The automotive industry is in the midst of weathering an unexpected storm due to COVID-19. As the Q1 2020 numbers rolled out, everyone was curious to see what the delinquency rates would tell us, and based on the data alone, it tells a positive story: delinquencies were down in Q1 2020.

In Q1 2020, 30-day delinquencies decreased from 1.98 percent in Q1 2019 to 1.93 percent, while 60-day delinquencies dropped from 0.68 percent to 0.67. However, it’s important to note, the pandemic wasn’t officially declared a national emergency until the middle of March. Additionally, consumers are likely leveraging financial resources and assistance programs, such as stimulus checks to manage through financial hardship, meaning the pandemic’s true impact may not be evident until the months ahead.

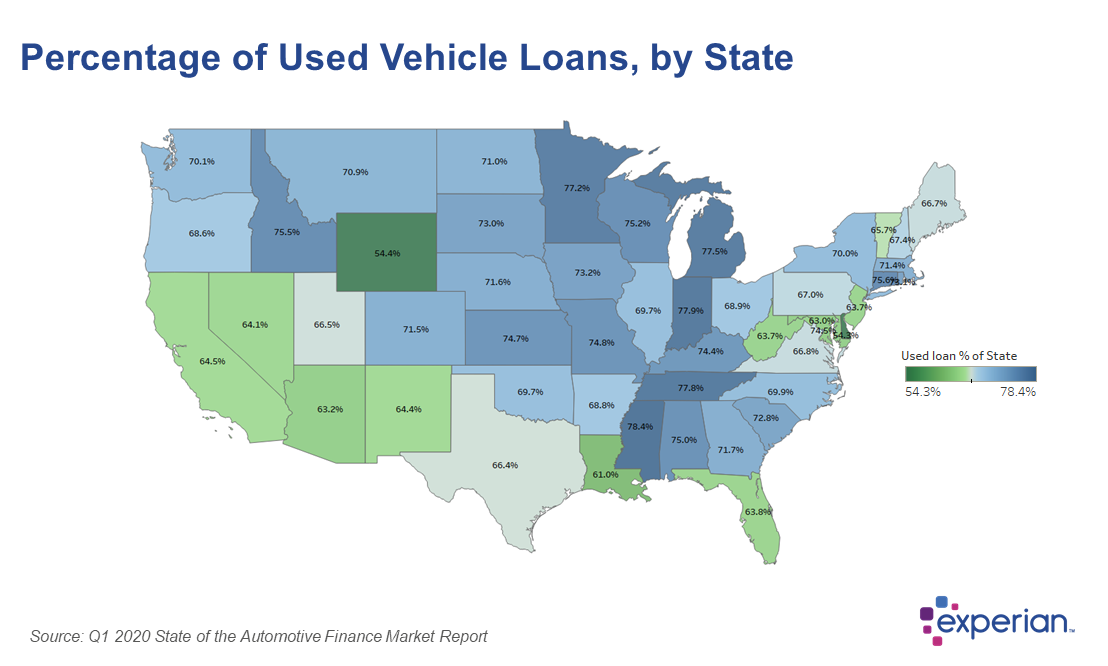

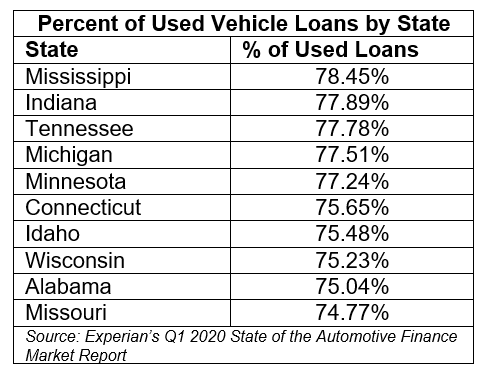

That said, Q1 data can still be informative as lenders and dealers create strategies to move forward. For instance, the trend of prime consumers continuing to select used vehicle financing. In Q1 2020, prime consumers comprised 50.47 percent of used vehicle loans. As this trend has been ongoing for a while, we took a closer look at where used vehicle loans were most common.

Mississippi topped the list, with used vehicle loans making up more than three-quarters of automotive loans in the state. In fact, this was true across the top nine states.

The trend towards used vehicles continues as automotive affordability remains a prominent topic of discussion. With many vehicles coming off-lease over the past few years, there are late-model vehicles available—these often offer many of the same features of a new vehicle but at a lower price point.

In addition to finance trends, dealers and lenders should assess the sales trends and consumer sentiment in their local markets. The pandemic created a fluid situation for many Americans and understanding how consumers are reacting to COVID-19 will help inform strategies moving forward. For instance, as of June 1, only 14 percent of survey respondents are considering buying a new vehicle in the next few months—of those 37 percent plan to buy something less expensive than originally planned.

While many aspects of our current situation are unlike anything we’ve experienced before, we know the automotive industry is resilient. Keeping a pulse on trends, sentiment, and other data points can help lenders and dealers make informed decisions and help address consumers’ most pressing needs in the days to come.

To view the entire Experian Q1 2020 State of the Automotive Finance Market report, or to watch the webinar, visit https://www.experian.com/automotive/automotive-webinars.html