Many data furnishers are experiencing increases in dispute rates. It’s a tough spot to be in. Data furnishers are not only obligated under the FCRA to investigate and respond to all consumer disputes – reviewing every Automated Consumer Dispute Verification – but they must also do so within less than 30 days.

As the number of disputes rise, resources become taxed and the risk of not meeting Fair Credit Reporting Act (FCRA) obligations increases. Let’s face it, consumer disputes aren’t going away, but understanding the reported data and metrics behind disputes can help data furnishers minimize them and defend reporting strategies and processes.

5 Way to Uncover Data Inaccuracy

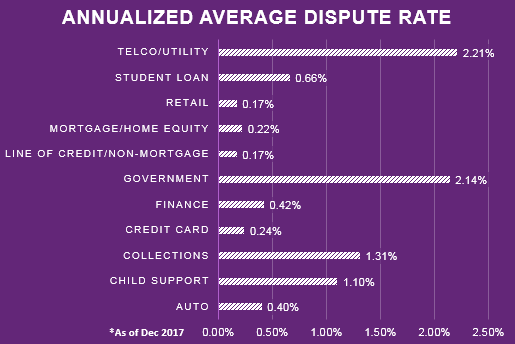

1. Gain perspective against the industry and peers. Depending on the industry you service, the general benchmarks for dispute rates can vary. It’s important to understand where you fall in regards to dispute rates. Are you trending high or low? As an annualized average, we’ve recently experienced the following industry dispute rates through the end of the year:

However, industry averages are just the tip of the iceberg. Measurement against peers can provide a clearer picture of where you fall. Are you an outlier or on par? How do you respond in comparison to peers? Are you deleting the trade as the result of the dispute at a higher rate? This could be an indicator of a systemic problem that needs addressing.

2. Implement pre-submission quality checks. Once you know where you stand, make sure your data is accurate before it heads out the door and hits the consumer’s credit report. Implement manual checks against Metro 2 rules. Build SQL queries to perform your checks. Better yet, use data validation software to automatically identify, track and remediate errors before sending the file to the bureaus. These steps can catch disputes before they happen.

3. Review any data being rejected after submission. Even if your new reporting motto is ‘know before it goes’; once the data has been transmitted, you’ll still want to monitor data being rejected due to Metro 2® errors. When data is rejected that means the update you provided did not make it to file. This leaves room for disputes. Incorporating a robust review of all rejected data in a timely and detailed manner, with updates made before the next reporting period, can improve the accuracy of your data.

4. Audit to identify and correct any stale data on file. An audit for any stale data – which includes open accounts with a balance greater than zero that have not been updated recently – should be performed at least annually. Review, research and remediate any outdated data that could affect your customer, making it susceptible to a dispute.

5. Educate your customers. Why are your customers disputing? Are there common themes within your customer base? Often, a dispute can be eliminated before it happens, with some explanation on the way an account is reported. By providing proactive access to materials and resources that help demystify the credit reporting process, a potentially negative interaction can be turned into a positive learning opportunity, helping the overall customer experience.

Learn more about data accuracy solutions.