In this article…

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus at nisl nunc. Sed et nunc a erat vestibulum faucibus. Sed fermentum placerat mi aliquet vulputate. In hac habitasse platea dictumst. Maecenas ante dolor, venenatis vitae neque pulvinar, gravida gravida quam. Phasellus tempor rhoncus ante, ac viverra justo scelerisque at. Sed sollicitudin elit vitae est lobortis luctus. Mauris vel ex at metus cursus vestibulum lobortis cursus quam. Donec egestas cursus ex quis molestie. Mauris vel porttitor sapien. Curabitur tempor velit nulla, in tempor enim lacinia vitae. Sed cursus nunc nec auctor aliquam. Morbi fermentum, nisl nec pulvinar dapibus, lectus justo commodo lectus, eu interdum dolor metus et risus. Vivamus bibendum dolor tellus, ut efficitur nibh porttitor nec.

Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Maecenas facilisis pellentesque urna, et porta risus ornare id. Morbi augue sem, finibus quis turpis vitae, lobortis malesuada erat. Nullam vehicula rutrum urna et rutrum. Mauris convallis ac quam eget ornare. Nunc pellentesque risus dapibus nibh auctor tempor. Nulla neque tortor, feugiat in aliquet eget, tempus eget justo. Praesent vehicula aliquet tellus, ac bibendum tortor ullamcorper sit amet. Pellentesque tempus lacus eget aliquet euismod. Nam quis sapien metus. Nam eu interdum orci. Sed consequat, lectus quis interdum placerat, purus leo venenatis mi, ut ullamcorper dui lorem sit amet nunc. Donec semper suscipit quam eu blandit. Sed quis maximus metus. Nullam efficitur efficitur viverra. Curabitur egestas eu arcu in cursus.

H1

H2

H3

H4

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum dapibus ullamcorper ex, sed congue massa. Duis at fringilla nisi. Aenean eu nibh vitae quam auctor ultrices. Donec consequat mattis viverra. Morbi sed egestas ante. Vivamus ornare nulla sapien. Integer mollis semper egestas. Cras vehicula erat eu ligula commodo vestibulum. Fusce at pulvinar urna, ut iaculis eros. Pellentesque volutpat leo non dui aliquet, sagittis auctor tellus accumsan. Curabitur nibh mauris, placerat sed pulvinar in, ullamcorper non nunc. Praesent id imperdiet lorem.

H5

Curabitur id purus est. Fusce porttitor tortor ut ante volutpat egestas. Quisque imperdiet lobortis justo, ac vulputate eros imperdiet ut. Phasellus erat urna, pulvinar id turpis sit amet, aliquet dictum metus. Fusce et dapibus ipsum, at lacinia purus. Vestibulum euismod lectus quis ex porta, eget elementum elit fermentum. Sed semper convallis urna, at ultrices nibh euismod eu. Cras ultrices sem quis arcu fermentum viverra. Nullam hendrerit venenatis orci, id dictum leo elementum et. Sed mattis facilisis lectus ac laoreet. Nam a turpis mattis, egestas augue eu, faucibus ex. Integer pulvinar ut risus id auctor. Sed in mauris convallis, interdum mi non, sodales lorem. Praesent dignissim libero ligula, eu mattis nibh convallis a. Nunc pulvinar venenatis leo, ac rhoncus eros euismod sed. Quisque vulputate faucibus elit, vitae varius arcu congue et.

Ut convallis cursus dictum. In hac habitasse platea dictumst. Ut eleifend eget erat vitae tempor. Nam tempus pulvinar dui, ac auctor augue pharetra nec. Sed magna augue, interdum a gravida ac, lacinia quis erat. Pellentesque fermentum in enim at tempor. Proin suscipit, odio ut lobortis semper, est dolor maximus elit, ac fringilla lorem ex eu mauris.

- Phasellus vitae elit et dui fermentum ornare. Vestibulum non odio nec nulla accumsan feugiat nec eu nibh. Cras tincidunt sem sed lacinia mollis. Vivamus augue justo, placerat vel euismod vitae, feugiat at sapien. Maecenas sed blandit dolor. Maecenas vel mauris arcu. Morbi id ligula congue, feugiat nisl nec, vulputate purus. Nunc nec aliquet tortor. Maecenas interdum lectus a hendrerit tristique. Ut sit amet feugiat velit.

- Test

- Yes

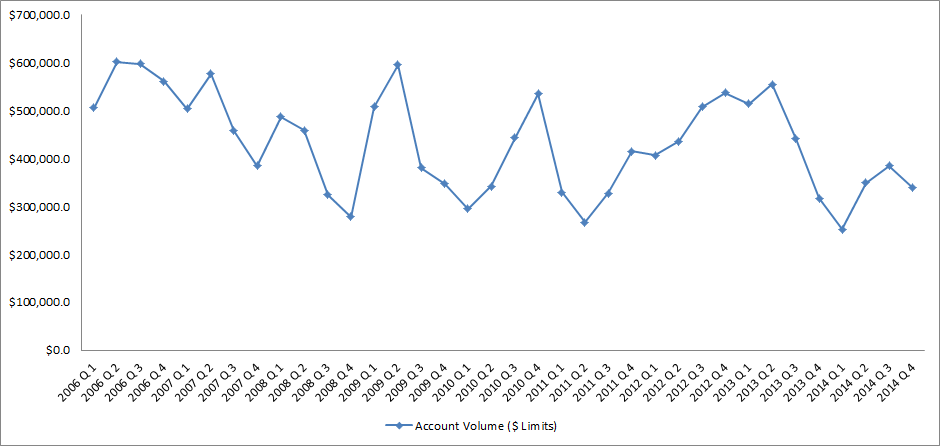

Source: IntelliViewsm powered by Experian Sales of existing homes dropped 50% from the peak in August 2005 to the low point in July 2010. The spike in home sales in late 2009 and early 2010 was due to the large number of foreclosure sales as well as very low prices. Since 2010, sales have increased to almost to the level they were in 2000, before the financial crisis. However, the homeownership rate has steadily gone down. How could sales have picked up while the homeownership rate declined? Investors have entered the market snapping up single family homes and renting them. Therefore, the recent good news in the existing home market has been driven by investors, not homeowners. But as I point out below, this is changing. Looking at the homeownership rate by age, shown in the table below, it is clear that since the crisis the rate has declined most for people under 45. The potential for marketing is greatest in this cohort as the numbers indicate a likely demand for housing. Homeownership Rate by Age Source: U.S. Census Bureau and Haver Analytics as reported on the Federal Reserve Bank of St. Louis Fred database The factors that have impeded growth, described above, are beginning to reverse which, along with pent-up demand, will present an opportunity for mortgage originators in 2015. Home prices have risen in 246 of the 277 cities tracked by Clear Capital.With prices going up, investors have begun to back away from the market, resulting in prices increasing at a slower rate in some cities but they are still increasing.Therefore the perception that homeownership is risky will likely change.In fact, in some areas, such as California’s coastal cities, sales are strong and prices are going up rapidly. Lenders and regulators are recognizing that the stringent guidelines put in place in reaction to the crisis have overly constrained the market.Fannie Mae and Freddie Mac are reducing down payment requirements to as low as 3%.FHA is lowering their guarantee fee, reducing the amount of cash buyers need to close transactions.Private securitizations, which dried up completely, are beginning to reappear, especially in the jumbo market. As unemployment continues to go down, consumer confidence will rise and household formation will return to more normal levels which result in more sales to first time homebuyers, who drive the market.According to Lawrence Yun, chief economist for the National Association of Realtors, “…it’s all about consistent job growth for a prolonged period, and we’re entering that stage.” The number of houses in foreclosure, according to RealtyTrac, has fallen to pre-crisis levels.This drag on the market has, for the most part, cleared and as prices continue to inflate, potential buyers will be motivated to buy before homes become unaffordable.Despite the recent increases, home prices are still, on average, 23% lower than they were at the peak. Focusing marketing dollars on those people with the highest propensity to buy has always been a challenge but in this market there are identifiable targets. “Boomerangs” are people who owned real estate in the past but are currently renting and likely to come back into the market.Marketing to qualified former homeowners would provide a solid return on investment. People renting single family houses are indicating a lifestyle preference that can be marketed to. Newly-formed households are also profitable targets. The housing market, at long last, appears to be finally turning the corner and normalizing. Experian’s expertise in identifying the right consumers can help lenders to pinpoint the right people on whom marketing dollars should be invested to realize the highest level of return. Click here to learn more.

Cont. Understanding Gift Card Fraud By: Angie Montoya In part one, we spoke about what an amazing deal gift cards (GCs) are, and why they are incredibly popular among consumers. Today we are going to dive deeper and see why fraudsters love gift cards and how they are taking advantage of them. We previously mentioned that it’s unlikely a fraudster is the actual person that redeems a gift card for merchandise. Although it is true that some fraudsters may occasionally enjoy a latte or new pair of shoes on us, it is much more lucrative for them to turn these forms of currency into cold hard cash. Doing this also shifts the risk onto an unsuspecting victim and off of the fraudster. For the record, it’s also incredibly easy to do. All of the innovation that was used to help streamline the customer experience has also helped to streamline the fraudster experience. The websites that are used to trade unredeemed cards for other cards or cash are the same websites used by fraudsters. Although there are some protections for the customer on the trading sites, the website host is usually left holding the bag when they have paid out for a GC that has been revoked because it was purchased with stolen credit card information. Others sites, like Craigslist and social media yard sale groups, do not offer any sort of consumer protection, so there is no recourse for the purchaser. What seems like a great deal— buying a GC at a discounted rate— could turn out to be a devalued Gift card with no balance, because the merchant caught on to the original scheme. There are ten states in the US that have passed laws surrounding the cashing out of gift cards. * These laws enable consumers to go to a physical store location and receive, in cash, the remaining balance of a gift card. Most states impose a limit of $5, but California has decided to be a little more generous and extend that limit to $10. As a consumer, it’s a great benefit to be able to receive the small remaining balance in cash, a balance that you will likely forget about and might never use, and the laws were passed with this in mind. Unfortunately, fraudsters have zeroed in on this benefit and are fully taking advantage of it. We have seen a host of merchants experiencing a problem with fraudulently obtained GCs being cashed out in California locations, specifically because they have a higher threshold. While five dollars here and ten dollars there does not seem like it is very much, it adds up when you realize that this could be someone’s full time job. Cashing out three ten dollar cards would take on average 15 minutes. Over the course of a 40-hour workweek it can turn into a six-figure salary. At this point, you might be asking yourself how fraudsters obtain these GCs in the first place. That part is also fairly easy. User credentials and account information is widely available for purchase in underground forums, due in part to the recent increase in large-scale data breaches. Once these credentials have been obtained, they can do one of several things: Put card data onto a dummy card and use it in a physical store Use credit card data to purchase on any website Use existing credentials to log in to a site and purchase with stored payment information Use existing credentials to log in to an app and trigger auto-reloading of accounts, then transfer to a GC With all of these daunting threats, what can a merchant do to protect their business? First, you want to make sure your online business is screening for both the purchase and redemption of gift cards, both electronic and physical. When you screen for the purchase of GCs, you want to look for things like the quantity of cards purchased, the velocity of orders going to a specific shipping address or email, and velocity of devices being used to place multiple orders. You also want to monitor the redemption of loyalty rewards, and any traffic that goes into these accounts. Loyalty fraud is a newer type of fraud that has exploded because these channels are not normally monitored for fraud— there is no actual financial loss, so priority has been placed elsewhere in the business. However, loyalty points can be redeemed for gift cards, or sold on the black market, and the downstream affect is that it can inconvenience your customer and harm your brand’s image. Additionally, if you offer physical GCs, you want to have a scratch off PIN on the back of the card. If a GC is offered with no PIN, fraudsters can walk into a store, take a picture of the different card numbers, and then redeem online once the cards have been activated. Fraudsters will also tumble card numbers once they have figured out the numerical sequence of the cards. Using a PIN prevents both of these problems. The use of GCs is going to continue to increase in the coming years— this is no surprise. Mobile will continue to be incorporated with these offerings, and answering security challenges will be paramount to their success. Although we are in the age of the data breach, there is no reason that the experience of purchasing or redeeming a gift card should be hampered by overly cautious fraud checks. It’s possible to strike the right balance— grow your business securely by implementing a fraud solution that is fraud minded AND customer centric. *The use of GC/eGC is used interchangeably

End-of-draw approaching for many home equity lines of credit (HELOCs) originated during the U.S. housing boom period of 2006 – 2008