Trends

Global trends

Most consumers (89 percent) agree that credit plays an important role when buying a home or a car but only 73 percent recognize that identity fraud could affect their ability to get loans with favorable interest rates, according to a new survey from Experian Consumer Services. In addition, more than half of big-ticket purchasers fail to check their credit at any point in the buying process, which leads to surprises when it comes time to close the deal. “Identity fraud is real and affects consumers at very important times of life,” said Ken Chaplin, senior vice president of marketing for Experian Consumer Services. “In today’s environment, it’s especially important that consumers check their credit regularly to spot signs of fraud, understand better what affects their credit and make decisions that will help them be in the best position possible when it comes time to buy their dream home or car.”

With less than a month left in the year, what does your to-do list look like? Finish holiday shopping? Jotting down your resolutions for the new year? Or perhaps you plan on heading down to the car dealership to take advantage of the great end of year sale offers. If it’s the latter of the three, you might just be in luck, because it’s a very good time to purchase a new vehicle.

According to Experian Automotive’s Q3 State of Automotive Finance Market report, the average interest rate for a new vehicle loan hit 4.27 percent, down from 4.53 percent a year ago. This marks the lowest rate we have seen, since Experian began publicly reporting the data in 2008.

With less than a month left in the year, what does your to-do list look like? Finish holiday shopping? Jotting down your resolutions for the new year? Or perhaps you plan on heading down to the car dealership to take advantage of the great end of year sale offers. If it’s the latter of the three, you might just be in luck, because it’s a very good time to purchase a new vehicle.

According to Experian Automotive’s Q3 State of Automotive Finance Market report, the average interest rate for a new vehicle loan hit 4.27 percent, down from 4.53 percent a year ago. This marks the lowest rate we have seen, since Experian began publicly reporting the data in 2008.

The past several years have been somewhat of an uphill climb for our country’s economy and this has impacted the default rates for consumer credit. However, now that we’re out of the recession, consumers are managing their credit back to pre-recession levels. In June 2013, the S&P/Experian Consumer Credit Default Indices, a monthly comprehensive measure of changes in consumer credit defaults, showed that default rates have fallen at a national level, as well as, in all four major buckets it tracks including, bankcard, auto, first mortgage and second mortgage. Additionally, the national composite and first mortgage defaults rates hit new post-recessions lows at 1.34 percent and 1.23 percent, respectively.

A recent study conducted by the Governing Institute and commissioned by Experian confirms that government benefit agencies can greatly improve their eligibility verification processes through automated data analytics. Historically, assorted health and human service programs have been compartmentalized, with each benefit agency having its own data collection system, eligibility requirements and program rules. The technology to streamline processing by allowing one agency to match its data against other content repositories, though available, has not been in place. The result has been frequent re-entry of information causing processing delays, slowing response time and increasing manual labor costs. These shortcomings have limited agencies’ ability to detect and combat fraud.

Further evidence of economic recovery throughout the nation, an Experian trends analysis of new mortgages and bankcards from Q1 2013 showed a 16 percent year-over-year increase in mortgage origination volume and a 20 percent increase in bankcard limits. Other insights offered by Experian, include evidence of a strong rebound in the Midwest as well as unprecedented lows in bankcard delinquencies.

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car - huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car - huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

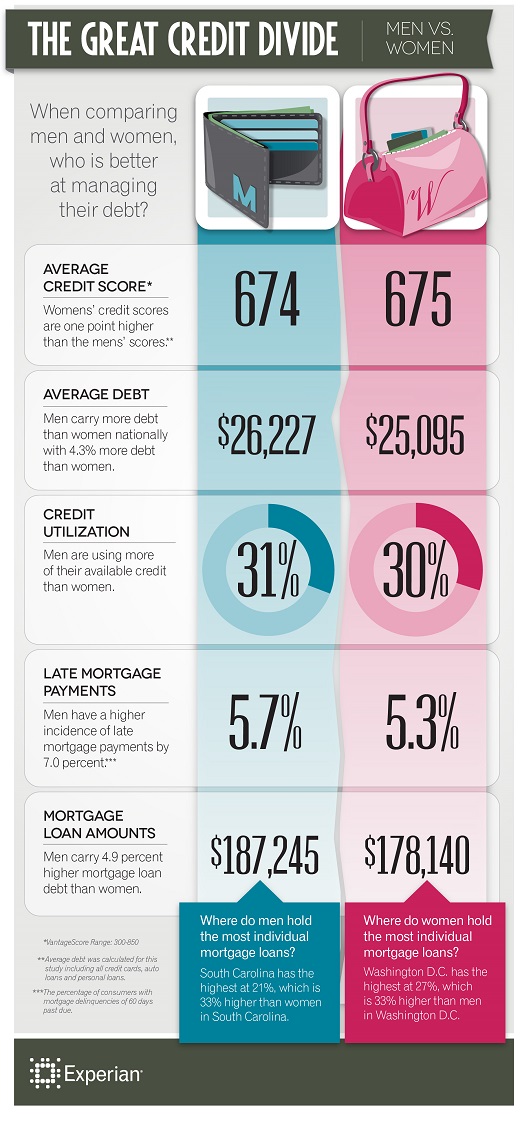

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt.

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt. For the first time, Experian® analyzed credit scores, average debt, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States. While the national credit scores only vary slightly — with a one point difference — other differences between the population of men and women include the following:

- Men have 4.3 percent more debt than women

- Men have a 2 percent higher credit utilization amount

- Mortgage loan amounts for men are 4.9 percent higher

- Men have a higher incidence of late mortgage payments by 7 percent

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.