At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

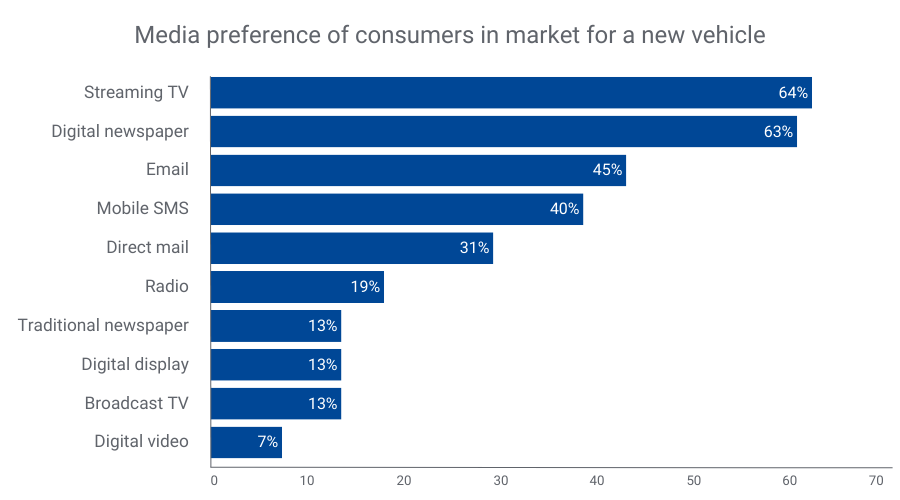

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

Marketers Can Now Harness The Tapad Graph In Concert With Twine’s Vetted, Verified TrueData™ Identity Graph. Los Angeles and New York – August 2, 2018 – Tapad, now part of Experian, is reinventing personalization for the modern marketer, today announced that it is partnering with mobile data leader Twine Data to bring Twine’s hundreds of millions of deterministic mobile identity connections to The Tapad Graph. Together, the two companies will create one of the largest portable identity graph & CRM onboarding services in the U.S., through the integration of Tapad’s best in class cross-device capability and Twine’s deterministic identity graph. "Twine is a respected player in the onboarding space", said Chris Feo, SVP of Global Data Licensing and Strategic Partnerships at Tapad. "Through Tapad and Twine’s partnership, our clients can now use their first-party CRM data to leverage the full power of The Tapad Graph — fueling a wide range of data-driven marketing use cases, including audience extension, attribution, and personalization." At the core of one-to-one marketing and true personalization is identity resolution. For marketers, the ability to accurately and safely connect customer activity across desktop/laptop, mobile, CTV, tablets, as well as CRM and offline touchpoints is ultimately what enables informed and personalized future conversations with each customer. Tapad is known for the precision, accuracy, and scale of their cross device connections, setting them up as an ideal partner for Twine’s TrueData deterministic identity graph. “We believe that by combining Tapad’s renowned cross-device connectivity and our deterministic identity graph, marketers will finally be able to seamlessly segment users based on digital and offline behaviors as well as easily distribute those audiences to both DMP and DSP environments for personalized messaging,” said Elliott Easterling, CEO of Twine Data. With this partnership, Tapad will build a client's cross-device graph off of identities onboarded by Twine from a client's offline CRM. The resulting identity graph can either be delivered directly to brands looking to host their own identity graph, or can be leveraged in a managed fashion for marketers looking for simple connectivity of their offline CRM audiences to their DSPs. To date, Twine & Tapad have seen full connectivity rates* for CRM segments from advertisers at between 259 percent and 322 percent at major DSPs. *Full Connectivity Rate is defined as {total unique desktop, laptop, and mobile devices active at DSP} / {unique CRM users in original audience post cleansing}. It represents the final match rate of the clean audience in CRM format to onboarded audience at a client’s DSP instance. This metric encompasses Twine’s onboarding & linkage validation and Tapad’s cross-device amplification. Contact us today About TapadTapad, Inc. is the marketing technology company reinventing personalization for the modern marketer through its identity-driven solutions. The company's signature Tapad Graph connects millions of consumers across billions of devices. The world's largest brands and most effective marketers entrust Tapad to provide an accurate, privacy-conscious and unified approach to connecting with consumers across screens. In 2018, Tapad introduced its Tapad Customer Data Platform (CDP), purpose-built to offer marketers a highly personalized and privacy-safe platform to convert first-, second- and third-party data into actionable, results-driven campaigns. Tapad is based in New York and has offices in Chicago, London, Oslo, Singapore and Tokyo. Tapad's numerous awards include: Forbes' Most Promising Companies, Deloitte's Technology Fast 500, Crain's Fast 50, TMCnet Tech Culture Award and Global Startup Award's "Startup Founder of the Year." Tapad was acquired by the Telenor Group in 2016. Telenor Group is one of the world's largest mobile operators across Scandinavia and Asia. About TwineTwine is a mobile data platform that believes true, honest, accurate data is the fuel that helps our partners grow their businesses efficiently and effectively; Twine’s TrueData is used by brands, agencies, and ad tech partners across the country and across the globe. Twine’s app publisher partners generate revenue while maintaining control over their data; their marketer partners get comprehensive, high quality mobile targeting and intelligence. To learn more about Twine, visit www.twinedata.com.

Marketers Using Centro’s DSP Basis Can Leverage Tapad’s Technology for Extended Cross-device Reach Chicago – May 15, 2018 – Centro, a provider of enterprise-class software for digital advertising, today announced that its Basis programmatic ad platform has licensed cross-device marketing technology from Tapad, a part of Experian, the company reinventing personalization for the modern marketer. Media professionals using Basis can now drive better performance by identifying a person across the different devices he or she uses, serving ads in the most optimum environment, then analyzing performance to see what ad worked best based on creative, device, location and time of day. Today’s digital media ecosystem is fragmented. People consume content on their multiple devices from multiple locations. According to digital analytics firm GlobalWebIndex, a typical consumer owns three digital devices and has seven digital ID’s active in the last 60 days. Advertising technology that treats every device as a single user would not be able to guide customers down the marketing funnel according to how users jump from one device to the next. Furthermore, they wouldn’t see when conversions occur on a device different from that in which the ad was first shown to the user. The Tapad Graph identifies the point of conversion across all screens – smartphones, tablets, home computers, and smart TVs – so that marketers can better gauge the efficiency and return on ad spend. “Our technology helps brands gain a deeper level of understanding of their customer, enabling marketers to better deliver services and products users want,” said Chris Feo, SVP of Global Data Licensing and Strategic Partnerships, Tapad. “With our technology as part of Basis, Centro is providing robust, accessible tools for marketers that want to advance their knowledge of the consumers they want to reach.” Centro’s Basis enables advertisers to plan, buy and analyze real-time bidding (RTB), direct, search and social campaigns in a single platform. It is the only platform that combines all of these elements with cross-device conversion attribution and advanced reporting features in a DSP. With the Tapad Graph integrated into Basis, marketers can now identify consumers across all of their devices during any point of the consumer journey. This can help marketers determine ad spend effectiveness for optimizing campaigns in real-time or for the future. Other cross-device marketing capabilities for Basis users include: Frequency Capping: Apply frequency caps at a unique person-level rather than at a device-level to prevent saturating users with ads and showing them more impressions than desired. Audience extension: Expand the reach of a campaign by learning what other devices a single user may have, then deliver ads to single users’ other devices. Reporting insights: Learn how users interact with ads across their devices. Gain insight about how consumers respond on devices to improve targeting parameters. Conversion attribution: Record conversions on devices different from that in which the ad was displayed to learn the true effectiveness of advertising efforts. “Cross-device analytics and optimization aligns with our vision that converging the different parts of digital media to create a holistic view of campaigns will drive performance,” said Katie Risch, EVP of customer experience, Centro. “Having Tapad’s powerful capability of personalized marketing gives our advertisers high-quality data to cultivate relationships with customers, wherever they are in digital channels.” About Tapad Tapad Inc. is the marketing technology company reinventing personalization for the modern marketer through its identity-driven solutions. The company's signature Tapad Graph connects millions of consumers across billions of devices. The world's largest brands and most effective marketers entrust Tapad to provide an accurate, privacy-conscious and unified approach to connecting with consumers across screens. In 2018, Tapad introduced its Tapad Customer Data Platform (CDP), purpose-built to offer marketers a highly personalized and privacy-safe platform to convert first and third-party data into actionable, results-driven campaigns. Tapad is based in New York and has offices in Chicago, London, Oslo, Singapore and Tokyo. Tapad's numerous awards include: Forbes' Most Promising Companies, Deloitte's Technology Fast 500, Crain's Fast 50, TMCnet Tech Culture Award and Global Startup Award's "Startup Founder of the Year." Tapad was acquired by the Telenor Group in 2016. Telenor Group is one of the world's largest mobile operators. About Centro Centro is a provider of enterprise-class software for digital advertising organizations. Its technology platform, Basis, is the first of its kind SaaS advertising solution unifying programmatic and direct media buying, along with workflow automation, cross-channel campaign planning, universal reporting and business intelligence. It boosts media, team and business performance by enabling advertisers to plan, buy and analyze real-time bidding (RTB), direct, search and social campaigns in a single platform. Headquartered in Chicago with

The concept of identity resolution has emerged over the years as a strategic imperative among marketers and technology vendors. A report by Forrester contends that accurately establishing and maintaining customer identity is one of the most perplexing challenges facing marketers today. Customers have footprints in the offline and online worlds and tend to seamlessly transition across various channels and devices – presenting a unique challenge to truly understand who they are. But the ability to stitch these disparate components of information together means marketers can make better decisions and have more meaningful interactions with their customers. And for customers, this means an experience with personalized advertising content more likely to resonate with them. Why should marketers prioritize identity? The ability to accurately identify customers is the most basic prerequisite for marketing analytics, orchestration and execution. As such, it is becoming increasingly important for brands and marketers planning to link together disparate systems of audience insights and engagement to foster a more seamless and personalized omnichannel customer experience. For example, if an advertiser can identify a customer’s interests, as well as how that person prefers to consume information, then the advertiser can create and deliver messaging that will resonate with the customer. However, like most competitive differentiators, the mission critical components to accurately determine an identity reside within the suite of identity management tools at the marketers’ disposal and the expertise required for proper execution – a struggle for most marketers. But when properly implemented, a comprehensive customer identity strategy can be among a brand or marketer’s most valuable and proprietary assets. Where to begin with identity resolution? With the convergence of CRM platform data, cross-channel online touchpoints, offline record linkage management, probabilistic cross-device graphs, and data onboarding—evolving from point solutions to unified platforms—marketers are faced with an increasingly complex set of challenges in addressing and solving for customer identity management. To properly implement from the get go, and to avoid having to bolt on disparate technologies down the road, emerging industry trends and success stories suggest marketers need a neutral technology service provider that can provide each of these solutions via a single, unified platform. A vendor that can build a solid identity management foundation comprised of omni-channel targeting and attribution, cross-device resolution, online-offline linkage management, and data onboarding form the nexus of a cohesive identity strategy, built to last. Experian helps connect consumer identity As a trusted name in data and information services for more than 40 years, we are committed to privacy by design and the responsible usage and security of data. Whether you’re a brand, agency, or publisher, Experian has the wide-ranging toolset to help you put people at the heart of your business and make better marketing decisions. By harnessing the power of the sum of these parts, fusing both offline and online identifiers and attributes, Experian has established a leadership position in identity management. If you're ready to begin building your identity foundation, contact us and get started today! Learn more about why identity matters to marketers and consumers, here!