As Earth Day approaches, it’s the perfect opportunity for marketers to explore innovative ways to engage with eco-conscious customers. With a strong and growing interest in sustainable business practices worldwide, green audiences are becoming increasingly influential. In addition to being good for the planet, engaging these customers is great for any brand or organization striving to become more eco-friendly and socially responsible. By taking advantage of this timely event and using appropriate tools, you can create personalized campaigns that will both promote your brand and increase customer loyalty.

Eco-conscious audiences

In this blog post, we’ll cover three eco-conscious audiences to target this Earth Day:

- Solar energy

- GreenAwareTM

- Electric vehicles

Solar energy

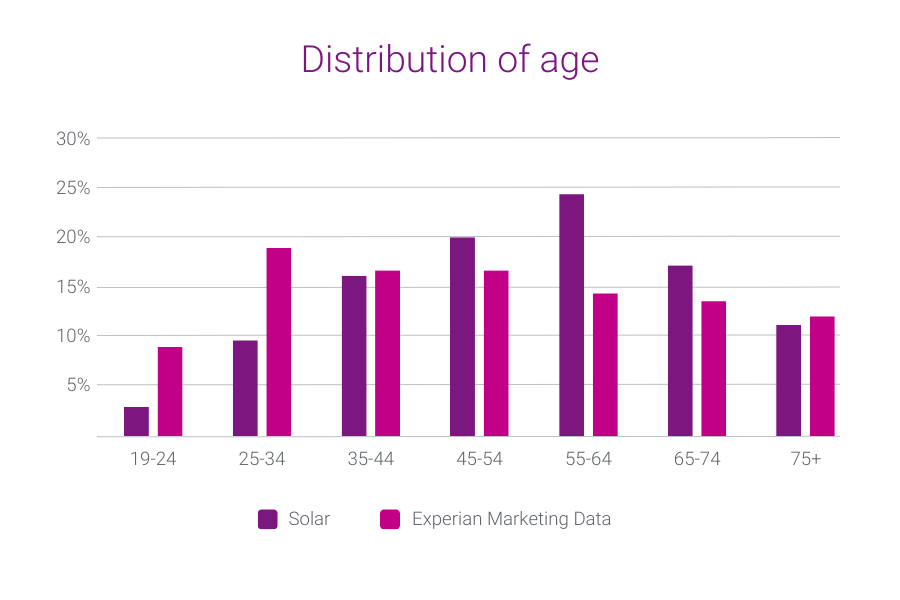

Our first eco-conscious audience is Solar energy. Consumers in this audience show an inclination toward harnessing the power of the sun as a clean, renewable energy source. Our audience data can provide valuable insights into the Solar energy consumer base, including their age, education level, occupation, household income, and communication preferences. Let’s explore these metrics to better understand how to reach this group effectively.

Age and living situation

Consumers in our Solar energy audience are more likely to live in a home with two or more adults and are between the ages of 45-74.

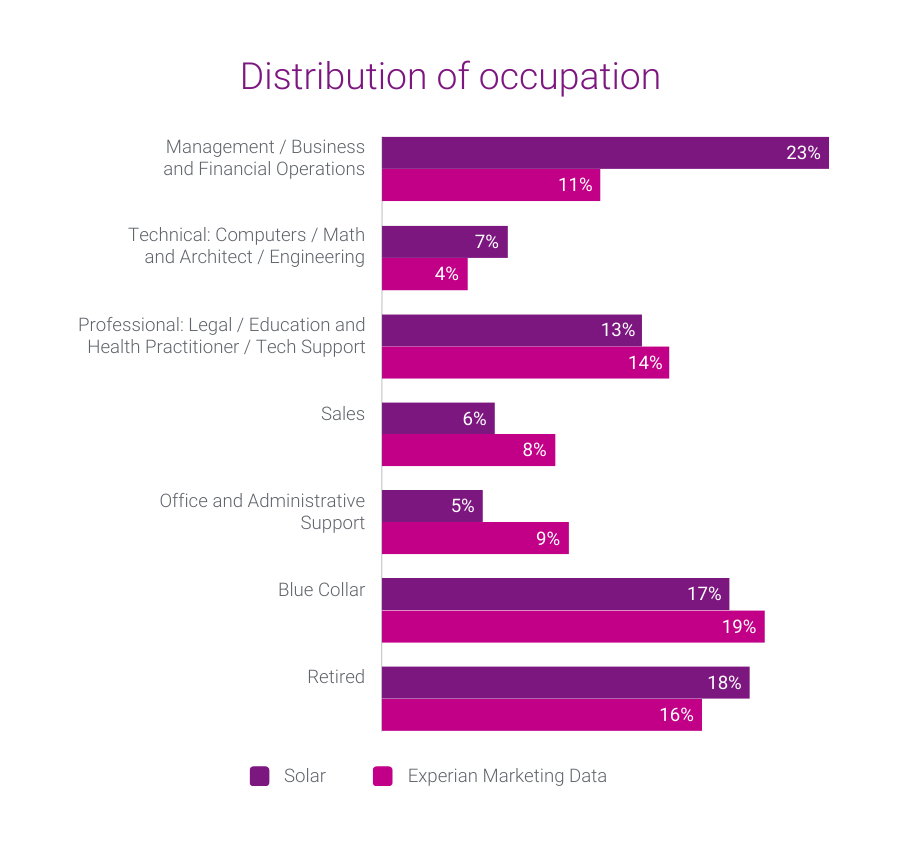

Education level and occupation

Consumers in our Solar energy audience are more likely to have graduated from college or graduate school and work in management-level occupations.

Household income

Consumers in our Solar energy audience have household incomes of more than $75,000 and their homes are valued at over $550,000.

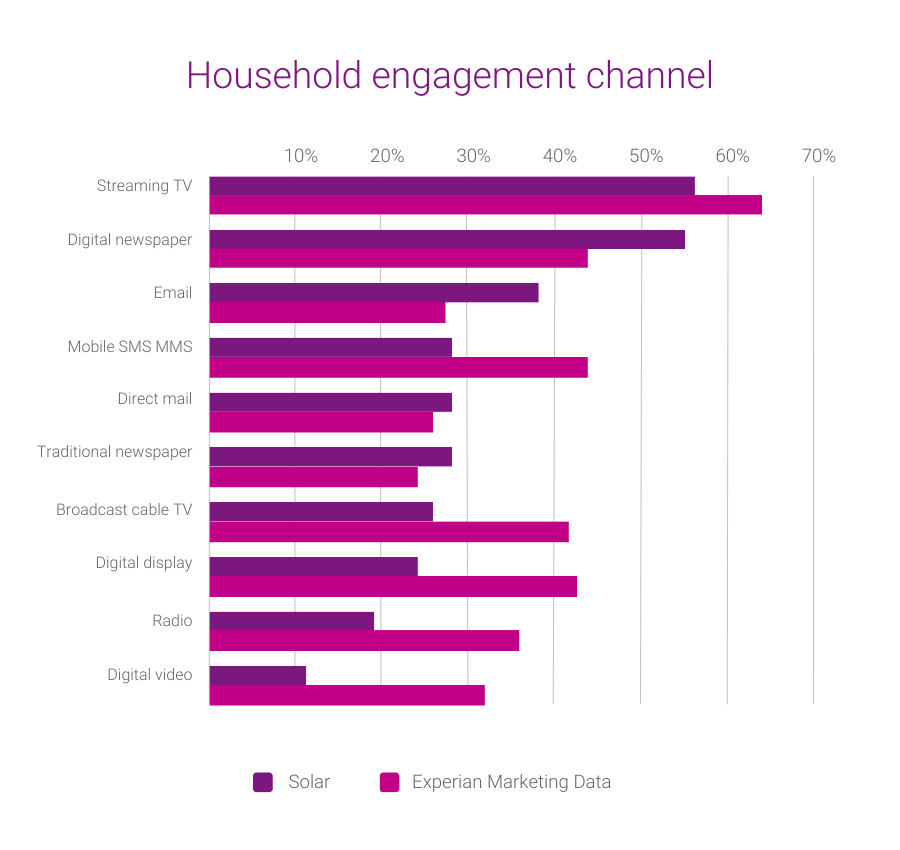

Preferred engagement channels

Consumers in our Solar energy audience are most receptive to ads served through digital channels like digital newspapers and email.

Solar energy audience pairings

Consumers in our Solar energy audience also belong to three of our Mosaic® USA groups:

- Power Elite

- Flourishing Families

- Booming with Confidence

Our consumer segmentation portal of 126 million households and 650 lifestyle and interest attributes empowers marketers like you to precisely target your ideal audience and communicate with them on a personal level. Mosaic’s data segments the U.S. into 19 overarching groups and 71 underlying types, giving you the insights needed to anticipate the behavior, attitudes, and preferences of your most profitable customers and communicate with them on their preferred channels, with messaging that resonates.

GreenAware

Our second eco-conscious audience is GreenAware.

GreenAware segments the 126 million U.S. households within Consumer View into four distinct groups. Each group differs in their attitudes and behaviors toward purchasing products that are environmentally safe and working with companies that are eco-conscious. We created these groups using an enhanced application of traditional statistical clustering techniques based on environmentally relevant measurements in Simmons’ National Consumer Study.

Based on the distinctive mindset of consumers toward the environment, you can learn how environmental concerns fit into their lives through four major consumer segments:

- Eco-Friendly Enthusiasts

- Sustainable Spectators

- Passive Greenies

- Eco Critics

Let’s dive deeper into each group to understand their unique perspective on the environment and how this impacts their attitudes and behaviors.

Eco-Friendly Enthusiasts

This eco-conscious segment prioritizes a green lifestyle and takes pride in avoiding products that harm the planet. With traditional and liberal values, they embrace optimism and prioritize family. With their children out of the house, they take the time for some well-deserved rejuvenation and are committed to a healthy lifestyle. Some members of this group are transitioning into retirement and welcoming a new chapter in their life.

- Mature adults and retirees

- College graduate or more

- Above average income

- May be married or single

- Typically own their homes

Sustainable Spectators

This segment aspires to be more sustainable, but they struggle with translating their green ideas into action. They have a soft spot for a cozy home. While their love for interior design and taking care of their own space is evident, they’re always looking for new experiences and opportunities to learn. Staying healthy and active is a top priority for this group, so it’s no surprise that they’re always looking for ways to stay fit and feel their best.

- Established and mid-life adults

- College graduate or more

- High income

- Typically married

- Likely to own their homes

Passive Greenies

This is the largest and one of the most youthful groups. Known for their love of exploration and self-discovery, they may not have fully embraced eco-conscious behaviors yet, but they are eager to stay current with the latest technology and trends. With their incredible ability to multitask, they’re always on-the-go, and constantly seek the next best thing.

- Mainly young adults and diverse

- Education ranges from high school through some college

- Below average income

- More likely to be single or divorced

- Typically rent

Eco Critics

This group is not likely to be eco-conscious and may have negative attitudes about the environment. They are confident, driven, and focused on their personal growth. They crave instant gratification, seeking out quick and easy solutions to their everyday decisions. They place a high value on entertainment, their social life, and carefully curate their image.

- Young and established adults

- Education ranges from high school through post-graduate studies

- High income

- Married or single

- Typically own their homes

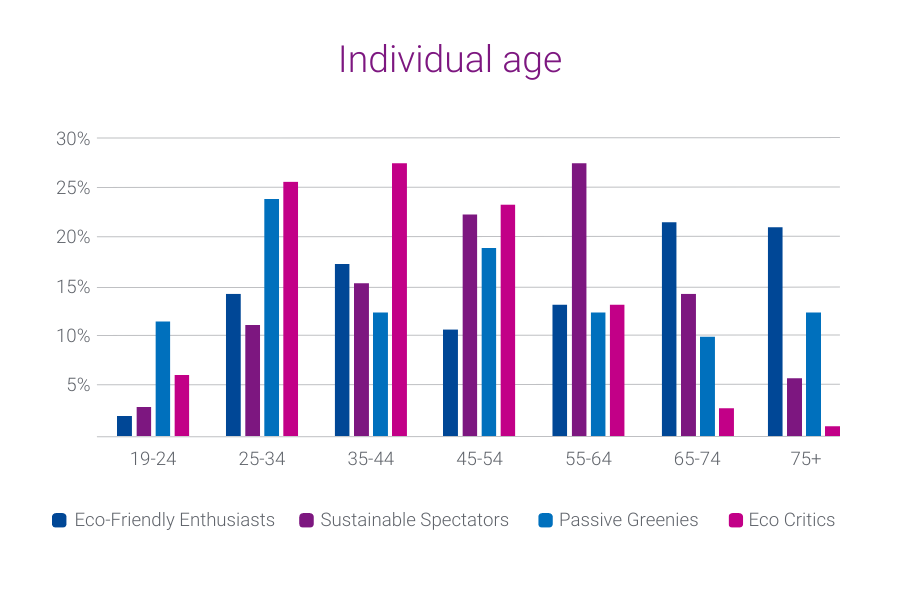

Let’s take a look at how the GreenAware segments stack up against each other in terms of age, household income, education level, and media preference. How do they compare? Let’s find out.

Age

Consumers in the Eco-Friendly Enthusiasts segment are the oldest of the four GreenAware segments – about half of the consumers are 65 or older. Eco Critics are the youngest segment, with over half of consumers in this group between ages 25-44.

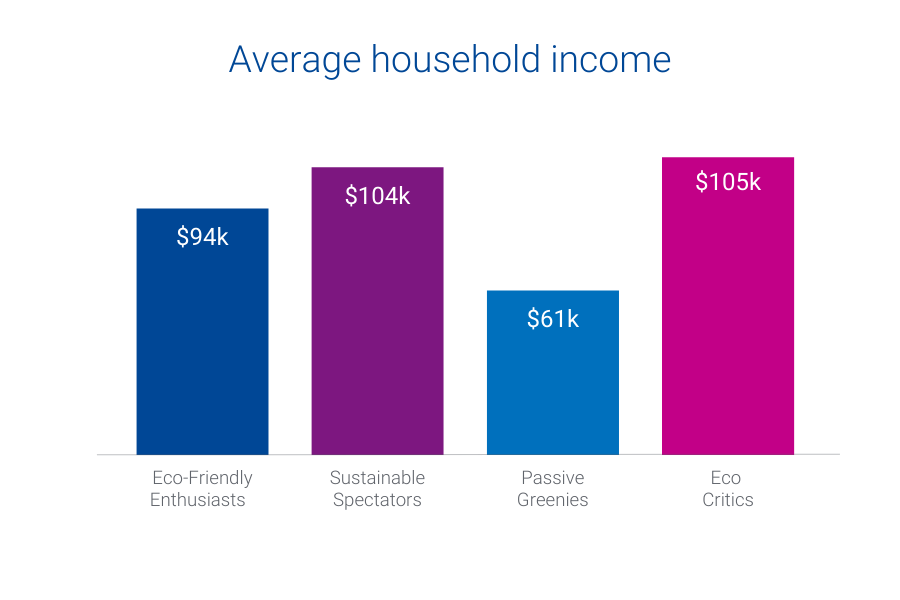

Household income

Sustainable Spectators and Eco Critics are the wealthiest GreenAware segments. The average household income of consumers in these segments is above $100,000. Passive Greenies have the lowest household income, with a majority below $50,000.

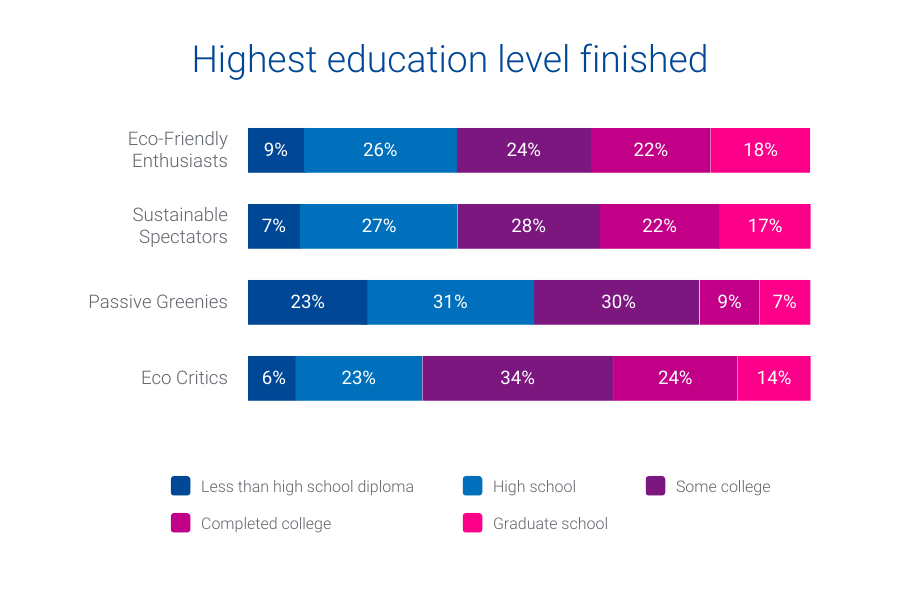

Education level and occupation

Passive Greenies are more likely to work Blue Collar jobs and have the lowest level of education. As the wealthiest segments, Sustainable Spectators and Eco Critics have the highest levels of college degrees and work in management, business, and financial operations. Eco-Friendly Enthusiasts are the most likely to be retired and out of the workforce.

Preferred engagement channels

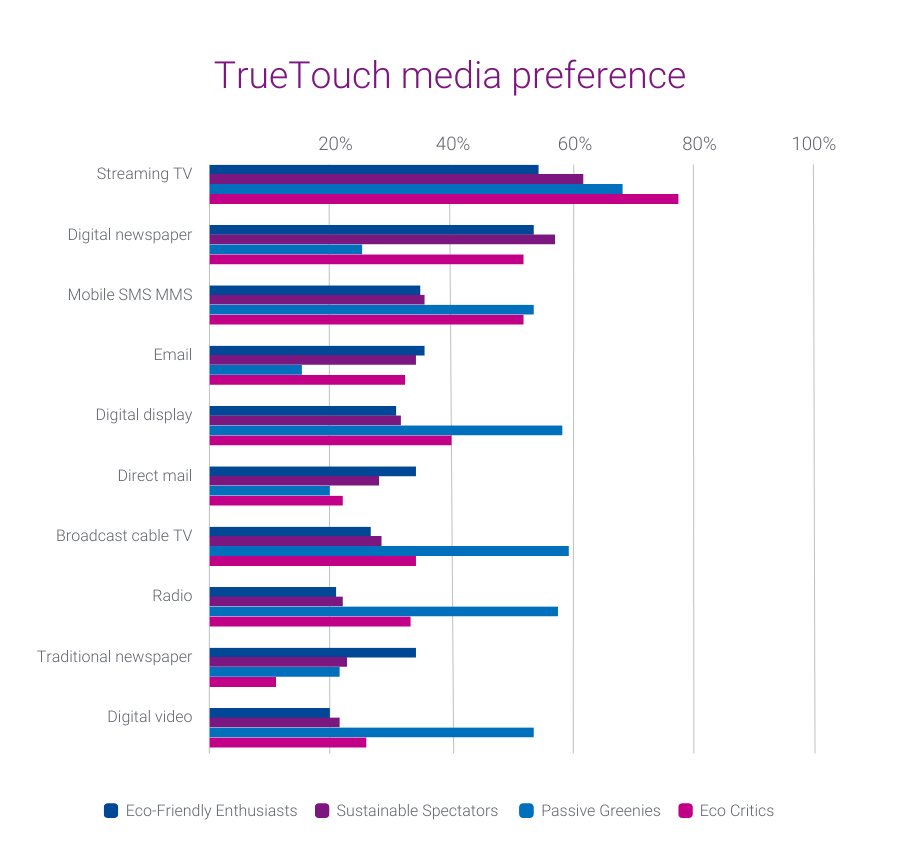

Streaming TV is the preferred engagement channel for all GreenAware segments.

Eco-Friendly Enthusiasts prefer digital channels like digital newspapers, mobile SMS, and email. They also engage with traditional channels like direct mail and newspaper.

Passive Greenies have a high preference for digital display, mobile SMS, digital video, broadcast cable TV, and radio.

Eco Critics have a high preference for digital channels like digital newspapers, mobile SMS, and digital display.

Sustainable Spectators strongly prefer digital newspapers. They don’t show as strong of a preference for mobile SMS and digital display as Eco Critics and Passive Greenies.

GreenAware audience pairings

Six of our Mosaic groups have at least one GreenAware segment with 10% or more of the population. For more precise targeting, below are suggested Mosaic audiences you can pair with each GreenAware segment:

| Eco-Friendly Enthusiasts | Sustainable Spectators | Passive Greenies | Eco Critics |

| Booming with Confidence | Power Elite | Singles and Starters | Power Elite |

| Autumn Years | Booming with Confidence | Golden Year Guardians | Suburban Style |

| Golden Year Guardians | Singles and Starters |

Electric vehicles

Our third eco-conscious audience is electric vehicles.

Electric vehicles (EVs) are having a major moment in the automotive industry. This is no surprise given that new EV models are being released and an increasing number of charging stations are popping up around the country. As EVs become more prominent, it’s essential to stay up to date on relevant trends to make informed decisions about what lies ahead.

The demand for electric vehicles (EVs) is on the rise

Consumers are embracing the EV revolution, showing their desire for a cleaner, greener future. Automotive marketers are increasingly looking to reach in-market EV shoppers and current alternative fuel vehicle owners due to the growing availability of electric vehicles, improved infrastructure, and rising popularity. In 2022, EVs charged up the market and accounted for a remarkable 6% of new retail registrations.

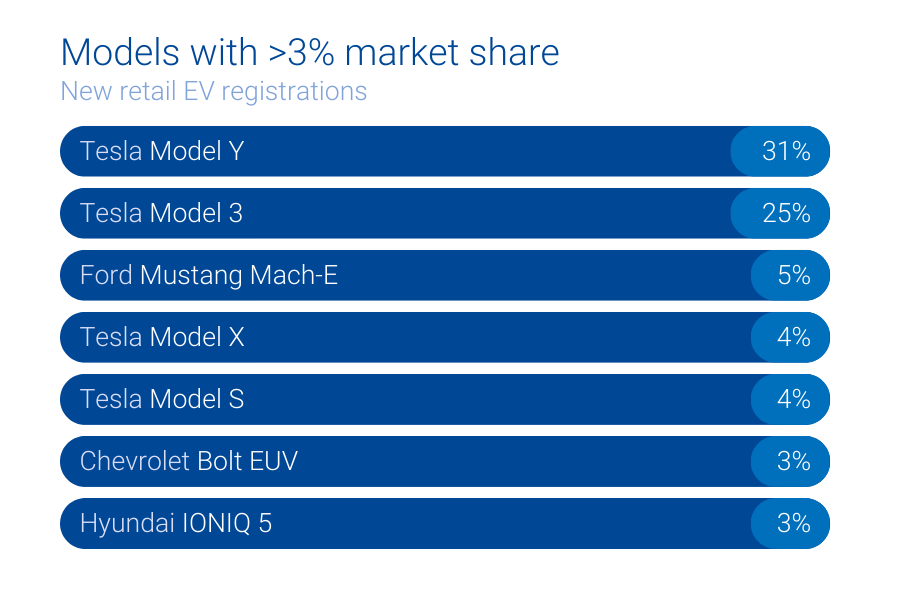

While Tesla continues to dominate the EV market, Ford, Chevrolet, and Hyundai are starting to compete, each holding more than 3% of the market share of new retail EV registrations.

Geography

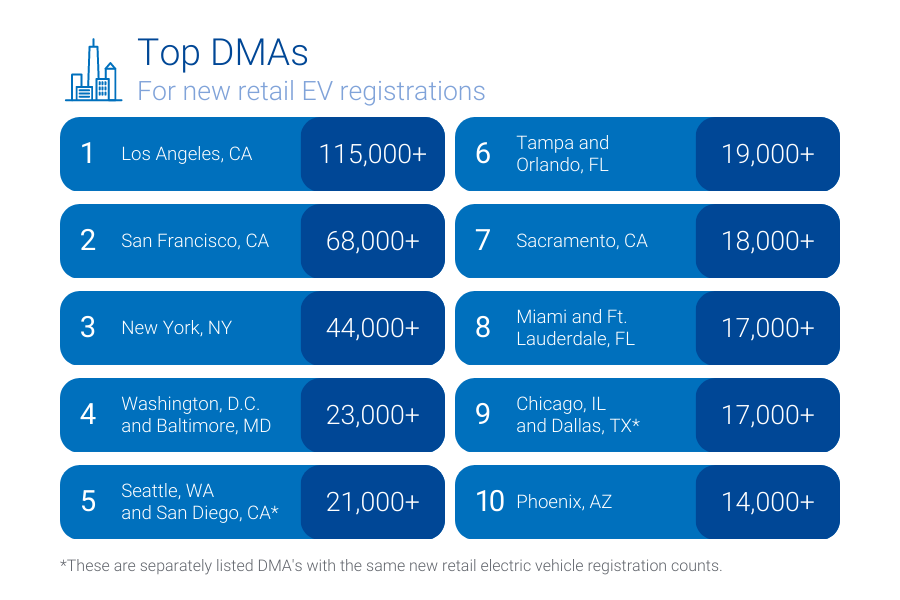

Where are we seeing the most new retail EV registrations? The top designated market areas (DMAs) for new retail EV registrations are mostly located in heavily populated, coastal cities like Los Angeles, CA and New York, NY.

The fastest growing DMAs, however, are in smaller cities like Tucson, AZ and Oklahoma City, OK.

Generational demographics

Gen X and Millennials make up the largest percentage of new retail EV buyers at 37.5% and 34.4%. Gen Z and the Silent generation represent the smallest shares at 5% and 2.1%. Boomers hover between Gen X and Millennials’ share and account for 20.6% of new EV retail purchases.

EV audience pairings

Our top five Mosaic groups for new EV buyers include:

- American Royalty

- Cosmopolitan Achievers

- Philanthropic Sophisticates

- Couples with Clout

- Fast Track Couples

How to target consumers in-market for electric vehicles

We offer 70+ audiences that are focused on likely buyers and owners of EV and plug-in hybrid (PHEV) vehicles. We also offer a subset of 28 audiences focused on individual EV/PHEV vehicle models.

Below is how you can find a few of these audiences on-the-shelf of most trusted advertising platforms:

- Autos, Cars, and Trucks > In Market-Fuel Type > Electric

- Autos, Cars, and Trucks > In Market-Fuel Type > Used Electric

- Autos, Cars, and Trucks > In-Market Make and Models > Tesla

- Autos, Cars, and Trucks > In-Market Make and Models > Chevrolet Bolt EV

We can help you reach eco-conscious consumers

Earth Day is a great opportunity to get creative with your marketing efforts with our three eco-conscious audiences: Solar energy, GreenAware, and electric vehicles. To find out how you can add eco-conscious audiences to your marketing plan, contact us.

Latest posts

Next up in our Ask the Expert series, we hear from Sarah Ilie and Lauren Portell. Sarah and Lauren talk about the internet’s value exchange – what we gain and lose when it’s so easy to share our information. Is convenience hurting or helping us? The age of connectivity Today, it’s almost unimaginable to think about how your day-to-day life would look without the convenience of the internet, smartphones, apps, and fitness trackers; the list goes on and on. We live in the age of connectivity. We have the convenience to buy products delivered to our homes on the same day. We can consume content across thousands of platforms. We also have watches or apps that track our health with more granularity than ever before. The internet's value exchange In exchange for this convenience and information, we must share various kinds of data for these transactions and activities to take place. Websites and apps give you the option to “opt in” and share your data. They also often let you know that they are collecting your data. This can feel like an uncomfortable proposition and an invasion of privacy to many people. What does it mean to opt-in to a website or app’s tracking cookies? What value do we exchange? What opting in means for you Opting in to cookies means that you are allowing the app or website to track your online activity and collect anonymous data that is aggregated for marketing analytics. The data provides valuable information to understand users better to create better online experiences or offer more useful products and content. Granting access to “tracking” offers several benefits to users such as a customized, more personal user experience or advertising that is more likely to be relevant. For example, let’s imagine you have recently been using an app or website to plan a camping trip. By sharing your data, the website or app has visibility into what is interesting or useful to you which can lead to related content suggestions (best campsites) or relevant advertising and product recommendations (tents and camping equipment). It’s important to know that the marketing data collected when you opt in is extremely valuable. The revenue that advertising generates is often very important to websites and apps because this is how they make money to continue providing content and services to consumers. Data privacy practices Privacy concerns regarding how companies and developers use tracking information have risen over the last couple of years and have resulted in additional protection for consumers’ privacy while still allowing companies to improve their products and advertising. One big step in this direction has been simply making people aware that their data is being collected, why it’s being collected, and providing users with the option to share this data for marketing analytics through opting-in or not. Other important steps to maintain online privacy include formal legal legislation and self-regulation. The right to privacy is protected by more than 600 laws between individual states and federal legislation and the U.S. House Committee on Energy and Commerce recently voted to pass the American Data Privacy and Protection Act. Additionally, marketing organizations such as the Interactive Advertising Bureau and Association of National Advertisers regulate themselves with codes of conduct and standards given there is so much attention on privacy issues. Is the internet's value exchange worth it? The data that we choose to share by opting in has a lot of benefits for us as consumers. There are laws in place to protect our data and privacy. Of course, it’s important to be aware that data is collected and used for marketing purposes, but it’s also reasonable to share a certain amount of data that translates into benefits for you as well. The best data unlocks the best marketing. Contact us to tap into the power of the world’s largest consumer database. Learn how you can use Experian Marketing Services' powerful consumer data to learn more about your customers, drive new business, and deliver intelligent interactions across all channels. Meet the Experts: Lauren Portell, Account Executive, Advanced TV, Experian Marketing Services Sarah Ilie, Strategic Partner Manager, Experian Marketing Services

We asked the experts about hashed email. What is email hashing? Do we need to hash email addresses in databases? What can we expect for hashed identifiers?

While the weather outside is frightfully hot this summer, it’s never too soon to start thinking about the holidays – and consumers are more likely to start their holiday shopping early this year. To get you ready for the 2022 holiday shopping season, we looked back at consumer shopping trends from 2019-2021. What did we learn and what trends do we expect to see this year? Let’s look back. A look back Over the last three years, average consumer spending has increased. Record 2021 holiday sales came amidst a wave of COVID-19 cases, rising inflation, labor shortages, and supply chain problems. Despite these challenges, consumers continued to let it snow when it came to spending during the holiday season. 2022 has been a year with its own economic roadblocks – the war in Ukraine, rising gas prices, and recession concerns. Yet 2021 was a banner year for holiday sales despite its obstacles, and we predict similar trends in the 2022 holiday shopping season. What trends do we expect to see for the most wonderful time of the year? 2022 predictions While consumer spending remains strong, changing economic conditions continue to shape shopper behavior. To develop our predictions for 2022 holiday shopper behavior, we focused on four key areas: When consumers shop Where consumers shop What consumers purchase Consumer media preferences Now, let's make our holiday campaign planning checklist and check it twice. When consumers shop Chestnuts roasting on an open fire. Jack Frost nipping at your nose. Those aren’t the only ways to know when the holiday season has begun. Shoppers tend to spread out their holiday purchases across multiple months and were more likely to start shopping earlier. To understand holiday retail sales trends from 2019-2021, we identified four shopper segments: Early Shoppers Traditional Shoppers Late Shoppers Random Shoppers What differences did we see between our four shopper segments? Early shoppers made almost half of their holiday purchases in October Random shoppers spread out their holiday purchases evenly across multiple months Late shoppers made almost half of their holiday purchases in December Traditional shoppers made almost half of their holiday purchases in November While December continues to dominate holiday sales, October has started to gain traction over the last three years, and November remains a core shopping month. Everybody knows a turkey and a mistletoe help to make the season bright but knowing when your consumers are most likely to shop will help deck your campaign planning halls. Jingle bell rock your way to holiday sales that shine bright with our tips to prepare for earlier shoppers: Offer targeted promotions earlier in the shopping season Target your ads based on the shopping habits of your customers throughout the season Where consumers shop There’s no place like home for the holidays but most consumers aren’t shopping from home. Despite the rise in online shopping, brick and mortar locations continue to dominate holiday sales. October is the most popular month to take a one-horse open sleigh to a store, and consumers gather around the fire to online shop in November and December. With most shoppers preferring to shop in-store, and e-commerce popularity growing, it’s critical to think about bridging the gap between your online and offline presence for the consumer. Are you offering multiple paths to purchase with solutions such as BOPIS (Buy Online, Pickup In-Store)? Go down in history like Rudolph with our tips to prepare for more in-store shopping: Focus on in-store shopping experience technology (self-checkout, VR, QR codes, scan to pay, etc.) Offer multiple paths to purchase to connect your online and physical presence through methods such as BOPIS (Buy Online, Pickup In-Store), BORIS (Buy Online, Return In-Store), and ROPO (Research Online, Purchase Offline), etc. What consumers purchase When it comes to holiday gifts, for some, only a hippopotamus will do. Compared to pre-pandemic, shoppers are spending more at apparel stores and mass retailers. Spending at specialty retailers, warehouse clubs, and on office, electronic, and games is almost the same across holiday and non-holiday shopping months. Time for toys and time for cheer may be year-round, but are there any correlations between where consumers shop (online vs. in-store) and what they purchase? Our data found that shoppers who bought from mass retailers were more likely to shop online, while shopping for apparel and warehouse clubs was done at a physical store location. Put this insight to the test by thinking through how you can target your consumer based on where they shop in-store and online. You just might find that hippopotamus at a brick and mortar mass retailer location! Consumer media preferences Do you see what I see? While we are seeing a shift to digital media channel preference, consumers still engage with traditional media channels like direct mail and the traditional newspaper. Successfully connecting with your customers involves capturing their attention through the right channel. We found that our four shopping groups prefer a mix of traditional and digital media channels. What does your media channel mix look like? Hark! The herald angels sing of ways to adapt to the change in holiday spend and media preferences: Align your activation efforts to digital, but don't forget about traditional channels Expand your targeting and activation focus beyond in-store vs. online Download our new 2024 report For a deeper dive into our predictions and actionable insights you can use to take your holiday campaign planning home for the holidays, download our new 2024 report. Experian data can help you refine your content and creative strategy to achieve maximum ROI for each campaign across all your channels. Download now