Following the success of our recent launch of Third-Party Onboarding, we are excited to introduce the Experian marketplace, a new addition to our portfolio of data-driven activation solutions.

Experian’s marketplace bridges TV operators, programmers, supply partners, and demand platforms with top-tier third-party audiences across retail, CPG, health, B2B, and location intelligence. Easily activate premium audiences from leaders like Attain, Alliant, Circana, and Dun & Bradstreet – driving precise, efficient consumer reach.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

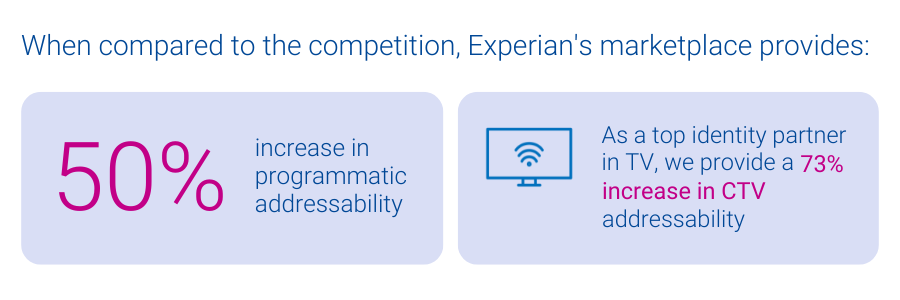

As privacy regulations evolve and traditional identity signals shift, many activation platforms face declining addressability. This impacts their ability to effectively reach consumers, which is critical to staying competitive. Experian’s marketplace, powered by our identity graphs which include 126 million households, 250 million individuals, and 4 billion active digital IDs, enables audiences to be easily activated and maintain high addressability across display, mobile, and connected TV (CTV) channels.

Benefits of Experian’s marketplace

- Enhanced addressability and match rates: All audiences delivered from our marketplace benefit from our best-in-class offline and digital identity graphs, which ensure addressability across all channels like display, mobile, and CTV. Unlike other data marketplaces, Experian ensures all identifiers associated with an audience have been active and are targetable, improving the accuracy of audience planning.

- Simplified audience planning and distribution for TV Operators: TV operators can build custom audiences matched directly to their subscriber footprint and distribute them across all advanced TV channels (data-driven linear, addressable, digital, and CTV) for maximum impact.

- Diversification within the data marketplace ecosystem: With the recent departure of Oracle’s advertising business, the optionality for buyers and sellers to connect with third-party data has become increasingly limited. With Experian marketplace, we’re excited to offer a new solution to the market that ensures data-driven targeting can continue to take place at scale.

- Lower activation costs: Experian’s marketplace offers transparent, pass-through pricing with no additional access fees, enabling partners to maximize their earnings while reducing costs.

- Audience diversity and scale: Platforms can access a broad range of audiences across top verticals from our partner audiences, which can be combined with 2,400+ Experian Audiences. This offers the flexibility, reach, and scale necessary to effectively execute advertising campaigns.

- Remove compliance concerns: Experian’s rigorous data partner review ensures available audiences comply to all federal, state and local consumer privacy regulations.

“Circana and Experian have enjoyed a deep partnership for over a decade. We are exceedingly excited to extend our partnership and be an early adopter and launch partner of the Experian data marketplace. This additional capability will enable the ecosystem to more easily access Circana’s purchase-based CPG and General Merchandise (for example Consumer Electronics, Toys, Beauty, Apparel etc.) audience segments to drive performance outcomes across all media channels.”

Patty Altman, President, Global Solutions, Circana

“Capturing the attention of target audiences across channels is critical for marketers navigating an increasingly connected digital world. We are excited to be an exclusive provider of B2B solutions within Experian’s marketplace, helping brands and media agencies to accelerate their reach, addressability and targeting capabilities across TV, mobile and connected TV channels.”

Georgina Bankier, VP of Platform Partnerships at Dun & Bradstreet

Better connections start here: Experian’s marketplace

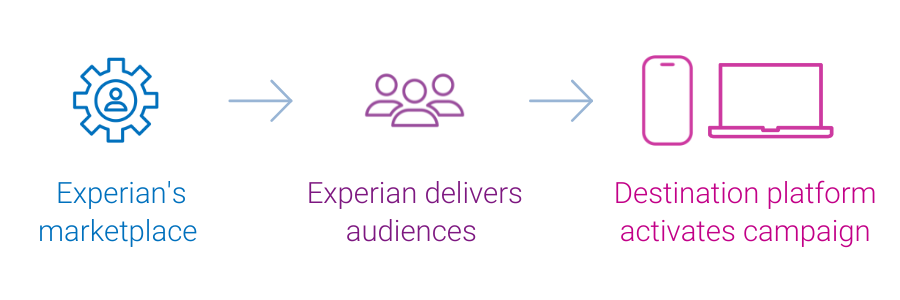

Experian’s marketplace, easily accessible from our Audience Engine platform, brings unparalleled addressability, enabling our clients to reach more relevant consumers and increase revenue.

If you’re interested in learning more about Experian’s marketplace or becoming an active buyer or seller in our marketplace, please contact us.

Latest posts

Every day it seems, mobile device fragmentation increases. With consumers spending their time online across multiple devices – phones, tablets, over-the-top TV devices, gaming consoles, a nascent, yet growing internet-of-things, and a variety of other internet connected devices – the challenge of keeping up with consumers continues to be a daunting one. The industry has, of course, adopted many different identity solutions and cross-device technologies. Perhaps you’ve adopted some of them. Perhaps you feel like they are working. But perhaps you feel you could be doing a better job at connecting the dots. Marketers require solutions that can truly unify identities across channels and devices in order to understand consumer behavior, predict intent, and ultimately reach them with relevant communications. The easier it is to do that, the better. So, consider a couple scenarios and see how well are you doing. Within your core CRM data, are you able to connect your email subscribers to your in-store customers, all without relying on a loyalty program? Can you do this all the way down to an individual level? And are you leveraging this connected identity information to inform future online targeting? This kind of PII-based identity management is foundational to consumer engagement! Next scenario. Are you an app publisher? Or a media platform? Or any other type of organization that has a steady stream of device data? How much do you know about the consumer behind the device? Behavioral information is certainly a step in the right direction. But what about known consumer insights? How deep is the profile of information you’ve built for each device? Does it include both online and offline insights? Done in a compliant manner? There are a myriad of different techniques and approaches available to you to keep up with consumers. If you’re considering implementing a new strategy in the near future, or have questions about your current ones, contact Experian and we can help assess the opportunities available to you.

The Tapad Device Graph™ Complements Freckle’s IoT Capabilities to Extend Scale and Precision of Audience Data New York, NY — December 6, 2017 — Tapad, part of Experian, is the leader in cross-device marketing technology and Freckle IoT, the global leader in multi-touch, offline attribution, today announced they are partnering to provide brands with a holistic and insightful view of their customers, in predefined locations in all global markets. Starting today Freckle IoT will be leveraging the Tapad Device Graph™ to supplement the company’s data set to offer brands more granular attribution data. Consumer’s online behavior is becoming more and more complex, with the average consumer owning three or more devices and 35 percent of consumers converting on a different device from the one on which they started their research. These interactions become even more complicated when considering how online interactions and media impact offline sales. The collaboration between Tapad and Freckle, which combines Freckle IoT’s persistent location data with Tapad’s proprietary cross-device technology, is an important step in empowering brands with the information they need to better understand how digital media, consumed across multiple devices, is impacting offline attribution. Using its opt-in, first-party data, Freckle IoT helps brands measure the effectiveness of their advertising by independently matching media spend to in-store visits. Tapad’s technology extends Freckle’s data-set by allowing brands to access additional deterministic and probabilistic data, at scale and across all devices, to analyze consumer behavior ahead of in-store purchase. “Combining our technology with Tapad’s identity-driven solutions was a natural fit for our business,” said Neil Sweeney, founder and CEO at Freckle IoT. “With our unbiased, agnostic measurement and Tapad’s precise and privacy-safe data set, we knew this partnership would be a strong complement to providing more effective results for the needs of our brand partners.” “Freckle IoT is a valuable partner for Tapad as our cross-channel attribution capabilities continue to expand at global scale,” says Chris Feo, SVP, strategy and global partnership at Tapad. “Marketers today need a tool that can address the online and offline disconnect throughout the consumer journey. Freckle’s IoT innovations combined with the Tapad Device Graph help address this need by providing brands, across multiple verticals, accurate and precise identity-driven data powered by true consumer behavior — online and offline.” For more information about the Tapad Device Graph™, or to request a demonstration, contact us. For more information on Freckle IoT’s measurement offerings, please visit www.freckleiot.com.

London – 24 November, 2017 – Tapad, part of Experian, is the leader in cross-device marketing technology and continues to broaden its reach across EMEA. The business today reported a 20 percent growth in the scope of its regional device graph, a data set used by organisations to map consumers to their devices, enabling better, more personalised cross-device marketing. This news complements Tapad’s recent expansion of its UK team with the hire of experienced solutions engineer, Davide Rosamilia. As the demand for cross-device technology solutions continues to grow around the globe, coupled with the emergence of regulations such as Europe’s General Data Protection Regulation (GDPR), Tapad is committed to offering suppliers the greatest level of insight without compromising consumer privacy. Since Tapad started licensing its proprietary Tapad Device GraphTM just over a year ago, demand for the company’s technology has experienced significant growth. New supply partnerships and proactive data sourcing have also meant an increase in devices across key markets, which contribute to the overall 20 percent growth of the EMEA device graph, including a 44 percent increase in the U.K., 47 percent in France, and 85 percent in Germany. “We’re continuing to invest heavily in growing our regional device graph, allowing us to better meet the needs of EMEA marketers as they strive to reach individuals with greater precision in some of the most tightly regulated marketplaces worldwide,” said Tom Rolph, VP EMEA, Tapad. “This year, we have also welcomed 10 new data suppliers whom we’ve helped to increase cross-device amplification, attribution and audience extension, helping to further set us apart in the marketplace and successfully expand our EMEA presence.” Available around the world, the Device Graph provides access to Tapad’s globally compliant and privacy-safe datasets across EMEA, APAC and the U.S., and offers deeper knowledge of consumer preferences, purchase intent, and conversion behaviors. “Tapad has shown a unique ability to adapt to the nuances of the local EMEA market and display impressive growth without sacrificing dedication to privacy,” said Alistair Hill, CEO and Co-founder at On Device Research. “When we started vetting technology vendors, we needed to be sure that we selected a partner that could offer compliant and privacy-safe datasets to operate within our stringent data standards. Tapad’s probabilistic solution offered us greater scale, greater device reach, and increased engagement without compromising on privacy.” For information more about the Tapad Device Graph™, or to request a demo, contact us today. Get started with us