![A Glimpse at the Largest Metropolitan Areas’ State of Credit [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

Experian’s fourth annual State of Credit features nationwide data on how four different generations are managing their debts. To provide a more detailed picture of how the nation is faring, we also analyzed over 100 Metropolitan Statistical Areas (MSAs).

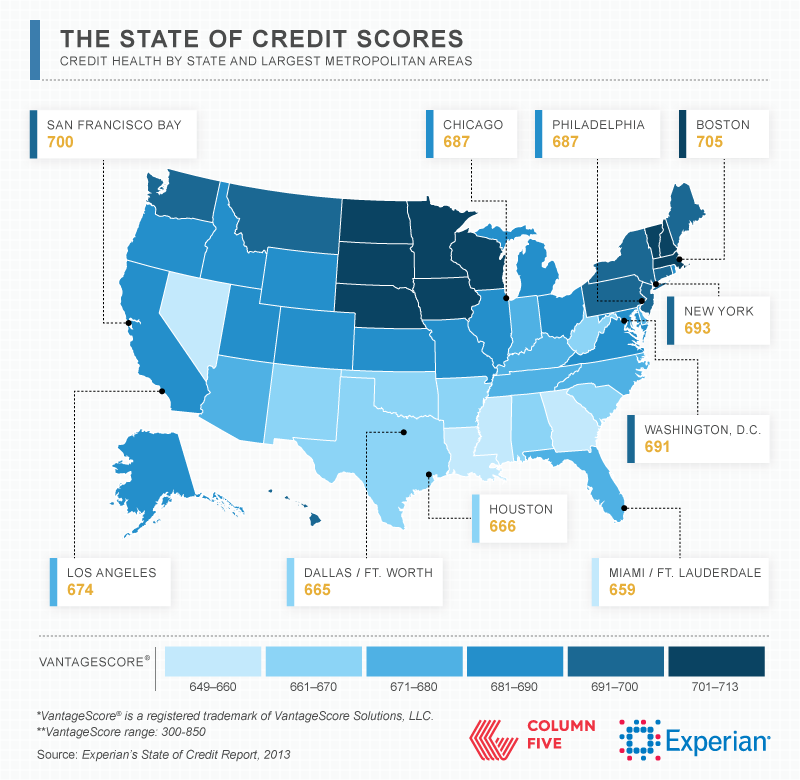

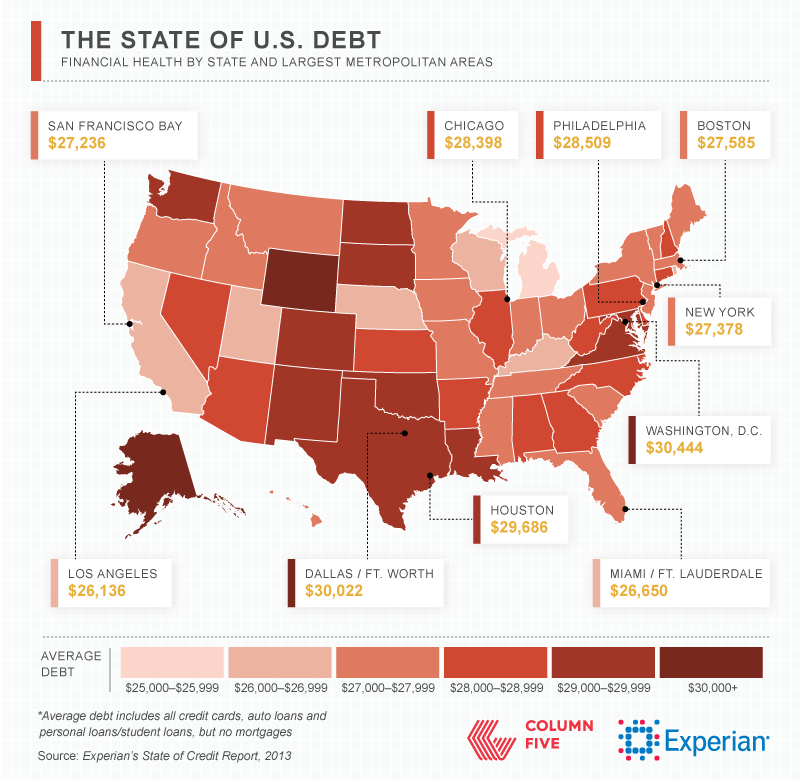

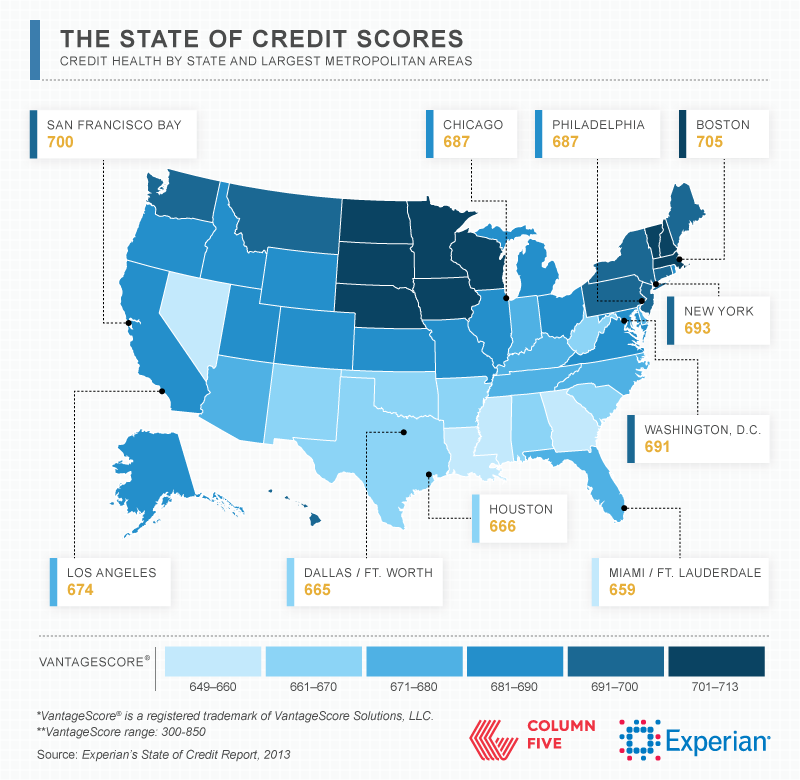

Below are two snapshots of average credit scores and debt for the largest metropolitan areas. This study is an opportunity for consumers to better understand how credit works so they can make more informed financial decisions and live credit smart even in the face of national economic challenges. View our interactive map to learn more.

![Average Debt in Largest Metropolitan Areas [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

A glimpse at average debt in the largest metropolitan areas …

View interactive map: Experian’s Fourth Annual State of Credit Report

View interactive map: Experian’s Fourth Annual State of Credit Report

![Credit Scores in Largest Metropolitan Areas [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

A glimpse at credit scores in the largest metropolitan areas …

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

1. Think experience over tangible items

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December – so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December – so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

This guest post is by Gail Cunningham, Vice President of Membership and Public Relations.

Experian’s recent State of Credit Study revealed that The Greatest Generation has something else to brag about: responsibly managing credit. And that’s no small achievement considering that some of these folks have 50 or more years of credit history under their belt. That’s a lot of on-time payments. If you fall into the 65+ age bracket, congratulations! You’ve done a lot right. Now let’s keep a good thing going. Here are some tips to help you stay financially healthy moving forward:

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.