At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

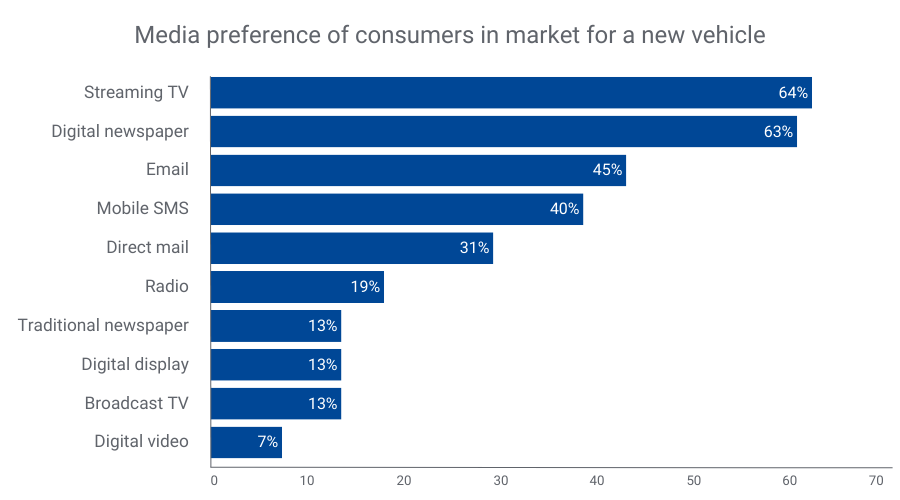

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

Our 2023 forecast for digital audience strategies in AdTech. We reveal the top advertising platforms and the best audience strategies by vertical.

Advertisers continue to increase their spending across addressable TV, connected TV (CTV), and digital. According to IAB's "2021 Video Ad Spend and 2022 Outlook" report, digital video ad spending is expected to increase by 26% to $49.2 billion in 2022. Understanding who consumers are and how to best reach them in their preferred channel is becoming more complex. Damian Amitin and Colleen Dawe discuss how a seamless identity strategy can address the complexity of the emerging TV space. The evolution of identity resolution Around ten years ago, the idea of digital “identity resolution” or “Device Graphs” was born. This idea connected cookies and MAIDs to understand when many IDs were the same person or household. In more recent years, our industry began to connect that initial understanding to the CTV ecosystem. But, a large part of the TV ecosystem existed in silos, like first and third-party audience data, and the growing advanced TV market. The goal of identity resolution has always been to understand the consumer better. To achieve more accurate targeting and measurement in the CTV ecosystem, we must incorporate the following: What we know about the household and consumer from an ID perspective Who the consumer is as it relates to audience data, as well as the wealth of first-party data in the advanced TV space We know the cookie is a flawed way to collect data. While Google delayed the deprecation of third-party cookies, there are other challenges that we face right now. Such as the glaring gap in Safari traffic and the Identifier for Advertisers (IDFA) turning to “opt-in." Understanding consumer behavior across devices and platforms continues to challenge marketers and publishers. These challenges are creating the need to find more stable identifiers. Though the cookie remains valuable, it has an uncertain future. This has led advertisers to place bigger bets on the combination of addressable and CTV. The overlap in addressable and CTV data leads to fragmentation Personally identifiable information (PII) makes up the majority of addressable TV households' data. Part of the attraction to CTV is that their IDs remain universal, persistent, and stable. Analysts project that CTV ad spending will hit $23B in 2023. Consumers now have an average of 4.7 streaming subscriptions per household. It’s no surprise then, that Disney+, HBO, and Netflix released or announced ad-supported tiers. Addressable TV and CTV are often thought of as distinct markets across the industry. But, in the context of identity, we should look at them through the same lens. Millions of households still consume TV and video content via a set-top box or through apps on CTVs. This is in addition to what they consume on their laptops, tablets, and phones. Of the top 11 cable and satellite providers, 65 million U.S. households still have a box in their homes. On the other hand, approximately 96 million U.S. households have at least one or more Smart TVs and streaming services. With about 126 million total U.S. TV households, that’s a lot of overlap. There are still significant numbers of both addressable and CTV homes. How can we address fragmented TV consumption? Through a holistic and comprehensive approach to identity. An approach that captures addressable TV, CTV, and digital identifiers. An approach that captures all audience attributes inside of a single identity graph. This is the ideal approach for publishers, AdTech vendors, and brands. Discover how to unlock holistic identity How can we achieve a holistic identity? Through a three-pillared approach: First-party data onboarding Digital identifiers Consumer data First-party data onboarding Bringing offline data from a brand’s consumers is very valuable due to the quality of the data. Because the data is being collected right from the source, you know it’s accurate. It provides the foundation you can build your identity strategy from. Digital identifiers Once you create a foundation with first-party data, you need to connect it. Either with an internal or licensed digital ID graph. Then you can understand the connections between all devices within the household. Consumer data After you know which devices tie to a single consumer, you'll want to act on that knowledge. The next step is to partner with a data provider that can help you understand your consumers. Establishing this partnership will help improve targeting, measurement, and the customer experience. To achieve a well-rounded customer view tomorrow, we need to start today The three-pillared approach bridges the gap between the offline and online worlds. This provides a well-rounded view of customers and audiences. However, the ability to tie these aspects of identity together still presents several challenges. To achieve the three-pillared approach today, you need to use many vendors and fragmented data sources. Often with conflicting data. As we look forward, the tools to do this are becoming more advanced and unified. The players in our ecosystem should adopt a seamless identity strategy. One that provides a privacy-safe yet full-picture solution. That means capturing and unifying all devices within a household. While also understanding the consumer behaviors and profiles behind those devices. As TV becomes more sophisticated, our data and services will enable you to unlock a holistic identity. Chris Feo, SVP of Advanced TV and Platforms, spoke with Broadcasting & Cable about how our data powers measurement, audience insights, and results for businesses within the TV space. "As more and more companies enter the general TV space, whether you're a publisher, an advertiser or anyone in between that's doing measurement, insights, analytics, our data or our services will play a role in some part of that value exchange." – Chris Feo, SVP of Advanced TV and Platforms, Experian Marketing Services Keep up with your customers and their data Once we create an informed identity strategy, we can begin to understand the makeup of each household and the individuals within. In this new world, personalizing the experience for an audience is key. Where do they prefer to spend their time? What type of content are they most engaged in? Only then can we as an industry provide an optimal experience for each consumer. All while driving greater ROI for advertisers and publishers. Are you ready to know more about your customers than ever before? Let's get to work together to achieve your marketing goals. Contact us to learn how we can connect the complex dots of identity resolution. About our experts Damian Amitin, VP of Enterprise Partnerships, Experian Marketing Services Damian Amitin is the VP of Enterprise Partnerships and joined Experian during the Tapad acquisition in November 2020. Damian is a senior sales and partnerships executive, specializing in the identity resolution and marketing data ecosystem. Damian helps brands, publishers, and technology vendors enable enhanced ID resolution through The Experian/Tapad platform to attain a 360 view of the customer across targeting analytics, attribution, and personalization. Colleen Dawe, Senior Account Executive, Experian Marketing Services Colleen Dawe is a Senior Account Executive on the Advanced TV Team within Experian Marketing Services. With 15 years of experience working within the television ecosystem, Colleen works with clients to bring the value and expertise of Experian to support their objectives in the areas of data, identity, activation, and measurement.

Brands can leverage non-clinical factors, like the social determinants of health, to gain a holistic view of their patients and increase access to care.