Tag: collections

Debt management is becoming increasingly complex. People don’t answer their phones anymore. There are many, many communication channels available (email, text, website, etc.) and just as many preferences from consumers regarding how they communicate. Prioritizing how much time and effort to spend on a debtor often requires help from advanced analytics and machine learning to optimize those strategies. Whether you are manually managing your collections strategies or are using advanced optimization to increase recovery rates, we’ve got keys to help you improve your recover rates. Watch our webinar, Keys to unlocking debt management success, to learn about: Minimizing the flow of accounts into collections and ensuring necessary information (e.g. risk, contact data) is used to determine the best course of action for accounts entering collections Recession readiness – prepare for the next recession to minimize impact Reducing costs and optimizing collections treatment strategies based on individual consumer circumstances and preferences Increasing recovery rates and improving customer experience by enabling consumers to interact with your organization in the most effective, efficient and non-threatening way possible Watch on-demand now>

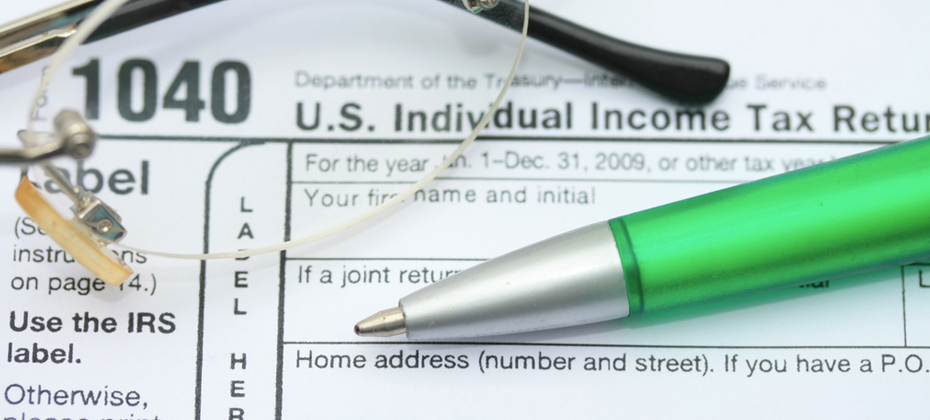

We’ve popped the bottles at midnight, now it’s time to burst the reality bubble. Countdown: t-minus less than 90 days until what is for many the dreaded April 15 tax deadline. Tax Season - Get Started Coupled with debt consolidation post-holidays, January is a harsh contrast to all the feasting and festivities of the holiday season. However, the tax season doesn’t necessarily have to be synonymous with doom and gloom – many Americans look forward to receiving a tax refund. And of those people expecting a tax refund, 35% of consumers said they would use it to pay down debt, according to the National Retail Federation. Lenders and financial institutions can help their consumers get off on the right financial foot for 2019 by helping them to pay down their debt. Here are 5 tools you need to have this tax season to make the most of your collections efforts: 1. Identify your target market – Tax Season Payment IndicatorTM Did you know the average tax refund in 2016 and 2017 was over $2,760, according to the IRS? Also, during the 2017 tax season, 45 million consumers paid at least $500 and 10% or more of a tradeline balance(s), according to Experian data. Tax Season Payment Indicator examines payment behavior over the past two years to determine whether a consumer has made a large payment to a tradeline balance – or balances – during tax season. 2. Keep up-to-date on consumer information – Clear ProfileTM Skip tracing just got easier. Narrow in on the right contact information for your past-due consumer using Clear Profile. Leveraging Clarity Service’s database, Clear Profile provides the most recent and historical demographic elements associated with your consumer’s previous applications including addresses, phone numbers, employers, emails and banks. 3. Know the right time to collect – Collection TriggersSM Take the guesswork out of how to manage your collections efforts. Track your accounts to notify you of a new contact information and changes that indicate your past-due consumers’ ability to pay. 4. Stay ahead of fraudsters – CrossCoreTM Fraudsters are everywhere, so protect your customers and your organization by monitoring your portfolio to keep fraudulent accounts from being opened. Still wondering how to get tax season ready? Get Your Collections Tax Season Ready

Ben Franklin was wrong. Death and taxes are not the only two constants in life. For many, debt makes a third. And where there is past-due debt, collections is not far from the conversation, if not included in the same breath. While the turn of the new year may mark some arduous work to be done – losing those holiday pounds, spring cleaning, balance transfers and tax filings – there’s also opportunity for lenders, collectors and consumers alike. Just as the spikes in retail trends are analogous with the holiday months, there’s an evident uptick in collections during tax season year after year. As such, successful lenders, financial institutions and collections agencies know that January, February and March are critical months to engage with past-due customers, specifically as they relate to the tax season. The average tax refund for 2016 and 2017 was $2,860 and $2,769 respectively, according to the IRS. And while some may assume that all consumers look at this money as an opportunity for a “treat yourself” splurge, 35% of consumers expecting a refund said they would use it to pay down debt, according to the National Retail Federation. Additionally, during the 2017 tax season, 45 million consumers paid at least $500 and 10% or more of a tradeline balance(s), according to Experian data. So, if past-due consumers want to pay down debt, and the ultimate goal of collections is to recoup over-due funds, and first quarter collections growth appears to be driven by tax refunds, how do we make the connection? Think of the scene from Jerry Maguire – “Help me, help you!” Help consumers help themselves. Experian’s new Tax Season Payment IndicatorTM examines payment behavior over the past two years to determine whether a consumer has made a large payment to a tradeline balance – or balances – during tax season. “Millions of consumers used their tax refunds to pay down debt and many plan to do it again,” said Denise McKendall, Product Manager. “Collectors that leverage previous tax season payment behavior to identify and strategically engage with this group will benefit the most from the tax refund season.” Engaging this information can be like having a collections crystal ball. Targeting consumers that are likely to use their refund to pay down debt can influence messaging, campaign refinement and the timeliness of your touchpoints, resulting in greater collections ROI. This means as the year closes out and planning begins for 2019, collections prioritization strategy is key. And those conversations should be taking place now. Are you tax season ready? Learn More About Tax Season Payment Indicator

Optimizing your collections With a maximized approach to collections, you can see an uplift in performance of 5% to 30% in Key Performance Indicators against traditional techniques. Here are some suggestions for optimizing your strategies: Consider every combination of actions. Understand the tradeoffs between the different actions, which are forced by constraints. Choose the best set of actions to fit within the constraints. Maximize your collections efforts by knowing your customers better, segmenting and targeting your approach more effectively, and automating as much as possible. Learn more in our white paper Collections Optimization. Download now

As soon as the holiday decorations are packed away and Americans reign in the New Year, the advertisements shift to two of our favorite themes – weight loss and taxes. No wonder the “blues” kick in during February. While taxes aren’t due until April 17, the months of January, February and March have consumers prepping to file. Coincidentally, it is also a big season for lenders to collect after the high-spending months of October through December. “Knowing which of your customers may receive a refund is critical,” said Colleen Rose, an Experian product manager specializing in the collections industry. “This information can help lenders create a strategy to capitalize on this important segment during the compressed collections window.” The industry has become more familiar with trended data and its ability to predict how consumers are faring on the credit score slider, but many don’t know that it has also proven popular in identifying people who may get a tax refund, and who is likely to use a refund to pay down delinquent balances. The past two tax seasons are evaluated to provide a complete picture of a customer’s behavior during tax refund season. Balance, credit limit and other historical fields are incorporated with tradeline-level data to determine who paid down their delinquent balances during this time. According to the IRS, in fiscal year 2016, the average individual income tax refund was about $3,050, so it’s a prime time for consumers to come into some unexpected cash to either pay down debt or spend. It’s estimated that 35% of consumers who get a refund will pay down debt. “Using Experian’s trended data attributes, we’ve identified past-due customers who paid down a delinquent tradeline balance by at least 10% and made a large payment during tax season,” said Rose. “With these specific attributes, we can help clients target a very desirable population during the critical collections months, helping them to refine their campaigns and create offers geared toward this population.” Anticipating who is likely to receive a refund and use it to pay down debt can influence how collections departments develop their messaging, call outreach and mailings. And for consumers who owe multiple debts, these well-timed touchpoints and messages could influence who they pay back first. The collectors with the best data, once again win, with trended data providing the secret sauce for predictions. ‘Tis the season for taxes.

The collections space has been migrating from traditional mail and outbound calls to electronic payment portals, digital collections and virtual negotiators. Now that collectors have had time to test virtual collections, we’ve collected some data points. Here are a few: On average, 52% of consumers who visit a digital site will proceed to a payment schedule if the right offer is made. 21% of the visits were outside the core hours of 8 a.m. to 8 p.m., an indication that traditional business hours don’t always work. Of the consumers who committed to a payment plan, only 56% did it in a single visit. The remaining 44% did so mostly later that day or on a subsequent day. As more financial institutions test this new virtual approach, we anticipate customer satisfaction and resolutions will continue to climb. Get your debt collections right>

It should come as no surprise that the process of trying to collect on past-due accounts has been evolving. We’ve seen the migration from traditional mail and outbound calls, to offering an electronic payment portal, to digital collections and virtual negotiators. Being able to get consumers who have past-due debt on the phone to discuss payments is almost impossible. In fact, a recent informal survey divulged a success rate of a 15% contact rate to be considered the best by several first-party collectors; most reported contact rates in the 8%-range. One can only imagine what it must be like for collection agencies and debt buyers. Perhaps, inviting the consumer to establish a non-threatening dialog with an online system can be a better approach? Now that collectors have had time to test virtual collections, we’ve collected some data points. Conversion rates, revisits, and time of day An analysis of several clients found that on average 52% of consumers that visit a digital site will proceed to a payment schedule if the right offer is made. 21% of the visits were outside the core hours of 8 a.m. to 8 p.m., an indication that consumers were taking advantage of the flexibility of reaching out at any time of the day or night to explore their payment and settlement options. The traditional business hours don’t always work. Here is where it really gets interesting, and invites a clear comparison to the traditional phone calls that collectors make trying to get the consumer to commit to a payment plan on the line. Of the consumers that committed to a payment plan, only 56% did it in a single visit. The remaining 44% that committed to payments did so mostly later that day, or on a subsequent day. This strongly suggests they either took time to check their financial status, or perhaps asked a friend or family to help with the payment. In other words, rather than refusing to agree to an instantaneous agreement pressured by a collector, the consumer took time to reflect and decide what was the best course of action to settle the amount due. On a similar note, the attrition rate of “Promises to Pay” were 24% lower using online digital solutions versus the traditional collector phone call. This would be consistent with more time to agree to a payment plan that could be met, rather than weakly agreeing to a collector phone call just to get the collector off the phone. Another possible reason for a lower attrition rate may be that a well-defined digital collection solution can send out reminders to consumers via email or text in advance of the next scheduled payment, so that the consumer can be reminded to have the funds available when the next payment hits their account. For accounts where settlement offers are part of the mix, a higher percentage of balances is being resolved versus the collection floor. In fact, the average payment improvement is 12% over what collectors tend to get on the collections floor. The reason for this significant change is unclear, but the suspicion is that a digital collection solution will negotiate stronger than a collector, who is often moving to the bottom of an acceptable range too soon. What's next? Further assessing the consumer’s needs and capabilities during the negotiation session will undoubtedly be a theme going forward. Logical next steps will include a “behind-the-scenes” look at the consumer’s entire credit picture to help the creditor craft an optimal settlement amount that both the consumer can meet, and at the same time optimizes recovery. Potential impact to credit scores will also come into the picture. Depending on where the consumer and his past-due debt is in the credit lifecycle, being able to reasonably forecast the negative impact of a missed payment can act as an additional argument for making a past-due or delinquent payment now. As more financial institutions test this new virtual approach, we anticipate customer satisfaction and resolutions will continue to climb.

We regularly hear from clients that charge-offs are increasing and they’re struggling to keep up with the credit loss. Many clients use the same debt collection strategy they’ve used for years – when businesses or consumers can’t repay a loan, the creditor or collection agency aggressively contacts them via phone or mail to obtain repayment – never considering the customer experience for the debtor. Our data shows that consumers accounted for $37.24 billion in bankcard charge-offs in Q2 2017, a 17.1 percent increase from Q2 2016. Absorbing credit losses at such a high rate can impact the sustainability of the institution. Clearly the process could use some adjusting. Traditionally, debt collection has been solely about the money. The priority was ensuring that as much of the outstanding debt as possible was repaid. But collecting needs to be about more than that. It also should focus on the customer and his or her individual situation. When it comes to debt collection, customers should not all be treated the same way. I recently shared some tips in Credit Union Business Magazine about how to actively engage and collect from members. The same holds true for other financial institutions – they need to know the difference between a customer who has simply forgotten to make a payment and one who is dealing with financial hardship. As an example, if a person is current on his or her mortgage payment but has slipped behind on his or her credit card payment, that doesn’t necessarily signify financial hardship. It’s an opportunity to work with the customer to manage the debt and get back to current. Modern financial institutions build acquisition and customer management strategies targeted at individuals, so why should the collection process be any different? The challenge is keeping the customer at the center while also managing against potential increases in delinquencies. This holistic approach may be slightly more complex, but technology and analytics will simplify the process and bring about a more engaging experience for customers. The Power of Data and Technology Instead of relying on the same outdated collections approach – which results in uncomfortable exchanges on the phone that don’t ensure repayment –leverage data to your advantage. The data and technology exists to help you make more informed decisions, such as: What’s the most effective communication channel to reach the defaulting customer? When should you contact him or her? How often? The best course of action could be high-touch outreach, but sometimes doing nothing is the right approach. It all depends on the situation. Data and analytics can help uncover which customers are most likely to pay on their own and those who may need a little more help, allowing you to adjust your treatment strategy accordingly. By catering to the preferences of the customer, there’s a greater chance for a positive experience on both sides. The results: less charge-off debt, higher customer satisfaction and a stronger relationship. Explore the Digital Age In 2016, 36 million Americans made some form of mobile payment—paying a bill, purchasing something online, or paying for fast food, or making a Mobile Wallet purchase at a retailer. By 2020, nearly 184 million consumers will have done so, according to Aite. Consumers expect and deserve convenience. In the digital world, financial institutions have an opportunity to provide that expectation and then some. Imagine a customer being able to negotiate and manage his or her past-due account virtually, in the privacy of his or her own home, when it’s most convenient, to set their payment dates and terms. Luckily, the technology exists to make this vision a reality. Customers, not money, need to be at the heart of every debt collections strategy. Gone are the days of mass phone calls to debtors. That strategy made consumers unhappy, embarrassed and resentful. Successful debt collection comes down to a basic philosophy: Treat customers and his or her unique situation individually rather than as a portfolio profile. The creditors who live by that philosophy have an opportunity to reap the rewards on the back-end.

Create a better consumer experience during the debt collection process When most people think about debt collection, unpleasant images may come to mind, like relentless phone calls or collections notices. Whatever the case may be, the collections process often ends in a less than desirable experience for consumers. And, quite frankly, it needs to change. Steve Platt, Experian’s Group President of Decision Analytics, recently spoke with American Banker regarding how banks and other financial institutions can create a better consumer experience during the debt collection process. While balancing consumer needs and managing rising delinquencies can be a complex challenge, Steve conveyed that the technology and analytics exist to simplify the process. As an industry, we’re at a point where customer acquisition costs far exceed the costs to nurture existing customers through the entire life-cycle - from application to repayment. So, suffice to say, lenders need to rethink how they engage and communicate with their customers. Technology to the rescue Luckily, we live in an era where troves and troves of data are made available every day. We just need to help lenders leverage it to its fullest extent. For example, the right data and technology can help answer questions, such as: What’s the most effective communication channel to reach a customer? When should you contact them? How often? There isn’t a one-size-fits-all approach to debt collection. Each customer is different. Each has their own unique situation. Effective debt collection is about knowing the difference between a customer who has simply forgotten to pay and those who may be struggling financially, and communicating with them accordingly. Go digital Part of knowing how to engage consumers is also understanding we live in a digital world. We perform many of our daily tasks through our mobile devices, desktops or tablets. So, it would make sense for lenders to help their customers manage their past-due accounts virtually. Imagine being able to negotiate payment dates and terms from the privacy of your own home. It just so happens that technology can make this a reality. At the end of the day, the customer needs to be at the heart of the collections strategy. Each customer needs to be communicated with on a case-by-case basis depending on their unique circumstances. The resources exist to make customers feel like individuals, rather than numbers in a spreadsheet. And the lenders that appeal to the customer’s experience will see lower charge-offs and higher customer retention.

In March 2015, Experian, Equifax and Trans Union announced an agreement to enhance collecting accurate consumer information and providing consumers with a better experience interacting with the National Credit Reporting Agencies (CRA’s) about their credit reports, through the National Consumer Assistance Plan (NCAP). Since then, a series of mandatory updates to data reporting and collections procedures have been announced and implemented. Have you made the required changes and are you prepared for the next implementation? Understanding how these changes affect your business and reporting processes can be difficult to navigate. Some of these changes affect all data furnishers while others are relevant to collection agencies and debt buyers only. Here’s what you need to know: What’s coming up that ALL consumer data furnishers need to know? Effective Sept. 15, 2017, new requirements for reporting personally identifiable information will be in place. This new minimum standard will apply to accounts reported with a date opened after Sept. 15, 2017 and must be included for the CRAs to accept these records for processing. Following the Metro 2® Format, furnishers must report: Full name (First, middle or middle initial (if available), last and generation code/ suffix) Address Full Social Security Number (If full Social Security Number is not available, full Date of Birth (mmddyyyy) will be required) Date of birth (mmddyyyy) As of Feb. 1, 2018, consumer data will no longer be accepted by the CRAs in the older MetroTM format. Prior to the effective date you will need to take the necessary action to ensure that your organization will convert to the Metro 2® Format. You can access information about the Metro 2® Format on the Consumer Data Industry Association website. Should you have any questions about your Experian conversion, we’re here to help, contact us at Experian Experian_Metro2_Conv@experian.com Do you report Authorized User trades? Effective Sept. 15, 2017 you must report the full date of birth for newly added authorized users on all pre-existing and newly opened accounts. If you are a collection agency or debt buyer, the following changes are ALSO applicable to your business: As of Sept. 15, 2017, you will need to stop reporting medical debt collection accounts until they are at least 180 days past the date of first delinquency with the original creditor and delete any accounts that are being paid by insurance or paid in full through insurance. Effective Sept. 1, 2016, you must report a full file monthly. This means reporting all accounts monthly, including open collection accounts, collection accounts paid in full, and accounts requiring deletion or correction. In June 2016, the CRA’s agreed to adopt a certain industry standard with respect to the reporting of debts that did not arise from a contract or agreement to pay. Experian’s policy even prior to June 2016 is not to accept any data that falls outside of a contract or agreement to pay including, but not limited to, certain fines, tickets, and other assessments. For example, library fees or fines, parking tickets, speeding tickets, and court fees or fines. Also, the name of the Original Creditor and Creditor Classification Code became requirements to include in all reporting per the Metro 2® Format. These changes are important to the quality of our data and ultimately provide a positive impact to the consumer and your business. Are you prepared?

It should come as no surprise that reaching consumers on past-due accounts by traditional dialing methods is increasingly ineffective. The new alternative, of course, is to leverage digital channels to reach and collect on debts. The Past: Dialing for dollars. Let’s take a walk down memory lane, shall we? The collection approach used for many years was to initially send the consumer a collection letter recapping the obligation and requesting payment, usually when an account was 30 days late. If the consumer failed to respond, a series of dialing attempts were then made, trying to reach the consumer and resolve the debt. Unfortunately, this approach has become less effective through the years due to several reasons: The use of traditional landlines continues to drop as consumers shift to cell and Voice Over Internet Protocol (VOIP) services. The cost of reaching consumers by cell is more costly since predictive dialers can’t be used without prior consent, and the obtaining and maintaining consent presents its own set of tricky challenges. Consumers simply aren’t answering their phones. If they think a bill collector is calling, they don’t pick up. It’s that simple. In fact, here is a breakdown by age group that Gallup published in 2015, highlighting the weakness of traditional phone-dialing. The Present: Hello payment portal. With the ability to get the consumer on the phone to negotiate a payment on the wane, the logical next step is to go digital and use the Internet or text messaging to reach the consumer. With 71 percent of consumers now using smartphones and virtually everyone having an Internet connection, this can be a cost-effective approach. Some companies have already implemented an electronic payment portal whereby a consumer can make a payment using his or her PC or smartphone. Usually this is prompted by a collection letter, or if permitted by consumer consent, a text message to their smartphone. The Future: Virtual negotiation. But what if the consumer wants to negotiate different terms or payment plans? What if they want to try and settle for less than the full amount? In the past – and for most companies operating today – this translates into a series of emails or letters being exchanged, or the consumer must actually speak to a debt collector on the phone. And let’s be honest, the consumer generally does not want to speak to a collector on the phone. Fortunately, there is a new technology involving a virtual negotiator approach coming into the market now. It works like this: The credit grantor or agency contacts the consumer by letter, email, or text reminding them of their debt and offering them a link to visit a website to negotiate their debt without a human being involved. The consumer logs onto the site, negotiates with the site and hopefully comes to terms with what is an acceptable payment plan and amount. In advance, the site would have been fed the terms by which the virtual negotiator would have been allowed to use. Finally, the consumer provides his payment information, receives back a recap of what he has agreed to and the process is complete. This is the future of collections, especially when you consider the younger generations rarely wanting to talk on the phone. They want to handle the majority of their matters digitally, on their own terms and at their own preferred times. The collections process can obviously be uncomfortable, but the thought is the virtual negotiator approach will make it less burdensome and more consumer-friendly. Learn more about virtual negotiation.

Every portfolio has a set of delinquent customers who do not make their payments on time. Truth. Every lender wants to collect on those payments. Truth. But will you really ever be able to recover all of those delinquent funds? Sadly, no. Still, financial institutions often treat all delinquent customers equally, working the account the same and assuming eventually they’ll get their funds. The sentiment to recover is good, but a lot of collection resources are wasted on customers who are difficult or impossible to recover. The good news? There is a better way. Predictive analytics can help optimize the allocation of collection resources by identifying the most effective accounts to prioritize to your best collectors, do not contact and proceed to legal actions to significantly increase the recovery of dollars, and at the same time reduce collection costs. I had the opportunity to recently present at the annual Debt Buyer Association’s International Conference and chat with my peers about this very topic. We asked the room, “How many of you are using scoring to determine how to work your collection accounts?” The response was 50/50, revealing many of these well-intentioned collectors are working themselves too hard, and likely not getting the desired returns. Before you dive into your collections work, you need to respond to two questions: Which accounts am I going to work first? How am I going to work those accounts? This is where scoring enters the scene. A scoring model is a statistical algorithm that assigns a numerical expression based on known information to predict an unknown future outcome. You can then use segmentation to group individuals with others that show the same behavior characteristics and rank order groups for collection strategies. In short, you allow the score to dictate the collection efforts and slope your expenses based on the propensity and expected amount of the consumer to pay. This will inform you on: What type, if any, skip trace tactic you should use? If you should purchase additional data? What intensity you should work the account? With scoring, you will see different performances on different debts. If you have 100 accounts you are collecting on, you’ll then want to find the accounts where you will have the greatest likelihood to collect, and collect the most dollars. I like to say, “You can’t get blood from a stone.” Well the same holds true for certain accounts in your collections pile. Try all you like, but you’ll never recoup those dollars, or the dollars you do recoup will be minimal. With a scoring strategy, you can establish your “hit list” and find the most attractive accounts to collect on, and also match your most profitable accounts with your best collectors. My message to anyone managing a collections portfolio can be summed up in three key messages. You need to use scoring in your business to optimize resources and increase profits. The better data that goes into your model will net you better performance results. Get a compliance infrastructure in place so you can ensure you are collecting the right way and stay out of trouble. The beauty of scores is they tell you what to do. It will help you best match resources to the most profitable accounts, and work smarter, not harder. That’s the power of scoring.

The new year has started, the champagne bottles recycled. Bye-bye holidays, hello tax season. In fact, many individuals who are expecting tax refunds are filing early to capture those refunds as soon as possible. After all, a refund equates to so many possibilities – paying down debt, starting a much-needed home improvement project or perhaps trading up for a new vehicle. So what does that mean for lenders? As consumers pocket tax refunds, the likelihood of their ability to make payments increases. By the end of February 2014, more than 48 million tax refunds had been issued according to the IRS – an increase of 5.6 percent compared to the same time the previous year. As of Feb. 28, the average refund in 2014 was $3,034, up 3 percent compared to the average refund amount for the same time in 2013. To capitalize on this time period, introducing collection triggers can assist lenders with how to manage and collect within their portfolios. Aggressively paying down a bankcard, doubling down on a mortgage payment or wiping out a HELOC signal to the lender a change in positive behavior, but without a trigger attached, it can be hard to pinpoint which customers are shifting from their status quo payments. Experian actually offers around 100 collection triggers, but lenders do not need all to seek out the predictive insights they require. A “top 20” list has been created, featuring the highest percentages in lift rates, and population hit rates. Experian has done extensive analysis to determine the top-performing collection triggers. Among the top 15 to 20 triggers, the trigger hit rate ranged from 2 to 8 percent on an average client’s total portfolio, taking into consideration liquidation rates, average percent of payment lifts, lift in liquidation rates over the baseline liquidation, percent of overall portfolio that triggered, percent of overall portfolio that triggered only on the top-selected triggers, and percent of volume by trigger on the total customers that had a trigger hit. With that said, it is essential to implement the right strategy that includes a good mixture of the top-performing triggers. The key is diversifying and balancing trigger selection and setting triggers up during opportune times. Tax season is one of those times. Some of the top-ranked triggers include: Closed-Zero Balance Triggers: This is when a consumer’s account is reported as closed after being delinquent for a certain number of days. Specifically, the closed-zero balance trigger after being delinquent for 120 days has the highest percent of payment lift over an average payment that you would receive from a customer (at a 710 percent lift rate). These triggers are good indicators the consumer is showing positive improvement, thus having a higher likelihood for collections. Paid Triggers: This is when a consumer’s account is reported as paid after being delinquent, in collections, etc. Five of the top 20 triggers are paid triggers. These triggers have good coverage and a good balance between high lift rates (100 percent to 500 percent) and percent of the triggered population. These triggers are also good indicators the consumer is showing positive improvement, thus having a higher likelihood for collections. Inquiry Triggers: This is when a consumer is applying for an auto loan, mortgage loan, etc. The lift rates for these triggers are lowest within the Top 20, but on the other hand, these triggers have the highest hit rates (up to a 33 percent hit rate). These triggers are good indicators consumers are seeking to open additional lines of credit. Home Equity Loan Triggers: These triggers indicate the credit available on a consumer’s home equity loan. They are specifically enticing to collectors due to the fact that home equity lines of credit are usually larger than your average credit on your bank card. The larger the line of credit, the more you are able to potentially collect. To learn more about collection triggers, visit https://www.experian.com/consumer-information/debt-collection.html

By: Maria Moynihan Government organizations that handle debt collection have similar business challenges regardless of agency focus and mission. Let’s face it, debtors can be elusive. They are often hard to find and even more difficult to collect from when information and processes are lacking. To accelerate debt recovery, governments must focus on optimization--particularly, streamlining how resources get used in the debt collection process. While the perception may be that it’s difficult to implement change given limited budgets, staffing constraints or archaic systems, minimal investment in improved data, tools and technology can make a big difference. Governments most often express the below as their top concerns in debt collection: Difficulty in finding debtors to collect on late tax submissions, fines or fees. Prioritizing collection activities--outbound letters, phone calls, and added steps in decisioning. Difficulty in incorporating new tools or technology to reduce backlogs or accelerate current processes. By simply utilizing right party contact data and tools for improved decisioning, agencies can immediately expose areas of greater possible ROI over others. Credit and demographic data elements like address, income models, assets, and past payment behavior can all be brought together to create a holistic view of an individual or business at a point in time or over time. Collections tools for improved monitoring, segmentation and scoring could be incorporated into current systems to improve resource allotment. Staffing can then be better allocated to not only focus on which accounts to pursue by size, but by likelihood to make contact and payment. Find additional best practices to optimize debt recovery in this guide to Maximizing Revenue Potential in the Public Sector. Be sure to check out our other blog posts on debt collection.

By: Maria Moynihan Reduced budgets, quickly evolving technologies, a weakened economy and resource constraints are clearly impacting the Public Sector, but it’s not all doom and gloom. Always with new challenges, come new opportunities. Government agencies must still effectively run programs, optimize processes and find growth in revenue streams. Below you will find the top 5 business challenges facing the Public Sector and municipal utilities today and ways to overcome them: 1. Difficulty finding debtors When asked to name the top challenge to their debt collection processes, governments most often indicate the difficulty in locating debtors whose whereabouts don’t in fact match information they have on hand. Skip tracing with right party contact data is key to finding people or businesses for collections and there are several cost effective ways to do this - either through industry leading tools or by tapping into available sources like voter registration information. 2. Difficulty in prioritizing debt collection efforts When resources are limited, it is critical to not only focus efforts by size, but by likelihood to make contact and access debtors with an ability to pay. Credit and demographic data elements like income, assets, past payment behavior, and age can all be brought together to better identify areas of greater ROI over others. 3. Lack of data available By simply incorporating third-party data and analytics into an established infrastructure, agencies can immediately gain improved insight for efficient decision making. Leverage on-hand data sources to improve understandings of individuals or businesses. 4. Difficulty of incorporating tools to improve debt recovery Governments too often attempt to reduce backlogs by simply trying to accelerate processes that are suboptimal to start with. This is both expensive and unlikely to produce the desired result. In the case of debt collection, success is driven by the tools and processes that allow for refined monitoring, segmentation and prioritization of accounts for improved decisioning. 5. Difficulty in determining to outsource or continue to internally collect While outsourcing to debt collection agencies is always an option, it may not be the most resourceful one, or in some cases, even necessary. Cost to value considerations per effort need to be made by agencies and often, the most effective strategy is to perform minimal efforts internally and to outsource older or skip accounts to third party agencies. What is your agency’s biggest business challenge? See what industry experts suggest as best practices for Public Sector collections or download Experian’s guide to Maximizing Revenue Potential in the Public Sector to learn more.