Following the success of our recent launch of Third-Party Onboarding, we are excited to introduce the Experian marketplace, a new addition to our portfolio of data-driven activation solutions.

Experian’s marketplace bridges TV operators, programmers, supply partners, and demand platforms with top-tier third-party audiences across retail, CPG, health, B2B, and location intelligence. Easily activate premium audiences from leaders like Attain, Alliant, Circana, and Dun & Bradstreet – driving precise, efficient consumer reach.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

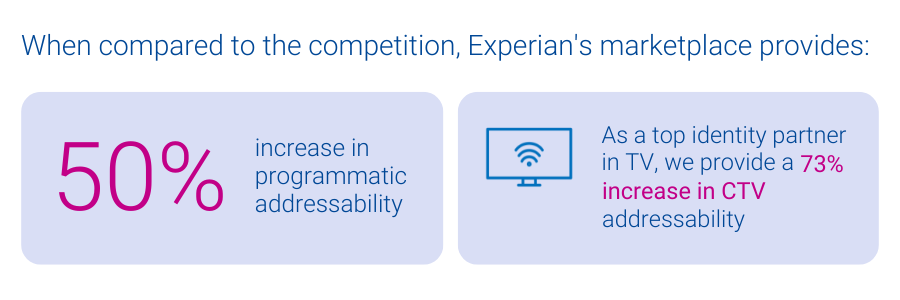

As privacy regulations evolve and traditional identity signals shift, many activation platforms face declining addressability. This impacts their ability to effectively reach consumers, which is critical to staying competitive. Experian’s marketplace, powered by our identity graphs which include 126 million households, 250 million individuals, and 4 billion active digital IDs, enables audiences to be easily activated and maintain high addressability across display, mobile, and connected TV (CTV) channels.

Benefits of Experian’s marketplace

- Enhanced addressability and match rates: All audiences delivered from our marketplace benefit from our best-in-class offline and digital identity graphs, which ensure addressability across all channels like display, mobile, and CTV. Unlike other data marketplaces, Experian ensures all identifiers associated with an audience have been active and are targetable, improving the accuracy of audience planning.

- Simplified audience planning and distribution for TV Operators: TV operators can build custom audiences matched directly to their subscriber footprint and distribute them across all advanced TV channels (data-driven linear, addressable, digital, and CTV) for maximum impact.

- Diversification within the data marketplace ecosystem: With the recent departure of Oracle’s advertising business, the optionality for buyers and sellers to connect with third-party data has become increasingly limited. With Experian marketplace, we’re excited to offer a new solution to the market that ensures data-driven targeting can continue to take place at scale.

- Lower activation costs: Experian’s marketplace offers transparent, pass-through pricing with no additional access fees, enabling partners to maximize their earnings while reducing costs.

- Audience diversity and scale: Platforms can access a broad range of audiences across top verticals from our partner audiences, which can be combined with 2,400+ Experian Audiences. This offers the flexibility, reach, and scale necessary to effectively execute advertising campaigns.

- Remove compliance concerns: Experian’s rigorous data partner review ensures available audiences comply to all federal, state and local consumer privacy regulations.

“Circana and Experian have enjoyed a deep partnership for over a decade. We are exceedingly excited to extend our partnership and be an early adopter and launch partner of the Experian data marketplace. This additional capability will enable the ecosystem to more easily access Circana’s purchase-based CPG and General Merchandise (for example Consumer Electronics, Toys, Beauty, Apparel etc.) audience segments to drive performance outcomes across all media channels.”

Patty Altman, President, Global Solutions, Circana

“Capturing the attention of target audiences across channels is critical for marketers navigating an increasingly connected digital world. We are excited to be an exclusive provider of B2B solutions within Experian’s marketplace, helping brands and media agencies to accelerate their reach, addressability and targeting capabilities across TV, mobile and connected TV channels.”

Georgina Bankier, VP of Platform Partnerships at Dun & Bradstreet

Better connections start here: Experian’s marketplace

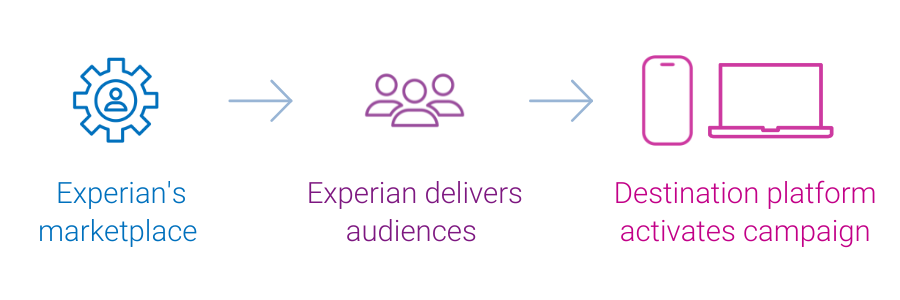

Experian’s marketplace, easily accessible from our Audience Engine platform, brings unparalleled addressability, enabling our clients to reach more relevant consumers and increase revenue.

If you’re interested in learning more about Experian’s marketplace or becoming an active buyer or seller in our marketplace, please contact us.

Latest posts

NEW YORK, Sept. 28, 2016 /PRNewswire/ — Tapad, the leader in cross-device marketing technology, today announced a new metric for cross-device marketers, Viewable Exposure Time (VET). Viewable Exposure Time measures across screens and ad formats, identifying the optimal amount of time a consumer spends with an ad before they take action. The announcement coincides with Unify Tech '16, Tapad's third-annual cross-device summit during Advertising Week NY. Frequency caps are currently used to ensure that dollars aren't wasted on redundant ads. Viewable Exposure Time evolves the frequency capping approach to include accelerating a consumer's ad exposure rate up to the optimal time spent with the brand. VET is used in affinity, digital transaction and offline purchase models as a key indicator of marketing budget well-spent. Beta users of VET span every vertical, though interest is especially high from CPG, Automotive, Telecommunications and Retail. Viewable Exposure Time unifies and upgrades marketers' predictors of advertising success by leveraging cross-screen engagement across digital and television, with vendor-agnostic viewability scores for video, rich media and display. "Today's current measurement options, like click-through rate (CTR) and TV gross ratings points (GRP) tell an incomplete story," said Tapad GM of Media Kate O'Loughlin. "Tapad is focused on measuring what really matters to marketers – building an efficient connection with a customer. Innovation in metrics was long overdue." More than just a measurement tool, Tapad also provides clients with VET activation. Factoring in time spent with ads in viewable seconds and minutes, these analytics inform marketers about which audiences are underexposed, enabling them to adjust campaigns and deliver according to optimal viewable exposure time. This effectively increases conversion rates at the lowest cost. Contact us today

Strong Revenue Performance and Thriving Culture Contribute to Industry Recognition NEW YORK, Sept. 15, 2016 /PRNewswire/ — Tapad, the leader in cross-device marketing technology and now a part of Experian, was named a top company on Inc. Magazine’s list of the 5000 fastest-growing private companies in the U.S. In addition, Tapad won the TMCnet 2016 Tech Culture Award. The exclusive Inc. 5000 ranking highlights the fastest-growing privately-held* companies in America. These distinguished companies have achieved success in strategy, service and innovation. TMCnet recognizes talented tech professionals who are committed to building a culture that prioritizes employee growth, collaboration and engagement. Tapad continues to broaden their presence into new markets, having launched in APAC earlier this year, as well as continuing their European expansion. Tapad’s proprietary technology, The Device Graph™ is leveraged by more marketers and brands to understand digital engagement across devices. The company’s rapidly expanding client base includes numerous Fortune 500 company brands as well as all four major advertising holding companies in the U.S. “We have an exceptional team of innovative people who are all working very hard to achieve the kind of results these publications are recognizing,” said Tapad CEO and Founder, Are Traasdahl. “Given that, we have an even greater responsibility to our talent to create an environment that fosters innovation and nurtures open communication. Ultimately, this is how we will continue to reach our very ambitious goals of becoming the world’s leading unified marketing technology provider.” Tapad’s award-winning work culture is defined by its gold-standard benefits which include a six-month parental leave policy, unlimited vacation time, company-sponsored meals and office space designed to facilitate collaboration and open communication. Tapad’s highly talented team has also received multiple customer service awards in 2016. These awards include the iMedia ASPY awards for Best Customer Service and Best Mobile Partner as well as recognition from The Communicator Awards of Excellence in Interactive Media. *Prior to Tapad’s acquisition by Telenor in February 2016. Contact us today!

The Tapad Device GraphTM Had Twice the Precision and Three Times the Scale as Next Competitor New York, September 14, 2016 – Just-released findings of a Hotels.com® study revealed that Tapad’s (part of Experian) cross-screen marketing technology achieved the highest levels of precision and scale among competitors. According to the leading online accommodation booking website, after a rigorous, three-and-a-half month vendor analysis, Tapad achieved twice the precision of the next highest-scoring cross-screen offering and three times greater scale. The two other companies evaluated were not named. Said Helene Cameron-Heslop, Senior Manager of Analytics of the Hotels.com brand, “Our team implemented an extremely rigorous vetting of open, cross-screen technology vendors. At the outset, we assumed we would have to compromise on either scale or accuracy – particularly given the importance to our brand of operating in a privacy-safe setting. We were surprised to find a complete package, but Tapad’s Device Graph won out on scale, accuracy and privacy; making our choice of partners very clear.” In another metric critical to the Hotels.com brand, The Tapad Device GraphTM was eight times more “unique” than the next closest offering, meaning Tapad’s graph was found to have a much greater number of connections not seen in any of the other graphs. In addition to precision, uniqueness and scale, the Tapad Device GraphTM was found to have: ● 100% higher recall● 47% more incremental matches● 53% higher North American market coverage● 101% higher F-Score* “A valuable cross-device solution should enable partners to get everything they’re looking for from a single vendor,” said Tapad Founder and CEO, Are Traasdahl. “We are deeply impressed with how thorough Hotels.com was in their vetting, and we confidently tackle the complex challenges of the martech industry thanks to our superior technology. Everyone loves a bake-off, and Tapad is no exception – delivering best-in-class results in areas that really count.” *F-score is a statistical measurement that takes precision and recall together. The calculation is 2*(precision*recall)/precision + recall). It gives you one number instead of two numbers to look at and judge performance. Contact us today