Debt & Collections

New challenges created by the COVID-19 pandemic have made it imperative for utility providers to adapt strategies and processes that preserve positive customer relationships. At the same time, they must ensure proper individualized customer treatment by using industry-specific risk scores and modeled income options at the time of onboarding As part of our ongoing Q&A perspective series, Shawn Rife, Experian’s Director of Risk Scoring, sat down with us to discuss consumer trends and their potential impact on the onboarding process. Q: Several utility providers use credit scoring to identify which customers are required to pay a deposit. How does the credit scoring process work and do traditional credit scores differ from industry-specific scores? The goal for utility providers is to onboard as many consumers as possible without having to obtain security deposits. The use of traditional credit scoring can be key to maximizing consumer opportunities. To that end, credit can be used even for consumers with little or no past-payment history in order to prove their financial ability to take on utility payments. Q: How can the utilities industry use consumer income information to help identify consumers who are eligible for income assistance programs? Typically, income information is used to promote inclusion and maximize onboarding, rather than to decline/exclude consumers. A key use of income data within the utility space is to identify the eligibility for need-based financial aid programs and provide relief to the consumers who need it most. Q: Many utility providers stop the onboarding process and apply a larger deposit when they do not get a “hit” on a certain customer. Is there additional data available to score these “no hit” customers and turn a deposit into an approval? Yes, various additional data sources that can be leveraged to drive first or second chances that would otherwise be unattainable. These sources include, but are not limited to, alternative payment data, full-file public record information and other forms of consumer-permissioned payment data. Q: Have you noticed any employment trends due to the COVID-19 pandemic? How can those be applied at the time of onboarding? According to Experian’s latest State of the Economy Report, the U.S. labor market continues to have a slow recovery amidst the current COVID-19 crisis, with the unemployment rate at 7.9% in September. While the ongoing effects on unemployment are still unknown, there’s a good chance that several job/employment categories will be disproportionately affected long-term, which could have ramifications on employment rates and earnings. To that end, Experian has developed exclusive capabilities to help utility providers identify impacted consumers and target programs aimed at providing financial assistance. Ultimately, the usage of income and employment/unemployment data should increase in the future as it can be highly predictive of a consumer’s ability to pay For more insight on how to enhance your collection processes and capabilities, watch our Experian Symposium Series event on-demand. Watch now Learn more About our Experts: Shawn Rife, Director of Risk Scoring, Experian Consumer Information Services, North America Shawn manages Experian’s credit risk scoring models while empowering clients to maximize the scope and influence of their lending universe. He leads the implementation of alternative credit data within the lending environment, as well as key product implementation initiatives.

Consumer behavior and payment trends are constantly evolving, particularly in a rapidly changing economic environment. Faced with changing demands, including an accelerated shift to digital communications, and new regulatory rules, debt collectors must adapt to advance in the new collections landscape. According to Experian research, as of August, the U.S. unemployment rate was at 8.4%, with numerous states still having employment declines over 10%. These triggers, along with other recent statistics, signal a greater likelihood of consumers falling delinquent on loans and credit card payments. The issue for debt collectors? Many debt collection departments and agencies are not equipped to properly handle the uptick in collection volumes. By refining your process and capabilities to meet today’s demands, you can increase the success rate of your debt collection efforts. Join Denise McKendall, Experian’s Director of Collection Solutions, and Craig Wilson, Senior Director of Decision Analytics, during our live webinar, "Adapting to the New Collections Landscape," on October 21 at 10:00 a.m. PT. Our expert speakers will provide a view of the current collections environment and share insights on how to best adapt. The agenda includes: Meeting today’s collections challenges A Look at the state of the market Devising strategies and solving collections problems across the debt lifecycle Register now

Achieving collection results within the subprime population was challenging enough before the current COVID-19 pandemic and will likely become more difficult now that the protections of the Coronavirus Aid, Relief, and Economic Security (CARES) Act have expired. To improve results within the subprime space, lenders need to have a well-established pre-delinquent contact optimization approach. While debt collection often elicits mixed feelings in consumers, it’s important to remember that lenders share the same goal of settling owed debts as quickly as possible, or better yet, avoiding collections altogether. The subprime lending population requires a distinct and nuanced approach. Often, this group includes consumers that are either new to credit as well as consumers that have fallen delinquent in the past suggesting more credit education, communication and support would be beneficial. Communication with subprime consumers should take place before their account is in arrears and be viewed as a “friendly reminder” rather than collection communication. This approach has several benefits, including: The communication is perceived as non-threatening, as it’s a simple notice of an upcoming payment. Subprime consumers often appreciate the reminder, as they have likely had difficulty qualifying for financing in the past and want to improve their credit score. It allows for confirmation of a consumer’s contact information (mainly their mobile number), so lenders can collect faster while reducing expenses and mitigating risk. When executed correctly, it would facilitate the resolution of any issues associated with the delivery of product or billing by offering a communication touchpoint. Additionally, touchpoints offer an opportunity to educate consumers on the importance of maintaining their credit. Customer segmentation is critical, as the way lenders approach the subprime population may not be perceived as positively with other borrowers. To enhance targeting efforts, lenders should leverage both internal and external attributes. Internal payment patterns can provide a more comprehensive view of how a customer manages their account. External bureau scores, like the VantageScore® credit score, and attribute sets that provide valuable insights into credit usage patterns, can significantly improve targeting. Additionally, the execution of the strategy in a test vs. control design, with progression to successive champion vs. challenger designs is critical to success and improved performance. Execution of the strategy should also be tested using various communication channels, including digital. From an efficiency standpoint, text and phone calls leveraging pre-recorded messages work well. If a consumer wishes to participate in settling their debt, they should be presented with self-service options. Another alternative is to leverage live operators, who can help with an uptick in collection activity. Testing different tranches of accounts based on segmentation criteria with the type of channel leveraged can significantly improve results, lower costs and increase customer retention. Learn About Trended Attributes Learn About Premier Attributes

New challenges created by the COVID-19 pandemic have made it imperative for utility providers to adapt strategies and processes that preserve positive customer relationships while continuing to collect delinquent balances during an unpredictable and unprecedented time. As part of our ongoing Q&A perspective series, Beth Bayer, Experian’s Vice President of Energy Sales, and Danielle Grigaliunas, Product Manager of Collection Solutions, discuss the changing collections landscape and how the utility industry can best adapt. Check out what they had to say: Q: How are the COVID-19 crisis and today’s economic environment impacting consumer behavior? Particularly as it relates to delinquencies and payments? BB: Typically, when we experience recessions, delinquency goes up. In this recession, delinquency is declining. Stimulus money and increased unemployment benefits, coupled with stay at home orders, appear to be leading to more dollars available for consumers to repay obligations and debts. Another factor is related to special accommodations, forbearances, and payment holidays or extensions, that provide consumers with flexible options in making their regularly scheduled payments. Once an accommodation is granted, the lender or bank puts a code on the account when it’s reported to the bureaus and the account does not continue to age. Q: As a result of the pandemic, many regulatory bodies are recommending or imposing changes to involuntary disconnect policies. How can utility providers effectively collect, even if they can’t disconnect? BB: The public utility commissions in many areas have suspended disconnects due to non-payment, further increasing balances, delinquency and delaying final bill generation. Without the fear of being disconnected for non-payment in some regions of the country, customers are not paying delinquent utility bills. Utility providers should continue to provide payment reminders and delinquency notices and offer payment plans in exchange for partial payments to continue to engage customers. Identifying which customers can pay and are actively paying other creditors and institutions helps prioritize proactive outreach. Q: For utility providers who offer in-house collection services, what strategies and credit data do you find most valuable? DG: Current and accurate data is key when looking to provide stronger and more strategic collections. This data is built into efficient scoring models to articulate which debts are most collectible and how much money will be recovered from each consumer. Without the overlay of credit data, it’s harder for utility providers to predict how consumers prioritize utility debt during times of economic stress. By better understanding the current state of the consumer, utility providers can focus on consumers who are most likely to pay. Investing in monitoring solutions allows utility providers to receive notifications when their consumers are beginning to cure and pay off other obligations and take a more proactive approach. Q: What are the best methods for utility providers to reach collection consumers? What do they need to know as they begin to utilize omnichannel communications? DG: Regular data hygiene checks and skipping are the first line of defense in collections. Confirming contact information is correct and up to date throughout the entire consumer lifecycle helps to establish a strong relationship. Those who are successful in collections invest in omnichannel messaging and self-service payment options, so consumers have a choice on how they’d like to settle their obligations. Q: What current collection trends/challenges are we seeing within the utility space? BB: Utility providers do not traditionally report active customer payments and delinquencies to the credit bureaus. Anecdotally, our utility partners tell us that delinquencies are up and balances are growing. Many customers know that they cannot currently be disconnected if they fall behind on their utility payments and are using this opportunity to prioritize other debts. We also know that some utilities have reduced collection activities during the pandemic due to office closures and have cut back on communication efforts. Additionally, we’re hearing from some of our utility partners that collections and recoveries of final billed or charged-off accounts are increasing, despite many agencies closing and limited to no collection activities occurring. We assume this is because these balances are typically reported to the credit reporting agencies, triggering a payment and interest in clearing that balance first. Constant communication, flexibility, and empathizing with your customers by offering payment plans and accommodations will lead to an increase in dollars collected. DG: There’s been a large misunderstanding that because utility providers can’t disconnect, they can’t attempt to collect. The success of collections has been seen within first parties, as they are still maintaining strong relationships by reaching out at optical times and remaining top-of-mind with consumers. The utility industry needs to take a proactive approach to ensure they are focusing on the right consumers through the right channels at the right time. Credit data that matches the consumer’s credit health (i.e. credit usage and payments) is needed insight when trying to understand a consumer’s overall financial standing. For more insight on how to enhance your collection processes and capabilities, watch our Experian Symposium Series event on-demand. Watch now About our Experts: Beth Bayer, Vice President of Sales, Experian Energy, North America Beth leads the Energy Vertical at Experian, supporting regulated, deregulated and alternative energy companies throughout the United States. She strives to bring innovative solutions to her clients by leveraging technology, data and advanced analytics across the customer lifecycle, from credit risk and identity verification through collections. Danielle Grigaliunas, Product Manager of Collections Solutions, Experian Consumer Information Services, North America Danielle has dedicated her career to the collections space and has spent the last five years with Experian, enhancing and developing collections solutions for various industries and debt stages. Danielle’s focus is ensuring that clients have efficient, compliant and innovative collection and contact strategies.

Do consumers pay certain types of credit accounts before others during financial distress? For instance, do they prioritize paying mortgage bills over credit card bills or personal loans? During the Great Recession, the traditional notion of payment priority among multiple credit accounts was upended, throwing strategies employed by financial institutions into disarray. Similarly, current circumstances in the context of COVID-19 might cause sudden shifts in prioritization of payments which might have a dramatic impact on your credit portfolio. Financial institutions would be better able to forecast and control exposure to credit risk, and to optimize servicing practices such as forbearance and collections treatments if they could understand changing customer payment behaviors and priorities of their existing customers across all open trades. Unfortunately, financial institutions’ data—including their own behavioral data and refreshed credit bureau data--are limited to information about their own portfolio. Experian data provides insight which complements the financial institutions’ data expanding understanding of consumer payment behavior and priorities spanning all trades. Experian recently completed a study aimed at providing financial institutions valuable insights about their customer portfolios prior to COVID-19 and during the initial months of COVID-19. Using the Experian Ascend Technology Platform™, our data scientists evaluated a random 10% sample of U.S. consumers from its national credit file. Data from multiple vintages were pulled (June 2006, June 2008 and February 2018) and the payment trends were studied over the subsequent performance period. Experian tabulated the counts of consumers who had various combinations of open and active trade types and selected several trade type combinations with volume to differentiate performance by trade type. The selected combinations collectively span a variety of scenarios involving six trade types (Auto Loans, Bankcard, Student Loan, Unsecured Personal Loans, Retail Cards and First Mortgages). The trade combinations selected accommodate a variety of lenders offering different products. For each of the consumer groups identified, Experian calculated default rates associated with each trade type across several performance periods. For brevity, this blog will focus on customers identified as of February 2018 and their subsequent performance through February 2020. As the recession evolves and when the economy eventually recovers, we will continue to monitor the impacts of COVID-19 on consumer payment behavior and priorities and share updates to this analysis. Consumers with Bankcard, Mortgage, Auto and Retail accounts Among consumers having open and recently active Bankcard, Mortgage, Auto and Retail accounts, bankcard delinquency was highest throughout the 24-month performance window, followed by Retail. Delinquency rates for Auto and Mortgage were the lowest. During the pre-COVID-19 period, consumers paid their secured loans before their unsecured loans. As demonstrated in the table below, customer payment priority was stable across the entire 24-month period, with no significant shift in payment priorities between trade types. Consumers with Unsecured Personal Loan, Retail Card and Bankcard accounts. Among consumers having open and recently active Unsecured Personal Loan, Retail Card and Bankcard accounts, consumers are likely to pay unsecured personal loans first when in financial distress. Retail is the second priority, followed by Bankcard. KEY FINDINGS From February 2018 through April 2020, relative payment priority by trade type has been stable Auto and Mortgage trades, when present, show very high payment priority Download the full Payment Hierarchy Report here. Download Now Learn more about how Experian can create a custom payment hierarchy for the customers in your own portfolio, contact your Experian Account Executive, or visit our website.

With many individuals finding themselves in increasingly vulnerable positions due to COVID-19, lenders must refine their policies based on their consumers’ current financial situations. Alternative Financial Services (AFS) data helps you gain a more comprehensive view of today's consumer. The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture? See if you qualify for a complimentary hit rate analysis Download AFS Trends Report

The COVID-19 pandemic has created unprecedented challenges for the utilities industry. This includes the need to plan for – and be prepared to respond to – changing behaviors and a sudden uptick in collections activities. As part of our recently launched Q&A perspective series, Mark Soffietti, Experian’s Senior Manager of Analytics Consulting and Tom Hanson, Senior Energy Consultant, provided insight on how utility providers can evolve and refine their collections and recovery processes. Check out what they had to say: Q: How has COVID-19 impacted payment behavior and debt collections? TH: Consumer payment behavior is changing. For example, those who paid as agreed, may not currently have the means to pay and are now distressed borrowers. Or those who were sloppy payers before the pandemic may now be defaulting on a more consistent basis. MS: As we saw with the last recession when faced with economic stress, consumer and commercial payment behavior changes based on their needs and current cash flow. For example, people prioritize their car, as they need it to get to and from work, so they’ll likely pay their auto bills on time. The same goes for their credit cards, which they need to make ends meet. We expect this will also be true with COVID-19. The commercial segment will face more dramatic and challenging circumstances, where complete or partial business closures and lack of federal relief could have severe ramifications. Q: What new restrictions have been put in place surrounding debt collection efforts and outbound calls? TH: To protect consumers who may be experiencing financial distress, most states have imposed new, stringent restrictions to prevent utilities from engaging in certain collections activities. Utilities are currently not charging any late payment fees and are instead structuring payment plans. Additionally, all outbound collections efforts have been suspended and there is fieldwork being executed of services for both commercial and consumer properties. As of now, consumer and commercial fieldwork will likely not commence until after the first year or when the winter moratorium concludes. MS: The new restrictions imposed upon collections activities will likely drive consumer payment behavior. If consumers know that their utilities (i.e. energy and water) will not be shut off if they miss a payment, they will make these bills less of a priority. This will dramatically increase the amount owed when these restrictions are lifted next year. Q: Can we predict how the utilities industry will fare post-COVID-19? TH: The volume of accounts in collections and eligible for disconnect will be overwhelming. Many utility providers fear the unpaid balances consumers and commercial entities accumulate will be nearly impossible to fit into a repayment schedule. Both analyzing internal payment segments and overlaying external factors may be the best way to optimize the most critical go-forward plan. MS: The amount of people who fall into collections is going to greatly increase and utility providers need to start planning for it now to weather the storm. They will need to use data, analytics and tools to help them optimize their tasks, so they can be more efficient with their resources. Like many other industries, the utilities sector will look to increasing digitalization of their processes and having less social interaction where possible. This could mean the need and drive for expediting current smart meter programs where possible to enable remote fieldwork to assist in managing this unprecedented level of activity that is sure to overwhelm field operations (where allowed by state regulators). Q: What should utility providers be doing to plan for an uptick in collections activities post-COVID-19? TH: With regulatory mandated suspensions of collections activities for utility providers and self-selected reductions due to stay at home orders and staff protection, the backlog of payments, calls and inquiries once business resumes as normal is set to overwhelm existing capacity. More than ever, self-service options (text/web), Q&A and alternative communication methods will be needed to shepherd consumers through the collections process and minimize the strain on call center agents. Many utility providers are asking for external data points to segment their consumers by industry or by those whose employment would have been adversely impacted by COVID-19. MS: Utility providers should be monitoring consumer data in order to prepare for when they are able to collect. This will help them strategize the number of resources they will need in their call centers and out in the field performing shut off activities. Given that the rise in cases will be more volume than their call centers can handle, they will need to use their resources wisely and plan to use them efficiently when they are able to resume collections. Q: How can Experian help utility providers reduce collections costs and maximize recovery? TH: Experian can help revise collections tactics and segmentation strategies by providing insight on how consumers are paying other creditors and identifying new segmentation opportunities as we emerge from the freeze on collections activities. Collections cases will be complex, and many factors and constraints will need to balanced against changing goals, making optimization key. MS: Utilizing Experian’s credit data and models can help ensure that resources are being used efficiently (i.e. making successful calls). There is also a need to leverage ability to pay models as well as prioritization models. By using these models and tools, utility providers can optimize their treatment strategies, reduce costs and maximize dollars collected. Learn more About our Experts: Tom Hanson, Senior Energy Consultant, Experian CEM, North America Tom is a Senior Consultant within the Energy Vertical at Experian, supporting regulated energy companies throughout the U.S. He brings over 25 years of experience in the energy field and supports his clients throughout the customer lifecycle, providing expertise in ID verification, account treatment, fraud solutions, analytics, consulting and final bill/field optimization strategies and techniques. Mark Soffietti, Analytics Consulting Senior Manager, Experian Decision Analytics, North America Mark has over 15 years of experience transforming data into actionable knowledge for effective decision management. Mark’s expertise includes solution development for consumer and commercial lending across the credit spectrum – from marketing to collections.

The economic impact of the COVID-19 health crisis is ever-evolving and requires great flexibility and planning from lenders. Shannon Lois, Experian’s Senior Vice President, Analytics, Consulting and Operations, discusses what lenders can expect and next steps to take. Q: Though COVID-19 is catalyzing a sharp economic slowdown, many experts expect it to be temporary and liken it more to a global natural disaster than the prior financial crisis. What are your reactions? SL: There is still debate as to whether we will have a U-shaped or a V-shaped recession and its probable severity and longevity. Regardless, we are in a recession caused by a health pandemic with uncertainty of what it will mean for our global economy and without a clear view as to when it will end. The sooner we can contain the virus the more it will help to curtail the size of the recession. The unemployment rates and the consumer lack of confidence in the future will continue to contract spending which in turn will continue to propagate the recession. Our ability to limit COVID-19 over the coming months will have a direct impact in the economy, although the effects will probably linger on for six or more months. Q: From an economic perspective, what are the current trends we’re seeing? SL: Unemployment has skyrocketed and every business sector has been impacted although with different degrees of severity. In particular, tourism/hospitality, airlines, automotive, consumer products and retail have suffered. Consumers’ financial status varies and will continue to fluctuate, and credit conditions tighten while welfare payments increase. The government programs that have started will help, but they’re not enough to counter a prolonged recession. As some states seek to reopen and others extend their shelter in place orders, we will continue to see economic changes, with different sectors bouncing back or dipping further depending on their geographic location. Q: How does the economic slowdown compare to what we may have expected previously? SL: This recession is different than anything we have encountered previously not only because of the health concerns and implication of our population but because of the uncertainty of it all. As an example, social distancing has significantly and immediately impacted consumer demand but overall it is their low confidence in the future that will cause a continuous drop in discretionary and non-discretionary spending. Not only do we have challenges on the demand side, we also are seeing the same on the supply side with no automotive manufacturing occurring in the USA, and international oil flooding the market causing negative impact on domestic oil and the broad energy market. Q: How do the unemployment and liquidity challenges come into play? SL: The unemployment rate has already jumped to a record high. Most consumers are facing liquidity and affordability challenges and businesses do not have enough cash reserves to sustain them. Consumer activity has shifted drastically across all channels while lenders are exercising more caution. If this is a V-shaped recession (and hopefully it will be), then most activity is bound to spring back quickly in Q3. With companies safeguarding some jobs and the help of governments’ supplemental programs, businesses will restore supply and consumer demand will get a kick start. Q: What is the smartest next play for financial institutions? SL: The path forward requires several steps. First, understand your customers, existing and new. Refine your policies with the right information around your customers’ financial situations and extend programs (forbearance and loan payment forgiveness) as needed under the right guidelines. It’s also important to use refreshed data to lend to consumers and businesses who need it now more than ever, with the proper policies and fraud checks in place. Finally, increase your agility to operate effectively and dynamically with automation, interactive communication and self-serving digital tools. Experian is committed to helping lenders throughout these uncertain times. For more resources, visit our Look Ahead 2020 Resource Hub. Learn more About Our Expert Shannon Lois, Senior Vice President, Analytics, Consulting and Operations, Decision Analytics Shannon and her team of analysts, scientists, credit, fraud and marketing risk management experts provide results-driven consulting services and state-of-the-art advanced analytics, science and data products to clients in a wide range of businesses, including banking, auto, credit, utility, marketing and finance. Prior to her current role, she founded the Advisory Services practice at Experian, driving to actionable and proven solutions for our clients’ most pressing business problems.

The coronavirus (COVID-19) outbreak is causing widespread concern and economic hardship for consumers and businesses across the globe – including financial institutions, who have had to refine their lending and downturn response strategies while keeping up with compliance regulations and market changes. As part of our recently launched Q&A perspective series, Shannon Lois, Experian’s Head of DA Analytics and Consulting and Bryan Collins, Senior Product Manager, tackled some of the tough questions for lenders. Here’s what they had to say: Q: What trends and triggers should lenders be prepared to react to? BC: Lenders are still trying to figure out how to assess risk between the broader, longer-term impacts of the pandemic and the near-term Coronavirus Aid, Relief, and Economic Security (CARES) Act that extends relief funds and deferment to consumers and small businesses. Traditional lending processes are not possible, lenders will have to adjust underwriting strategies and workflows as they deploy hardship programs while complying with the Act. From a utilization perspective, lenders need to look for near-term trends on payments, balances and skipped payments. From an extension standpoint, they should review limits extended or reduced by other lenders. Critical trends to look for would be missed or late auto payments, non-traditional credit shopping and rental payment delinquencies. Q: What should lenders be doing to plan for an uptick in delinquencies? SL: First, lenders should make sure they have a complete picture of how credit risk and losses are evolving, as well as any changes to their consumers’ affordability status. This will allow a pointed refinement of their customer management strategies (I.e. payment holidays, changing customer to cheaper product, offering additional services, re-pricing, term amendment and forbearance management.) Second, given the increased stress on collection processes and regulations guidelines, they should ensure proper and prepared staffing to handle increased call volumes and that agency outsourcing and automation is enabled. Additionally, lenders should migrate to self-service and interactive communication channels whenever possible while adopting new segmentation schemas/scores/attributes based on fresh data triggers to queue lower risk accounts entering collections. Q: How can lenders best help their customers? SL: Lenders should understand customers’ profiles with vulnerability and affordability metrics allowing changes in both treatment and payment. Payment Holidays are common in credit card management, consider offering payment freezes on different types of credit like mortgage and secured loans, as well as short term workout programs with lower interest rates and fee suppression. Additionally, lenders should offer self-service and FAQ portals with information about programs that can help customers in times of need. BC: Lenders can help by complying with aspects of the CARES Act guidance; they must understand how to deploy payment relief and hardship programs effectively and efficiently. Data integrity and accuracy of loan reporting will be critical. Financial institutions should adjust their collection and risk strategies and processes. Additionally, lenders must determine a way to address the unbanked population with relief checks. We understand how challenging it is to navigate the changing economic tides and will continue to offer support to both businesses and consumers alike. Our advanced data and analytics can help you refine your lending processes and better understand regulatory changes. Learn more About Our Experts: Shannon Lois, Head of DA Analytics and Consulting, Experian Data Analytics, North America Shannon and her team of analysts, scientists, credit, fraud and marketing risk management experts provide results-driven consulting services and state-of-the-art advanced analytics, science and data products to clients in a wide range of businesses, including banking, auto, credit, utility, marketing and finance. Shannon has been a presenter at many credit scoring and risk management conferences and is currently leading the Experian Decision Analytics advisory board. Bryan Collins, Senior Product Manager, Experian Consumer Information Services, North America Bryan is a member of Experian's CIS product management team, focusing on the Acquisitions suite and our evolving Ascend Identity Services Platform. With more than 20 years of experience in the financial services and credit industries, Bryan has established strong partnerships and a thorough understanding of client needs. He was instrumental in the launch of CIS's segmentation suite and led product management for lender and credit-related initiatives in Auto. Prior to joining Experian, Bryan held marketing and consumer experience roles in consumer finance, business lending and card services.

Security. Convenience. Personalization. Finding the balance between these three priorities is key to creating a safe and low-friction customer experience. We surveyed more than 6,500 consumers and 650 businesses worldwide about these priorities for our 2020 Global Identity and Fraud Report: Most business are focusing on personalization, specifically in relation to upselling and cross-selling. This is frustrating customers who are looking for increases in both security and convenience. It’s possible to have all three. Read Full Report

Update: After closely monitoring updates from the WHO, CDC, and other relevant sources related to COVID-19, we have decided to cancel our 2020 Vision Conference. If you had the chance to experience tomorrow, today, would you take it? What if it meant you could get a glimpse into the future technology and trends that would take your organization to the next level? If you’re looking for a competitive edge – this is it. For more than 38 years, Experian’s premier conference has connected business leaders to data-driven ideas and solutions, fueling them to target new markets, grow existing customer bases, improve response rates, reduce fraud and increase profits. What’s in it for you? Everything to gain and nothing to lose. Are you a marketer? These sessions were made to drive your conversion rates to new heights: Know your customers via omnichannel marketing: Your customers are everywhere, but can you reach them? Learn how to drive business-expansion strategy, brand affinity and customer engagement across multiple channels. Plus, gain insight into connecting with customers via one-to-one messaging. By invitation only, the future of ITA marketing: An evolving landscape means marketers face new challenges in effectively targeting consumers while staying compliant. In this session, we’ll explore how you can leverage fair lending-friendly marketing data for targeting, analysis and measurement. Want the latest in technology trends? Dive into discussions to transform your customer experience: Credit in the age of technology transformation: Machine learning and artificial intelligence are the current darlings of big data, but the platform that drives the success of any big data endeavor is crucial. This session will dive into what happens behind the curtain. Put away your plastic – next-generation identity: An industry panel of experts discusses the newest digital identity and authentication capabilities – those in use today and also exciting solutions on the horizon. How about for the self-proclaimed data geeks? Analyze these: Alternative data: Listen in on an in-depth conversation about creative and impactful examples of using emerging data assets, such as alternative and consumer-permissioned data, for improved consumer inclusion, risk assessment and verification services. The next wave in open data: Experian will share their views on the potential of advanced data and models and how they benefit the global value chain – from consumer scores to business opportunities – regardless of local regulations. And the risk masters? Join us as we kick fraud to the curb: Understanding and tackling synthetic ID fraud: Synthetic IDs present a serious challenge for our entire industry. This expert panel will explore the current landscape – what’s working and what’s not, the expected impact of the next generation SSA eCBSV service, and best practice prevention methods. You are your ID – the new reality of biometrics: Consumers are becoming increasingly comfortable with biometrics. Just as CLEAR has transformed how we use our biometric identity to move through airports, sports venues and more, financial transactions can also be made friction-free. The point is, there’s something for everyone at Vision 2020. It’s not just another conference. Trade in stuffy tradeshow halls and another tri-fold brochure for the insights and connections you need to take your career and organization to the next level. Like technology itself, Vision 2020 promises to connect us, unify us and enable us all to create a better tomorrow. Join us for unique networking opportunities, one-on-one conversations with subject-matter experts and more than 50 breakout sessions with the industry’s most sought-after thought leaders.

Do you have 20/20 vision when it comes to the readiness of your organization? How financially healthy are your customers today? They are likely facing some challenges and difficult choices. Based on a study by the Center for Financial Services Innovation (CFSI), almost half of the US adult population - that’s 112.5 million - say they do not have enough savings to cover at least three months of living expenses. With debt rising and a possible recession on the horizon, it’s crucial to have a solid strategy in place for your organization. Here are three easy steps to help you prepare: Anticipate the recession before it arrives Gathering a complete view of your customers can be difficult if you have multiple systems, which can result in subjective, costly and inefficient processes. If you don’t have a full picture of your customers, it’s hard to understand their risk, behavior and ability to pay and to determine the most effective treatment decisions. Having the right data is only the first step. Using analytics to make sense of the data helps you better understand your customers at an individual level, which will increase recovery rates and improve the customer experience. Analytics can provide early-warning indicators that identify customers most likely to miss payments, predict future behavior, and deliver the best treatment option based on a customer’s specific situation or behavior. With a deeper understanding of at-risk customers, you can apply more targeted interventions that are specific to each customer, so you can be confident your collections process is individualized, efficient and fair. The result? A cost-effective, compliant process focused on retaining valuable customers and reducing losses. What to look for: ✔ Know when customers are experiencing negative credit events ✔ View consumer credit trends that may not yet be visible on your own account base ✔ Watch for payment stress – understand the actual payment consumers are making. Is it changing? ✔ See individual trends and take action – are your customers sliding down to a lower score band? ✔ Understand how your client-base is performing within your own portfolio and with other organizations Take immediate and impactful actions around risk mitigation and staffing Every interaction with consumers needs optimizing, from target marketing through to collections and recovery. Organizations that proactively modernize their business to scale and increase effectiveness before the next economic downturn may avoid struggling to address rising delinquencies when the economy corrects itself. This may improve portfolio performance and collection capabilities — significantly increasing recoveries, containing costs and sustaining returns. Identify underperforming products and inefficient processes by staff. Consider reassessing the data used and the manual processes required for making decisions. Optimize product pricing and areas where organizations or staff could automate the decision processes. Areas to focus: ✔ Identity theft protection and account takeover awareness ✔ Improve underwriting strategy and automation ✔ Maximize profitability — drive spend, optimize approvals, line assignment and pricing ✔ Evaluate collection risk strategies and operational efficiencies Design and deploy a strategy to be organizationally and technologically ready for change Communication is key in debt recovery. Failing to contact customers via their preferred channel can cause frustration and reduce the likelihood of recovery. Your customers are looking for a convenient and discreet way to negotiate or repay debt, and if you aren’t providing one, you’re incurring higher collections costs and lower recovery rates. With developments in the digital world, consumer interactions have changed. Most people prefer to communicate via mobile or online, with little to no human interaction. Behavioral analytics help to automate and decide the next best action, so you contact the right customer at the right time through the right channel. In addition, offering a convenient, discreet way to negotiate or repay debt can result in customers who are more engaged and more likely to pay. Online and self-service portals along with AI-powered chatbots use the latest technology to provide a safe and customer-centric experience, creating less time-consuming interactions and higher customer satisfaction. Your digital collections process is more convenient and less stressful for consumers and more profitable and compliant for you. Visualize the future... ✔ Superior customer service is embraced at the end of the customer life cycle as it is in the beginning ✔ Leverage data, analytics, software, and industry expertise to drive an automated collections process with fewer manual interventions ✔ Meet the growing expectation for digital consumer self-service by providing the ability to proactively negotiate and manage debt through preferred contact channels ✔ When economy and market conditions change for the worst, have the right data, analytics, software in place and be prepared to implement relevant collections strategies to remain competitive in the market Don’t wait until the next recession hits. Our collaborative approach to problem solving ensures you have the right solution in place to solve your most complex problems and are ready for market changes. The combination of our data, analytics, fraud tools, decisioning software and consulting services will help you proactively manage your portfolio to minimize the flow of accounts into collections and modernize your collections and recovery processes. Learn More

It may be a new decade of disruption, but one thing remains constant – the consumer is king. As such, customer experience (and continually evolving digital transformations necessary to keep up), digital expansion and all things identity will also reign supreme as we enter this new set of Roaring 20s. Here are seven of the top trends to keep tabs of through 2020 and beyond. 1. Data that does more – 100 million borrowers and counting Traditional, alternative, public record, consumer-permissioned, small business, big business, big, bigger, best – data has a lot of adjectives preceding it. But no matter how we define, categorize and collate data, the truth is there’s a lot of it that’s untapped, which is keeping financial institutions from operating at their max efficiency levels. Looking for ways to be bigger and bolder? Start with data to engage your credit-worthy consumer universe and beyond. Across the entire lending lifecycle, data offers endless opportunities – from prospecting and acquisitions to fraud and risk management. It fuels any technology solution you have or may want to implement over the coming year. Additionally, Experian is doing their part to create a more holistic picture of consumer creditworthiness with the launch of Experian LiftTM in November. The new suite of credit score products combines exclusive traditional credit, alternative credit and trended data assets, intended to help credit invisible and thin-file consumers gain access to fair and affordable credit. "We're committed to improving financial access while helping lenders make more informed decisions. Experian Lift is our latest example of this commitment brought to life,” said Greg Wright, Executive Vice President and Chief Product Officer for Experian Consumer Information Services. “Through Experian Boost, we're empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we're empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem,” he said. 2. Identity boom for the next generation Increasingly digital lifestyles have put personalization and frictionless transactions on hyperdrive. They are the expectation, not a nice-to-have. Having customer intelligence will become a necessary survival strategy for those in the market wanting to compete. Identity is not just for marketing purposes; it must be leveraged across the lending lifecycle and every customer interaction. Fragmented customer identities are more than flawed for decisioning purposes, which could potentially lead to losses. And, of course, the conversation around identity would be incomplete without a nod to privacy and security considerations. With the roll-out of the California Consumer Privacy Act (CCPA) earlier this month, we will wait to see if the other states follow suit. Regardless, consumers will continue to demand security and trust. 3. All about artificial intelligence and machine learning We get it – we all want the fastest, smartest, most efficient processes on limited – and/or shrinking – budgets. But implementing advanced analytics for your financial institution doesn’t have to break the bank. And, when it comes to delivering services and messaging to customers the way they want it, how to do that means digital transformation – specifically, leveraging big data and actionable analytics to evaluate risk, uncover industry intel and improve decisioning. One thing’s for certain, financial institutions looking to compete, gain traction and pull away from the competition in this next decade will need to do so by leveraging a future-facing partner’s expertise, platforms and data. AI and machine learning model development will go into hyperdrive to add accuracy, efficiency, and all-out speed. Real-time transactional processing is where it’s at. 4. Customer experience drives decisioning and everything Faster, better, more frictionless. 2020 and the decade will be all about making better decisions faster, catering to the continually quickening pace of consumer attention and need. Platforms and computing language aside, how do you increase processing speed at the same time as increasing risk mitigation? Implementing decisioning environments that cater to consumer preferences, coupled with best-in-class data are the first two steps to making this happen. This can facilitate instant decisioning within financial institutions. Looking beyond digital transformation, the next frontier is digital expansion. Open platforms enable financial institutions to readily add solutions from numerous providers so that they can connect, access and orchestrate decisions across multiple systems. Flexible APIs, single integrations and better strategy and design build the foundation of the framework to be implemented to enhance and elevate customer experience as it’s known today. 5. Credit marketing that keeps up with the digital, instant-gratification age Know your customer may be a common acronym for the financial services industry, but it should also be a baseline for determining whether to send a specific message to clients and prospects. From the basics, like prescreen, to omni-channel marketing campaigns, financial institutions need to leverage the communication channels that consumers prefer. From point of sale to mobile – there are endless possibilities to fit into your consumers’ credit journey. Marketing is clearly not a one-and-done tactic, and therefore multi-channel prequalification offers and other strategies will light the path for acquisitions and cross-sell/up-sell opportunities to come. By developing insights from customer data, financial institutions have a clear line of sight into determining optimal strategies for customer acquisition and increasing customer lifetime value. And, at the pinnacle, the modern customer acquisition engine will continue to help financial institutions best build, test and optimize their customer channel targeting strategies faster than ever before. From segmentation to deployment, and the right data across it all, today and tomorrow’s technology can solve many of financial organizations’ age-old customer acquisition challenges. 6. Three Rs: Recession, regulatory and residents of the White House Last March, the yield curve inverted for the first time since 2007. Though the timing of the next economic correction is debated, messaging is consistent around making a plan of action now. Whether it’s arming your collections department, building new systems, updating existing systems, or adjusting rules and strategy, there are gaps every organization needs to fill. By leveraging the stability of the economy now, financial institutions can put strategies in place to maximize profitability, manage risk, reduce bad debt/charge-offs, and ensure regulatory compliance among their list of to-do’s, ultimately resulting in a more efficient, better-performing program. Also, as we near the election later this year, the regulatory landscape will likely change more than the usual amount. Additionally, we will witness the first accounts of what CECL looks like for SEC-filing financial institutions (and if that will suggest anything for how non-SEC-filing institutions may fare as their deadline inches closer), as well as see the initial implications of the CCPA roll out and whether it will pave a path for other states to follow. As system sophistication continues to evolve, so do the risks (like security breaches) and new regulatory standards (like GDPR and CCPA) which provide reasons for organizations to transform. 7. Focus on fraud (in all forms) With evolving technology, comes evolved fraudsters. Whether it’s loyalty and rewards programs, account openings, breaches, there are so many angles and entry points. Synthetic identity fraud is the fastest-growing type of financial crime in the United States. The cost to businesses is estimated to grow to $1.2 billion by 2020, according to the Aite Group. To ensure the best protection for your business and your customers, a layered, risk-based approach to fraud management provides the highest levels of confidence in the industry. Balance is key – while being compliant with regulatory requirements and conscious of user experience, ensuring consumers’ peace of mind is priority one. Not a new trend, but recognizing fraud and recognizing good consumers will save continue to save financial institutions money and reputational harm, driving significant improvement in key performance indicators. Using the right data (and aggregating multiple data sets) and digital device intelligence tools is the one-two punch to protect your bottom line. For all your needs in 2020 and throughout the next decade, Experian has you covered. Learn more

If you’ve been on the dating scene in the last few years, you’re probably familiar with ghosting. For those of you who aren’t, I’ll save you the trip to Urban Dictionary. “Ghosting” is when the person you’re dating disappears. No calls. No texts. No DMs. They just vanish, never to be heard from again. As troublesome as this can be, there’s a much more nefarious type of ghosting to be wary of – credit ghosting. Wait, what’s credit ghosting? Credit ghosting refers to the theft of a deceased person’s identity. According to the IRS, 2.5 million deceased identities are stolen each year. The theft often occurs shortly after someone dies, before the death is widely reported to the necessary agencies and businesses. This is because it can take months after a person dies before the Social Security Administration (SSA) and IRS receive, share, or register death records. Additionally, credit ghosting thefts can go unnoticed for months or even years if the family of the deceased does not check their credit report for activity after death. Opportunistic fraudsters check obituaries and other publicly available death records for information on the deceased. Obituaries often include a person’s birthday, address or hometown, parents’ names, occupation, and other information regularly used in identity verification. With this information fraudsters can use the deceased person’s identity and take advantage of their credit rating rather than taking the time to build it up as they would have to with other types of fraud. Criminals will apply for credit cards, loans, lines of credit, or even sign up for a cell phone plan and rack up charges before disappearing. Where did this type of identity theft come from? Credit ghosting is the result of a few issues. One traces back to a discrepancy noted by the Social Security’s inspector general. In an audit, they found that 6.5 million Social Security numbers for people born before June 16, 1901, did not have a date of death on record in the administration’s Numident (numerical identification) system – an electronic database containing Social Security number records assigned to each citizen since 1936. Without a date of death properly noted in the database, government agencies and other entities inquiring won’t necessarily know an individual is deceased, making it possible for criminals to implement credit ghosting schemes. Additionally, unreported deaths leave further holes in the system, leading to opportunity for fraudsters. When financial institutions run checks on the identity information supplied by a fraudster, it can seem legitimate. If the deceased’s credit is in good standing, the fraudster now appears to be a good customer—much like a synthetic identity—but now with the added twist that all of the information is from the same person instead of stitched together from multiple sources. It can take months before the financial institution discovers that the account has been compromised, giving fraudsters ample time to bust out and make off with the funds they’ve stolen. How can you defend against credit ghosting? Luckily, unlike your dating pipeline, there are ways to guard against ghosting in your business’ pipeline. Frontline Defense: Start by educating your customers. It’s never pleasant to consider your own passing or that of a loved one, but it’s imperative to have a plan in place for both the short and long term. Remind your customers that they should contact lenders and other financial institutions in the event of a death and continue monitoring those accounts into the future. Relatives of the deceased don’t tend to check credit reports after an estate has been settled. If the proper steps aren’t taken by the family to notify the appropriate creditors of the death, the deceased flag may not be added to their credit report before the estate is closed, leaving the deceased’s information vulnerable to fraud. By offering your customers assistance and steps to take, you can help ensure that they’re not dealing with the fallout of credit ghosting—like dealing with calls from creditors following up after the fraudster’s bust-out—on top of grieving. Backend Defense: Ensure you have the correct tools in place to spot credit ghosts when they try to enter your pipeline. Experian’s Fraud Shield includes high risk indicators and provides a deceased indicator flag so you can easily weed them out. Additionally, you can track other risk indicators like previous uses of a particular Social Security number and identify potential credit-boosting schemes. Speak to an Experian associate today about how you can increase your defenses against credit ghosting. Let's talk

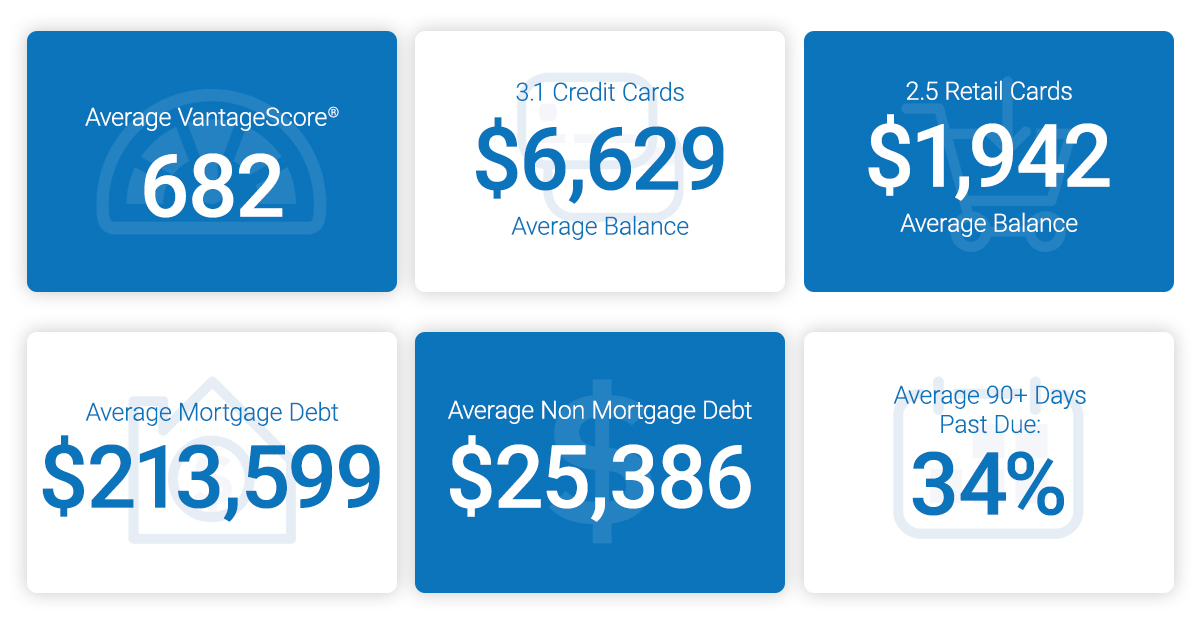

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.