The holiday season is just around the corner, and retailers and marketers are gearing up for the busiest shopping period of the year. It’s crucial to understand how consumer behavior is evolving and what emerging trends to expect. Experian’s 2023 Holiday spending trends and insights report analyzes recent trends, consumer spending habits, and anticipates what’s to come in 2023 to help you deliver a top-notch shopping experience this holiday season.

In this blog post, we’ll cover three key insights from our report.

1. Consumers are shopping earlier

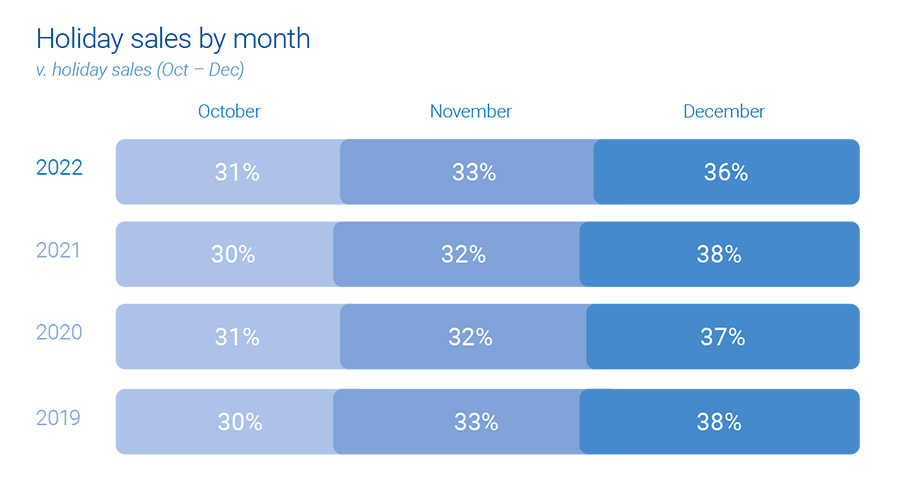

It’s no secret that December has always been the go-to month for consumers when it comes to holiday spending. However, holiday shopping now starts earlier, particularly with online sales.

This can be attributed to a surge in promotions and deals, enticing shoppers to open their wallets ahead of time, giving a significant boost to holiday sales. Notably, Cyber Week sales have proven to be an influential factor, accounting for 8% of total consumer holiday spending.

Experian tip

Reach the right shoppers with your promotions with sell-side targeting. This powerful approach gives you control over where your ads are placed while ensuring maximum visibility through direct connections with publishers. Whether on mobile, web, or CTV, this seamless ad experience will engage your audience effectively.

2. Online sales are on the rise

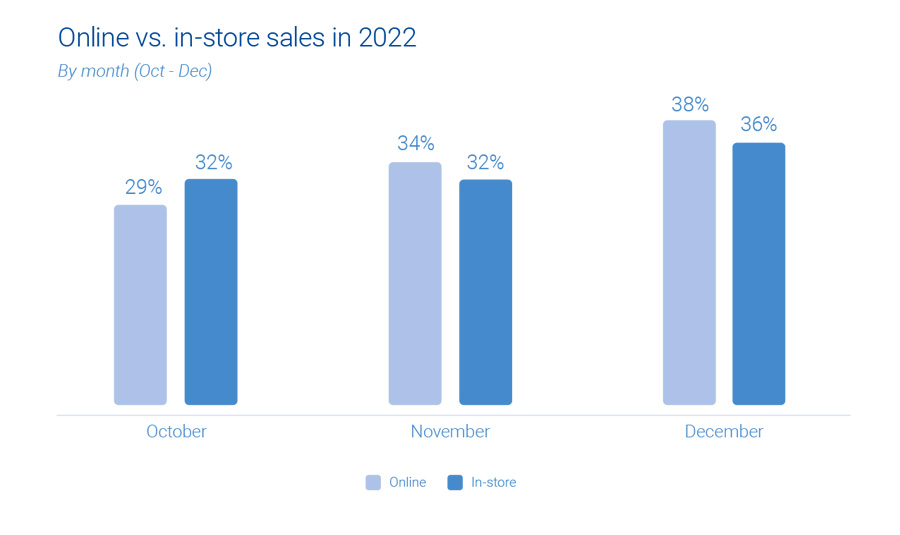

The popularity of online holiday sales is continuously growing, surpassing in-store shopping. There has been a consistent 1% year-over-year increase in online sales, while in-store sales have seen a 1% decrease.

“It’s easier for consumers to comparison shop for large ticket items online that they might find at a mass retailer or office supply store. Consumers prefer to have larger, bulkier items shipped directly to their home for minimal cost. By shopping online, consumers can save time since they don’t need to wait in checkout lines.”

Anna Liparoto, Sr. Account Executive, Retail & CPG

Although online sales currently make up only one-third of all holiday shopping, there is immense potential for further expansion. Mass retailers and office, electronics, and games industries particularly excel in online holiday sales. While in-store purchases remain the primary choice for holiday shoppers, consumer online and offline activities intersect before the final purchase.

Experian tip

Take advantage of the surge in online shopping by diversifying your marketing channels. An agnostic identity graph can bring together device and media data, capturing valuable user insights. By gaining a holistic view of your target audience, you’ll be able to optimize your ad spend and allocate resources effectively, ultimately boosting your return on investment.

“Omnichannel targeting during the upcoming holiday season will continue to prove to be the best way to reach scale and maximize ROI across all marketing channels.”

Joe LigÉ, Head of Enterprise Demand Partnerships

3. 2023 holiday spending will be on par with 2022

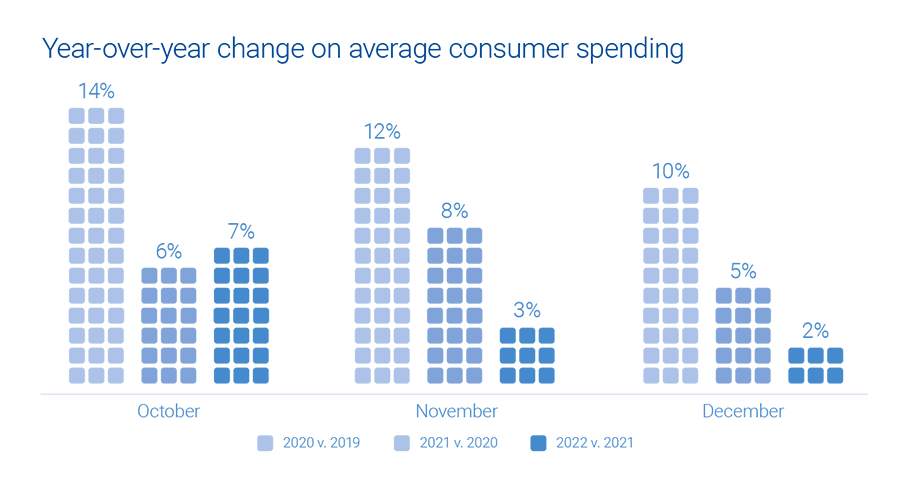

During the holiday season in 2022, consumer spending showed an anticipated increase, although the growth rate was slightly lower compared to previous years. October saw a surge in average consumer spending, indicating a swift response to early discounts and promotions offered by retailers.

As the holiday season progressed, holiday spending gradually slowed down and reached a level similar to that of the previous year. Overall, there was a modest 2% growth. Looking into the future, if economic conditions remain stable in the second half of 2023, we can expect holiday spending to align with the figures from last year.

Experian tip

To truly maximize impact, consider data enrichment. By diving deeper into your target audience’s preferences and behaviors, you can better tailor your strategies and seamlessly integrate the enriched data across various channels. This allows you to unlock the true potential of your ad inventory, creating more meaningful connections with your audience.

Download our 2024 report

Get ready for the holiday shopping season with Experian’s 2024 Holiday spending trends and insights report. Inside you’ll find:

- Analysis of past trends and what they mean for 2024

- Exclusive predictions for the upcoming holiday season

- The top audiences to activate this holiday season

To access to all of our predictions for this year’s holiday shopping season, download our 2024 Holiday spending trends and insights report today.

Latest posts

NEW YORK, May 4, 2016 /PRNewswire/ – Tapad, the leader in cross-device marketing technology and now a part of Experian, has been honored with two iMedia ASPY Awards. Announced on May 3rd at the iMedia Summit in Lost Pines, TX, Tapad's 2016 ASPY Awards include "Best Customer Service" and "Best Mobile Partner." In 2015, Tapad's proprietary technology, Tapad Device Graph™, was named "Best New Media Innovation" and Tapad employee Chris Martin was awarded the "Rising Star Award." The iMedia ASPY Awards – determined exclusively by agency votes – recognize the industry's top marketing technology, media companies and publishers for outstanding service to agencies. The award for "Best Customer Service" recognizes Tapad's client services team and their dedication to helping agencies fully understand their consumers' behavior and achieve the best cross-screen campaign ROI through Tapad's Campaign Pulse and TV Pulse analytics reporting. The "Best Mobile Partner" win recognizes the abilities of the Tapad Device Graph™ to deliver unified cross-screen solutions for the company's partners. "We are privileged to have a talented and dynamic group of people on our client services team, and we are honored to be recognized by iMedia Connection and our agency partners," said Tapad Founder and CEO, Are Traasdahl. "We have always strived to provide the best solutions and the best customer support, so it's extremely gratifying to be rewarded for our efforts. If our clients and partners are happy, we are happy." For more information on the iMedia ASPY Awards please visit: http://aspyawards.com. Read the full press release here. Contact us today!

Supporting mobile apps with text messaging programs, such as SMS will help improve your customer’s mobile experience.

Cross-screen marketing tech firm, Tapad, drove unified campaign; partnered with Statiq to measure cross-screen impact on in-store visits LONDON, March 8, 2016 /PRNewswire/ — Carat North completed the UK's most comprehensive digital campaign with Tapad, the leader in cross-device marketing technology and now a part of Experian. Coupled with location-based audience data from Statiq, this marks the first time a UK-company has measured the impact of unified, cross-screen campaign on in-store visits. Carat North served display and video ads to grocery shoppers for the leading retailer ASDA from August through October. During the campaign, Tapad utilized Statiq's audience data to measure which users visited a store after being exposed* to the campaign's ad on multiple devices. The digital campaign demonstrated a lift of 59% for in-store visits when users were exposed to ads on three devices over people who were shown an ad only on onescreen. Those who engaged with the ad were also 411% more likely to visit an ASDA store. Of those who were exposed to an ad, 248% were more likely to visit a store. Impressions served to mobile devices saw the highest success rate with an in-store visit lift of 67%. The campaign leveraged Tapad's proprietary technology, The Device Graph™, which Nielsen confirmed Tapad's cross device accuracy to be 91.2%, to serve ads sequentially on connected devices belonging to the same user. CARAT NORTH: "The ability to know which devices belong to our customer, coupled with the ability to deliver the right ad, and right message, wherever they are and on whatever device they're using, has been something this industry has long needed," said Steve Thornton, Digital Account Manager, Carat North. "We're impressed with the results that have come from the work with Tapad and Statiq for this media-first, and look forward to continuing to offer these solutions to clients like ASDA. Matching unified cross-device capabilities with real insights on campaign performance is an invaluable advantage in the marketing world." TAPAD: "This campaign is a perfect example of the capabilities of cross-device advertising," said Are Traasdahl, Founder and CEO, Tapad. "In addition to reaching users across devices, we're able to analyze campaign results and determine how different combinations of ad exposure, creative type or view frequency affected their decision to visit a location." STATIQ: "As a location data specialist, Tapad is our ideal partner – they are an industry leader and by working with them we are able to determine the impact unified messaging has on real world consumer behaviours," said Dean Cussell, Co-Founder of Statiq. "We believe this type of analysis will significantly aid brands in optimising future ad spend." About Carat North Carat North is a leading independent media planning & buying specialist in digital and non-traditional media solutions. Owned by global media group Dentsu Aegis Network, the Carat network is more than 6,700 people in 130 countries worldwide across 170 cities. Carat defined the sector when established as the world's first media independent in 1968 and is now Europe's largest media network, a position held for more than 15 years. For more information visit www.carat.co.uk About Tapad Tapad Inc. is a marketing technology firm renowned for its breakthrough, unified, cross-device solutions. With 91.2% data accuracy confirmed by Nielsen, the company offers the largest in-market opportunity for marketers and technologies to address the ever-evolving reality of media consumption on smartphones, tablets, home computers and smart TVs. Deployed by agency trading desks, publishers and numerous Fortune 500 brands, Tapad provides an accurate, unified approach to connecting with consumers across screens. In 2015, Tapad began aggressively licensing its identity management solution, the Tapad Device Graph™, and swiftly became the established gold-standard throughout the ad tech ecosystem. Tapad is based in New York and has offices in Atlanta, Boston, Chicago, Dallas, Detroit,Frankfurt, London, Los Angeles, Miami, Minneapolis, San Francisco and Toronto. TechCrunch called the powerhouse Tapad team "a hell of a list of entrepreneurs who created some of the most valuable online advertising companies of the last decade." Among Tapad's numerous awards: EY Entrepreneur of The Year (East Coast) 2014, among Forbes' Most Promising Companies two year's running, Deloitte's Technology Fast 500, Crain's Fast 50, Entrepreneur 360, Digiday Signal Award, iMedia ASPY Award, and a MarCom Gold Award. Read the full release here. *Tapad utilized Statiq's audience data to measure which users visited a store during, or within one month of, being exposed to the campaign's ad on multiple devices. Contact us today!