As Earth Day approaches, it’s the perfect opportunity for marketers to explore innovative ways to engage with eco-conscious customers. With a strong and growing interest in sustainable business practices worldwide, green audiences are becoming increasingly influential. In addition to being good for the planet, engaging these customers is great for any brand or organization striving to become more eco-friendly and socially responsible. By taking advantage of this timely event and using appropriate tools, you can create personalized campaigns that will both promote your brand and increase customer loyalty.

Eco-conscious audiences

In this blog post, we’ll cover three eco-conscious audiences to target this Earth Day:

- Solar energy

- GreenAwareTM

- Electric vehicles

Solar energy

Our first eco-conscious audience is Solar energy. Consumers in this audience show an inclination toward harnessing the power of the sun as a clean, renewable energy source. Our audience data can provide valuable insights into the Solar energy consumer base, including their age, education level, occupation, household income, and communication preferences. Let’s explore these metrics to better understand how to reach this group effectively.

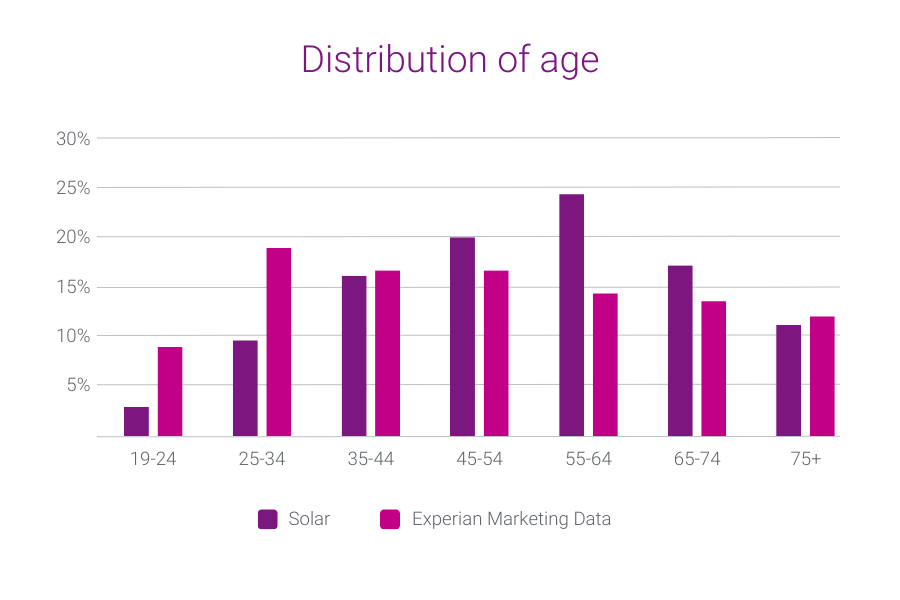

Age and living situation

Consumers in our Solar energy audience are more likely to live in a home with two or more adults and are between the ages of 45-74.

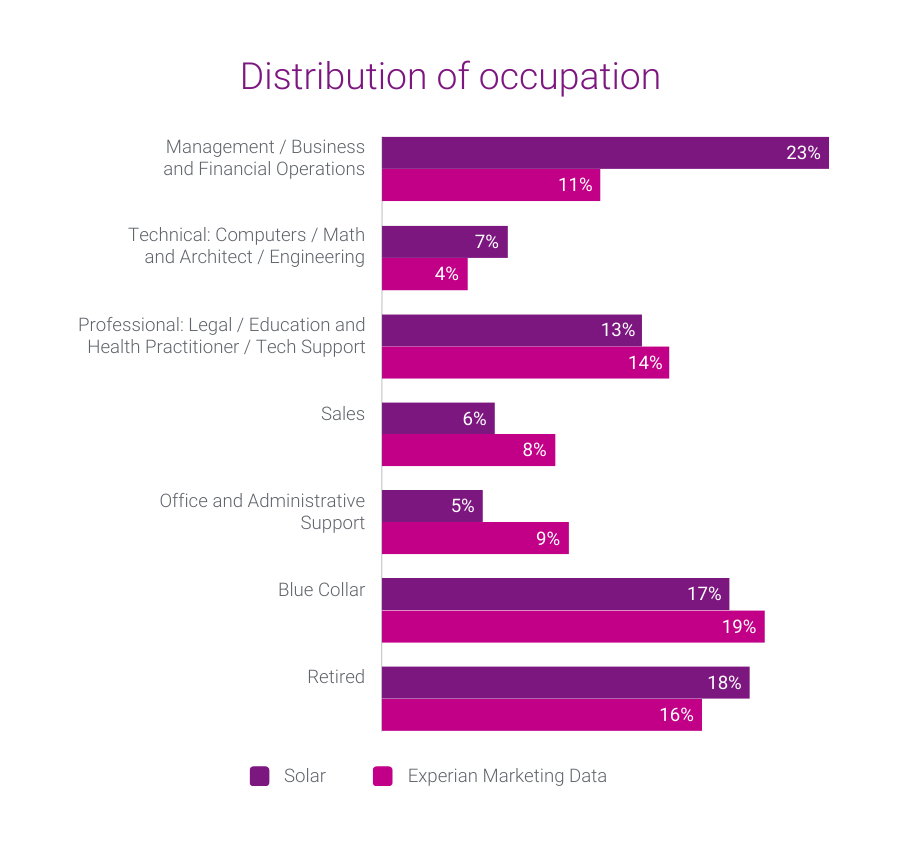

Education level and occupation

Consumers in our Solar energy audience are more likely to have graduated from college or graduate school and work in management-level occupations.

Household income

Consumers in our Solar energy audience have household incomes of more than $75,000 and their homes are valued at over $550,000.

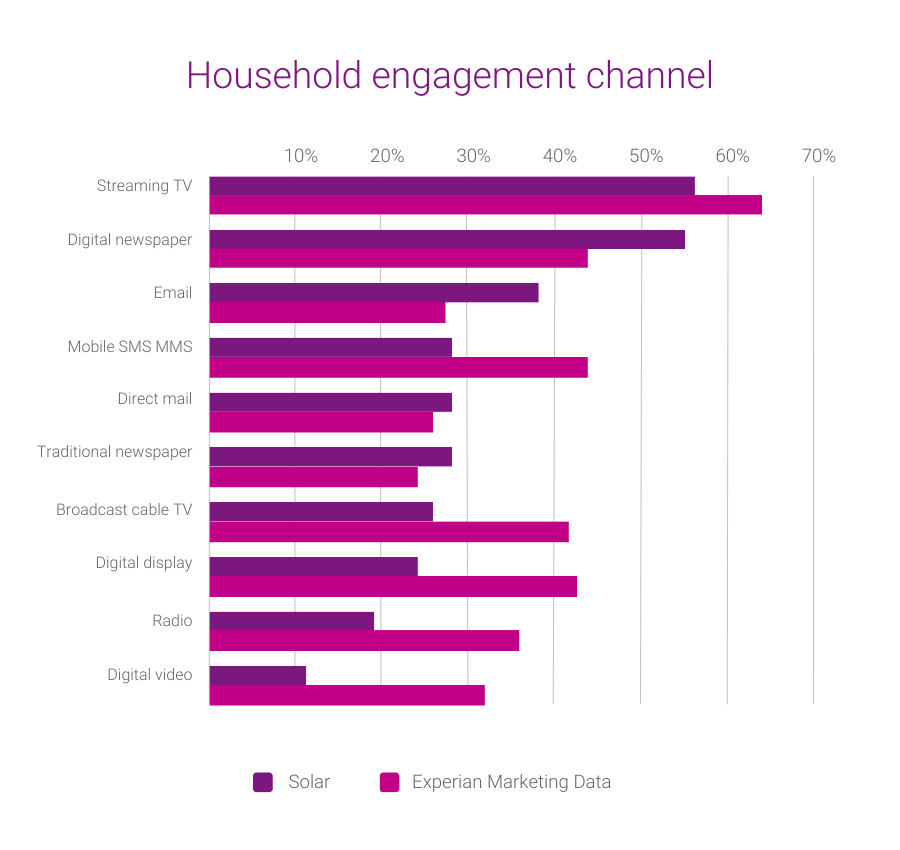

Preferred engagement channels

Consumers in our Solar energy audience are most receptive to ads served through digital channels like digital newspapers and email.

Solar energy audience pairings

Consumers in our Solar energy audience also belong to three of our Mosaic® USA groups:

- Power Elite

- Flourishing Families

- Booming with Confidence

Our consumer segmentation portal of 126 million households and 650 lifestyle and interest attributes empowers marketers like you to precisely target your ideal audience and communicate with them on a personal level. Mosaic’s data segments the U.S. into 19 overarching groups and 71 underlying types, giving you the insights needed to anticipate the behavior, attitudes, and preferences of your most profitable customers and communicate with them on their preferred channels, with messaging that resonates.

GreenAware

Our second eco-conscious audience is GreenAware.

GreenAware segments the 126 million U.S. households within Consumer View into four distinct groups. Each group differs in their attitudes and behaviors toward purchasing products that are environmentally safe and working with companies that are eco-conscious. We created these groups using an enhanced application of traditional statistical clustering techniques based on environmentally relevant measurements in Simmons’ National Consumer Study.

Based on the distinctive mindset of consumers toward the environment, you can learn how environmental concerns fit into their lives through four major consumer segments:

- Eco-Friendly Enthusiasts

- Sustainable Spectators

- Passive Greenies

- Eco Critics

Let’s dive deeper into each group to understand their unique perspective on the environment and how this impacts their attitudes and behaviors.

Eco-Friendly Enthusiasts

This eco-conscious segment prioritizes a green lifestyle and takes pride in avoiding products that harm the planet. With traditional and liberal values, they embrace optimism and prioritize family. With their children out of the house, they take the time for some well-deserved rejuvenation and are committed to a healthy lifestyle. Some members of this group are transitioning into retirement and welcoming a new chapter in their life.

- Mature adults and retirees

- College graduate or more

- Above average income

- May be married or single

- Typically own their homes

Sustainable Spectators

This segment aspires to be more sustainable, but they struggle with translating their green ideas into action. They have a soft spot for a cozy home. While their love for interior design and taking care of their own space is evident, they’re always looking for new experiences and opportunities to learn. Staying healthy and active is a top priority for this group, so it’s no surprise that they’re always looking for ways to stay fit and feel their best.

- Established and mid-life adults

- College graduate or more

- High income

- Typically married

- Likely to own their homes

Passive Greenies

This is the largest and one of the most youthful groups. Known for their love of exploration and self-discovery, they may not have fully embraced eco-conscious behaviors yet, but they are eager to stay current with the latest technology and trends. With their incredible ability to multitask, they’re always on-the-go, and constantly seek the next best thing.

- Mainly young adults and diverse

- Education ranges from high school through some college

- Below average income

- More likely to be single or divorced

- Typically rent

Eco Critics

This group is not likely to be eco-conscious and may have negative attitudes about the environment. They are confident, driven, and focused on their personal growth. They crave instant gratification, seeking out quick and easy solutions to their everyday decisions. They place a high value on entertainment, their social life, and carefully curate their image.

- Young and established adults

- Education ranges from high school through post-graduate studies

- High income

- Married or single

- Typically own their homes

Let’s take a look at how the GreenAware segments stack up against each other in terms of age, household income, education level, and media preference. How do they compare? Let’s find out.

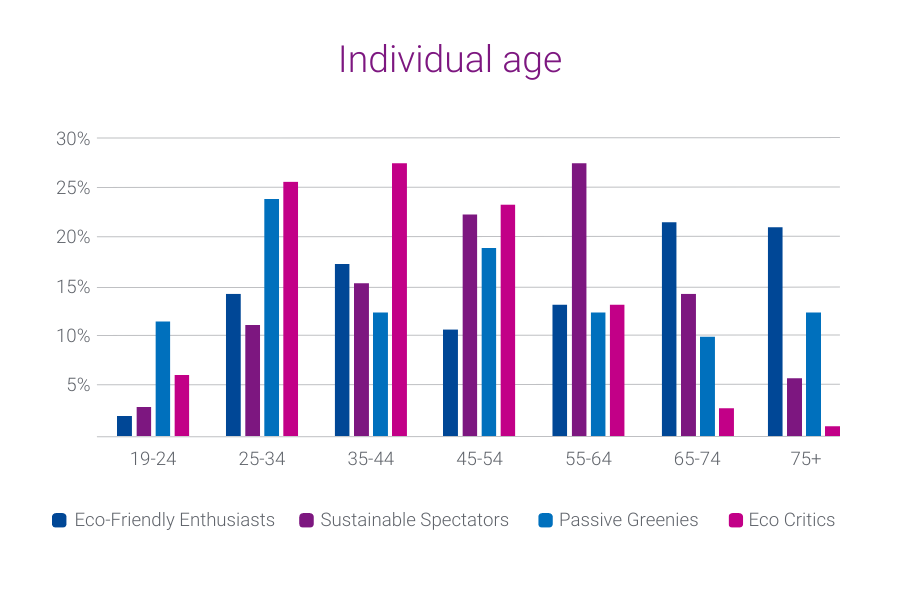

Age

Consumers in the Eco-Friendly Enthusiasts segment are the oldest of the four GreenAware segments – about half of the consumers are 65 or older. Eco Critics are the youngest segment, with over half of consumers in this group between ages 25-44.

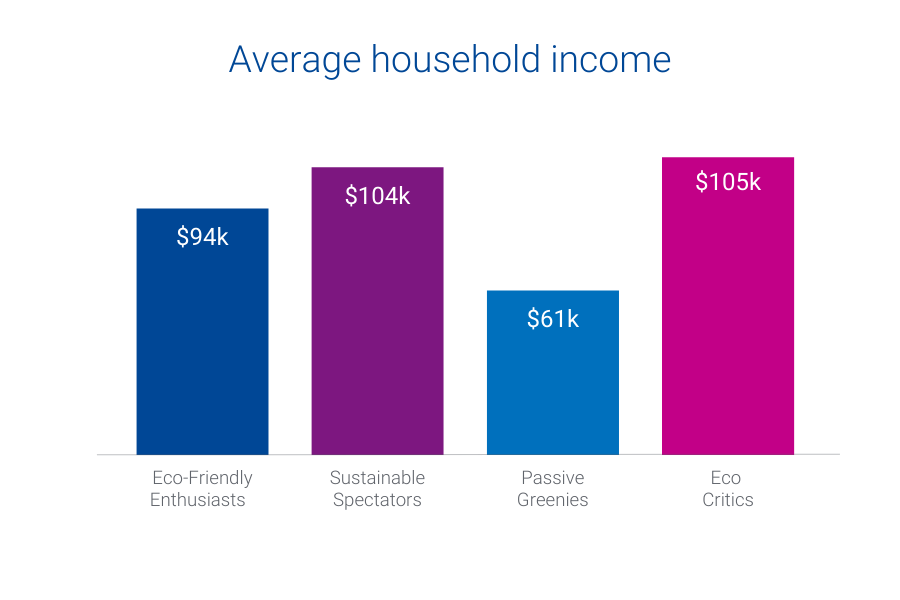

Household income

Sustainable Spectators and Eco Critics are the wealthiest GreenAware segments. The average household income of consumers in these segments is above $100,000. Passive Greenies have the lowest household income, with a majority below $50,000.

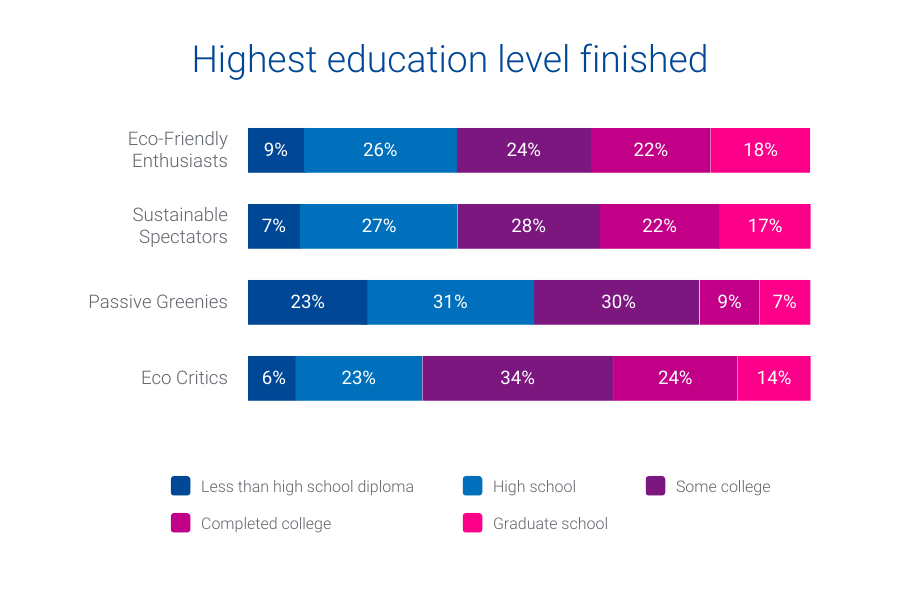

Education level and occupation

Passive Greenies are more likely to work Blue Collar jobs and have the lowest level of education. As the wealthiest segments, Sustainable Spectators and Eco Critics have the highest levels of college degrees and work in management, business, and financial operations. Eco-Friendly Enthusiasts are the most likely to be retired and out of the workforce.

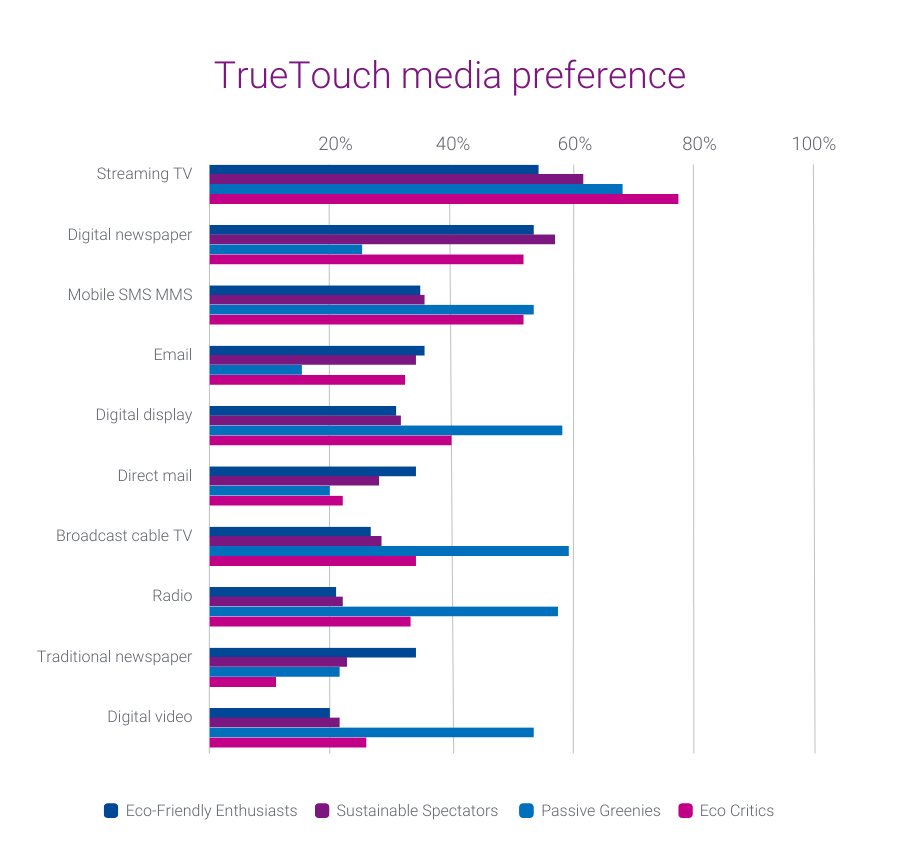

Preferred engagement channels

Streaming TV is the preferred engagement channel for all GreenAware segments.

Eco-Friendly Enthusiasts prefer digital channels like digital newspapers, mobile SMS, and email. They also engage with traditional channels like direct mail and newspaper.

Passive Greenies have a high preference for digital display, mobile SMS, digital video, broadcast cable TV, and radio.

Eco Critics have a high preference for digital channels like digital newspapers, mobile SMS, and digital display.

Sustainable Spectators strongly prefer digital newspapers. They don’t show as strong of a preference for mobile SMS and digital display as Eco Critics and Passive Greenies.

GreenAware audience pairings

Six of our Mosaic groups have at least one GreenAware segment with 10% or more of the population. For more precise targeting, below are suggested Mosaic audiences you can pair with each GreenAware segment:

| Eco-Friendly Enthusiasts | Sustainable Spectators | Passive Greenies | Eco Critics |

| Booming with Confidence | Power Elite | Singles and Starters | Power Elite |

| Autumn Years | Booming with Confidence | Golden Year Guardians | Suburban Style |

| Golden Year Guardians | Singles and Starters |

Electric vehicles

Our third eco-conscious audience is electric vehicles.

Electric vehicles (EVs) are having a major moment in the automotive industry. This is no surprise given that new EV models are being released and an increasing number of charging stations are popping up around the country. As EVs become more prominent, it’s essential to stay up to date on relevant trends to make informed decisions about what lies ahead.

The demand for electric vehicles (EVs) is on the rise

Consumers are embracing the EV revolution, showing their desire for a cleaner, greener future. Automotive marketers are increasingly looking to reach in-market EV shoppers and current alternative fuel vehicle owners due to the growing availability of electric vehicles, improved infrastructure, and rising popularity. In 2022, EVs charged up the market and accounted for a remarkable 6% of new retail registrations.

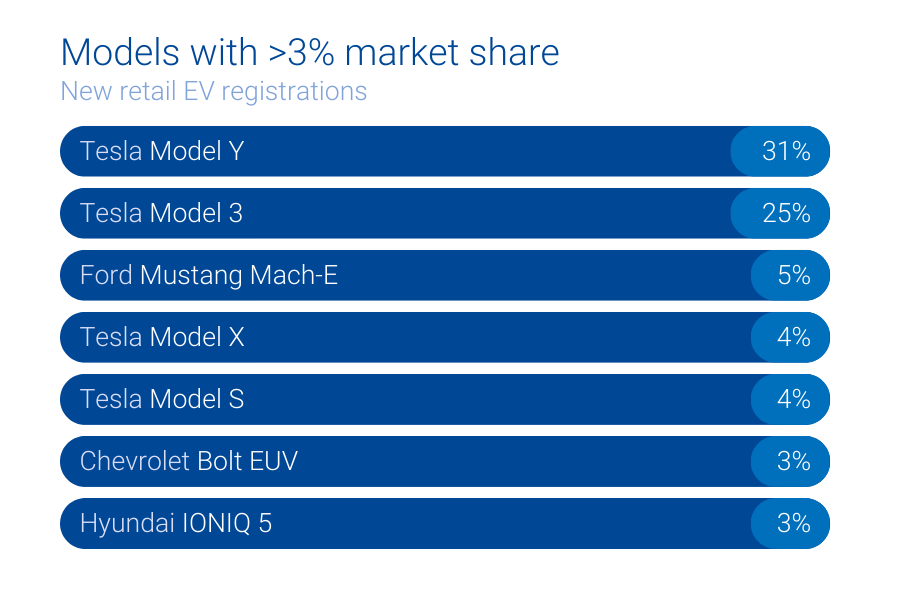

While Tesla continues to dominate the EV market, Ford, Chevrolet, and Hyundai are starting to compete, each holding more than 3% of the market share of new retail EV registrations.

Geography

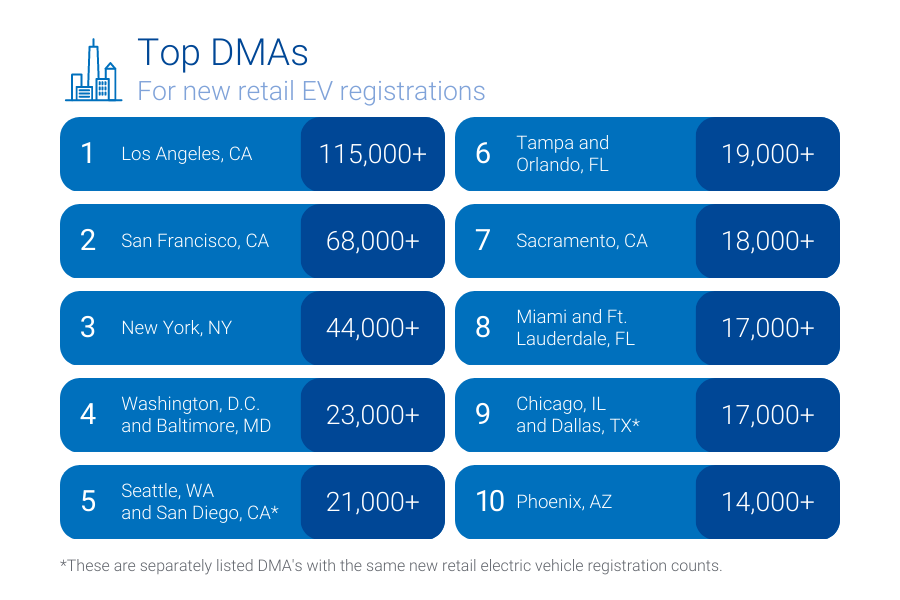

Where are we seeing the most new retail EV registrations? The top designated market areas (DMAs) for new retail EV registrations are mostly located in heavily populated, coastal cities like Los Angeles, CA and New York, NY.

The fastest growing DMAs, however, are in smaller cities like Tucson, AZ and Oklahoma City, OK.

Generational demographics

Gen X and Millennials make up the largest percentage of new retail EV buyers at 37.5% and 34.4%. Gen Z and the Silent generation represent the smallest shares at 5% and 2.1%. Boomers hover between Gen X and Millennials’ share and account for 20.6% of new EV retail purchases.

EV audience pairings

Our top five Mosaic groups for new EV buyers include:

- American Royalty

- Cosmopolitan Achievers

- Philanthropic Sophisticates

- Couples with Clout

- Fast Track Couples

How to target consumers in-market for electric vehicles

We offer 70+ audiences that are focused on likely buyers and owners of EV and plug-in hybrid (PHEV) vehicles. We also offer a subset of 28 audiences focused on individual EV/PHEV vehicle models.

Below is how you can find a few of these audiences on-the-shelf of most trusted advertising platforms:

- Autos, Cars, and Trucks > In Market-Fuel Type > Electric

- Autos, Cars, and Trucks > In Market-Fuel Type > Used Electric

- Autos, Cars, and Trucks > In-Market Make and Models > Tesla

- Autos, Cars, and Trucks > In-Market Make and Models > Chevrolet Bolt EV

We can help you reach eco-conscious consumers

Earth Day is a great opportunity to get creative with your marketing efforts with our three eco-conscious audiences: Solar energy, GreenAware, and electric vehicles. To find out how you can add eco-conscious audiences to your marketing plan, contact us.

Latest posts

Experian’s Chief Product Officer, Kimberly Gilberti, shares her insights on the potential of advertising on connected TV (CTV).

Samsung’s demand-side platform (DSP) is now equipped with Experian’s data insights to improve campaign targeting, reach, and more.

Hear what two industry leaders from Experian had to say about the potential of connected TV (CTV) advertising at Beet Retreat 2023.