The holiday season is almost here, and knowing how each generation plans to shop can give your holiday advertising campaigns the edge you need. Our recent survey of 1,000 U.S. consumers reveals 2024 holiday shopping trends for each generation and key insights into their anticipated spending levels, preferred shopping categories, and how they look for gift ideas.

In this blog post, we’ll explore three 2024 holiday shopping trends across generations:

- Projected consumer spending

- Top categories on shoppers’ lists

- Preferred channels for researching gifts

1. Projected consumer spending

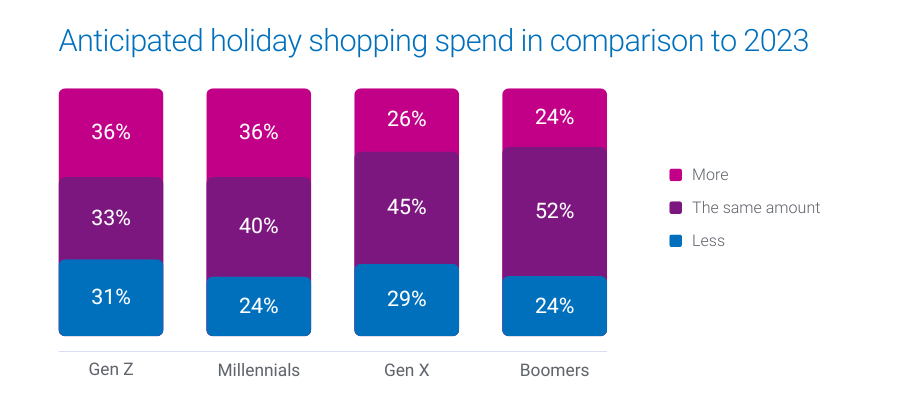

Over 1 in 3 Gen Z and Millennials are gearing up to increase their holiday budgets this year, while Gen X and Boomers are likelier to stick to last year’s budget.

- 36% of Millennials and Gen Z plan to spend more this holiday season

- 45% of Gen X and 52% of Boomers expect their spending to remain consistent with last year

What this means for marketers

These insights highlight the importance of tailoring your messaging. For Gen Z and Millennials, emphasize value and unique offerings that justify increased spending. For Gen X and Boomers, focus on trust and reliability, reinforcing their confidence in your brand.

How Experian can help you target these audiences

Experian’s custom and syndicated audience segments, including Holiday Shopper High Spenders and Holiday Shopper Moderate Spenders, enable you to connect with these diverse consumer groups. Our audiences are available on-the-shelf of leading ad platforms to help you reach people across social, TV, and mobile.

The election effect

U.S. holiday retail sales saw 4.1% YoY growth in 2016 and 8.3% YoY growth in 2020 following presidential elections. There’s a chance that holiday spending increases after the 2024 election, regardless of the outcome. Experian has 240+ politically relevant audiences that you can activate across major ad platforms ahead of the upcoming election.

2. Top categories on shoppers’ lists

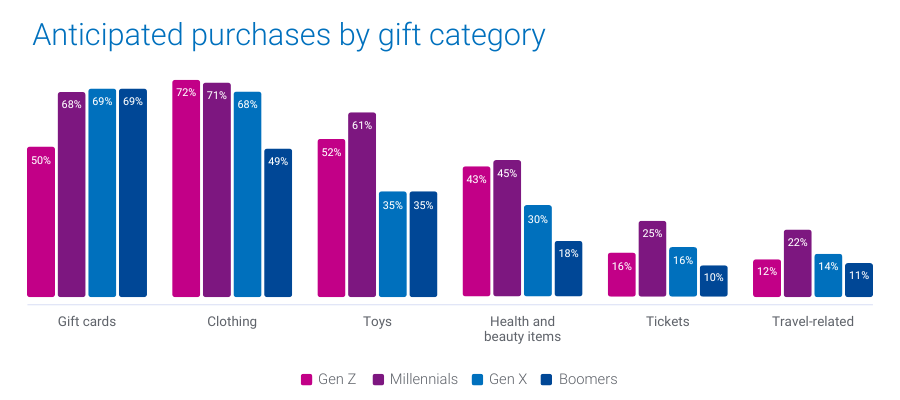

Different generations have distinct preferences when it comes to what they plan to buy. Gift cards top the list for Gen X and Boomers, while Gen Z leans toward clothing. Millennials are looking to splurge on toys, electronics, and experiences.

- 69% of Boomers and Gen X plan to purchase gift cards

- 72% of Gen Z will buy clothing

- 45% of Millennials will buy health and beauty items

- 25% of Millennials will buy tickets and 22% of Millennials will buy experiences

What this means for marketers

Align your product offerings and promotions with each generation’s preferences to capture their attention. For example, highlighting versatile gift cards may resonate more with older generations, while showcasing trendy apparel and tech gadgets will appeal to younger consumers.

How Experian can help you target these shoppers

We offer audience segments like Holiday Shoppers: Apparel, Cosmetics & Beauty Spenders, and Toys Shoppers that you can activate to connect with consumers primed to purchase in these categories.

We recently released 19 new holiday shopping audiences we recommend targeting to drive engagement and conversions. Download our audience recommendations here.

3. Preferred channels for researching gift ideas

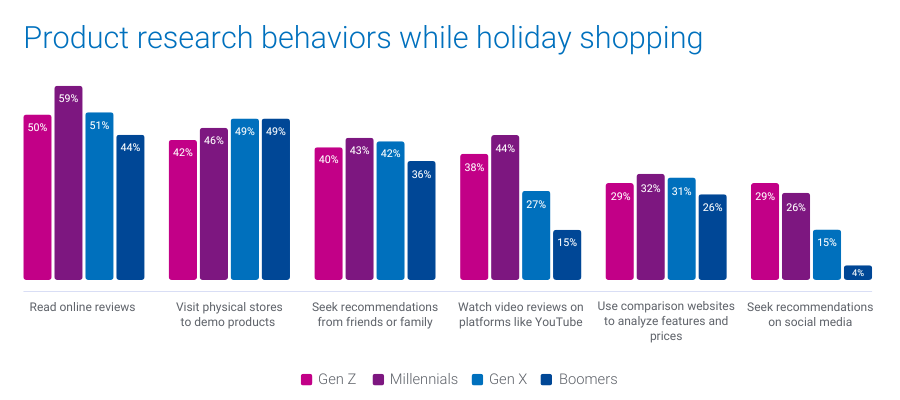

When it comes to finding the perfect gifts, Gen Z turns to social media, while Millennials prefer online reviews and video content. Boomers and Gen X are more inclined to visit physical stores for hands-on product evaluations.

- 29% of Gen Z and 26% of Millennials will look for gift ideas on social media

- 44% of Millennials will rely on video reviews and product demos on platforms like YouTube

- 49% of Gen X and Boomers plan to visit physical stores to evaluate products in person

What this means for marketers

Understanding where each generation looks for inspiration can guide your content and ad placement strategy. To engage Gen Z, focus on social media campaigns and influencer partnerships. For Millennials, consider investing in video content and reviews. For older generations, ensure your in-store experience is optimized to convert browsing into purchases.

How Experian can help you engage these shoppers

Our TrueTouchTM audiences can help you pair the perfect messaging styles with the right channels and calls to action. Our Social media channel and content engagement audiences can help you reach Gen Z who are likely to be active users on major social platforms and are Black Friday shoppers. For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide.

Download our report for five 2024 holiday shopping trends by generation

Understanding 2024 holiday shopping trends by generation can help you tailor your targeting, messaging, media planning, and creative based on the generation you’re targeting.

In addition to the insights covered here, download our 2024 Holiday spending trends and insights report to learn:

- When consumers plan to shop (hint: they’re already shopping)

- Where they plan to shop (online vs. in-store)

Download our full report to access all five of our predictions by generation, so you can address the diverse needs of this year’s holiday shoppers.

When you work with Experian for your holiday shopping campaigns, you’re getting:

- Accurate consumer insights: Better understand your customers’ behavioral and demographic attributes with our #1 ranked data covering the full U.S. population.

- Signal-agnostic identity solutions: Our deep understanding of people in the offline and digital worlds provides you with a persistent linkage of personally identifiable information (PII) data and digital IDs, ensuring you accurate cross-device targeting, addressability and measurement.

- Secure connectivity: Bring data and identity to life in a way that meets your needs by securely sharing data between partners, utilizing the integrations we have across the ecosystem, and using our marketing data in flexible ways.

Make the most of this holiday shopping season with Experian. Contact us today to get started.

Source

Online survey conducted in June, 2024 among n=1,000 U.S. adults 18+. Sample balanced to look like the general population on key demographics (age, gender, household income, ethnicity, and region).

Latest posts

As the pandemic took hold of the country and stay-at-home orders were put in place, one of the consumer categories that was most adversely affected was the restaurant industry. But while sit-down restaurants were forced to pivot to curbside delivery and other inventive means to make ends meet, quick-service restaurants (QSRs) that already had a solid delivery program or drive-through in place saw a surge in new guests. “Dinner and a movie” took on a different meaning as people either picked up or ordered in to make date night happen, and QSRs rose to the occasion like never before. With some states beginning phased re-openings of non-essential businesses, some restaurants are now allowed to open so long as they follow social distancing rules or allow for outdoor dining areas. But that doesn’t mean consumers will be ready to race out and participate in this new dining experience. Many may remain apprehensive about safety and continue to “dine at a distance” until they’re confident that they can remain healthy, or until a successful vaccine goes into use. Even as states begin their phased re-opening plans, many continue to work from home—which has greatly affected both dine-in and QSR venues. Those who saw a robust lunchtime crowd probably saw a drop-off while business-based locals shifted their office plans. However, new opportunities have emerged for restaurants to reach out to their regular lunch crowd to offer delivery or attract a whole new lunch crowd who may not have thought to order from them before. Between the challenges of a post-pandemic world, a shifting of diner priority, and an uncertain future facing the restaurant world, it’s now more important than ever before to leverage an intelligent, data-driven marketing strategy to ensure your campaigns reach the right consumers, and also attract new customers to expand your customer base over time. All of this can be done using the power of data, but having the right data is key to making the most of your marketing efforts. As you’re crafting your current marketing plans, it’s important to look at all the variables you need to address to create more targeted messaging, thus helping you zero in on your most desired consumer base. The first thing to consider is, how well do you know your guests, and what do you know about them? If you have no insight into their dining habits or preferences, it will be challenging to come up with messaging that will speak to them. But with the right data, you can discover if they frequent your competitor’s locations (and if so, how often), which apps they’re using to order food, which days of the week, and even which meals they are most likely to order. You can also use this information to better understand how often you factor into your customer’s dining plans by understanding if they are beginning to commute again, or continuing to work from home, and if the latter, do they live near one of your locations. Data can also help you discover more about who they are, so you can even further tailor your messaging to their needs. Let’s say your target customer is married with children. Addressing their busy life as a professional and a parent, and sharing how you can ease the burden of dinnertime to make life easier for them, may be exactly the kind of message of support they need to encourage them to reach out to you. Using data based on demographics, lifestyle, behavior, attitudinal and mobile location data can help you cook up a marketing strategy with precision and success, resulting in more diners knocking on your door (or at least, calling for take-out). Another key component to consider is the use of mobile location data, which Zeta Global cites1 as being the most important data chain restaurants can use for their marketing plans. Not only can this data be used to better understand share of wallet and potential up-sell opportunities, but it can also be leveraged to reach out directly to potential new customers that have historically frequented your top competitors. You can also use mobile location data to connect with consumers who may be more drawn to your restaurant because of your delivery or curbside pick-up options, and craft outreach based on that information that will encourage them to order with you. As Hospitality Tech pointed out2, building trust in a post-pandemic world is key for QSRs who want to continue to encourage loyalty with current guests, and entice new ones to place orders. The key to making that happen is data. By deploying marketing messages that resonate, activating them on the channels your guests use most, then measuring the impact of your campaigns, QSRs can create more opportunities for success and customer connection that can translate into real, long-term results. Plus, the right data can help you increase store traffic with high value guests, reactivate guests who haven’t visited in a while and find new individuals who live nearby that closely resemble your current high value guests. Experian has decades of experience in helping organizations better communicate with their customers across all marketing channels. How can we help you? Find out more about our restaurant marketing solutions. 1https://zetaglobal.com/blog/chain-restaurants-need-customer-data/ 2https://hospitalitytech.com/new-marketing-communications-playbook-during-covid-19

2020 has been a year of change and challenges for businesses and consumers alike. With the global pandemic, we have seen stay at home orders put in place, a shift to work from home for many, major events canceled, schools shifted to online format, graduations and other end-of-year activities canceled, and more. As we move through the phases of reopening, everyone is figuring out how to navigate the ‘new normal’ in the wake of new safety requirements, businesses are working to determine what their day-to-day operations will look like as they reopen. The changing times have implications on how consumers act, what and how they purchase, and how they manage their daily lives. With these changing times, consumers are quickly adapting their lifestyles which impacts the choices they make on how they shop, bank and provide for their families. Businesses across the United States are trying to understand how consumers are feeling during this time and how that might correlate with their visitation patterns. Using Experian’s Mobile Location data, coupled with Consumer Sentiment data, we looked at foot traffic and sentiment trends in the retail space throughout the pandemic. As you can see from the chart, there has been a steady increase in household visits to retail locations since March that correlates with the rise in sentiment. Note the differences in visitation patterns across the regions. You can see some foot traffic spikes, which correlate to reopening phases in several states during the week of May 4th and Memorial Day weekend. However, you see a lower average of foot traffic in the Northeast U.S. where reopening phases are rolling out at a slower pace. It is going to be essential for businesses to craft marketing strategies on a regional level as guidelines for reopening are the state-level. This means that a business’s consumers look different based on where they are located and might require more targeted and sensitive messaging. For example, using Experian’s Mosaic segmentation, we further delved into what consumers look like today by analyzing those Mosaics who have the most positive change in regard to the pandemic, versus those that had the most negative. You can see in the charts that there is a significant difference between the Mosaics trending positively versus those trending negatively. Consumer segments have drastically different sentiment, and foot traffic patterns and understanding how your consumers are feeling and where they are shopping will help improve your ROI. Having a comprehensive and targeted marketing plan will be essential for companies as they navigate the intricacies of reopening. Experian’s Reopening Package allows brands to take a phased approach to better understand and reach both new and existing customers through targeting, analytics and key insights. Companies can analyze their consumers’ sentiments and visitation patterns during the pandemic, segmented by Experian Mosaic® lifestyle segmentation group. Businesses can then take those insights and apply them to other models, or create their own models, to build out and run effective marketing campaigns that target current and prospective customers. A successful long-term marketing strategy needs to be data-driven, leveraging data and analytics to help craft targeted messaging. We can see that consumers want to shop again – foot traffic patterns appear to have increased since June, and sentiment is up – now it is necessary to understand where your customers fit into the spectrum. Missed our recent webinar, How COVID-19 Has Shaped Consumer Behavior for Retailers? Access the on demand version here.

Overview Chartable leverages The Tapad Graph to improve cross-device attribution rates and remove non-addressable IPs for clients. Challenge Chartable needs to differentiate between consumer and potential business IP addresses to provide accurate household modeling and reduce excess data for their customers. Podcasting generally only has access to IP addresses as a form of digital ID which limits its ability to connect activity to individuals and extend it across all devices. The Tapad + Experian solution Using Tapad, now a part of Experian, Chartable is able to cut through the noise of IP data and discard any addresses deemed a shared IP or business. Then, Tapad + Experian connects individual users to their other digital IDs and users in their household; creating a richer attribution model for Chartable customers. Increase in podcast attribution rates Get started with The Tapad Graph For personalized consultation on the value and benefits of The Tapad Graph for your business, email Sales@tapad.com today!