At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

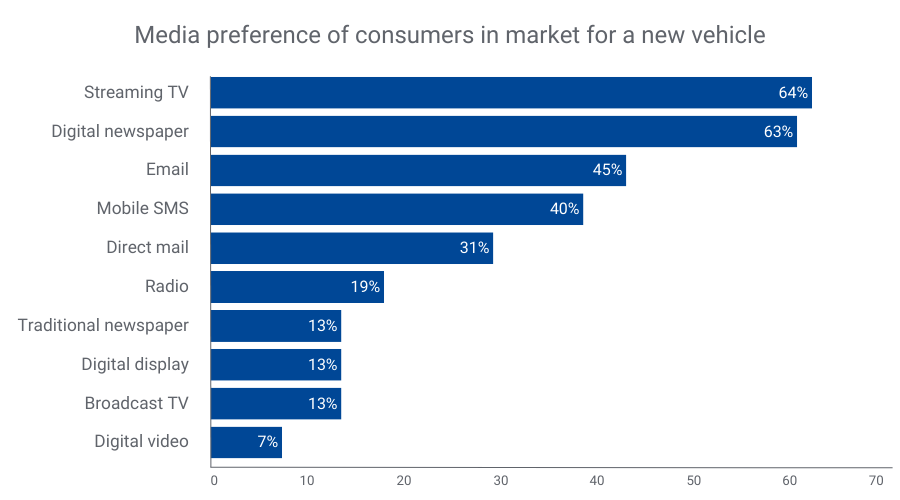

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

The Tapad Device Graph™ increases Throtle’s amplification by 475 percent. NEW YORK, Nov. 1, 2017 /PRNewswire/ — Tapad, now a part of Experian, the leader in cross-device marketing technology, today announced a partnership with Throtle, a leading data onboarding company. The Tapad Device Graph™ will enhance Throtle's best-in-class onboarding capabilities by providing accurate and privacy-safe cross-device reach as well as precise audiences at scale. In partnership with Tapad, Throtle will deterministically link its services to a corroborated individual with hundreds of targeting attributes. This linkage allows Throtle to offer true cross-device identity management and identity resolution services to accompany its robust onboarding capabilities. Throtle will also work with Tapad to validate its device graph, building larger, more comprehensive audience segments. To date, the Tapad Device Graph™ has connected 61 percent of Throtle IDs to related ones in the graph, with an average amplification rate of 475 percent for Throtle's IDs, or 4.8 new IDs per each of Throtle's. Throtle has also seen its overall match rates involving Tapad's identity insights rise an average of 15 percent since the inception of the partnership. More specifically, Tapad's mobile advertising IDs (MAIDs) have increased Throtle's in-app identity inventory by 35 percent. "Tapad has proven to be a trusted source for cross-device matching and has a tremendous reputation in the advertising and marketing technology industries for delivering superior precision and scale with the utmost dedication to privacy," says Paul Chachko, CEO, Throtle. "Since we first began our test phase, and continuing through to this day, Tapad has met and exceeded our expectations for what a partner should be." With Tapad's strong commitment to precision and accuracy, Throtle was confident that this partnership would prove to be the right choice for the strategic expansion of its platform. Not only does Tapad deliver in-depth insights, parsing deterministic from probabilistic linkages, but its pool of device-level touchpoints enables Throtle to increase scale without seeing a decline in precision. "Accuracy and precision are core characteristics of our proprietary Device Graph," explains Chris Feo, SVP, Strategy & Global Partnerships, Tapad. "When Throtle approached our team, we knew we would be the right partner to assist their leading onboarding technology. We're excited to work with Throtle to achieve cross-device reach, audience scale and precise deterministic and probabilistic linkages for its clients." For more information about the Tapad Device Graph™, or to request a demo, visit https://www.experian.com/marketing/consumer-sync About TapadTapad Inc. is a marketing technology company renowned for its breakthrough, unified, cross-device solutions. The company's signature Tapad Device Graph™ connects millions of consumers across billions of devices. The world's largest brands and most effective marketers entrust Tapad to provide an accurate, privacy-conscious, and unified approach to connecting with consumers across screens. In 2015, Tapad began licensing the Tapad Device Graph™ and swiftly became the established gold-standard throughout the ad tech ecosystem. Tapad is based in New York and has offices in Boston, Chicago, Dallas, Detroit, London, Los Angeles, Miami, Oslo, San Francisco, Singapore, and Tokyo. Tapad's numerous awards include: Forbes' Most Promising Companies, Deloitte's Technology Fast 500, Crain's Fast 50, TMCnet Tech Culture Award, and Global Startup Award's "Startup Founder of the Year". In 2016, Tapad was acquired by the Telenor Group, one of the world's largest mobile operators. About ThrotleThrotle is a data onboarding company focused on deterministic matching and identity resolution, empowering brands with true individual-based marketing. Our data centric onboarding approach guarantees the highest level of accuracy, scale, and responsiveness for our clients. For more information on Throtle, please visit, throtle.io. Contact us today!

Autotrader leverages The Tapad Device GraphTM to achieve higher performance and reach new audiences across all devices New York, NY – September 6, 2017 – Tapad, the leader in cross-device marketing technology and now a part of Experian, today revealed findings from a campaign conducted with Autotrader which connects with more actual car buyers than any other third-party listing site.* Autotrader’s premium audience, combined with the Tapad Device GraphTM, delivered significant audience extension across desktop, mobile, and tablet to drive awareness and maximize both reach and delivery across screens. To help analyze shopping behaviors across multiple devices, the global automotive brand for this campaign turned to Autotrader and Tapad, who created a cross-device pre-roll video strategy with a focus on viewability, concentrating on potential customers already searching for vehicles. By using a one-to-one connection, instead of look-alike modeling, Tapad also ensured that the automotive brand discovered only new consumers across all of their devices. This approach discovered a new potential audience of more than 14 million consumers, eliminated communication waste and the risk of duplicates, increased overall performance, and ensured more of their campaign dollars reached meaningful audiences. Overall, this case study represents a leap forward in terms of audience-based targeting and the highly-sought after multi-touch attribution modeling. “We really enjoy working with the team at Tapad to help execute our Audience Extension campaigns”, said Lynne Green, product manager at Autotrader. “Their ability to meet the demands of an ever-changing industry, as well as their dependable customer service has allowed us to confidently deliver against our unique in-market automotive audience and provide our clients ongoing messaging opportunities to our audience beyond Autotrader.com.” “How identity relates to conversion behavior is a complex part of any advertising campaign,” said Jeff Kelosky, RVP and head of global automotive at Tapad. “After identifying auto consumer’s behavioral patterns and device usage while shopping for vehicles, we knew we could successfully help Autotrader and its automotive brand clients maximize campaign viewability and drive results.” To learn more about using Audience Extension with Autotrader, click here. For more about the Tapad Device GraphTM, or to request a demo, visit https://www.experian.com/marketing/consumer-sync Contact us today!

With campaigns applied to seven major holding companies, Tapad continues to see healthy adoption with The Trade Desk clients NEW YORK, NY – August 23, 2017 – Tapad, now a part of Experian, the leader in cross-device marketing technology, today announced its ongoing momentum with The Trade Desk, Inc. (Nasdaq: TTD), a global technology platform for buyers of advertising. Tapad is providing cross-device segments from the groundbreaking Tapad Device GraphTM through The Trade Desk’s platform. Since 2015, Tapad has seen steady growth in the use of its cross-device data across The Trade Desk platform. This forward progress continues, as 1H2017 saw important milestones for Tapad. Seven major private and independent holding companies now apply Tapad’s data to their campaigns, in addition to more than 1,500 unique brands. Tapad’s proprietary Device GraphTM connects billions of devices, providing unified and insightful data for brands, agencies, and marketers across the globe. Several of these clients, representing varying industries from financial, to auto, CPG and retail, apply Tapad’s data across a number of key tactics and strategies, including: first party CRM extension, third party audience extension, cross-device retargeting, cross-device frequency management, and more. Clients in these verticals continue to rely on Tapad’s cross-device data, as Tapad saw the amount of usage by financial and retail clients grow by four times over the past year, and double for automotive and CPG clients. “We are pleased to offer our clients access to Tapad’s device graph”, said David Danziger, VP of Data Partnerships, The Trade Desk. “Their cross-device identification capabilities have been a powerful addition to our omnichannel platform.” “This integration is a shining example of the amplifying effect of two of the best platforms working together,” said Chris Feo, SVP of Global Partnerships at Tapad. "Clients leveraging Tapad's Device Graph in The Trade Desk platform have the potential to see higher returns and reach with access to substantial cross-device data, as well as a very effective media platform." Contact us today!