World

News about Experian from all over the globe:

In the chronicles of business evolution, one often recalls Amazon's humble beginnings as an online book seller before transforming into the e-commerce giant we know today. Reminiscent of that journey, Experian has undergone its own transformation. It has long since ceased to be simply a “credit bureau” and has instead embraced a story that is far more dynamic and which defies this caricature. The Real Experian: When people associate Experian with being a credit bureau, our response is a resounding, “Yes, but that is only a part of our story." It is the beginning chapter—as data evolved to ‘Big Data’, we layered in technology to understand that data, catapulting our company into a different realm. Today, Experian is a global force with a presence in over 30 countries, boasting a team of 22,000 professionals dedicated to harnessing the power of data and analytics for the betterment of businesses, societies, and consumers worldwide. Embracing Data and Analytics: At the core of our story lies a commitment to embrace data and analytics in a way that only Experian can. We collaborate across our operations to deploy advanced technologies, artificial intelligence, and to tap into rich data. The result? A powerful impact on businesses, societies, and consumers alike. Only Experian can: We are proud to share our story of how we power opportunities in a way that only Experian can. Experian leaders worldwide provide a glimpse into what sets Experian apart in the modern landscape of advanced technologies and powerful analytics. You can read the 5-minute story here. Continual Evolution: Experian's evolution from the world's leading credit bureau to a global data and analytics powerhouse is an ongoing journey. Our vision propels us forward, driving us to continually redefine our role in an ever-changing landscape. As Experian continues to evolve, our commitment to making a powerful difference remains unwavering. Our story is one of transformation, innovation, and a relentless pursuit of excellence. Join us on this journey, as we redefine what it means to be a global leader in data and analytics.

Experian celebrates its fifth consecutive year of achieving the highest score in the Human Rights Campaign's Corporate Equality Index (CEI), solidifying our position as a leader in LGBTQ+ workplace inclusion. Our enduring commitment to LGBTQ+ equality and inclusion has not only earned us this prestigious recognition, but also underscores our dedication to fostering a diverse and inclusive workplace where everyone can thrive. Michele Bodda, Executive Sponsor of Experian’s PRIDE ERG said, “I am incredibly proud to see our company achieve this milestone recognition again. It's a testament to the dedication of our entire Experian family in fostering an inclusive and accepting workplace where everyone can be their authentic selves.” LGBTQ+ Workplace Inclusion in ActionOur score of 100 in the 2023 CEI is a testament to our continued efforts in promoting LGBTQ+ workplace inclusion. Here are some of the initiatives that exemplify our commitment: Progressive Benefit Programs: Experian offers comprehensive benefit programs that encompass transgender services and provide equal coverage to same and different-sex domestic partners and spouses. These benefits support the diverse needs of all our employees. Non-Discrimination and Equal Employment Policies: Our non-discrimination and equal employment policies are committed to fairness and respect for all employees, transcending federal requirements and embracing inclusivity without regard to gender identity or sexual orientation. Transgender and Nonbinary Identity Support: We've created a process for transgender and non-binary individuals to update their identity documentation without emotional and financial strain. We also suppress their former names (deadnames) from Experian credit reports. The Power of YOU Initiative: To foster an inclusive work culture, Experian actively supports LGBTQ+ employees through initiatives like the Power of YOU campaign and the PRIDE Employee Resource Group. Check out the 2023 Power of You DEI Report to learn more. Celebrating five consecutive years of earning the highest possible score on the CEI is a milestone that underscores our continued dedication to creating an inclusive work environment where every employee, feels supported, valued, and empowered. For more information on our HRC Award and the 2023 Corporate Equality Index, check out the full report here. You can also learn more about Experian’s awards for our work supporting consumers, businesses, and our employees here.

Experian North America has once again been recognized for its inclusive work environment and corporate culture by The Orange County Register. This marks the 11th straight year that Experian has been named to the list of Top Workplaces. The publication annually surveys employees at hundreds of local businesses to evaluate their respective companies on a variety of criteria. According to the OC Register, we earned the accolade based on a positive company culture and listening to our team. This was highlighted by employees’ response to our collaborative and engaging work environment — one that enables every team member to clearly understand their own personal contribution to the company's mission. By welcoming a wide range of ideas and opinions, we’ve been able to create a favorable environment for employee achievement while continuing to develop new and better ways to serve our clients and benefit consumers. This latest award builds on other recognitions the company has received, including being recognized on Fortune’s list of the “100 Best Companies to Work For.” Great Places to Work, a global authority on workplace culture, has listed Experian as one of the “Best Workplaces for Parents™” and one of the “Best Workplaces for Millennials™” “While business strategy is core to our growth and success, the only way that strategy gets executed is to build a culture that makes workers want to stick around and give their best each day,” said Jennifer Schulz, Experian North America CEO. “I am proud that we are recognized for driving an award-winning culture, while staying true to our growth strategy.”

By the time Vikki Nunnery decided to join the U.S. Army, she was almost finished with her nursing degree. It was her senior year, on the cusp of achieving her Bachelor of Science. A professor piqued her interest in the military. “One of my instructors was an LPN. She deployed and did a presentation about being a nurse in the army. I came in (to the Army) as a registered nurse (RN) and am now a nurse practitioner,” Nunnery said. Now Lieutenant Colonel Nunnery, DNP, is married to a fellow military member, has two children and has been on active duty for 17 years. Between student loans and credit cards, she also accumulated a lot of debt. “We never talked about (money) at home. My family never talked about managing money,” Nunnery said. “Being married with kids, I’m trying to be more financially responsible for the future.” Experian and Operation HOPE are helping Nunnery do just that. She is a client of the expansion of its partnership, which offers new, no-cost dedicated resources specifically for active duty members, veterans and military families across the country. The program provides financial coaching and wellness, credit education and financial disaster preparedness. The unique circumstances of the military community impact their finances more than the general population. A survey shows servicemembers and their spouses have more difficulty paying some monthly bills and finding economic assistance because of overseas deployments and frequent moves, combined with rising inflation. “(This work) is personal. I’ve been working around military communities for over 10 years. I know the challenges,” said Jessica Hamel, financial wellbeing coach for Operation HOPE Inside Experian program. Hamel is a Gold Star sister and military spouse. Her husband’s divorce and her brother’s passing had negative financial impacts on their respective families. “Often with some of our younger soldiers, younger service members, they haven’t had life experience in terms of needing to budget. We have members of the military right now right out of high school and there’s not a lot of experience managing their own money. They’re quickly thrust into a place where they don’t have a support system to do that,” Hamel said. “What we see at some major bases is a lot of predatory financial institutions – payday lenders, title max loans, pawn shops, buy-here-pay-here dealerships.” "We have members of the military right now right out of high school and there’s not a lot of experience managing their own money. They’re quickly thrust into a place where they don’t have a support system to do that." Without a foundation of money management know-how, as service members move up in rank and earn more money, their habits can follow. Hamel stressed the importance of helping clients establish a foundation of knowledge and provide tools to help them address specific financial situations and their future. “Clients know they need to do something different than the way they grew up, but perhaps they grew up in generational poverty and they’re using the military to secure a job immediately, get job experience or support. They can make a great living in the military,” she said. “They don’t know what they don’t know, but they know they don’t have all the right information.” With Hamel’s guidance, Nunnery has set up a budget and developed habits that have led to increased savings, saving for a house, and a bump in credit scores. Hamel is also exploring whether Nunnery qualifies for public school loan forgiveness. The couple is planning to pass on these lessons to their kids, starting with opening their own checking accounts, and teaching them how to save, budget, and the importance of credit scores. “Without Jessica, we’d still be living paycheck to paycheck. I wasn’t paying attention to my accounts. I was just spending and spending,” Nunnery said. “Little things like a budget, where our money is going - she really helps us focus on these things. That’s really good support.” “We have so many people who haven’t learned about credit and then get blamed for a game they never got the rules to,” Hamel said. “I’m honored to be the coach for this program.” For more information about financial coaching and resources for servicemembers, military family or veterans, contact Jessica Hamel at Jessica.hamel@operationhope.org.

Healthcare insurance coverage is a necessity in the U.S. but it’s a complex system to navigate for both providers and patients. At Experian Health, we aim to simplify the administrative and operational sides of healthcare so improving the registration and insurance identification process for providers within the patient access workflow is an important problem we want to help solve. With a myriad of insurers, plans and benefits coverage, along with complexities like multiple levels of coverage some individuals may have, providers have a tough task trying to coalesce all the right information when a patient registers for care in real time – so the searching and querying is often pushed out beyond the registration desk, creating manual rework, denied claims and delays in reimbursements. This downstream impact has been a huge pain point with claims denials contributing to hospitals and medical practices losing more than $200 billion dollars in lost revenue per year. A rejection not only impacts the provider but the patient too. If inaccurate information is submitted to a payer and the claim gets denied, providers don’t get reimbursed and patients could receive bills that they may not be able to pay. We believe technology is the answer to solve many administrative challenges, which led us to acquire Wave HDC, a healthcare company that can deliver a real-time response. Identifying insurance coverage and benefits is a piece to the overall claims puzzle and this workflow has been ripe for improvement with better software. We believe we can now deliver the best solution in the market with this integration. What is Wave HDC’s expertise? Their AI-powered healthcare data curation solutions utilize an “if-then” logic, returning multiple data points required for accurate patient billing from a single inquiry, in real-time (30-45 second processing time), during the registration process. This innovation is a major step forward. No longer is a single response efficient as it pertains to uncovering a patient’s eligibility, coordination of benefits, insurance coverage and beyond. Our acquisition of Wave HHDC transforms the outdated clearinghouse model and will deliver immense benefits to our healthcare providers in the form of more accurate claim submissions and higher reimbursement rates, while also reducing manual work on their administrative teams. In fact, Wave HDC has prevented denials for its clients of over $1 billion dollars since 2020. Reducing claims denials will have a major impact on providers as the industry faces many headwinds including inflation, complex regulations, and constantly changing payer rules that may hurt their financial stability. The issue is only getting worse; a 2022 Experian Health survey revealed that 42 percent of respondents see claims denials increasing and that uptick is between 10-15 percent according to a third of respondents. Additionally, 3 out of 4 survey respondents say reducing denials is the highest priority. We are very excited to tackle this pain point with an advanced solution and welcome the Wave HDC team and these additional capabilities to Experian Health. For more information about Experian Health, visit experian.com/health.

Early in my career, I gained a lot of knowledge about credit. But when I moved to the United States from Brazil, establishing credit was a challenge. I worked part-time in a credit card company call center during college. I come from a humble family, and through helping customers, I learned the ins and outs about credit and money management. But all the solid credit history I built up in my home country didn’t transfer to the U.S. When I immigrated, I had to pay upfront for everything from utilities to a cellphone and it made me feel at a disadvantage. Thanks to Experian Boost®i, our feature that allows you to build credit without debt, and responsible management of debt, my FICO® Scoreii quickly rose to reflect my true creditworthiness. But I’ll never forget how it felt to be invisible when it came to the credit system. Being seen is the first step to equitable access to financial tools. Now that Experian conveniently offers Experian credit reports in Spanish onlineiii, consumers who prefer to access information in Spanish will be able to directly comprehend their credit profile so they can feel empowered. Understanding your credit report is a critical component for your ability to make informed decisions about your finances. As the executive sponsor of our Juntos Employee Resource Group (ERG) and someone who was new to credit in the U.S., I know first-hand that being seen is the first step in a journey towards financial wellness. To help you be informed, Experian also has a Spanish-language credit e-book and articles at the Ask Experian blog. Learn more about my financial health journey and my colleague's through #ExperianStories. i Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. ii Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. iii Only Experian credit reports are available in Spanish. All other services associated with an Experian membership are available in English only. English fluency is required for full access to Experian’s products.

Ball pits, a video game and a neon-pink house might not be what typically comes to mind when you think of our mission of financial inclusion. But that’s some of the ways Experian spent its summer sharing resources and information to empower underserved communities. FINANCIAL INCLUSION AND INNOVATION The mild weather ushered-in summer early in the City of Brotherly Love, where we joined the Allen Iverson Roundball Classic to launch B.A.L.L. (Be A Legacy Leader) for Life. It was our second year as the exclusive financial literacy partner. In partnership with the National Urban League, we introduced this program to the athletes and their families participating in the all-star weekend. We also created a gamified app that enables users to shoot hoops using gesture controls as they learn about credit and financial tools. Experian’s partnership with UnidosUS includes support for its Financial Empowerment Network (FEN), a program, which offers free, individualized, culturally-relevant support to Latino families. Our colleagues shared credit education resources and their journeys to financial health at the national conference. We are… financially fierce! As a proud sustaining Titanium partner of Out & Equal, we brought The House of Experian to this year’s Workplace Summit. Hundreds visited the eye-catching attraction to learn about financial and credit tools. We also led engaging conversations about money matters for the trans community and dove deep into the financial wellness of LGBTQ+ consumers and entrepreneurs. To learn more about the gaps and needs of the community, we’ve launched a financial wellness survey in partnership with Out & Equal. COMMUNITY ADVOCACY The mental health and wellness of our teammates is a priority for Experian, and it was a big topic of panel discussions at the Disability:IN Annual Conference. Empowering Asian American and Pacific Islander (AAPI) professionals is the focus of the annual Ascend Leadership Convention. This year’s theme was “I Ascend,” encouraging participants to share how they navigate and succeed in their careers. At Essence Fest’s National Urban League Women’s Empowerment Luncheon, Victoria Crain, Experian’s vice president of global compliance and governance and co-executive sponsor of our Black Professionals Employee Resource Group, shared keynote remarks about courage and legacy. EMPOWERING THE NEXT GENERATION Building paths towards generational wealth took center stage at the National Urban League Annual Conference. We led a conversation with multigenerational influencers and financial experts on money matters from personal and entrepreneurial lenses, and brought the B.A.L.L. for Life experience to the community. Our support for entrepreneurship extends to the Women of Color and Capital, where we were a returning sponsor and joined a discussion about financial solutions for small business owners. HomeFree-USA closed out our summer by honoring Experian with the 2023 Trailblazer Award and the 2023 CFA Partner of the Year Award. Our innovative program, launched in 2022 in partnership with the Center for Advancement (CFA), trained 250 scholars from Historically Black Colleges and Universities to become knowledge ambassadors about credit, and share what they’ve learned in the program with peers and family. Through events like these, we aim to normalize conversations about credit and make it easier for consumers to access the tools they need for their financial wellness. We are already looking forward to Summer 2024. To learn more about how Experian supports diverse communities, check out www.experian.com/deievents.

Generative A.I. is rapidly transforming every industry as we know it and introduces a whole new world of opportunity and risk. At Experian, we already have many years of experience in machine learning, neural network embedding and artificial intelligence. Because of this, we’re established as a trusted leader in the space and are uniquely positioned to champion the ethical, responsible and compliant use of generative A.I. We manage the risk while advancing the opportunity. This was one of the key themes emerging from a recent panel discussion for Bloomberg’s Intelligent Automation Event in London that I participated in with Thomas Duecke, COO, Digital at BT Group, Marc Palmer, CTO at T-Systems and Amy Thomson, Bloomberg’s EMEA Technology Team Leader. At Experian, we support the responsible use of generative A.I. to accelerate new product offerings, drive operational productivity, increase financial inclusion, and foster an adaptive approach to using the technology. I’m personally very passionate about this as my team is dedicated to creating innovative solutions that enable clients to better automate processes across a variety of use cases including fraud prevention, lending and process optimization. We’re always looking for new data-driven solutions that can create meaningful change for consumers around the world. That’s why our teams are focused on advancements through generative A.I. and identifying use cases across many aspects of our internal operations as well as within our customer-facing portfolio of products and services. We’re encouraged by the opportunities generative A.I. can facilitate when it comes to productivity. It can allow us to automate processes that are mundane or labor-intensive and enable employees to focus more of their time and energy on creative decision making, problem solving, and more effective collaboration. We’ll continue to leverage our expertise and knowledge in broader intelligence fields to uncover the opportunities this next chapter will provide for our business, clients and consumers. Bloomberg Intelligent Automation

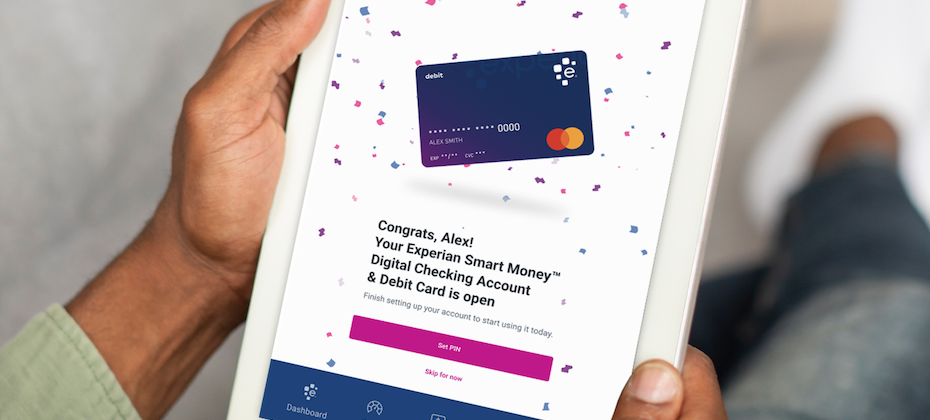

Our mission at Experian Consumer Services to achieve Financial Power for All™ drives our purpose and innovation. As part of this focus, we aim to help the more than 28 million1 consumers who are considered “credit invisible” with no or little credit history to gain fair and affordable access to credit. Continuing in our commitment to financially empower consumers, we are excited to announce today the launch of the Experian Smart Money™ Digital Checking Account & Debit Card2. What makes the Experian Smart Money Account unique is that it takes one of our most successful features ever in Experian Boost®3 to a new level of ease by embedding the feature in our new digital checking account. Experian Boost is a free game-changing feature launched in 2019 that allows consumers to contribute positive payments for eligible bills such as utilities and residential rent to their Experian® credit reports to potentially increase their credit scores. More than 14 million consumers have already connected to Experian Boost - via their existing checking account or credit card - with an average FICO® Score 84 increase of 13 points, among those who saw an increase. Now, the Experian Smart Money Account will drive efficiencies for consumers by allowing them to build credit more easily without debt and manage their day-to-day finances in one place. Helping consumers along their financial journeyWe understand that every consumer has different needs when it comes to their finances. When consumers engage with Experian, they can tap into many resources such as Experian Go™, which allows consumers to directly establish an Experian credit file for the first time and take off on their credit journey. For consumers who already have a credit profile and are looking to build their credit history and potentially increase their credit scores, they can leverage Experian Boost to contribute eligible payment history to their Experian credit file. Now with the Experian Smart Money Account, Experian is building upon these innovations and creating an even more robust credit and financial hub beneficial for various life stages. In fact, being credit visible and establishing a good credit score is essential for achieving many goals like moving into a new home, buying a car or securing employment. The positive impact we can have on consumers’ financial lives is what motivates us every day to create products and tools like the Experian Smart Money Account. Making ‘smart’ money movesWhile Experian is entering a different category of services, offering a digital checking account is a natural next step for us to help consumers reach their financial goals. The Experian Smart Money Account could most benefit consumers who are looking to build their credit profile. So, we believe our credit-building power makes this offering a positive complement to other financial products and services in the market. The Experian Smart Money™ Account accelerates, supports, and enriches consumer choice to build credit responsibly, which has a direct impact on the growth of credit-eligible populations. It benefits both consumers and broader financial institutions, and we are dedicated to playing a special role in the financial ecosystem helping consumers leverage debit and credit to their advantage. For more information about Experian Smart Money™ Account, visit www.experian.com/smartmoney. 1 Financial Inclusion and Access to Credit by Experian and Oliver Wyman, October 2021 2 The Experian Smart Money Debit Card™ is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. 3 Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. 4 Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.