Tag: email marketing

With the new year comes new goals, new accomplishments and new opportunities. And while new things are often associated with growth and success, nurturing what you already have should be just as important. The same goes for customer retention — although many financial institutions mainly focus on expanding their customer base, statistics show that a 5% increase in customer retention can lead to a company’s profits growing by 25% to 95% over time.1 What’s more, acquiring a new customer can cost five to seven times more than retaining an old one.2 What can your organization do to improve your customer retention efforts? Let’s first dive into recent consumer behavior trends. Consumer behaviors are changing High prices hit consumers, but service spending continues. Consumers are still seeing short-term price pressures. While spending on goods decreased by 0.9% in December, service spending remained flat. Consumers are starting to pull back. As economic uncertainty persists and excess savings from the pandemic dwindle further, consumers are saving more. Consumers aren’t completely satisfied when interacting with businesses digitally. 58% of consumers don’t feel that businesses completely meet their expectations for a digital online experience. With these trends in mind, how can your organization improve customer retention in 2023? Here are three tips to help you get started: Stay informed. Keeping up with your customers’ changing interests, behaviors, and life events enables you to identify cross-sell opportunities and create relevant credit marketing campaigns. With a large and comprehensive consumer database, like Experian’s ConsumerView®, you can better understand your customers, including the types of products they like to purchase and if they’re likely to buy a new or used vehicle in the next six months. To further enhance your customer retention efforts, you can also leverage Prospect TriggersSM, which allow you to stay alert whenever a customer is actively shopping for credit and extend preapproved credit offers to customers within hours or minutes, helping increase response rates. Be more than a business – be human. As consumers save more, financial institutions can build lifetime loyalty by serving as trusted financial partners and advisors. To do this, organizations can launch credit education programs and services that empower their customers to make smarter financial decisions. Helping consumers take control of their finances is especially important in today’s changing economy providing them with educational tools and resources, customers will learn how to strengthen their financial profiles while continuing to trust and lean on your organization for their credit needs. Think outside the mailbox. While direct mail is still an effective way to reach consumers, forward-thinking lenders are now meeting their customers online. To ensure you’re getting in front of your customers where they spend most of their time, consider leveraging digital channels, such as email or mobile applications when presenting and representing credit offers. This way, you can better connect with your customers and stay competitive. Importance of customer retention Rather than centering most of your growth initiatives around customer acquisition, your organization should focus on holding on to your most profitable customers, especially now with consumer behaviors changing and an abundance of credit options in the market. To learn more about how your organization can develop an effective customer retention strategy, explore our customer loyalty solutions. Improve customer retention today 1 Customer Retention Versus Customer Acquisition, Forbes, December 2022.

The challenges facing today’s marketers seem to be mounting and they can feel more pronounced for financial institutions. From customizing messaging and offerings at an individual customer level, increasing conversion rates, moving beyond digital while keeping an eye on traditional channels, and more, financial marketers are having to modernize their approach to customer acquisition. The most forward-thinking financial firms are turning to customer acquisition engines to help them best build, test and optimize their custom channel targeting strategies faster than ever before. But what functionality is right for your company? Here are 5 capabilities you should look for in a modern customer acquisition engine. Advanced Segmentation It’s without question that targeting and segmentation are vital to a successful financial marketing strategy. Make sure you select a tool that allows for advanced segmentation, ensuring the ability to uncover lookalike groups with similar attributes or behaviors and then customize messages or offerings accordingly. With the right customer acquisition engine, you should be able to build filters for targeted segments using a range of data including demographic, past behavior, loyalty or transaction history, offer response and then repurpose these segments across future campaigns. Campaign Design With the right campaign design, your team has the ability to greatly affect customer engagement. The right customer acquisition engine will allow your team to design a specific, optimized customer journey and content for each of the segments you create. When you’re ready to apply your credit criteria to the audience to generate a pre-screen, the best tools will allow you to view the size of your list adjusted in real-time. Make sure to look for an acquisition engine that can do all of this easily with a drag and drop user experience for faster and efficient campaign design. Rapid Deployment Once you finalize your audience for each channel or offer, the clock starts ticking. From bureau processing, data aggregation, targeting and deployment, the data that many firms are currently using for prospecting can be at least 60-days. When searching for a modern customer acquisition engine, make sure you choose a tool that gives you the option to fetch the freshest data (24-48 hours) before you deploy. If you’re sending the campaign to an outside firm to execute, timing is even more important. You’ll also want a system that can encrypt and decrypt lists to send to preferred partners to execute your marketing campaign. Support Whether you have an entire marketing department at your disposal or a lean, start-up style team, you’re going to want the highest level of support when it comes to onboarding, implementation and operational success. The best customer acquisition solution for your company will have a robust onboarding and support model in place to ensure client success. Look for solutions that offer hands-on instruction, flexible online or in-person training and analytical support. The best customer acquisition tool should be able to take your data and get you up and running in less than 30 days. Data, Data and more Data Any customer acquisition engine is only as good as the data you put into it. It should, of course, be able to include your own client data. However, relying exclusively on your own data can lead to incomplete analysis, missed opportunities and reduced impact. When choosing a customer acquisition engine, pick a system that gives your company access to the most local, regional and national credit data, in addition to alternative data and commercial data assets, on top of your own data. The optimum solutions can be fueled by the analytical power of full-file, archived tradeline data, along with attributes and models for the most robust results. Be sure your data partner has accounted for opt-outs, excludes data precluded by legal or regulatory restrictions and also anonymizes data files when linking your customer data. Data accuracy is also imperative here. Choose a marketing and technology partner who is constantly monitoring and correcting discrepancies in customer files across all bureaus. The best partners will have data accuracy rates at or above 99.9%.

Reactivation campaigns make economic sense. They build on a brand’s previous investments, targeting customers who already are aware of and previously have engaged with your brand. Use these 4 steps to build a successful reactivation framework: 1. Analyze subscriber data to identify reactivation segments to target. 2. Identify subscriber activity to divide customers into at least 3 unique segments. 3. Develop messaging strategies for each segment. 4. Integrate or suppress inactive subscribers based on whether they re-engage. Reactivation campaigns can deliver significant incremental revenue and position inactive subscribers for further engagement in future campaigns. Download report>

Experian’s 2016 Digital Marketer Report reveals the key issues impacting marketers today. 38% of marketers rank knowing customer needs, wants and attitudes as their top challenge. Other key challenges include: Increasing visibility over competitors (35%) Staying ahead of new marketing trends (33%) Integrating multiple marketing technologies and platforms (32%) Making messages relevant/contextual (27%) Companies can increase engagement by leveraging data and technology to understand customers and provide exceptional experiences through every channel, every time. >> Download The 2016 Digital Marketer Report

With the holidays around the corner, retailers are getting ready to release their holiday campaigns.

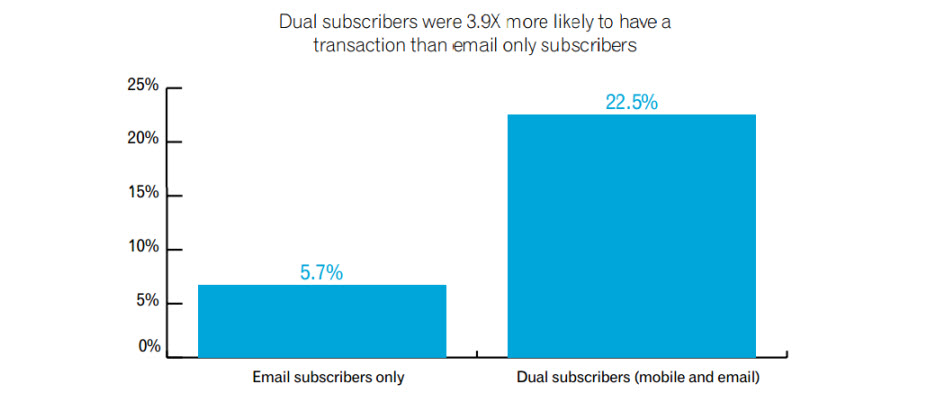

While mobile subscriber lists typically are much smaller than email lists, mobile subscribers tend to be loyal and highly engaged customers.

This season’s peak week, the Wednesday before Thanksgiving through the Tuesday after Cyber Monday, had an 18 percent increase in email volume, an 11 percent rise in transactions and a 7 percent increase in email revenue in comparison to peak week 2013. Cyber Monday provided 27 percent of total peak week revenue followed by Black Friday, which accounted for 18 percent of revenue. Marketers can design more successful holiday campaigns by staying on top of the latest email trends. View the December Holiday Hot Sheet

According to a recent Experian Data Quality study, three out of four organizations personalize their marketing messages or are in the process of doing so.