps – just like they are able to do so through in-app payments in mobile, or on online. Forcing consumers through a Wallet app – is counter to that intent, and undesirable in the long scheme. Loyalty as a construct is tangled up in payments today – and merchants who have achieved a clean separation (very few) or can afford to avoid it (those with large Private label portfolios that are really ‘loyalty programs w/ payments tacked on’) – benefit for now. But soon, they will need to fold in the payment interaction in to their app, or Apple must streamline the clunky swap. The auto-prompt of rewards cards in Wallet is a good step, but that feels more like jerry rigging vs the correct approach. Wallet still feels very v1.5 from a merchant integration point of view. Wallet not Passbook. Finally, Apple branding Passbook to Wallet is a subtle and yet important step. A “bank wallet” or a “Credit Union wallet” is a misnomer. No one bank can hope to build a wallet – because my payment choices aren’t confined to a single bank. And even where banks have promoted “open wallets” and incentivized peers to participate – response has been crickets at best. On the flip side, an ecosystem player that touches more than a device, a handful of experiential services in entertainment and commerce, a million and a half apps – all with an underpinning of identity, can call itself a true wallet – because they are solving for the complete definition of that term vs pieces of what constitutes it. Thus – Google & Apple. So the re-branding while being inevitable, finds a firm footing in payments, looks toward loyalty and what lies beyond. Solving for those challenges has less to do with getting there first, but putting the right pieces in play. And Apple’s emphasis (or posturing – depending on who you listen to) on privacy has its roots in what Apple wants to become, and access, and store on our behalf. Being the custodian of a bank issued identity is one thing. Being a responsible custodian for consumer’s digital health, behavior and identity trifecta has never been entirely attempted. It requires pushing on all fronts, and a careful articulation of Apple’s purpose to the public must be preceded by the conviction found in such emphasis/posturing. Make sure to read our perspective paper to see why emerging channels call for advanced fraud identification techniques

By: Mike Horrocks The other day in the American Banker, there was an article titled “Is Loan Growth a Bad Idea Right Now?”, which brings up some great questions on how banks should be looking at their C&I portfolios (or frankly any section of the overall portfolio). I have to admit I was a little down on the industry, for thinking the only way we can grow is by cutting rates or maybe making bad loans. This downer moment required that I hit my playlist shuffle and like an oracle from the past, The Clash and their hit song “Should I stay or should I go”, gave me Sage-like insights that need to be shared. First, who are you listening to for advice? While I would not recommend having all the members of The Clash on your board of directors, could you have maybe one. Ask yourself are your boards, executive management teams, loan committees, etc., all composed of the same people, with maybe the only difference being iPhone versus Android?? Get some alternative thinking in the mix. There is tons of research to show this works. Second, set you standards and stick to them. In the song, there is a part where we have a bit of a discussion that goes like this. “This indecision's buggin' me, If you don't want me, set me free. Exactly whom I'm supposed to be, Don't you know which clothes even fit me?” Set your standards and just go after them. There should be no doubt if you are going to do a certain kind of loan or not based on the pricing. Know your pricing, know your limits, and dominate that market. Lastly, remember business cycles. I am hopeful and optimistic that we will have some good growth here for a while, but there is always a down turn…always. Again from the lyrics – “If I go there will be trouble, An' if I stay it will be double” In the American Banker article, M&T Bank CFO Rene Jones called out that an unnamed competitor made a 10-year fixed $30 million dollar loan at a rate that they (M&T) just could not match. So congrats to M&T for recognizing the pricing limits and maybe congrats to the unnamed bank for maybe having some competitive advantage that allowed them to make the loan. However if there is not something like that supporting the other bank…the short term pain of explaining slower growth today may seem like nothing compared to the questioning they will get if that portfolio goes south. So in the end, I say grow – soundly. Shake things up so you open new markets or create advantages in your current market and rock the Casbah!

Source: IntelliViewsm powered by Experian Sales of existing homes dropped 50% from the peak in August 2005 to the low point in July 2010. The spike in home sales in late 2009 and early 2010 was due to the large number of foreclosure sales as well as very low prices. Since 2010, sales have increased to almost to the level they were in 2000, before the financial crisis. However, the homeownership rate has steadily gone down. How could sales have picked up while the homeownership rate declined? Investors have entered the market snapping up single family homes and renting them. Therefore, the recent good news in the existing home market has been driven by investors, not homeowners. But as I point out below, this is changing. Looking at the homeownership rate by age, shown in the table below, it is clear that since the crisis the rate has declined most for people under 45. The potential for marketing is greatest in this cohort as the numbers indicate a likely demand for housing. Homeownership Rate by Age Source: U.S. Census Bureau and Haver Analytics as reported on the Federal Reserve Bank of St. Louis Fred database The factors that have impeded growth, described above, are beginning to reverse which, along with pent-up demand, will present an opportunity for mortgage originators in 2015. Home prices have risen in 246 of the 277 cities tracked by Clear Capital.With prices going up, investors have begun to back away from the market, resulting in prices increasing at a slower rate in some cities but they are still increasing.Therefore the perception that homeownership is risky will likely change.In fact, in some areas, such as California’s coastal cities, sales are strong and prices are going up rapidly. Lenders and regulators are recognizing that the stringent guidelines put in place in reaction to the crisis have overly constrained the market.Fannie Mae and Freddie Mac are reducing down payment requirements to as low as 3%.FHA is lowering their guarantee fee, reducing the amount of cash buyers need to close transactions.Private securitizations, which dried up completely, are beginning to reappear, especially in the jumbo market. As unemployment continues to go down, consumer confidence will rise and household formation will return to more normal levels which result in more sales to first time homebuyers, who drive the market.According to Lawrence Yun, chief economist for the National Association of Realtors, “…it’s all about consistent job growth for a prolonged period, and we’re entering that stage.” The number of houses in foreclosure, according to RealtyTrac, has fallen to pre-crisis levels.This drag on the market has, for the most part, cleared and as prices continue to inflate, potential buyers will be motivated to buy before homes become unaffordable.Despite the recent increases, home prices are still, on average, 23% lower than they were at the peak. Focusing marketing dollars on those people with the highest propensity to buy has always been a challenge but in this market there are identifiable targets. “Boomerangs” are people who owned real estate in the past but are currently renting and likely to come back into the market.Marketing to qualified former homeowners would provide a solid return on investment. People renting single family houses are indicating a lifestyle preference that can be marketed to. Newly-formed households are also profitable targets. The housing market, at long last, appears to be finally turning the corner and normalizing. Experian’s expertise in identifying the right consumers can help lenders to pinpoint the right people on whom marketing dollars should be invested to realize the highest level of return. Click here to learn more.

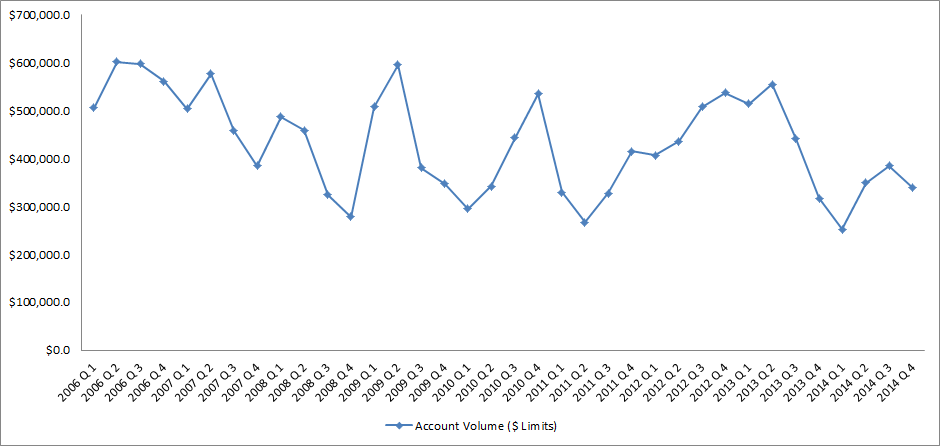

End-of-Draw approaching for many HELOCs Home equity lines of credit (HELOCs) originated during the U.S. housing boom period of 2006 – 2008 will soon approach their scheduled maturity or repayment phases, also known as “end-of-draw”. These 10 year interest only loans will convert to an amortization schedule to cover both principle and interest. The substantial increase in monthly payment amount will potentially shock many borrowers causing them to face liquidity issues. Many lenders are aware that the HELOC end-of-draw issue is drawing near and have been trying to get ahead of and restructure this debt. RealtyTrac, the leading provider of comprehensive housing data and analytics for the real estate and financial services industries, foresees this reset risk issue becoming a much bigger crisis than what lenders are expecting. There are a large percentage of outstanding HELOCs where the properties are still underwater. That number was at 40% in 2014 and is expected to peak at 62% in 2016, corresponding to the 10 year period after the peak of the U.S. housing bubble. RealtyTrac executives are concerned that the number of properties with a 125% plus loan-to-value ratio has become higher than predicted. The Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the National Credit Union Administration (collectively, the agencies), in collaboration with the Conference of State Bank Supervisors, have jointly issued regulatory guidance on risk management practices for HELOCs nearing end-of-draw. The agencies expect lenders to manage risks in a disciplined manner, recognizing risk and working with those distressed borrowers to avoid unnecessary defaults. A comprehensive strategic plan is vital in order to proactively manage the outstanding HELOCs on their portfolio nearing end-of-draw. Lenders who do not get ahead of the end-of-draw issue now may have negative impact to their bottom line, brand perception in the market, and realize an increase in regulatory scrutiny. It is important for lenders to highlight an awareness of each consumer’s needs and tailor an appropriate and unique solution. Below is Experian’s recommended best practice for restructuring HELOCs nearing end-of-draw: Qualify Qualify consumers who have a HELOC that was opened between 2006 and 2008 Assess Viability Assess which HELOCs are idea candidates for restructuring based on a consumer’s Overall debt-to-income ratio Combined loan-to-value ratio Refine Offer Refine the offer to tailor towards each consumer’s needs Monthly payment they can afford Opportunity to restructure the debt into a first mortgage Target Target those consumers most likely to accept the offer Consumers with recent mortgage inquiries Consumers who are in the market for a HELOC loan Lenders should consider partnering with companies who possess the right toolkit in order to give them the greatest decisioning power when restructuring HELOC end-of-draw debt. It is essential that lenders restructure this debt in the most effective and efficient way in order to provide the best overall solution for each individual consumer. Revamp your mortgage and home equity acquisitions strategies with advanced analytics End-of-draw articles

By: Kyle Enger, Executive Vice President of Finagraph Small business remains one of the largest and most profitable client segments for banks. They provide low cost deposits, high-quality loans and offer numerous cross-selling opportunities. However, recent reports indicate that a majority of business owners are dissatisfied with their banking relationship. In fact, more than 33 percent are actively shopping for a new relationship. With limited access to credit after the worst of the financial crisis, plus a lack of service and attention, many business owners have lost confidence in banks and their bankers. Before the financial crisis, business owners ranked their banker number three on the list of top trusted advisors. Today bankers have fallen to number seven – below the medical system, the president and religious organizations, as reported in a recent Gallup poll, “Confidence in Institutions.” In order to gain a foothold with existing clients and prospects, here is a roadmap banks can use to build trust and effectively meet the needs to today’s small business client. Put feet on the street. To rebuild trust, banks need to get in front of their clients face to face and begin engaging with them on a deeper level. Even in the digital age, business customers still want to have face-to-face contact with their bank. The only way to effectively do that is to put feet on the street and begin having conversations with clients. Whether it be via Skype, phone calls, text, e-mail or Twitter – having knowledgeable bankers accessible is the first step in creating a trusting relationship. Develop business acumen. Business owners need someone who is aware of their pain points, can offer the correct products according to their financial need, and can provide a long-term plan for growth. In order to do so, banks need to invest in developing the business and relationship acumen of their sales forces to empower them to be trusted advisors. One of the best ways to launch a new class of relationship bankers is to start investing in educational events for both the bankers and the borrowers. This creates an environment of learning, transparency and growth. Leverage technology to enhance client relationships. Commercial and industrial lending is an expensive delivery strategy because it means bankers are constantly working with business owners on a regular basis. This approach can be time-consuming and costly as bankers must monitor inventory, understand financials, and make recommendations to improve the financial health of a business. However, if banks leverage technology to provide bankers with the tools needed to be more effective in their interactions with clients, they can create a winning combination. Some examples of this include providing online chat, an educational forum, and a financial intelligence tool to quickly review financials, provide recommendations and make loan decisions. Authenticate your value proposition. Business owners have choices when it comes to selecting a financial service provider, which is why it is important that every banker has a clearly defined value proposition. A value proposition is more than a generic list of attributes developed from a routine sales training program. It is a way of interacting, responding and collaborating that validates those words and makes a value proposition come to life. Simply claiming to provide the best service means nothing if it takes 48 hours to return phone calls. Words are meaningless without action, and business owners are particularly jaded when it comes to false elevator speeches delivered by bankers. Never stop reaching out. Throughout the lifecycle of a business, its owner uses between 12 and 15 bank products and services, yet the national product per customer ratio averages around 2.5. Simply put, companies are spreading their banking needs across multiple organizations. The primary cause? The banker likely never asked them if they had any additional businesses or needs. As a relationship banker to small businesses, it is your duty to bring the power of the bank to the individual client. By focusing on adding value through superior customer experience and technology, financial institutions will be better positioned to attract new small business banking clients and expand wallet share with existing clients. By implementing these five strategies, you will create closer relationships, stronger loan portfolios and a new generation of relationship bankers. To view the original blog posting, click here. To read more about the collaboration between Experian and Finagraph, click here.

By: Linda Haran Complying with complex and evolving capital adequacy regulatory requirements is the new reality for financial service organizations, and it doesn’t seem to be getting any easier to comply in the years since CCAR was introduced under the Dodd Frank Act. Many banks that have submitted capital plans to the Fed have seen them approved in one year and then rejected in the following year’s review, making compliance with the regulation feel very much like a moving target. As a result, several banks have recently pulled together a think tank of sorts to collaborate on what the Fed is looking for in capital plan submissions. Complying with CCAR is a very complex, data intensive exercise which requires specialized staffing. An approach or methodology to preparing these annual submissions has not been formally outlined by the regulators and banks are on their own to interpret the complex requirements into a comprehensive plan that will ensure their capital plans are accepted by the Fed. As banks work to perfect the methodology used in this exercise, the Fed continues to fine tune the requirements by changing submission dates, Tier 1 capital definitions, etc. As the regulation continues to evolve, banks will need to keep pace with the changing nature of the requirements and continually evaluate current processes to assess where they can be enhanced. The capital planning exercise remains complex and employing various methodologies to produce the most complete view of loss projections prior to submitting a final plan to the Fed is a crucial component in having the plan approved. Banks should utilize all available resources and consider partnering with third party organizations who are experienced in both loss forecasting model development and regulatory consulting in order to stay ahead of the regulations and avoid a scenario where capital plan submissions may not be accepted. Learn how Experian can help you meet the latest regulatory requirements with our Loss Forecasting Model Services.

Do you really know where your commercial and small business clients stand financially? I bet if you ask your commercial lending relationship managers they will say they do - but do they really? The bigger question is how you could be more tied into to your business clients so that you could give them real advice that may save their businesses. More questions?? Nope, just one answer. Finagraph with Experian’s Advisor for relationship lending is a perfect setup to gather data that you currently are using within your financial institution that can then be matched that up with real financial spreads from the accounting systems that your business client use in their everyday process. By comparing the two sources of records you can get a true perspective on where your business clients stands and empower your relationship managers like ever before.

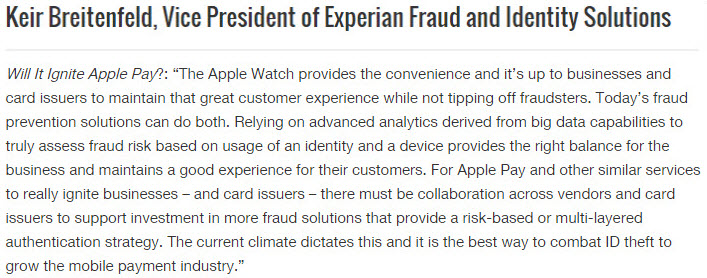

Apple Pay fraud solution Apple Pay is here and so are increased fraud exposures, confirmed losses, and customer experience challenges among card issuers. The exposure associated with the provisioning of credit and debit cards to the Apple Pay application was in time expected as fraudsters are the first group to find weaknesses. Evidence from issuers and analyst reports points to fraud as the result of established credit/debit cards compromised through data breaches or other means that are being enrolled into Apple Pay accounts – and being used to make large value purchases at large merchants. Keir Breitenfeld, our vice president of Fraud and Identity solutions said as much in a recent PYMNTS.com story where he was quoted about whether the Apple Watch will help grown Apple Pay. The challenge is that card issuers have no real controls over the provisioning or enrollment process so they currently only have an opportunity to authenticate their cardholder, but not the provisioning device. Fraud exposure can lie within call centers and online existing customer treatment channels due to: Identity theft and account takeover based on breach activity. Use of counterfeit or breached card data. Call center authentication process inadequacies. Capacity and customer experience pressures driving human error or subjectively lax due diligence. Existing customer/account authentication practices not tuned to this emerging scheme and level of risk. The good news is that positive improvements have been proven with bolstering risk-based authentication at the card provisioning process points by comparing the inbound provisioning device to the device that is on file for the cardholder account. This, in combination with traditional identity risk analytics, verifications, knowledge-based authentication, and holistic decisioning policies vastly improve the view afforded to card issuers for layered process point decisioning. Learn more on why emerging channels, like mobile payments, call for advanced fraud identification techniques.

The follow blog is by Kyle Enger, Executive Vice President of Finagraph With the surge of alternative lenders, competition among banks is stronger than ever. But what exactly does that mean for the everyday banker? It means business owners want more. If you’re only meeting your clients once a year on a renewal, it’s not good enough. In order to take your customer service to the next level, you need to become a trusted advisor. Someone who understands where your clients are going and how to help them get there. If you’re not investing in your clients’ business by taking the following actions, they may have one foot out the door. 1. Understand your clients’ business One of the biggest complaints from business owners is that bankers simply don’t understand their business. A good commercial banker should be well-versed in their borrower’s company, competitors and the industry. They should be willing to get to know their business, commit to them, stop by to check-in and provide a proactive plan to avoid future risks. 2. Utilize technology for your benefit The majority of recent bank innovations have been used to make the customer experience more convenient, but not necessarily the more helpful. We’ve seen everything from mobile remote deposit capture to online banking to mobile payments – all of which are keeping customers from interacting with the bank. Contrary to what many think, technology can be used to create strong relationships by giving bankers information about their customers to help serve them better. Using new software programs, bankers can see information like the current ratio, quick ratio, debt-to-equity, gross margin, net margin and ROI within seconds. 3. Heighten financial acumen Banks have access to a vast amount of customer financial data, but sometimes fail to use this information to its full potential. With insight into consumer purchasing behavior and business’ financial history, banks should be able to cater products and services to clients in a personalized manner. However, many lenders walk into prospect meetings without knowing much about the business. Their mode of operation is solely focused on trying to secure new clients by building rapport – they are what we call surface bankers. A good banker will educate clients on what they need to know such as equity, inventory, cash flow, retirement planning and sweep accounting. They should also know about new technology and consult borrowers on intermediate financing, terming out loans that are not revolving, or locking in with low interest rates. Following, they will bring in the right specialist to match the product according to their clients’ needs. 4. Go beyond the price Many business owners make the mistake of comparing banks based on cost, but the value of a healthy banking relationship and a financial guide is priceless. So many bankers these days are application gatherers working on a transactional basis, but that’s not what business owners need. They need to stop looking at the short-term convenience of brands, price and location, and start considering the long-term effects a trusted financial advisor can make on their business. 5. A partner in your business, not a banker “Sixty percent of businesses are misfinanced using short-term money for long-term use,” according to the CEB Business Banking Board. In other words, there are many qualified candidates in need of a trusting banker to help them succeed. Unbeknownst to many business owners, bankers actually want to make loans and help their clients’ business grow. Making this known is the baseline in building a strong foundation for the future of your career. Just remember to ask yourself – am I being business-centric or bank-centric? To view the original blog posting, click here. To read more about the collaboration between Experian and Finagraph, click here.

By: Mike Horrocks Experian has announced a new agreement with Finagraph, a best-in-class automated financial intelligence tool provider, to provide the banking industry with software to evaluate small business financials faster. Loan automation is key in pulling together data in a meaningful manner and this bank offering will provide consistent formatted financials for easier lending assessment. Finagraph’s automated financial intelligence tool delivers advanced analytics and data verification that presents small business financial information in a consistent format, making it easier for lenders to understand the commercial customer’s business. Experian’s portfolio risk management platform addresses the overall risks and opportunities within a loan portfolio. The company’s relationship lending platform provides a framework to automate, integrate and streamline commercial lending processes, including small and medium-sized enterprise and commercial lending. Both data-driven systems are designed to accommodate and integrate existing bank processes saving time which results in improved client engagement “Finagraph connects bankers and businesses in a data-driven way that leads to better insights that strengthens customer relationships,” said John Watts, Experian Decision Analytics director of product management. “Together we are helping our banking clients deliver the trusted advisor experience their business customers desire in a new industry-leading way.” “The lending landscape is rapidly changing. With new competitors entering the space, banks need innovative tools that allow them to maintain an advantage,” said James Walter, CEO and President of Finagraph. “We are excited about the way that our collaboration with Experian’s Baker Hill Advisor gives banks an edge by enabling them to connect with their clients in a meaningful way. Together we are hoping to empower a new generation of trusted advisors.” Learn more about our portfolio risk management and lending solutions and for more information on Finagraph please visit www.finagraph.com.

Deposit accounts for everyone Over the last several years, the Consumer Financial Protection Bureau (CFPB) has, not so quietly, been actively pushing for changes in how banks decision applicants for new checking accounts. Recent activity by the CFPB is accelerating the pace of this change for those managing deposits-gathering activities within regulated financial institutions. It is imperative banks begin adopting modern technology and product strategies that are designed for a digital age instead of an age before the internet even existed. In October 2014, the CFPB hosted the Forum On Access To Checking Accounts to push for more transparent account opening procedures, suggesting that bank’s use of “blacklists” that effectively “exclude” applicants from opening a transaction account are too opaque. Current regulatory trends are increasingly signaling the need for banks to bring checking account originations strategies into the 21st century as I indicated in Banking in the 21st Century. The operations and technology implications for banks must include modernizing the approach to account opening that goes beyond using different decision data to do “the same old thing” that only partially addresses broader concerns from consumers and regulators. Product features attached to check accounts, such as overdraft shadow limits, can be offered to consumers where this liquidity feature matches what the customer can afford. Banking innovation calls for deposit gatherers to find more ways to approve a basic transaction account, such as a checking account, that considers the consumer’s ability to repay and limit approving overdraft features for some checking accounts even if the consumer opts in. This doesn’t mean banks cannot use risk management principles in assessing which customers get that added liquidity management functionality attached to a checking account. It just means that overdraft should be one part of the total customer level exposure the bank considers in the risk assessment process. The looming regulatory impacts to overdraft fees, seemingly predictable, will further reduce bank revenue in an industry that has been hit hard over the last decade. Prudent financial institutions should begin managing the impact of additional lost fee revenue now and do it in a way that customers and regulators will appreciate. The CFPB has been signaling other looming changes for check account regulations, likely to accelerate throughout 2015, and portend further large impacts to bank overdraft revenue. Foreshadowing this change are the 2013 overdraft study by the CFPB and the proposed rules for prepaid cards published for commentary in December 2014 where prepaid account overdraft is “subject to rules governing credit cards under TILA, EFTA, and their implementing regulations”. That’s right, the CFPB has concluded overdraft for prepaid cards are the same as a loan falling under Reg Z. If the interpretation is applied to checking account debit card overdraft rules, it would effectively turn overdraft fees into finance charges and eliminate a huge portion of remaining profitability for banks from those fees. The good news for banks is that the solution for the new deposits paradigm is accomplished by bringing retail banking platforms into the 21st century that leverage the ability to set exposure for customers at the client level and apportioned to products or features such as overdraft. Proactively managing regulatory change, that is predictable and sure to come, includes banks considering the affordability of consumers and offering products that match the consumer’s needs and ability to repay. The risk decision is not different for unsecured lending in credit cards or for overdraft limits attached to a checking account. Banks becoming more innovative by offering checking accounts enabling consumers more flexible and transparent liquidity management functionality at a reasonable price will differentiate themselves in the market place and with regulatory bodies such as the CFPB. Conducting a capabilities assessment, or business review, to assess product innovation options like combining digital lines of credit with check accounts, will inform your business what you should do to maintain customer profitability. I recommend three steps to begin the change process and proactively manage through the deposit industry regulatory changes that lay ahead: First, assess the impacts of potential lost fees if current overdraft fees are further limited or eliminated and quantify what that means to your product profitability. Second, begin designing alternative pricing strategies, product offerings and underwriting strategies that allow you to set total exposure at a client level and apportion this exposure across lending products that includes overdraft lines and is done in a way that it is transparent to your customers and aligns to what they can afford. Third, but can be done in parallel with steps one and two, begin capability assessments of your financial institution’s core bank decision platform that is used to open and manage customer accounts to ensure your technology is prepared to handle future mandatory regulatory requirements without driving all your customers to your competitors. It is a given that change is inevitable. Deposit organizations are well served to manage this current shift in regulatory policy related to checking account acquisitions in a way consistent with guaranteeing your bank’s competitive advantage. Banks can stay out front of competitors by offering transparent and relevant financial products consumers will be drawn to buy and can’t afford to live without! Thank you for following my blog and insights in DDA best practices. Please accept my invitation to participate in a short market study. Click here to participate. Participants in this 5 minute survey will receive a copy of the results as a token of appreciation.

By: Scott Rhode This is the third and last of a three-part blog series focused on the residential solar market looking at; 1) the history of solar technology, 2) current trends and financing mechanisms, and finally 3) overcoming market and regulatory challenges with Experian’s help. As we’ve discussed in the two previous blogs, the residential solar industry in the US has experienced tremendous growth and much of that growth is attributed to financing. As the financing offers continue to evolve and mature, there are challenges that the industry faces. The first, and most obvious challenge, is that the Solar Investment Tax Credit is set to expire on December 31st, 2016. (To be clear, the credit is not eliminated on Dec. 31, 2016, it is simply planned to be reduced to 10%) Given the state of affairs in Washington, it is unlikely that the tax credit will get extended. This is unfortunate since this tax credit has been a catalyst for investment in this industry, greatly increasing affordability and adoption from the public. Once this incentive expires, the solar companies will need to acquire capital from more traditional sources (Debt markets, securitization, or other third party financing) to fund their growth since the Tax Equity community may no longer be willing to invest. In addition, the expiration of the credit means that panel manufactures must find ways to reduce the cost of production and that finance and installation companies must lower their customer acquisition cost since they are unsustainable in a post-ITC world. A benefit of moving towards other means of funding is that the sophistication level of pre-screening, scoring, and portfolio management should improve dramatically. Today, the Tax Equity community drives all of the credit strategies and those strategies are actually holding solar companies back because of their simplicity. For example, most of the TE investors require that the customer have a 680 FICO score or better in order to get approval. They do not require a debt to income threshold to be met, nor do they look at other attributes or data points. This overly simplistic approach is meant to keep the TE investor out of difficult conversations of being in the “sub-prime” space; however, it greatly limits growth and it turns away good customers. Additionally, this approach does not consider the “essential use” nature of the product. When a customer becomes seriously delinquent, their panels get disconnected and their costs for energy go up more than the cost of their monthly lease payment. This ensures that, unlike an unsecured loan or credit card, the customer is more likely to pay this obligation since it is actually saving them money. This does not mean that the industry can approve everyone; however, it does mean that, with the right decisioning logic and scorecards, they can go much deeper into the credit pool without taking on huge risks. Another challenge for the industry is the shear rate of growth. There are new players in the market every day and even established firms have a hard time keeping up with the growth. This leaves the individual organization and industry at risk for missing critical compliance steps in their operations. Given that these financial instruments are long term in nature and more consumers are adopting this as a means to get solar, it is only a matter of time before the regulators start to look into the practices and operating processes to ensure that all of the applicable regulations are being followed. The industry, as a whole, needs to ensure that they spend a little money now shoring up their compliance instead of paying a hefty fine later. Finally, what happens at the end of the lease? Many of the large players have taken a conservative approach as to how they price the residual amount at the end of term; however, no one really knows what these assets will be worth in 20 years. While many of the panel manufacturers warrant performance for 25, many panels have a shelf-life of 40 years, so how will consumers and the industry behave? What happens if there is a technological breakthrough in 10 years and those old panels are obsolete? At the moment, the industry’s answer to these questions is to set a very low residual which carries risk. Being too conservative here means that your customer’s payment is higher than it needs to be, pricing yourself out of certain markets where the cost of power is less than 20 cents / kwh. As the lease product continues to mature, more focus and emphasis on residual pricing will need to take place to find the right balance for the Consumer and the finance company. It should be said that while there are risks associated with this industry, all markets and new financing products carry risks. The goal of this particular blog is to highlight some of the larger risks that this industry faces. As these are identified, it is incumbent on the industry and partners of the industry to mitigate these risks so that consumers can continue to realize the power of solar. To close this series, I would be remiss if I didn’t offer up Experian’s Global Consultancy solutions to help address the challenges that the industry faces. Our knowledge of best practices in the financial services industry allows us to help those companies in the solar market grow originations responsibly, meet their regulatory requirements, and manage their long term risks with customers. While we cannot solve the funding issues, we can work with organizations and the tax equity community to educate them on the power of decisioning beyond a simple “one-size fits all” score. In addition, our products and data allow for flexibility and certainty, giving the industry an edge in acquiring new customers in a more efficient and less expensive manner. Finally, we can help provide advice and best practices in decisioning, risk management, and regulatory compliance so that the industry can continue to grow and thrive. All in all, we are advocates for the industry and can bring tremendous expertise and experience to help ensure continued success. Solar Financing – The current and future catalyst behind the booming residential solar market (Part II) Solar Financing — The current and future catalyst behind the booming residential solar market (Part I)