This holiday shopping season, marketers will look to take advantage of the surge in spending across channels like connected TV (CTV), programmatic, and mobile. Despite challenges such as privacy regulations and Google’s new cookie deprecation plan, this moment presents a unique opportunity for marketers to reshape their traditional approaches to consumer engagement and capitalize on these changes.

As we approach the holiday season, understanding how consumers spend, where they shop, and how their shopping habits are changing are key components to consider when crafting your holiday advertising campaigns. Our 2024 Holiday spending trends and insights report utilizes our expertise in data and insights to highlight emerging consumer behaviors and spending patterns. In our report, we share what these trends mean for marketers and how Experian can help, so you can refine your messaging and target the right audience through the best channels.

In this blog post, we cover three insights from our report. Watch our video for a recap below.

1. Consumers are shopping evenly throughout the holiday season

35% of holiday shopping was done in December, peaking at 9% of total holiday sales the week before Christmas. Cyber Week, the five-day period between Thanksgiving and Cyber Monday, and the week before Christmas brought the highest weekly sales for the past two holiday seasons.

What this means for marketers

Prepare for an extended promotional period. Schedule your marketing campaigns and sales initiatives to maximize impact during the extended season, focusing on the peaks of Cyber Week and the week before Christmas.

How Experian can help you target these shoppers

Experian’s data, ranked #1 in accuracy by Truthset, offers advertisers the ability to reach people based on demographic, geographic, and behavioral attributes (e.g. websites visited and purchase history). Our audiences are available on-the-shelf of most major platforms, making it easy for you to activate and target holiday shoppers.

We recently released 19 new holiday-focused audience segments. Here are a few you can activate:

- Black Friday Shoppers

- Cyber Monday Shoppers

- Big Box/Club Store Shoppers

- Luxury Gift Shoppers

- Discount Holiday Shoppers

- Holiday Airline Travel

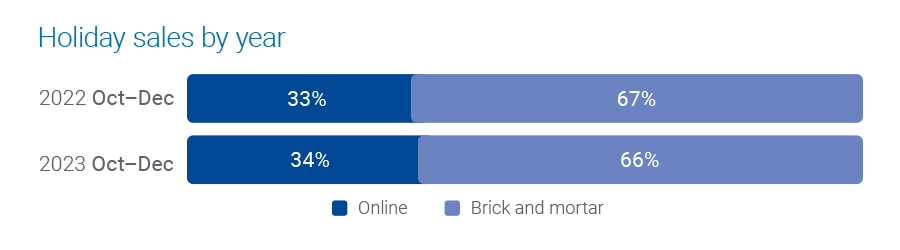

2. Online shopping is leveling out

Online holiday spending continues to remain around a third of all holiday shopping spending.

We are starting to see online shopping slow and level out – people are going back in-store. The high amount of online shopping we saw during the pandemic is starting to return to pre-pandemic behaviors.

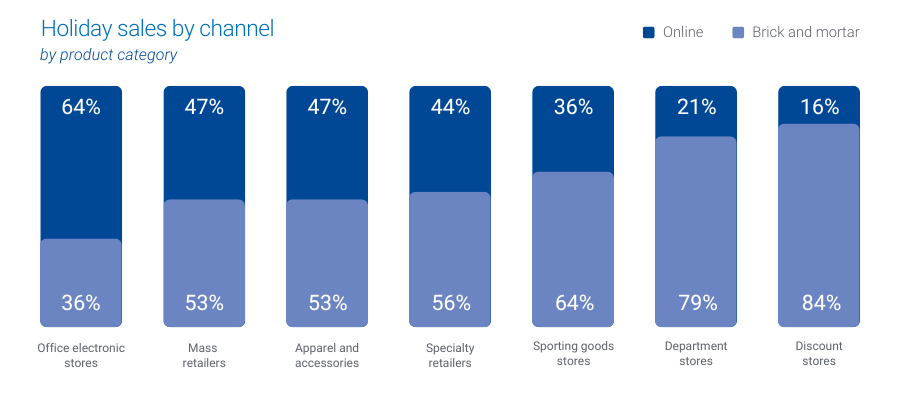

Consumers are spending more in-store at department and discount stores but are shopping online for office/electronics/games, mass retailers, and apparel.

- 84% of holiday shopping was done in-store for discount stores.

- 79% of holiday shopping was done in-store for department stores.

- 64% of holiday shopping was done online for office, electronics, and games stores.

What this means for marketers

Digital and physical experiences work together. Retailers should have a multi-channel plan to reach consumers, tailoring their approach to their target audience and product and creating engaging in-store experiences to drive visitors.

How Experian can help you target and measure across channels

We connect online and offline data to enable precise targeting and measurement of marketing efforts across multiple channels. Read our case study with Cuebiq to learn how they used our Activity Feed solution to deliver in-store lift analyses to their clients.

3. CTV is the top channel to reach consumers

Over two-thirds of the U.S. population now use CTV, and the average time spent among adults is expected to surpass two hours per day in 2024. CTV offers a creative ad experience similar to its linear counterpart but provides more sophisticated targeting and analytics capabilities.

What this means for marketers

As CTV viewing continues to dominate, the importance of cross-device targeting and measurement increases.

How Experian can help you reach shoppers across devices

Later this year, we’ll add support for IPv6 in our Digital Graph as well as phone-based UID2s. This is in addition to our current coverage of IPv4 and email-based UID2s. As a result, all IP signals and UID2s will be resolved back to Experian’s household and individual profiles and their associated devices, which means marketers and platforms can better understand the full customer journey and reach people across their devices.

Download our 2024 Holiday spending trends and insights report

This holiday season is about more than just transactions – it’s about cultivating meaningful connections with your audience. Download our 2024 Holiday spending trends and insights report to access all of our predictions for this year’s holiday season.

When you work with Experian for your holiday shopping campaigns, you’re getting:

- Accurate consumer insights: Better understand your customers’ behavioral and demographic attributes with our #1 ranked data covering the full U.S. population.

- Signal-agnostic identity solutions: Our deep understanding of people in the offline and digital worlds provides you a persistent linkage of personally identifiable information (PII) data and digital IDs, ensuring you accurate cross-device targeting, addressability and measurement.

- Secure connectivity: Bring data and identity to life in a way that meets your needs by securely sharing data between partners, utilizing the integrations we have across the ecosystem, and using our marketing data in flexible ways.

Make the most of this holiday shopping season with Experian. Contact us today to get started.

Latest posts

QSRs have emerged as superheroes during the pandemic, creating an entirely different consumer experience in record time by offering contactless delivery, curbside pick-up, and other innovations that have allowed them to stay open and operational when so many other businesses have shuttered. But as many states are still moving through their phased re-opening plans and more options become available to consumers, QSRs are challenged with keeping their momentum going. How can they continue to build on their success? The key is activation. Advertising on the right channels at the right time. The more QSRs can offer experiences that leverage the power of data to better speak to their customers and address their unique needs, the better chance they have of continuing to succeed in these unwieldy times. As we move into the fall and winter, and as more and more people look to QSR’s to help with their meal plans, consider the following: 1. Use data to create a more robust loyalty program. There’s no question consumers have plenty of QSRs to choose from and using a loyalty program is an excellent way to ensure they continue to view you as a preferred dining destination. But you might be surprised to learn how much of a difference it can make to your bottom line. PYMNTS reported that in 2019, Starbucks President and CEO Kevin Johnson shared how the company’s active mobile app rewards membership grew to 16.8 million users, which comprised 41% of sales in U.S. stores. The PYMNTS Restaurant Readiness Index also shows that 79.5% of QSR customers and 47.5% of QSR managers see loyalty programs as a feature that is important to a restaurant’s success. Now is a great time to review your loyalty program (or create a new one) and see if you can expand it to offer more perks, thereby enticing more customer interaction. A strong loyalty program should include a combination of your own customer data, enriched with third-party data for deeper customer insights, such as behavior, lifestyle and interests. 2. Make it easy for customers to order, purchase and pick-up with mobile ordering. Mobile ordering is no longer the wave of the future—it’s part of the new now. PYMNTS reported that Dunkin’ Brands CEO Dave Hoffmann noted on-the-go ordering experienced an average weekly sales increase of 25% year over year—and this growth was especially key in locations without a drive-through. For customers who want an easy option that allows them to order, pay and pick-up at curbside, mobile ordering is the ultimate in simplicity, and your data can help you determine who is most primed to take advantage of this option so you can push it directly to them. 3. Offer demographic and location-specific promos. The power of data can help you know a lot about your customers, from age and occupation to whether or not they have a family, how they spend their time, and how much of that time is spent at your competitor’s restaurant. This data can help you craft promotions that can speak directly to your consumer, ensure you’re advertising on the channels they prefer and frequent and get them in your door. When you know you cater to parents who are tired of a long day of homeschooling and work Zoom meetings, you can tailor and execute a promo campaign that speaks directly to their needs and deliver it to their preferred channel, encouraging them to skip cooking and order from you instead. Or maybe you have locations that are close to college campuses, allowing you to entice students with a two-for-one deal they just can’t pass up. And as offices start the slow process of opening back up, there’s an opportunity to welcome workers back to the neighborhood with a special curbside or delivery pick-up deal. 4. Ensure your customer knows your brand values. More and more, consumers are becoming conscious of who they spend their money with and why. As Longitude Design points out, this is something Ben & Jerry’s does exceptionally well, and their value message is spread across everything the brand does, from their scoop shops to their store-bought pints to their company-branded events. This is your opportunity to share what you value as a company and a brand, and how it aligns with your consumer’s lifestyle. Is your food sustainably sourced? Is your packaging environmentally friendly? Be transparent about your supply chain, share how you care for your employees, give some insight into the prep process behind your food, as these insights will help your consumer gain trust in you, which in turn creates loyalty. Social media is a great way to get the word out about your value-based operational initiatives. To learn more about how you can use data to build on and enhance the new customer QSR experience, visit our Restaurant Marketing Solutions page.

Healthcare marketers: Open enrollment starts November 1st. Are you ready? It’s that time of year again—time to promote your insurance plans to existing and potential members ahead of open enrollment. But do you know your members beyond the basics? Sure, you know their name, address, phone number and email address, but do you know what communication channels they prefer? Do you know their lifestyle, behaviors and interests? In order for member communications to be effective, they need to be data-driven—first and foremost. The problem is, the industry is fragmented—and so is its data. With individuals covered by both private and public insurance plans—many payers don’t have access to a complete and accurate view of members and their respective data. And as the industry continues to move toward digital transformation and embraces automation, organizations that aren’t leveraging data insights are in danger of missing out on the opportunity to create a more solid connection with members. Partnering with a third-party data provider like Experian to enrich your first-party data is the answer. With a reliable source of data, health plans can more easily identify members, deduplicate their profiles, and leverage accurate contact information and communicate on a personal, relevant, empathetic level. Here are 5 ways to attract new members and retain existing members: 1. Create more accurate personas for marketing needs: Whether we use your data or combine yours with ours, you can gain stronger member analysis for segmentation and modeling that can help you maintain current relationships or expand your outreach to acquire new members—and ensure the loyalty of both categories. 2. Ensure the accuracy of member data: With Experian’s identity and data solutions, you can rest assured that your member database is accurate and up to date to maximize contact rates and minimize errors. 3. Build strong communication channels with your members: Optimize your advertising efforts through preferred channels—and identify those communication channels—to effectively connect with your customers using our data identifying their lifestyle, interests, behaviors and more. 4. Understand more about your members’ needs and behaviors: We’ll help you keep your members healthy. What do your members do, need, prefer? How much can they afford for healthcare? How do they live? You could guess, or you can let unbiased data guide your decisions so you can better assist your members in their health care goals. 5. Create a better member experience: With data and insights, Experian can give you the information you need to enable a consistent member experience, allowing you to match your products in a way that complements your member’s needs and lifestyle. Experian cuts through the data overload by focusing on data that matters and drives actionable decisions. With Experian on your side, you’ll be able to leverage the largest consumer database. We’re here to help you to manage a wide range of marketing needs, including measuring your campaign impact and determining the best messages to use to connect with your audience. We can also assist with securely managing your data in a way that helps to ensure the accuracy of that data to give you the most up-to-date picture of your current member database. Ready to learn more about our healthcare marketing solutions for open enrollment? Complete our online form and an Experian Marketing Services representative will reach out to you soon.

With the long-term effects to the economy unknown, many consumers are feeling the financial impact, while others are looking for opportunities, resulting in a transformational shift in spending. Some brands are experiencing decreased or paused marketing budgets, and you may be trepidatious about making the right decisions in your efforts to grow share of wallet. Recent events have been an impetus for change and we’re seeing brands make modifications to traditional marketing strategies. Some are developing innovative technologies and utilizing new sources of data and analytics. As we look at how these changes impact marketing results, we see the gap grow between those brands who are equipped to pivot and implement new strategies quickly, versus those who are not. So what steps can your organization implement now to make the smartest choices for both your customers and your business to secure more share of wallet? Here are four ideas to accelerate the success of your next financial marketing campaign: 1. Meet your customers wherever they are: Digital-first strategies have never been more relevant than they are right now. While consumers have fully embraced online engagement, marketers are even more focused on reaching high-value segments in the channels they utilize. By using an informed, data-driven strategy that includes preferred marketing communication channels and decision-making styles, engagement increases across those channels your target audience frequents the most. For example, are they heavy social media users? Do they prefer streaming TV? Or do they tend to rely on financial advice vs. performing their own research? To drive take rates, your audience must be exposed to a tailored message, in the right channel, and possibly multiple times. 2. Use messaging that resonates: As consumers refocus priorities, their expectations of brands with whom they do business are ever-increasing. Reflecting an understanding of the current needs and interests of your customers and prospects is an undertone that can only help strengthen their view of your brand. Consumer behavior has changed and is unlikely to revert to what was, so you want to be relevant, but you also do not want to be seen as ‘tone deaf’. As a result, consider revising your segmentation strategy to leverage predictive insights, such as household economic indicators, financial behaviors, lifestyle propensities and interests to help shape your message into one that truly makes an impact. 3. Prove the worth of your campaign: New consumer journeys are being formulated and showing ROI is imperative as your marketing budget is scrutinized. Having the right industry-relevant metrics and reports to analyze and share with leadership are key. Demonstrate that your campaigns are contributing to bottom-line success—and justify future campaigns—by using data-driven measurement insights collected across multiple reads and countless touchpoints. Marketing budgets are being scrutinized now more than ever, so showing ROI is critical. Having the right metrics and reports to analyze and share with leadership are key. 4. Follow government regulations—leverage Fair Lending-friendly audiences: Whether you’re cross-selling or prospecting, now is the time to identify the right audiences with rich data insights to not only execute impactful campaigns but adhere to government regulations that protect consumers and your organization. Trusting that the data you are activating follows Fair Lending Laws, including the Equal Credit Opportunity Act (“ECOA”) and the Fair Housing Act (“FHA”) is crucial. The Federal ECOA prohibits creditors from discriminating against credit applicants on the basis of several prohibited factors. Developing people-based segments that are not derived using these factors positions you to follow these regulations. Check out our previous blog post about Fair Lending-friendly audiences here. As you transition to new operating models, access to current and accurate consumer data can provide confidence in campaign potential, help you avoid business risk, enable you to respond to market changes and make better decisions. Experian can help you implement these strategies and put your brand unique position for growth. From start to finish, we provide the marketing solutions you need to plan, build and execute successful, Fair Lending-friendly campaigns to cross-sell to existing customers and acquire new customers. Learn more about Experian’s financial services marketing solutions here. *Experian Fair Lending-friendly audiences do not constitute legal advice or otherwise assure compliance with the FHA, ECOA, or any other applicable laws. It’s recommended to seek legal advice with respect to the use of data in connection with lending decisions or application and compliance with applicable laws.