As the vibrant colors of spring emerge, so do opportunities for marketers to engage with their audience in fresh and meaningful ways. Crafting effective spring advertising campaigns requires a deep understanding of your target audience. In this blog post, we’ll explore five key audience categories, each presenting unique opportunities for impactful spring advertising campaigns.

Spring cleaning and home improvement

Embrace the energy of renewal associated with spring cleaning. Target audiences interested in home improvement and organization with Experian syndicated audiences like “Gardening Mothers” or “Home Improvement & DIY Frequent Spenders.” Share tips, hacks, and products that align with the desire for a fresh start, turning mundane chores into exciting opportunities for your brand to shine.

Here are 6 audience segments that you can activate to target consumers focused on spring cleaning and home improvements:

- Purchase Transactions > Household Goods > Frequent Spenders

- Purchase Predictors > Shoppers All Channels > Home Maintenance and Improvement

- Purchase Transactions > DIY and Advice Seekers > High Spenders

- Purchase Transactions > Home Improvement/DIY > High Spenders

- Retail Shoppers: Purchase Based > Home Improvement & DIY > Hardware & Home Improvement

- Retail Shoppers: Purchase Based > Shopping Behavior > Big Box and Club Stores: Walmart Frequent Spenders

Gardening

Spring is the time when consumers are investing in gardening equipment for lawn care. Here are a few audience segments you can activate to target consumers focused on gardening:

- Retail Shoppers: Purchase Based > Home Improvement & DIY > Garden & Landscaping Stores: Frequent Spenders

- Lifestyle and Interests (Affinity) > Hobbies > Gardening

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Gardening Mothers

- Purchase Predictors > Shoppers All Channels > Lawn and Garden

Movers and new homeowners

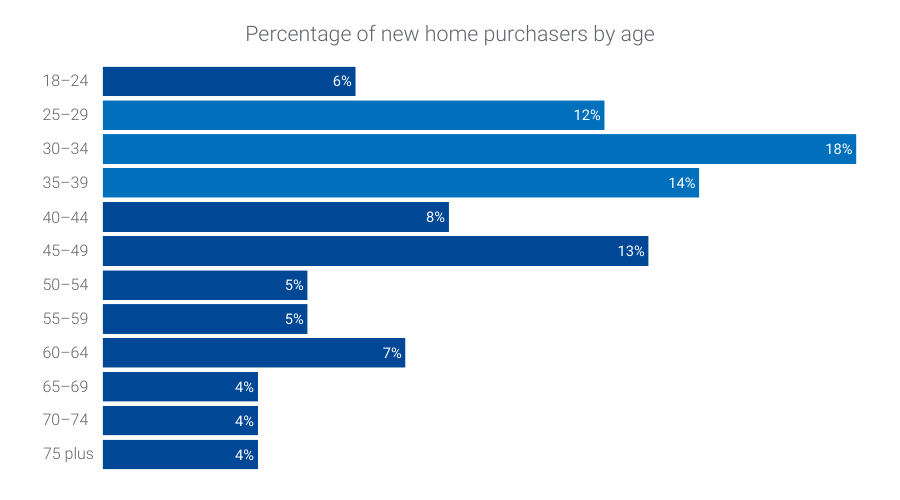

Did you know?

44% of new homeowners are between the ages of 25-39*.

Improve engagement for your spring targeting by pairing our new homeowner audiences with our Demographics > Ages > 25-29, 30-34, and 35-39 syndicated audiences. Here are a few you can activate now:

- Life Events > New Homeowners > Last 6 Months

- Life Events > New Movers > Last 12 Months

Mother’s Day: Unveil the perfect gift

Appealing to the emotion of gratitude and love, Mother’s Day is a significant occasion for marketers. Activate Experian syndicated audiences such as “Mother’s Day Shoppers” and “Florists & Flower Gifts High Spenders” to tailor your spring advertising campaign toward those likely to purchase heartfelt gifts. Share ideas and promotions that resonate with the nurturing and caring spirit of this celebration.

Here are 6 audience segments that you can activate to target consumers getting ready to celebrate Mother’s Day:

- Retail Shoppers: Purchase Based > Seasonal > Mothers Day Shoppers Spenders

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Mothers with 2+ children

- Mobile Location Models > Visits > Mothers Day Shoppers

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Moms Age 25-54

- Mobile Location Models > Visits > Jewelry Retail Stores

- Retail Shoppers: Purchase Based > Shopping Behavior > Florists & Flower Gifts: High Spenders

Father’s Day: Celebrate Dads in style

Highlighting the significance of paternal bonds, Father’s Day is an excellent opportunity to showcase thoughtful gifts and experiences. Engage the “Father’s Day Shoppers” or “Growing and Expanding families” with content and products aligned with their interests. Craft a campaign that acknowledges the varied roles fathers play and the unique gifts they would appreciate.

Here are 6 audience segments that you can activate to target consumers getting ready to celebrate Father’s Day:

- Retail Shoppers: Purchase Based > Seasonal > Fathers Day Shoppers Spenders

- Mobile Location Models > Visits > Fathers Day Shoppers

- Mosaic – Personas – Lifestyle and Interests > Group M: Families in Motion > M45 – Growing and Expanding (Young, working-class families and single parent households that live in small city residences)

- Geo-Indexed > Demographics > Presence of Children: Ages: 7-9

- Lifestyle and Interests (Affinity) > Activities and Entertainment > Home Improvement Spenders

- Life Events > New Parents > Child Age 0-36 Months

Plan for the 2024 TV Upfronts

When gearing up for the 2024 upfronts, you can expand your TV planning by incorporating diverse audience categories into your spring advertising campaigns. It’s not just about targeting a demographic; it’s about captivating your unique audience. Whether it’s cord cutters, ad avoiders, avid streamers, or households that watch TV together, understanding and engaging with these distinct segments is paramount. To maximize impact, use comprehensive TV data that goes beyond broad demographics.

Here are 6 audience segments that you can activate as part of your TV planning strategy:

- Retail Shoppers: Purchase Based > Entertainment > Streaming/Video/Audio/CTV/Cable TV: Cable/Broadcast TV: Cord Cutters: Recent

- Retail Shoppers: Purchase Based > Entertainment > Streaming/Video/Audio/CTV/Cable TV: Streaming Video: High Spenders

- Television (TV) > Ad Avoiders/Ad Acceptors > Ad Avoiders

- Television (TV) > TV Enthusiasts > Paid TV High Spenders

- Television (TV) > Ad Avoiders/Ad Acceptors > Ad Acceptors

- Television (TV) > Household/Family Viewing > Pay TV/vMVPD Subscribers Households

To find consumers who are most likely to engage with your TV ads, you can layer in our TrueTouchTM engagement channel audiences:

- TrueTouch: Communication Preferences > Engagement Channel Preference > Digital Video

- TrueTouch: Communication Preferences > Engagement Channel Preference > Streaming TV

Summer preparation: Anticipate the fun ahead

As spring transitions to summer, help your audience gear up for the upcoming season. Target “Summer break travelers” or “Memorial Day Shoppers” with offerings that align with their summer plans. Whether it’s fashion, travel essentials, or outdoor gear, position your brand as an essential companion for their summer adventures.

Here are 6 audience segments that you can activate to target consumers getting ready for summer:

- Mobile Location Models > Visits > Summer Break Travelers

- Retail Shoppers: Purchase Based > Seasonal > Summer Sales Event Shoppers: Independence Day Shoppers

- Retail Shoppers: Purchase Based > Travel > Vacation/Leisure Travelers: Summer Trips

- Mosaic – Personas – Lifestyle and Interests > Group B: Flourishing Families > B09 – Family Fun-tastic (Upscale, middle-aged families with older children that live in suburban areas and lead busy lives focused on their children)

- Mobile Location Models > Visits > Memorial Day Shoppers

- Retail Shoppers: Purchase Based > Seasonal > Summer Sales Event Shoppers: High Spenders: Memorial Day Shoppers

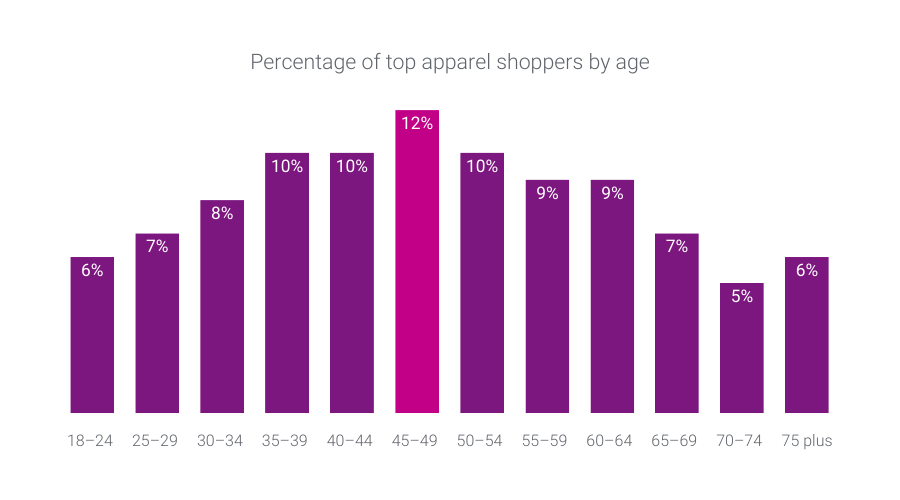

Did you know?

Consumers between the age of 45-49 make up the largest percentage of top apparel shoppers*.

Improve engagement for summer apparel shopping targeting by refining your audience with our Demographics > Ages > 45-49 syndicated audience.

Spring into effective advertising with Experian’s syndicated audiences

For spring advertising campaigns, understanding your audience is the key to success. By activating Experian’s syndicated audiences, you can refine your approach and resonate by activating specific segments. Embrace our syndicated audiences so you deliver campaigns that not only capture attention but also build lasting connections with your audience. As you embark on this spring marketing journey, remember – the possibilities are as endless as the blossoming flowers.

You can activate our syndicated audiences on-the-shelf of most major platforms. For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide below.

Check out other seasonal audiences you can activate today.

Footnote

*Experian looked at our demographic and purchase-based data to understand retail trends over the past year. Our demographic and purchase-based data covers credit and debit card usage across 500 top merchants.

Latest posts

Discover Experian’s 19 new holiday shopping audiences designed for you to reach the most relevant shoppers this holiday season.

In our Ask the Expert Series, we interview leaders from our partner organizations who are helping to lead their brands to new heights in ad tech. Today’s interview is with Jordan Feivelson, VP, Digital Audiences at Webbula. Jordan is a 22-year advertising industry veteran who has worked for media properties such as WebMD and Disney. Over the past ten years, he has transitioned to the data and programmatic space, including growing the data business for Kantar Shopcom and Adstra. What types of advertisers might benefit from utilizing Webbula audiences across various verticals? Can you provide examples of how different industries successfully leverage your data to achieve specific campaign goals? Most advertisers can leverage Webbula’s award-winning attributes for their activation initiatives. Webbula offers approximately 3,000 syndicated segments covering categories such as Demographics, Automotive, Political, Mortgage, B2B, Hobby/Interest/Lifestyle, and Interests & Brand Preferences (brand name targeting). Audience insights and marketing strategies What specific types of audience segments does Webbula provide? How can advertisers leverage these segments to craft more effective, personalized marketing strategies? Webbula has incredible depth and breadth within its verticals, giving marketers the tools to deliver targeted messaging effectively. Our Demographic, B2B, Mortgage, Automotive, and Interest and Brand Preferences segments each contain 500-1,000 segments, all built on deterministic, self-reported, and individually linked data. We ensure the best accuracy with multiple deterministic data points tied to the real world (ex., first name, last name, postal address, and email address). Some examples of our unique syndicated audience types: B2B: A view of the latest industry trends with detailed cuts of the professional world, such as companies with and not within the Fortune 500 companies and job positions that are directors and below. This also includes custom capabilities, including ABM (list of target companies in an activation campaign or by industry code (ex. NAICS, SIC). Interest and Brand Preferences: Consumers who have shown interest and affinity to hundreds of brands (ex., Nike), genres (ex., comedy, hip hop), sports teams, and more. Mortgage: A detailed view of homebuyers’ purchase range, loan type (ex. jumbo loan, standard loan), mortgage amount, interest rate, and more. With Webbula’s audience data, brands can create a comprehensive picture of their audiences down to the individual level and reach them accurately. Data quality, sourcing, and differentiation How is consumer data sourced and curated at Webbula? Are there data quality standards that Webbula establishes for consumer data, and how do you ensure your sources and methods meet these standards consistently? Webbula’s data is aggregated from over 110 trusted and authenticated sources, including publishers, data partners, social media, and more. The data collected comes directly from consumers who self-report information through surveys and other methods. We apply our hygiene filters to mitigate fraud and accurately score the data. Data Collection: The data collected comes directly from consumers who self-report information through surveys, questionnaires, transactions, and sign-ups. This ensures that brands display ads to audiences based on self-identified, cross-channel behaviors, not modeled assumptions. Hygiene Solutions: Webbula applies multi-method hygiene solutions to mitigate fraud and accurately score the data before onboarding, ensuring that all data meets the highest quality standards. Examples of Data Sources: Questionnaires: Self-reported data through surveys, offer submissions, and telemarketing. Transactions: Deterministic data from aftermarket parts, online purchases or services, and more. Sign-ups: Individually linked data from information entered through sweepstakes, infomercials, newsletters, and forms. What differentiates Webbula's data from other data providers in the market? Can you explain the unique value proposition that Webbula offers in terms of data depth and breadth? Due to our extensive experience in data cleansing, we provide the most accurate data within the programmatic ecosystem. TruthSet, the leading programmatic accuracy measurement company, has ranked Webbula as having the highest number of top attributes compared to other data providers with 150M+ HEMs. Additionally, Publicis Groupe and Neutronian further validate Webbula's data quality, underscoring its position as a leader in the industry. Webbula's data stands out in the market due to its unmatched accuracy and quality, achieved through years of expertise in data cleansing. Unlike other providers, Webbula’s foundation lies in its robust email hygiene process, ensuring that all data entering the programmatic ecosystem is thoroughly cleansed. Privacy, compliance, and future-proofing What measures does Webbula take to maintain data privacy and compliance? How do these efforts benefit advertisers in an evolving regulatory landscape and ensure ethical standards? Webbula was created over a decade ago with a future-proof, privacy-compliant foundation. We understand the industry’s rapid changes, including government and state legislation and cookie depreciation. Our goal has always been to build long-term partnerships and ensure we are prepared for industry changes. We rely on validated offline data sources, making us resilient to external influences. Success stories Can you share success stories where advertisers saw significant campaign improvements using Webbula’s data? What were the key factors that contributed to these successes? Our success is measured by client feedback and increased client spend. Webbula has helped several key advertisers achieve six-figure monthly thresholds by providing the most accurate data to meet campaign KPIs. Clients consistently return to use our data, validating our belief that “the proof is in the pudding.” Thanks for the interview. Any recommendations for our readers if they want to learn more? For those interested in learning more about Webbula, reach out for a personalized consultation. Contact us Latest posts

Experian’s 2024 Holiday spending trends and insights report covers consumer spending trends for the holiday season.