Ditch the cookie, not the data with the next evolution of contextual targeting

Today, we’re excited to announce Contextually-Indexed Audiences, a game-changer in contextual targeting. Experian’s new solution offers advertisers a powerful, privacy-safe solution that combines the precision of deterministic audience targeting with the flexibility of contextual targeting. Powered by real-time analysis from two million websites, access to 1,400 trusted audience segments, and easy activation through the top demand-side platform’s contextual marketplace or Audigent private marketplaces (PMPs), this solution offers advertisers a scalable way to reach their target consumers.

With this solution, advertisers can reach consumers on websites that over-index for visitors with the demographics, behaviors, or interests, they are looking to target. For example, an automotive brand can select Experian’s “Contextually-indexed in-market for a luxury electric car” audience segment and reach consumers when they are browsing websites that often attract that exact segment. Best of all, this is done in a privacy-safe way since it’s not reliant on cookies, mobile ad IDs (MAIDs) or other user identifiers.

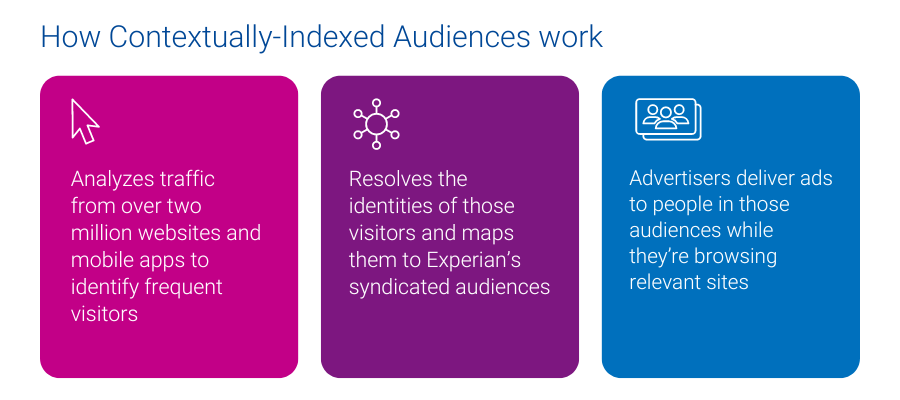

How Contextually-Indexed Audiences work

Contextually-Indexed Audiences harness advanced machine learning technology to move beyond traditional keyword-based strategies. The solution works in three steps:

- First, it analyzes traffic from over two million websites and mobile apps to identify the types of frequent visitors to those platforms.

- Next, using Experian’s Digital Graph, it resolves the identities of those visitors and maps them to more than 1,400 of Experian’s Syndicated Audiences, determining which audiences are most overrepresented on each site.

- Finally, the relevant audiences are assigned to those sites, allowing advertisers to deliver ads to people in those audiences while they are actively browsing the websites — without relying on user identifiers.

Customer success story

A leading auto manufacturer was among the first clients to activate this new solution while we were in beta. The goal was to identify new contextual targeting solutions that focus on privacy while maintaining scale and performance. The client identified two key target audiences: first-time vehicle buyers and experienced buyers. The initial campaigns using this new solution were highly successful. Even as the campaign scaled to twice the original volume, it continued to deliver three times the targeted click-through rate (CTR) goal.

“Partnering with industry leaders like Experian, we’re pushing the boundaries of contextual targeting with innovative data strategies that offer buyers greater flexibility and improved performance. These advanced contextual solutions are exciting as they not only drive results but also have the same privacy safeguards as traditional contextual targeting.”

Matt Griffith, CTO & Co-Founder, Audigent

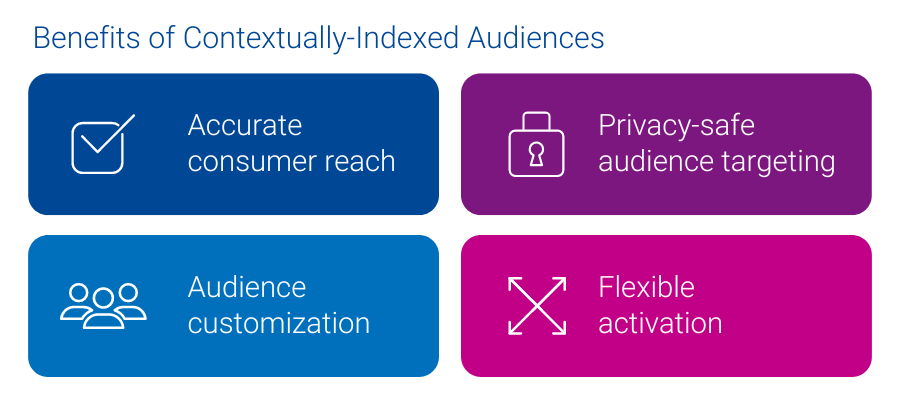

Benefits of Contextually-Indexed Audiences

- Accurate consumer reach: Real-time integrations with over two million websites and apps coupled with machine-learning indexing technology ensure audience segments are constantly refreshed, which means advertisers reach consumers based on their latest habits.

- Privacy-safe audience targeting: These audiences are not reliant on cookies or any other user identifiers for targeting.

- Audience customization: Create the right audience segment for your campaign by using a combination of over 1,400 audiences across 12 data categories like demographics, politics, health, travel, finance, and TV.

- Flexible activation: Activate these audiences instantly in the top demand-side platform’s contextual marketplace or utilize our partnership with Audigent to create a custom private marketplace (PMP), where they can be activated across any media buying platform. When using a PMP, advertisers benefit from additional performance optimization capabilities.

Experian’s Contextually-Indexed Audiences offer advertisers a powerful solution that combines the precision of audience targeting with the flexibility of contextual targeting. With real-time analysis of over two million sites and access to 1,400 trusted audience segments, advertisers can reach consumers based on their exact behaviors and interests. This is done in a privacy-safe, yet scalable way since it’s not reliant on cookies or other user identifiers. Whether activating instantly through the top demand-side platform or customizing through Audigent PMPs, this is the future of audience targeting.

Ditch the cookie, not the data, and elevate your strategy today.

Latest posts

With record ad spending predicted for the 2012 election, the rest of the nation will soon be bombarded with television ads “approved by” politicians from the left, right and the center of the political spectrum.

Social media continues to be one of the fastest growing industries online. Between September 2010 and September 2011 visits to Social Networks and Forums have increased by nearly 11% and, if you saw my Internet clock blog last month, social media accounts for nearly a quarter of all time spent online. But when are people engaging with social media the most?

With more than 80 million mobile internet users in the United States, retailers can really benefit from this communication channel. More and more companies are also offering their own phone apps so customers can search for product information and deals on the go.