All posts by Craig Boundy

In recent weeks, we have seen a growing rise in racist attacks against the Asian and Pacific Islander community in America. These incidents are appalling and go against our values, culture and everything we stand for. We stand in solidarity with our Asian and Pacific Islander colleagues. No one should live in fear of any kind of physical or verbal threat. I appreciate the leadership of our Asian American Employee Resource Group, allies and leaders throughout Experian for their support of our colleagues, and the communities where we live and work. At Experian, I am proud of our rich programming and focus on Asian cultures. We are sponsors of the National Association of Asian American Professionals and Ascend, which both focus on advancement and equity for Asian-Americans. We are committed to driving equity and ending racism. The Experian family is rich because of the diversity we embrace. We must all play our part to #StopAsianHate.

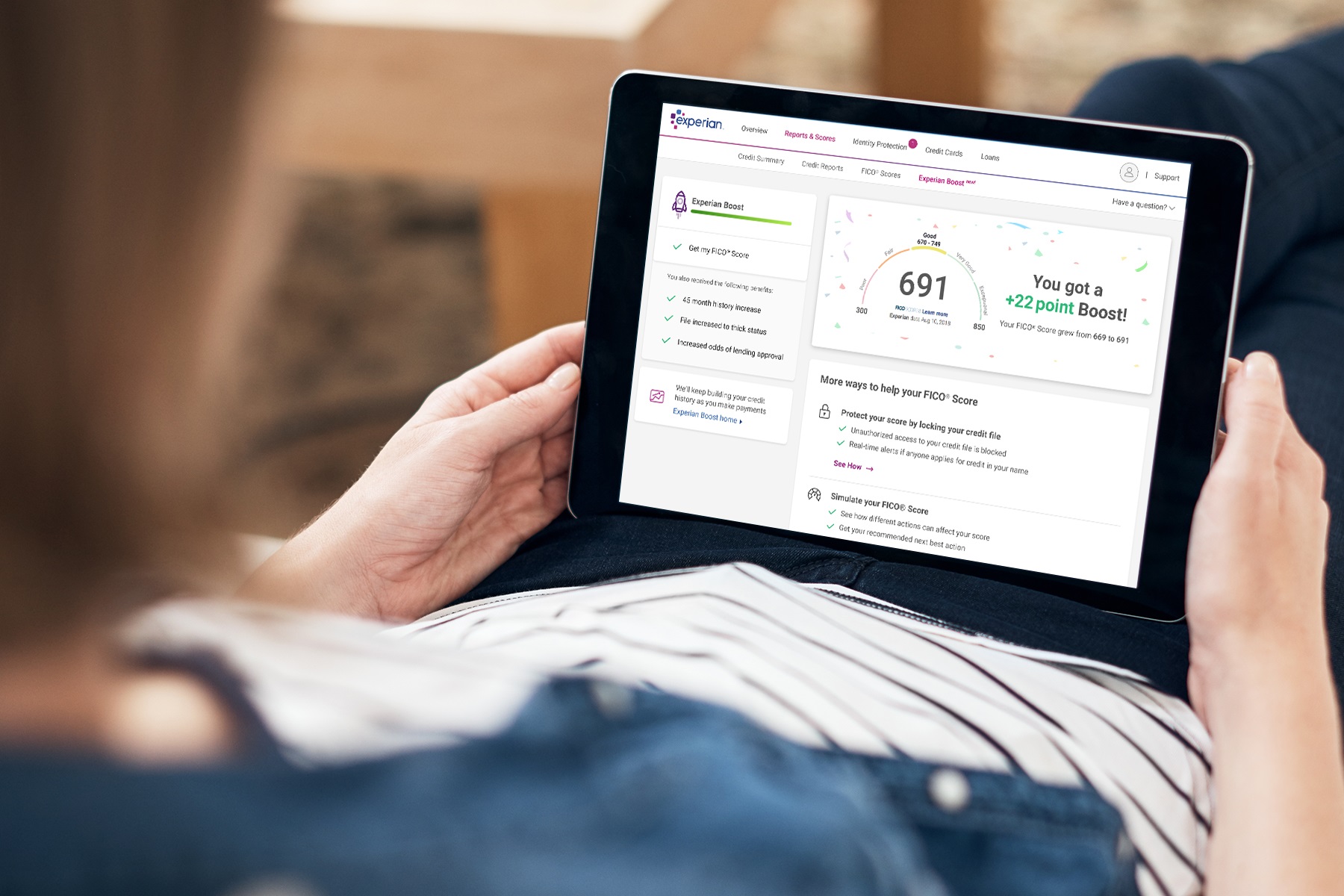

There are many responsibilities I carry as CEO of Experian North America. All of them critical in terms of client relationships, product offerings, innovation, culture, our people and our purpose. A part of my work that I\'m extremely passionate about is how we make a difference to consumers and their financial health. As leading data and technology company – and the world’s largest credit bureau – we have the opportunity to work with organizations and individuals every day to help them achieve their financial goals. And while that is good for business, it is also good for society and consumers. That is why I am pleased to join the HOPE Global Forum and John Hope Bryant to announce our new partnership. Operation HOPE is a national nonprofit with goals that align with our own at Experian: to uplift disenfranchised youth and adults from poverty to thriving in a credit ecosystem. We are committed to helping vulnerable communities with our data, analytics, products and services and working with Operation HOPE will help us further that mission. One way we have already been doing that is through products like Experian Boost, designed to drive financial inclusion and help people get fair and affordable access to credit. I have seen firsthand how these actions can change people’s lives. Let me tell you about an Experian Boost customer named Lawrence. Last spring, in March of 2019, his credit score was 640. He was already enrolled in our credit monitoring services, but was not proactive in trying to improve his credit score. Then, he tried Experian Boost. He was able to show positive payment history for utilities, cable, and his cell phone bills. Instantly, his score jumped 30 points. Following the advice of our credit education resources, he paid down his credit cards, which propelled his score even higher. He now has a credit score of 770. What does this mean for Lawrence and his family? Previously, they owned one car and paid 18% interest on that loan. Now, the family has two cars, and they pay 5% and 8.2% on two car loans. This represents incredible savings the family can now use for other needs, and increased access to financial services that can help them achieve other goals. This is what we mean when we talk about empowering consumers so they can have financial freedom. For some, this means the ability to purchase a car, have a credit card, own a home, or simply just save money. The financial health journey can start at any time and have a lifetime impact. I am really excited about this partnership. Together we have the potential to make a tangible difference in financial inclusion in the United States, combining Operation HOPE’s education and counseling programs with our credit education knowledge, capability and services like Experian Boost.

The pandemic’s full economic impact is still unfolding, and I can assure you we have not stopped evaluating and evolving our COVID-19 response nor our thinking about economic recovery for consumers and businesses alike. In the last month, we’ve been driven by two major priorities. The first is the health and safety of our employees. On top of that, we have placed a laser focus on putting our resources to work to help people and businesses during these uncertain times. While we have all been adjusting to our ‘new normal’ working environment, our employees in North America have not slowed down. In fact, they have worked hard to create solutions and tools designed specifically to help people successfully navigate the evolving financial landscape. From free credit reports to complementary ‘payer alerts’ for healthcare organizations to consumer credit education, we’ve launched a wide-range of initiatives. Here are a few highlights I’d like to share with you: FOR CONSUMERS: Experian Credit Report and Score: Consumers can sign up and access their FICO® Score, Experian credit report, and ongoing credit monitoring through Experian’s free CreditWorks product. Consumers can also sign up to Experian Boost, a free financial tool that has helped more than 2 million consumers increase their credit score. Consumer Resources Website: As the consumer\'s credit bureau, Experian’s commitment is to inform, guide and protect its consumers and customers during uncertain times. One way the company is doing this is through this dedicated website, with links to multiple resources and materials to help the community learn about credit and other important personal finance topics. COVID-19 and Your Credit Report: Being fully committed to helping consumers and lenders during this unprecedented period, Experian has created this dedicated blog page with ongoing and updated information pertaining to how COVID-19 may impact consumers’ creditworthiness and – ultimately – what people should do to preserve it. The blog will be updated with relevant news as Experian announces new solutions and tactics. #CreditChat: In response to the urgent and rapid changes associated with COVID-19, Experian is accelerating and enhancing its financial education programming to help consumers protect their financial health. With expected delays in bill payments, unprecedented layoffs, hiring freezes and related hardships, Experian seeks to aid consumers in understanding how the credit reporting system and personal finance overall will move forward in this landscape. Experian has launched an eight-week series of #CreditChat conversations surrounding COVID-19 on Wednesdays at 3 pm ET on Twitter and live video credit chats every Friday at 12:30 pm ET on Facebook Live. FOR BUSINESSES: Free Experian Business Credit Report: Experian is offering all American-owned small businesses free access to their Experian business credit report through May 1, 2020, to help small business owners impacted by the COVID-19 pandemic. By accessing a free business credit report now, small business owners can understand where their credit score stands and look for the best lending options for their business before they obtain funding. COVID-19 U.S. Business Risk Index: To further help small businesses gain access to capital they need, Experian launched its free COVID-19 U.S. Business Risk Index to assist lenders and government organizations in understanding how to make lending options available to the business segments that need it the most. This new risk index can help business risk professionals better understand the impact that the pandemic may have on commercial operations based on several key factors. This methodology combines business risk, anticipated impact on business industries and real-time COVID-19 case data to help businesses better simulate various impact scenarios down to the state level to help develop relevant strategies. Experian® Health Payer Policy Alerts: This is a free comprehensive list of COVID-19 and telehealth payer policy alerts for United States hospitals, medical groups, pharmacies and specialty healthcare service organizations. Payer policy alerts are provided by commercial, Medicare and Medicaid payers and summarize changes to medical coverage policies from those organizations. This public service to the healthcare community will continue to be updated and remain free as long as alerts related to the COVID-19 pandemic continue to be distributed. At-Risk Audiences: In an effort to help essential organizations, such as healthcare and government agencies, provide resources to those most in need during the COVID-19 pandemic, Experian is leveraging its data assets, free of charge, to identify groups of individuals that are most likely to be impacted. Experian developed new audience segments that are built in a privacy-compliant manner and designed to help these organizations find and communicate with at-risk populations, enabling them to deliver essential services as quickly as possible. Business Resources Website: This newly launched website was developed to help businesses prepare to manage increased attacks, continue to push toward digital banking, and understand regulatory changes as businesses find their footing in this evolving financial services landscape. FOR COMMUNITIES IN NEED: First Responders First: Experian North America is supporting first responder workers by donating funds for personal protective equipment (PPE) to COVID-19 for hotspots in New York City and New Orleans through the nonprofit organization, First Responders First. These funds will provide essential supplies, equipment and resources such as masks, gowns, gloves and more to those on the frontline. Heart of Experian Giving Opportunity: Experian is leading this effort in which employees can assist by making a donation to First Responders First through Experian’s Heart of Experian giving opportunity. Experian will match employee donations up to the annual limit of $500 per employee, while funds last. This donation is the latest support the company has provided to help minimize exposure for those most at risk. For example, in California, the company also donated 12,000 masks to the Hoag Medical Group. I’m proud of the work we’re doing at Experian to help those impacted by this crisis. We remain dedicated to our employees, consumers, businesses and communities – and we will continue to innovate and develop new offerings to help those in need. Craig Boundy CEO, Experian North America

These unprecedented times call for unprecedented measures. Experian supports the signing of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). We are encouraged by this historic effort to protect consumers and businesses alike. The relief bill is a great step toward economic recovery, directly supporting Americans through expanded unemployment coverage and by providing grants and loans to small businesses. At Experian, we have an unwavering commitment to help consumers and clients manage through this unprecedented period. We are actively working with financial institutions, lawmakers and regulators on tools and initiatives to protect consumers from potential adverse consequences to credit reports and credit scores as a result of financial hardship caused by the COVID-19 outbreak. Additionally, we remain focused on ensuring data integrity as we lead industry initiatives to provide financial institutions methods to clearly identify consumer accounts that are subject to financial hardship as a result of COVID-19 and ensure that such information is properly reflected in credit reports and scores. We’ve built a culture of continuous innovation at Experian, from the way we work to the solutions we create. This has formed a workplace where our teams across the world have a sense of purpose, with a collective desire to help change the lives of millions for the better. Now, more than ever, this is a crucial role we play as we work to create innovative solutions and tools for consumers and businesses to successfully navigate this evolving financial landscape moving forward. Our support of the CARES Act is just one step of many, as we support consumers and customers alike to help bolster the financial ecosystem.

For the past several years, Experian has been on a journey to help drive financial inclusion for millions of people around the world. This has required significant changes in how we operate, who we partner with, and the products and solutions we offer —and with those changes comes a renewed sense of purpose. What we do and the actions we take have the potential to improve lives. We are actively seeking out unresolved problems and creating products and technologies that will help transform the way businesses operate and consumers thrive in today’s society. But we know we can’t do it alone. That’s why over the last year, we have built out an entire team of account executives and other support staff that are fully dedicated to developing and supporting partnerships with leading fintech companies. We’ve made significant strides that will help us pave the way for the next generation of lending, while improving the financial health of more people around the world. Earlier this week, I attended the FinovateSpring conference in San Francisco to speak with fintechs and financial institutions about ways to put financial health at the center of an organization’s plans to build trust, reach new customers and ultimately grow business. We are developing platforms that are designed to play to the strengths of fintechs and disrupt the industry. In the past, we have looked at unresolved problems and asked ‘why?’ Today, with our fintech partners, we look at potential solutions to these unresolved challenges and say, ‘why not.’ As part of our concentration on fintech, Experian has made significant investments in alternative data, such as the game-changing Experian Boost platform, which was launched just two months ago and is already reshaping the way consumers gain access to credit. Since we launched Experian Boost, consumers across America have instantly increased their credit score by sharing their bill payment history for things like utilities, mobile phones and cable TV payments – payments which had never been factored into a credit score before. And, yes, this platform came to fruition as a result of a fintech partnership. We have partnered with fintechs in other powerful ways, too. Our new Ascend Analytical Sandbox – a first-of-its-kind data and analytics platform - gives companies instant access to more than 17 years of depersonalized credit data on more than 220 million U.S. consumers. This creates better opportunities for consumers by allowing our clients to provide more tailored solutions. It’s a great example of the power of analytics and we’re very proud of it. During our time at Finovate, we were able to engage in meaningful conversations with fintech leaders who were united in our goal of helping more consumers access the financial services they need. We’re more inspired than ever before to continue to build and explore strategic partnerships that will ultimately improve the lives of American consumers.

Today marks a notable milestone in our company’s history and for consumers. Today we officially launched Experian Boost, a free tool that, for the first time, will allow millions of consumers to add positive payment history directly into their credit file for an opportunity to instantly increase their credit score. For the past several years, we have been working to develop new products and innovations that will disrupt the credit industry and help improve the financial lives of consumers. This commitment to financial inclusion has defined us and created a real sense of purpose for everyone who works here – and that purpose is realized with the launch of Experian Boost today. There are more than 100 million Americans who don\'t have access to credit today. A low credit score, due to a thin file or incomplete information, may force these consumers to rely on high interest credit cards and loans. The fact that many of these consumers consistently and responsibly pay cell phone and utility bills on time every month hasn’t seemed to matter. At Experian, we know that’s not right. A good credit score is a gatekeeper to better financial opportunities. We need to develop products and services that make achieving and maintaining a good score easier, not harder. As the consumer’s bureau, we want to ensure that as many people as possible can access and participate in the financial system, and we believe everyone deserves a fair shot at achieving their financial dreams. We have a fundamental mission that is shared by our colleagues around the world: to strive to be a champion for the consumer. With Experian Boost, we\'re bringing that mission to life and I couldn’t be prouder. Many of our colleagues at Experian worked tirelessly over the last few years to make this day a reality. To everyone who’s played a part, I offer my very heartfelt thanks. It’s truly a great day to be a part of Experian, and we know there will be a lot of great days ahead for all the consumers who will benefit from having their credit score truly reflect who they are. To find out more about the Experian Boost, please visit experian.com/boost.

Today I testified before the U.S. House Committee on Financial Services. Many important questions were asked: Are we doing enough to ensure the accuracy and security of consumer data? What are we doing to help promote financial inclusion so that millions of American consumers can finally gain access to the credit they deserve and need? On behalf of everyone at Experian, I was proud to share with the committee that financial inclusion is part of our sense of purpose. This sense of purpose is what drove us to create game-changing initiatives like Experian Boost, which will help millions of Americans instantly increase their credit scores and gain access to better financial opportunities. I also commented to the committee that nothing was more important to us than ensuring the security and accuracy of consumer data, and our mobile-optimized online dispute resolution service is evidence of that ongoing commitment. You can read the full text of my written testimony here. However, the issues discussed today need to be part of a larger and ongoing dialogue. Credit is vital to buying a place to live, a car to drive and paying for everyday expenses. We know we have a special responsibility to play in what is arguably one of the most effective credit ecosystems in the world. We take that responsibility very seriously. But we also know that winning the trust of consumers is something we need to consistently earn. We hold ourselves accountable for doing that every day and agree with committee members that everyone involved in consumer credit should do the same. We are proud of what we have accomplished so far, but we know we can and must go further. We need to constantly strive to reinvent what is possible by leveraging new technologies and innovative solutions. Today’s consumers and even our lending customers should expect nothing less from us. And Congress has an important role to play, too. We strongly support legislative initiatives like the Credit Access and Inclusion Act, which would amend the Fair Credit Reporting Act and allow positive consumer credit information, such as on-time payment histories, to be shared with consumer reporting agencies. This proposed legislation would also remove barriers to financial inclusion, such as state and local laws that prevent public utilities from sharing positive customer payment data. While many voices need to contribute to a robust dialogue on the future of the credit economy, it seems clear that the most effective solutions will stem from consumer demand and not legislation or regulation. There are over 100 million American consumers who don\'t have access to credit today, either because their credit scores are too low, or because they don\'t have enough credit history. Most of these individuals have never heard of Experian and have little if any idea of what we do. That’s ok. We know the struggles they face and we have some ideas on how we can help make a difference. In many ways we already are and we’re ready to roll up our sleeves to do even more in the future. Millions are counting on us.

I’m pleased to share that Experian has taken another important step in the transformation of our Consumer Services business, having signed an agreement to acquire CSIdentity Corporation (CSID).

Through Experian’s long-standing partnership with the UCI Paul Merage School of Business, I had the pleasure of participating recently in UCI’s Distinguished Speaker Series. I spoke about the role big data plays in today’s economy, and how data is being used as a force for good. My message to the 300+ attendees was clear – big data is everyone’s business. And it’s only going to get bigger. We have 90% more data today than we had just 2 years ago. What will happen in the next 2 years, much less the next 10? As big data gets bigger, how can we use it in even better ways, as a much greater force for good in society? Where we’re headed In the next decade, I predict that: Every single industry – from food service to entertainment to technology to retail – will be using big data in some way. We’re moving quickly in that direction already. A recent Gartner survey found that three-quarters of companies plan to invest in big data over the next 2 years. We’ll be using big data to cure big diseases. I believe we can fully cure cancer and HIV, among others, if we can tap into new insights from wearable technologies and genetic mapping, and put all that data to good use. Big data will help our economy improve. The presidential candidates may argue about the best way to create jobs and increase wealth, but any way you look at it, big data has to be a part of it. The more we can capture trend data on spending patterns and investment returns, the more we can be smart about where we spend our tax dollars, and even how we manage our personal finances. In other words, big data is going to become the backbone of society in ways we least expect today. Sometime in the future, when you go to a museum or an art gallery, big data will make your experience more personal, more customized, and more relevant to your interests. We’re starting to see hints of this now. Think of how you might receive coupons on your phone for cheaper drinks at the ballpark food counter, because your phone realized you were at the game. “But I think we’re going to take this to an even higher level.” Imagine if we could add virtual reality to your experience – so that, when you walk into an art museum, your phone generates a hologram of your favorite artist. Overall, you’ll be getting a lot more value out of your everyday experiences. Some of the best uses of big data will be in the public sector, an area we’re already achieving significant benefits. Right now, big data is helping to improve public services, transportation and land use. Of particular interest these days, big data is helping to protect public safety in large crowds. And it’s helping people at hospitals figure out how to pay for their care, and pinpointing the most cost-effective payment plans. I think opportunities for big data will continue to expand within the public sector. How we get there But this will only happen if we take the right steps now: We all need to keep learning. This is the message I emphasized with the audience at UCI. No matter where you are in your career, it can only help to sharpen your skills in data and insights analysis. There’s more to discover, every day. Develop policies that encourage data-sharing. We can only benefit from big data if we make it easy for companies and governments to exchange the type of information that will ultimately make our world better. We have a tremendous responsibility to help implement policies that support that goal. Look beyond the obvious. Keep thinking of new sources of data and new applications for it. We’ll all benefit from thinking creatively. That’s the focus we’ve been taking at Experian. One example is our DataLabs, where we are using breakthrough experiments to take risks, so we can do good things with data on behalf of our clients. And we think the world will be better in the long run because of it. Watch these video excerpts from this event: Using Big Data For So Much More How is Big Data Helping Entrepreneurs Big Data Hurdles ### Craig Boundy is the CEO of Experian North America