Credit Lending

Although the average mortgage rate was more than 4% at the end of the first quarter*, Q1 mortgage originations were nearly $450 billion — a 5% increase over the $427 billion a year earlier. As prime homebuying season kicks off, lenders can stay ahead of the competition by using advanced analytics to target the right customers and increase profitability. Revamp your mortgage and HELOC acquisitions strategies>

Experian and Creative Strategies share survey results about Apple’s AirPods, Google Home, Amazon Echo and Echo Dot for consumer behavior with voice devices.

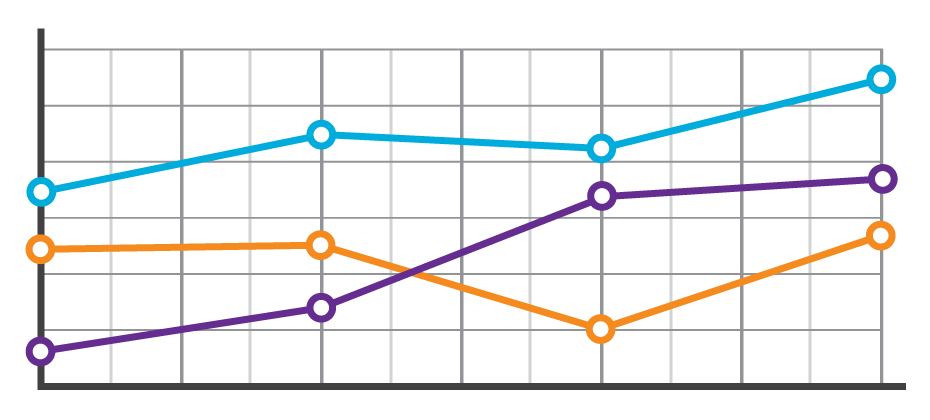

Sometimes life throws you a curve ball. The unexpected medical bill. The catastrophic car repair. The busted home appliance. It happens, and the killer is that consumers don’t always have the savings or resources to cover an additional cost. They must make a choice. Which bills do they pay? Which bills go to the pile? Suddenly, a consumer’s steady payment behavior changes, and in some cases they lose control of their ability to fulfill their obligations altogether. These shifts in payment patterns aren’t always reflected in consumer credit scores. At a single point in time, consumers may look identical. However, when analyzing their past payment behaviors, differences emerge. With these insights, lenders can now determine the appropriate risk or marketing decisions. In the example below, we see that based on the trade-level data, Consumer A and Consumer B have the same credit score and balance. But once we see their payment pattern within their trended data, we can clearly see Consumer A is paying well over the minimum payments due and has a demonstrated ability to pay. A closer look at Consumer B, on the other hand, reveals that the payment amount as compared to the minimum payment amount is decreasing over time. In fact, over the last three months only the minimum payment has been made. So while Consumer B may be well within the portfolio risk tolerance, they are trending down. This could indicate payment stress. With this knowledge, the lender could decide to hold off on offering Consumer B any new products until an improvement is seen in their payment pattern. Alternatively, Consumer A may be ripe for a new product offering. In another example, three consumers may appear identical when looking at their credit score and average monthly balance. But when you look at the trend of their historical bankcard balances as compared to their payments, you start to see very different behaviors. Consumer A is carrying their balances and only making the minimum payments. Consumer B is a hybrid of revolving and transacting, and Consumer C is paying off their balances each month. When we look at the total annual payments and their average percent of balance paid, we can see the biggest differences emerge. Having this deeper level of insight can assist lenders with determining which consumer is the best prospect for particular offerings. Consumer A would likely be most interested in a low- interest rate card, whereas Consumer C may be more interested in a rewards card. The combination of the credit score and trended data provides significant insight into predicting consumer credit behavior, ultimately leading to more profitable lending decisions across the customer lifecycle: Response – match the right offer with the right prospect to maximize response rates and improve campaign performance Risk – understand direction and velocity of payment performance to adequately manage risk exposure Retention – anticipate consumer preferences to build long-term loyalty All financial institutions can benefit from the value of trended data, whether you are a financial institution with significant analytical capabilities looking to develop custom models from the trended data or looking for proven pre-built solutions for immediate implementation.

Knowing where e-commerce fraud takes place matters We recently hosted a Webinar with Mike Gross, Risk Strategy Director at Experian and Julie Conroy, Research Director at Aite Research Group, looking at the current state of card-not-present fraud, and what to prepare for in the coming year. Our biannual analysis of fraud attacks, served as a backdrop for the trends we’ve been seeing. I wanted to share some observations from the Webinar. Of course, if you prefer to hear it firsthand, you can download the archive recording here. I’ll start with the current landscape of card-not-present fraud. Julie shared 5 key trends her firm has identified regarding e-commerce fraud: Rising account take-over fraud Loyalty points targeted Increasingly global transactions Frustrating false declines Increasingly mobile consumers One particularly interesting note that Julie made was regarding consumer frustration levels towards forgotten passwords. While consumers are more frustrated when they’re locked out of access to their banking accounts (makes sense, it’s their money), forgotten passwords are more detrimental to e-commerce retailers since consumers are likely to go to another site. This equates to a frustrated consumer, and lost revenue for the business. Next, Mike went through the findings from our 2016 e-commerce fraud attack analysis. Fraud attack rates show the attempted fraudulent e-commerce transactions against the population of overall e-commerce orders. Overall, e-commerce attack rates spiked 33% in 2016. The biggest trends we saw included: Increased EMV adoption is driving a shift from counterfeit to card-not-present fraud 2B breached records disclosed in 2016, more than 3x any previous year Consumers reporting credit card fraud jumped from 15% in 2015 to over 32% in 2016 Attackers shifting locations slightly and international orders rely on freight forwarders 10 states saw an increase of over 100% in fraudulent orders Over 70 of the top 100 riskiest postal codes were not in last year’s list So, what will 2017 bring? Be prepared for more attacks, more global rings, more losses for businesses, and the emergence of IoT fraud. Businesses need to anticipate an increase of fraud over time and to be prepared. The value of employing a multi-layered approach to fraud prevention especially when it comes to authenticating consumers to validate transactions cannot be understated. By looking at all the points of the customer journey, businesses can better protect themselves from fraud, while maintaining a good consumer experience. Most importantly, having the right fraud solution in place can help businesses prevent losses both in dollars and reputation.

The U.S. Senate declared April to be Financial Literacy Month back in 2004. Fast forward 13 years and one has to question if we’ve moved the needle on educating Americans about personal finance and money management. There is still no national standard or common curriculum to teach our kids the basics in schools, and only five states require high school students to take one semester of personal finance in order to graduate. I read an interesting stat years back that high school seniors spend more time shopping for their prom attire than they do researching financial education options for college. No wonder there is sticker shock post-graduation when those first student loan bills coming. The lack of investment shows. In a 2016 Mintel study, very few consumers gave themselves high grades for their knowledge of personal finance, and the situation was worse among women, with twice as many assigning themselves a “C” as an “A.” Having worked in the financial services industry for more than a decade, I can say with certainty I’m a bit of a personal finance geek. Learning about the latest products and economic shifts has been rolled into my job, and I’ve sadly seen the consequences of what happens to consumers when they make poor financial decisions. Slumping credit scores. Delinquent payments. Repossessed vehicles. Hard times. The good news? There are plenty of resources to help Americans learn. The challenge? Finding the right ways to capture mind share via the right mediums at the right time. There is obviously a benefit to the consumer to be more financially literate, but financial institutions benefit as well when consumers are money smart. Individuals who understand financial products and how they can use them to achieve their goals are more likely to purchase those products throughout their financial lives. So how can financial institutions help close the financial literacy gap? Make online education and resources readily available. Research shows more consumers would like to get information about finance through the use of online resources rather than seminars. This preference is likely due to the fact that online resources can be accessed on one’s own schedule and gives the user more control over the topics s/he wants to explore. Provide parents resources to launch smart money talks with their kids. Study after study reveals parents are one of the most powerful teachers in their kids’ lives – and this includes providing an education and modeling strong money management skills. Consider adding online education for kids – or partnering with a provider who has already built a money app for youngsters. Additionally, educate parents about when it might be time to help a child establish their first savings account. Advise them on ways to finance college. Talk about co-signing on vehicles. Explain the power of saving. Train up your next wave of customers and they will likely remain loyal to you. Offer one-on-one credit education sessions. A high-touch solution is sometimes the perfect opportunity to grow a customer in the right financial direction. Perhaps a low credit score prevents an individual from securing an ideal interest rate for an auto or home loan. Each person’s financial situation is different, and a one-on-one session with a trained agent can help them understand what is specifically contributing to their low score. With a few insights, a customer can determine if they need to pay down some debt, address a few late payments, or reduce their number of credit lines. Knowledge is power, and consumers will appreciate this service and personable touch. --- Lenders have a vested interest to close the financial literacy gap, and while they can’t solve for everything, they can certainly make a difference with some basic steps and investments. If nothing else, April seems like a perfect time to evaluate what you’re doing and what resolutions you can make for the year ahead. Just as every saved penny counts, so does every effort to educate Americans on manning their money more effectively.

Pay your bills on time, have cash set aside for emergencies, and invest your money for the future. These are the rules financial pros say people should follow if they want to build wealth. Straightforward advice, but for many people these milestones can seem out of reach. A recent financial literacy study by Mintel shows that many Americans are struggling with money management and lack confidence in their financial knowledge, with just 19 percent of respondents giving themselves an “A” grade on financial knowledge. The survey and other reports released recently shed light on how well Americans are handling their money. Here are some of the prevailing trends: Young people are struggling. The Mintel study revealed less than 30 percent of Americans have an emergency savings account that equals 3-6 months of household income. Of that total number, 19 percent of iGeneration has saved for a rainy day, followed by Millennials (20 percent), Gen Xers (28 percent), Baby Boomers (37 percent) and World War II/Swing Generation (40 percent). Not surprisingly, people who make more money save a bigger percentage of their pay. People in the bottom 90 percent of the income scale save close to none of their pay each year, while those in the top 10 percent save close to 15 percent. Most are not planning for the future. The majority of people are not doing everything they can to prepare for retirement, including meeting with a financial adviser to devise a plan, researching Social Security or even talking to friends or family about planning. Even more, 21 percent of Americans are “not at all confident” they will be able to reach their financial goals. Parents plan more than non-parents. People with children have many demands on their money, and as a result think ahead and follow budgets, contribute to retirement accounts and hire a financial adviser to help them create plans and budgets. Consumers who don’t have children don’t have as many competing demands, but aren’t as sensible about following a financial plan. In Mintel’s study, just 10 percent of non-parents have a written financial plan and 26 percent contribute regularly to a retirement account. Most people have a budget. Nearly one in three Americans prepare a detailed written or computerized household budget each month that tracks their income and expenses, but a large majority do not. Those with at least some college education, conservatives, Republicans, independents, and those making $75,000 a year or more are slightly more likely to prepare a detailed household budget than are their counterparts, according to Gallup. The good news is, the majority of Americans are open to more financial education. April—which is Financial Literacy Month—is a great time to look at education efforts for your customers. Financial literacy won’t change overnight, nor in a year. Yet initiatives taken in schools, workplaces, and in communities add up. What are you doing for your customers to build financial literacy?

Knowing a consumer’s credit information at a single point in time tells only part of the story. For the whole story, lenders need to assess a consumer’s credit behavior over time. Understanding how a consumer uses credit or pays back debt over several months can better position you to: Offer the right products and terms to increase response rates. Identify profitable customers. Avoid consumers with payment stress. Trended data adds needed color to the consumer’s credit story. And with the right analytics and systems, you can derive valuable insights on consumers. Trended data>

Newest technology doesn’t mean best when it comes to stopping fraud I recently attended the Merchant Risk Conference in Las Vegas, which brings together online merchants and industry vendors including payment service providers and fraud detection solution providers. The conference continues to grow year to year – similar to the fraud and risk challenges within the industry. In fact, we just released analysis, that we’ve seen fraud rates spike to 33% in the past year. This year, the exhibit hall was full of new names on the scene – evidence that there is a growing market for controlling risk and fraud in the e-commerce space. I heard from a few merchants at the conference that there were some “cool” new technologies out to help combat fraud. Things like machine learning, selfies and other two-factor authentication tools were all discussed as the latest in the fight against fraud. The problem is, many of these “cool” new technologies aren’t yet efficient enough at identifying and stopping fraud. Cool, yes. Effective, no. Sure, you can ask your customer to take a selfie and send it to you for facial recognition scanning. But, can you imagine your mother-in-law trying to manage this process? Machine Learning, while very promising, still has some room to grow in truly identifying fraud while minimizing the false positives. Many of these “anomaly detection” systems look for just that – anomalies. The problem is, we’re fighting motivated and creative fraudsters who are experts at avoiding detection and can beat anomaly detection. I do not doubt that you can stop fraud if you introduce some of these new technologies. The problem is, at what cost? The trick is stopping fraud with efficiency – to stop the fraud and not disrupt the customer experience. Companies, now more than ever, are competing based on customer experience. Adding any amount of friction to the buying process puts your revenue at risk. Consider these tips when evaluating and deploying fraud detection solutions for your online business. Evaluate solutions based on all metrics What is the fraud detection rate? What impact will it have on approvals? What is the false positive rate and impact on investigations? Does the attack rate decline after implementing the solution? Is the process detectable by fraudsters? What friction is introduced to the process? Use all available data at your disposal to make a decision Does the consumer exist? Can we validate the person’s identity? Is the web-session and user-entered data consistent with this consumer? Step up authentication but limit customer friction Is the technology appropriate for your audience (i.e. a selfie, text-messaging, document verification, etc...)? Are you using jargon in your process? In the end, any solution can stop 100% of the fraud – but at what cost. It’s a balance - a balance between detection and friction. Think about customer friction and the impact on customer satisfaction and revenue.

Has the EMV liability shift caused e-commerce fraud to increase 33% in 2016? According to Experian data, CNP fraud increased with Florida, Delaware, Oregon and New York ranked as the riskiest states. Miami accounted for the most fraudulent ZIP™ Codes in the US for shipping and billing fraud.

It was two years ago when I found myself sitting cross-legged on my home office floor, papers strewn about as I organized piles of tax returns, W-2s, pay stubs, 401k and bank statements, and previous escrow docs. My task? Sort through it all, scan them (if I couldn’t access them digitally) and then upload/email them to a site for my mortgage broker to print and package for my refinance application. For a girl accustomed to Amazon Prime, mobile banking, social media and smart TVs, this monumental financial task seemed utterly archaic – even in 2015. Fast forward two years later, and the mortgage space has failed to make much progress. Clearly, the financial meltdown and Great Recession placed more regulation and compliance stresses on financial institutions. Verification steps and requirements needed to be strengthened – and that made sense. We want to make sure people are capable of paying for those sizable mortgage payments, right? Even now, I get flashbacks to scenes from The Big Short. Still, the hunt for paper, the endless scanning, the emailing, the document uploads required? In an era where the smartphone rules, how has the mortgage industry failed to evolve in the digital age? It’s no secret the financial services industry is typically slow to adopt the latest in technology advancements, but consumers are pushing. A 2016 Accenture survey reveals online banking is now the top choice of consumers at 28%, followed by branch banking at 24%. In the mobile banking space, there has additionally been a significant increase. From 2011 to 2015, mobile banking doubled (22% to 43%) and rose from 43% to 53% for smartphone users in particular. But what about mortgage? Finally, it seems, shifts are underway. In a recent Oliver Wyman paper titled Digital Mortgage Nirvana, the authors state, “Gone are the days when the only way to properly underwrite a mortgage was with long application forms and tall stacks of documents.” Once easy to carry in one hand, the average mortgage application file has ballooned to 500 pages, according to David Stevens, CEO of the Mortgage Bankers Association. And while the application may not shrink, portions of the application process can be digitized and automated. Today, lenders have the ability to partner with data aggregators to verify a consumer’s assets and income with online solutions. In fact, lenders can take this a step further, feeding the data into their automated decision engines, providing the consumer with an approval, decline or conditions that must be met in order to clear the loan process. Nonbanks have been picking off business and disrupting the onerous mortgage process for the past several years. Think Quicken, LoanDepot and GuaranteedRate. But all mortgage lenders have the ability to speed up consumer verification and decisioning by partnering with data aggregators and leveraging solutions like Experian’s digital verification suite. Are we talking a one-click shopping experience? No. This is a mortgage after all, not your average online purchase. But banks now have the opportunity to dramatically enhance the mortgage experience for consumers. The question is whether they are ready to finally embrace a digital journey in the mortgage space in 2017, or will they let another year pass them by?

Experian recently acquired a minority stake in Finicity, a leading financial data aggregator enabling innovation in the FinTech industry through its modern RESTful API and Finicity Aggregation Platform. Steve Smith—chairman, CEO and co-founder of Finicity—has a passion and experience in developing innovative and disruptive technology, products and services that leads to efficiency for markets and, ultimately, improvements for consumers. Here he shares his thoughts about disruptive technology in the lending space and its benefits to lenders and consumers. Q: Finicity has said its objective is to take a loan application approval from weeks to minutes using its technology. That sounds pretty great, but how is that possible? How does this play out behind the scenes? A: Well, we’re living in a world where we, as consumers, expect very user-friendly experiences and we expect things to happen at digital speeds. The loan process is no exception. To deliver the experience consumers are expecting requires us to leverage the technology trends of digitization, mobility and big data. Finicity plays a foundational role by leveraging thousands of digital connections across financial institutions to aggregate consumer-permissioned account data. Once we have this data, we’re able to deliver real-time insights into an individual's financial health. This financial health assessment includes income and assets, two critical components to the loan approval process. All that’s required is the borrower to permission use of the data. Once that’s done, we’re able to gather all appropriate data across multiple accounts, rapidly analyze it and send a verification report to the lender. No papers. No multiple requests. No questions on the validity of the data. All done in minutes, not weeks. Q: This is very disruptive technology. What are the benefits for lenders? Consumers? A: Well, as we discussed, one of the major benefits is the speed to a loan. Furthermore, this reduces cost for the lender by maximizing loan officer’s time, while also freeing up loan capital as they can move through loans more quickly with a higher quality assessment. Another benefit for lenders is reduced fraud. Our information on income and assets is coming from real-time bank validated information. This eliminates the possibility of altered data. For consumers, it’s a dramatically simplified process. No need to chase down multiple documents. There are virtually no second requests for information, which we often see in the process. And they’re always in control of their information. All in all, it’s a dramatically better experience for both the lender and the borrower. Q: What sets this solution apart from others in the market? A: A few things set Finicity apart in delivering the quality of insights required. First, we are an industry leader in the number of financial institutions we connect with, ensuring broader access for more customers. Second, 95 percent of our integrations provide access to formatted data, something that’s critical to credit decisioning solutions. In these cases, we’re not screen scraping. This enhances our ability to collect bank validated transactions; we provide the financial institution transaction ID. This provides assurance of data quality. Finally, is our ability to categorize and analyze the transactions. This allows us to identify income streams and assets. Through this process, we’re also able to flag unusual transactions, like large deposits, that may skew actual assets. Q: The future of financial technology is still evolving. What lies ahead? A: We’re very excited about the future of financial technology and the impact that aggregation will have. Whether it’s financial management, digital payments or credit decisioning, real-time data will improve the experiences and the outcomes. As we’re talking about lending, this is one of the spaces that could see significant disruption. Our ability to generate a richer view of an individual’s or organization’s financial health will more accurately determine their ability to repay a loan. This will be a great benefit for those that have thin file or no credit history. We see a world where suitability for a loan will be driven by their actual financial life independent of their use of credit. One of the largest markets in the US is millennials. However, for consumers under 30, two-thirds have subprime or non-prime credit scores and one-third of millennials don't have any credit history. This is just one group underserved because legacy models don’t leverage the full extent of data available. Q: Is there anything else you can tell us about Finicity and its role changing customer experiences across financial service? A: For us, it all comes down to one thing: enabling individuals and organizations to have the information and insights they need to make smarter financial decisions. The data is there. We’re helping to unlock the potential of that data by working with innovative partners like Experian. To learn more about Experian and Finicity's account aggregation solutions, visit www.experian.com/finicity

Knowing a consumer’s credit information at a single point in time only tells part of the story. I often hear one of our Experian leaders share the example of two horses, running neck-in-neck, at the races. Who will win? Well, if you had multiple insights into those two horses – and could see the race in segments – you might notice one horse losing steam, and the other making great strides. In the world of credit consumers, the same metaphor can ring true. You might have two consumers with identical credit scores, but Consumer A has been making minimum payments for months and showing some payment stress, while Consumer B has been aggressively making larger pay-offs. Trended data adds that color to the story, and suddenly there is more intel on who to market to for future offers. To understand the whole story, lenders need the ability to assess a consumer’s credit behavior over time. Understanding how a consumer uses credit or pays back debt over time can help lenders: Offer the right products & terms to increase response rates Determine up sell and cross sell opportunities Prevent attrition Identify profitable customers Avoid consumers with payment stress Limit loss exposure The challenge with trended data, however, is finding a way to sort through the payment patterns in the midst of huge datasets. At the singular level, one consumer might have 10 trades. Trended data in turn reveals five historical payment fields and then you multiple all of this by 24 months and you suddenly have 1,200 data points. But let’s be real … a lender is not going to look at just one consumer as they consider their marketing or retention campaigns. They may look at 100,000 consumers. And on that scale you are now looking at sorting through 120M data points. So while a lender may think they need trended data – and there is definitely value in accessing it – they likely also need a solution to help them wade through it all, assessing and decisioning on those 120M data points. Tapping into something like Credit3D, which bundles in propensity scores, profitability models and trended attributes, is the solution that truly unveils the value of trended data insights. By layering in these solutions, lenders can clearly answer questions like: Who is likely to respond to an offer? How does a consumer use credit? How can I identify revolvers, transactors and consolidators? Is there a better way to understand risk or to conduct swap set analysis? How can I acquire profitable consumers? How do I increase wallet share and usage? Trended data sounds like a “no-brainer” and it definitely has the ability to shed light on that consumer credit horse race. Lenders, however, also need to have the appropriate analytics and systems to assess on the huge volume of data points. Need more information on Trended Data and Credit 3D? Contact Us

Direct mail is not dead, but it's 2017. Financial services companies need to acknowledge there might be other ways to deliver credit offers and capture consumer eyeballs. There are multiple screens competing for our attention, including one of the originals - TV. Advertising and TV have been married forever, but addressable TV allows marketers to target on a much more sophisticated level. Welcome to credit marketing in the digital age. To help financial services companies understand the addressable TV channel, Experian marketing expert Brienna Pinnow answered the following questions in a short interview. What is addressable TV? Addressable TV is an amazing 1-to-1 direct marketing capability. To put it simply, addressable TV is the ability for an advertiser to deliver a TV ad to a specific household. From a consumer perspective, that means even if you and your next door neighbor are watching the latest episode of The Voice, you may see an ad for a mini-van while your neighbor sees an ad for upcoming one-day sale from their favorite retailer. With addressable TV, brands can define their target audience based on 1st, 2nd or 3rd party data (like Experian’s). With the help of satellite and cable companies, they can deliver a personalized, measurable experience. This is an exciting departure from the way that TV advertising has been planned and targeted for nearly 70 years. Instead of focusing on the program, marketers can now focus on the person. Addressable TV makes reaching a precise audience – the same way you would with a direct mail piece or an email – a marketing reality. How long have marketers been leveraging addressable TV? Experian has been an pivotal player in the development of the addressable TV space. Since the first addressable TV trials back in 2004, nearly 13 years ago, Experian has provided the audience targeting data and privacy-compliant matching capabilities that make addressable TV possible. The past 3 years, however, have demonstrated unprecedented, hockey-stick growth in addressable TV. In 2016 alone, the volume of addressable campaigns doubled from the previous year accounting for nearly $300 million spend. That trajectory remains the same in 2017 and beyond. So why are we seeing this growth now? Here are a few reasons addressable TV is continuing to grow… Scale: Millions of households can now be targeted using addressable technology, and the footprint continues to grow with smart TVs and additional cable operators. Data: As organizations put data at the heart of their business, addressable TV enables them to infuse their most important customer information into the targeting. Education: Agencies, data providers, and TV providers have invested time educating brands on the process and power of addressable TV. And now, advertisers are becoming more experienced at making this a consistent part of their marketing plan. Accountability: You’ll be hard pressed to find a marketer that doesn’t have to demonstrate ROI on their marketing campaigns. The measurement capabilities that addressable TV provides adds a layer of accountability and insight that was not previously possible. Technology: Experian has developed an audience management platform, the Audience Engine, which makes addressable TV possible in a matter of clicks. In the past year alone, our platform has distributed over 1,800 audiences for addressable advertising campaigns. What types of companies have been utilizing addressable TV? Have you seen many financial services companies test this channel? The early adopters of addressable TV were primarily automotive advertisers. Compared to other verticals, auto advertisers still spend the largest proportion of their budgets across TV. For that reason, they know it’s a necessity to see if their dollars are actually driving sales for their big-ticket items. Addressable TV solves that problem for auto advertisers. In a DIRECTV campaign leveraging Experian’s automotive data for audience targeting and post-campaign sales reporting, one major auto OEM saw a 26.2% lift in sales for the advertised model compared to the control group. In the past few years, Experian has worked closely with advertisers across verticals – from retail to travel to finance – to launch addressable campaigns. Financial services clients particularly find Experian’s financial related segments, such as income or net worth, to be accurate and powerful in creating qualified target audiences that improve campaign performance. I’ve read that millennials are abandoning cable and TV providers in favor of services like Hulu and Netflix. Does this mean the market for addressable TV will shrink in the coming years? There is a segment of consumers who are abandoning traditional cable services. However, this doesn’t mean they are abandoning content. In fact, content consumption is at an all-time high with offerings from Roku, Hulu, Netflix, Sling TV, CBS, and beyond. All this shift in behavior means is that the definition of TV is becoming more fluid. “TV” doesn’t have to be a big screen sitting in your living room; it can be a laptop on a red-eye flight. And from a marketing perspective, the concept of addressable, 1-to-1 targeting is already moving into some of these products and services. The footprint of addressable TV will only continue to rise as consumers stay connected to the content they love. How can companies measure the success of utilizing addressable TV as a channel? Not only does addressable TV provide laser-targeted ad delivery, but it also opens up measurement capabilities that were never possible for TV advertisers in the past. Traditionally, TV audience measurement has focused simply on eyeballs and not revenue impact, with little insight into how TV advertising converts into sales. The primary source for audience measurement in the TV world has been program ratings and expensive brand studies. With addressable TV, that story is changing. With companies that collect second-by-second viewership data linked to households, marketers now have the ability to tie this data back to their online and offline sales. Experian is pivotal in making closed-loop TV reporting possible. As a data and matching safe-haven, we link together the viewing information from the target audience with the sales data provided by the advertiser. The end result is a privacy compliant report that clearly demonstrates the impact of the campaign on the target audience. Did the targeted audience visit a bank location? Email customer service? Sign up for a new account? Spend a certain amount? These are all questions our TV attribution reporting answers for clients. If a company wants to begin marketing in addressable TV, what is required in terms of set-up? Addressable TV may sound new, exciting or even complex. But it doesn’t have to be. Getting started is as simple as defining the target audience. Decide whether you would like to leverage your own CRM data, a custom model, third-party data or a combination of these data sources. If you’re still not sure where to start, ask yourself a very simple question, “Who am I sending a direct mail piece or email to in the next month?” There’s your audience. Better yet, you will be amplifying your message, reaching the customer with a consistent message and meeting them wherever they are. After you’ve determined who you want to target, a matching partner like Experian can work with you to show you the reach of your audience across TV providers. You’ll finalize your budget, creative and media plan while Experian distributes your audience to the selected media destinations. Before you know it, your campaign will be live, and reaching your target audience whether they’re watching Shark Tank or Sharknado. When the campaign wraps, you’ll be on your way to measuring results like never before. Are there any additional trends you see emerging in the addressable TV space? The future of addressable TV is related to both the targeting and measurement capabilities. More advertisers are working with Experian, for example, to launch coordinated campaigns. That doesn’t just mean launching a digital campaign and TV campaign at the same time. It really means targeting the same exact people for the digital and TV campaign. We like to consider this a "surround sound" approach where the customer or prospect experiences a consistent message across channels. As for measurement, Experian is working closely with advertisers to explore the power of mobile data. Recently, Experian partnered with Ninth Decimal and DIRECTV to incorporate mobile location data into the post-campaign measurement process for Toyota. The results proved a 19% lift in dealership visits for those exposed to the campaign. This is an exciting development because this approach can translate well for any other advertiser who wants to measure metrics like location visitation. If you’d like to learn more, check out our Addressable TV whitepaper.

As lenders seek to enhance their credit marketing strategies this year, they are increasingly questioning how to split their budgets between digital, direct mail and beyond. What is the ideal media mix to reach consumers in 2017? And is the solution different in the financial services space? Scott Gordon, Experian's senior director of digital credit marketing, recently tackled some of the tough questions financial services marketers are posing. Here are his responses: Q: We live in a world where consumers are receiving hundreds of messages and offers on a daily basis. How can financial services companies stand out and capture the attention of the customers they wish to engage with relevant offers? A: When it comes to the optimal marketing media mix, there is no “silver bullet.” It varies from product to product. The current post-campaign analysis is showing us that consumers react positively to coordinated multi-channel messaging. We’ve seen studies showing that marketers can see up to a 30% lift in sales by combining email with social media, for example. This makes sense, when you look at how consumers engage through devices. We are no longer a single channel culture; we check Facebook while watching TV, listen to podcasts while checking our email, etc. Consequently, marketers have had to adapt their campaign strategies accordingly – and this starts with the organizational structure. Far too often we see silo’ed groups responsible for disparate media verticals. For example, a company may have a direct mail group and a digital marketing team, and then (in extreme cases) outsource television to one agency group and social media to another. Aligning these groups and breaking down the barriers between the groups is a critical first step toward building a true multi-channel campaign strategy. This includes addressing budget concerns that are inherent with a culture where the size of a budget is tied to job security and corporate status. Aligning campaigns and finding the perfect cross channel market mix is much easier once you’ve broken down internal barriers and encouraged marketing collaboration. Q: What are some of the new best practices financial companies must embrace in 2017 in order to improve their marketing efforts? A: Thanks to tremendous efforts from industry leaders, we can now utilize regulated data with the same proficiency that they’ve been executing campaigns using non-regulated data. This presents unique challenges, as the industry races to get up-to-speed on new capabilities, take best-in-breed practices and apply them to the world of regulated campaigns. We’re seeing tremendous demand to combine programmatic advertising with people-based advertising, with cross-channel campaigns spanning mobile, video, social, and addressable TV. Measurement and analytics must play a large part in these strategies. While the industry hasn’t achieved true cross-channel measurement to identify a consumer’s path to purchase across multiple devices, it’s getting closer, thanks to technology advances. Q: Is direct mail dead? How should financial marketers be using direct mail in 2017? How can it best be combined with digital? A: Direct mail is certainly not dead. It has its place among a media mix that continues to grow as new advertising technologies come to market and are adopted by consumers. Will direct mail’s influence diminish in the future? Possibly. At Experian, we are focused on making sure that our advertisers can reach consumers where they spend time, when they are most receptive to receiving messages, and most importantly in a cost-effective manner. So no matter where consumers shift their focus in the future, we’ll be able to support comprehensive targeted advertising campaigns. How can digital be best combined with direct mail? We’ve seen encouraging results in retargeting direct mail with digital credit marketing like email and display. With that said, we haven’t seen a silver bullet solution, and we’re still advising our clients to put a heavy focus toward “test and learn” in concert with comprehensive campaign measurement and analytics protocols. Q: What are the advantages to serving up a firm offer of credit to a consumer in a digital format? Are consumers ready to embrace this type of delivery in the financial services space? A: The advantages of serving up a firm offer of credit to a consumer in a digital format are similar to those benefits for “traditional” digital marketing. Lower cost, more measurement capabilities, and greater flexibility to optimize campaigns are just some of the benefits. Early indications show that consumers are very receptive to digital credit marketing offers. It provides them with offers in the channels in which they spend time, in a consumer friendly manner which offers them numerous paths in which they can have a voice in the messages that they receive. Q: Some say digital credit marketing should largely be directed to Millennials? Do you think other generations are ready to embrace this type of digital messaging? A: We don’t view digital credit marketing as an exclusive offering just for Millennials. It is a holistic consumer offering – applicable to all generations as our parents and grandparents make the move to new channels such as addressable TV and social media. Need more info on Digital Credit Marketing? Learn More

Prescreen, prequalification and preapproval. The terms sound similar, but lenders beware. These credit solutions are quite different and regulations vary depending on which product is utilized. Let’s break it down … What’s involved with a prescreen? Prescreen is a behind-the-scenes process that screens consumers for a firm offer of credit without their knowledge. Typically, a Credit Reporting Agency, like Experian, will compile a list of consumers who meet specific credit criteria, and then provide the list to a lending institution. Consumers then see messaging like, “You have been approved for a new credit card.” Sometimes, marketing offers use the phrase “You have been preapproved,” but, by definition, these are prescreened offers and have specific notice and screening requirements. This solution is often used to help credit grantors reduce the overall cost of direct mail solicitations by eliminating unqualified prospects, reducing high-risk accounts and targeting the best prospects more effectively before mailing. A firm offer of credit and inquiry posting is required. And, it’s important to note that prescreened offers are governed by the Fair Credit Reporting Act (FCRA). Specifically, the FCRA requires lenders initiating a prescreen to: Provide special notices to consumers offered credit based on the prescreened list; Extend firm offers of credit to consumers who passed the prescreening, but allows lenders to limit the offers to those who passed the prescreening; Maintain records regarding the prescreened lists; and Allow for consumers to opt-out of prescreened offers. Lenders and the Consumer Reporting Agencies must scrub the list against the opt-outs. Finally, it is important to note that a soft inquiry is always logged to the consumer’s credit file during the prescreen process. What’s involved with a prequalification? Prequalification, on the other hand, is a consumer consent-based credit screening tool where the consumer opts-in to see which credit products they may be qualified for in real time at the point of contact. Unlike a prescreen which is initiated by the lender, the prequalification is initiated by the consumer. In this instance, envision a consumer visiting a bank and inquiring about whether or not they would qualify for a credit card. During a prequalification, the lender can actually explore if the consumer would be eligible for multiple credit products – perhaps a personal loan or HELOC as well. The consumer can then decide if they would like to proceed with the offer(s). A soft inquiry is always logged to the consumer’s credit file, and the consumer can be presented with multiple credit options for qualification. No firm offer of credit is required, but adverse action may be required, and it is up to the client’s legal counsel to determine the manner, content, and timing of adverse action. When the consumer is ready to apply, a hard inquiry must be logged to the consumer’s file for the underwriting process. How will a prequalification or prescreen invitation/offer impact a consumer’s credit report? Inquiries generated by prequalification offers will appear on a consumer’s credit report as a soft inquiry. For “soft” inquiries, in both prescreen and prequalification instances, there is no impact to the consumer’s credit score. However, once the consumer elects to proceed with officially applying for and/or accepting a new line of credit, the hard inquiry will be noted in the consumer’s report, and the credit score may be impacted. Typically, a hard inquiry subtracts a few points from a consumer’s credit score, but only for a year, depending on the scoring model. --- Each of these product solutions have their place among lenders. Just be careful about using the terms interchangeably and ensure you understand the regulatory compliance mandates attached to each. More info on Prequalification More Info on Prescreen