A recent report by the Consumer Financial Protection Bureau (CFPB) found that many people are confused and frustrated about how to check credit reports and scores and they feel they lack information to take action to improve their credit histories.

I have to admit that I was not surprised by some of the survey’s results, and I suspect my colleagues in financial literacy weren’t either. We devote our careers to educating consumers, financial educators and businesses about how to empower people to understand credit and the role it plays in their everyday lives. But it’s a steep uphill climb.

As a new federal agency, the Consumer Financial Protection Bureau is a relative newcomer to the financial literacy arena, but many of the people working in its education division have years of knowledge and experience in the field. I’ve met and worked with a number of them, and I have great respect for the focus they are bringing to such an important issue.

Many others — in the public sector like the Federal Trade Commission, and non-profits like the Mission Asset Fund and the Consumer Federation of America’s America Saves, and companies like Experian — invest in, conduct and work together on programs with the sole focus of helping people become more financially capable.

Together we can make a difference

More than 220 million people have credit histories. We want to help every one of them gain the knowledge they need to make their credit reports and credit scores a powerful financial tool. Experian can’t do that alone.

The good news is that there are many resources and education materials available for people. It takes all of us working together – private companies, non-profit organizations and the public sector – to get those resources into the hands of the people who need them.

We each play a part as an individual consumer, as well. We all need to be actively engaged in seeking information and gaining knowledge. The key to success is simple; as a consumer you need to gain insights and then take action. Each consumer shares the same responsibility as organizations to play an active role in their financial journey and to make understanding their personal finances a priority.

Organizations produce an abundance of tools and information and make it available through a wide range of sources. But they can’t force you to take it. In our digital age there is no excuse for not finding the information. All you have to do is enter “credit advice” in the search box.

It does take effort to be financially well-rounded and successful. It takes time to invest, plan your retirement, manage your budget and understand your credit. But it is time well spent and you can do it!

The challenge: turning insights into action

Experian is committed to turning insights into action. That idea is at the core of everything we do. Over the last two decades, Experian has committed to being the consumer’s bureau and championing consumers to help them improve their credit.

Almost 20 years ago we launched Ask Experian the industry’s first online credit advice column, and it’s still going strong. Now you can join our weekly #CreditChat and engage directly in conversation. Our company also awards financial literacy grants annually.

Experian was one of the founding members of the JumpStart Coalition for Financial Literacy more than 20 years ago. Its primary purpose is to bring together leaders from the public sector, non-profits, private industry and academia to increase consumer financial knowledge — beginning in Kindergarten and continuing through adulthood.

Through an Experian financial education grant, the JumpStart Coalition National Financial Educators Conference was launched six years ago. The first of its kind, high school teachers from across the U.S. attend the conference annually and take back what they learn to their districts, teaching fundamental personal finance skills to their students.

Our company conducts research to spark innovation in products and services which ultimately help the consumer.

Using data for good to spark change

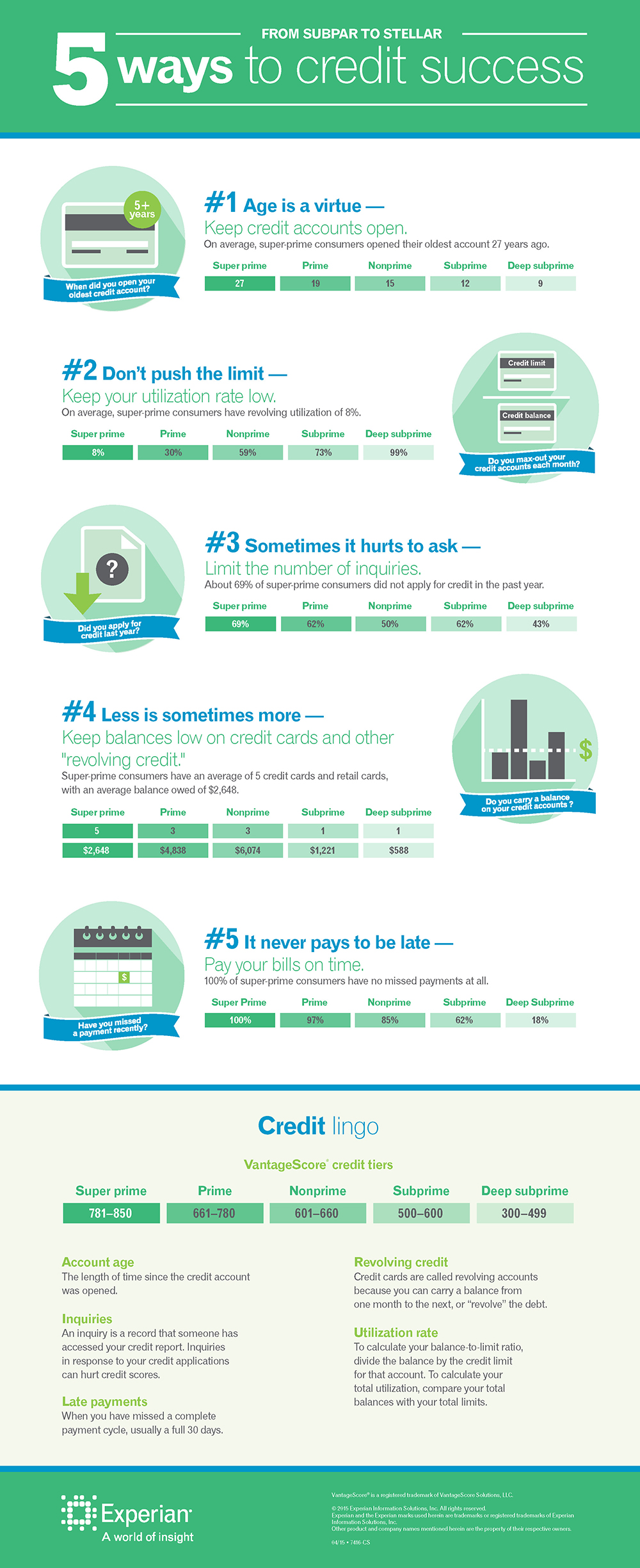

At Experian, we seek every opportunity to highlight how data could be used for good. So, to help get you motivated, Experian analysts compiled data to help clarify the traits of someone with outstanding credit as compared to those who could use a little TLC with their credit histories.

I challenge you to gain insights that will help you take action and improve your financial capability.

1. Make good credit a habit for the long-term. The longer an account is open and active with an on-time payment history, the more it shows you are a good credit risk.

2. Keep your utilization rate low. To calculate your balance-to-limit ratio, divide the balance by the credit limit for that account. To calculate your total utilization compare your total balances to your total limits.

A high utilization rate is a sign that you may be experiencing financial difficulty and is a strong indicator of lending risk. As a result, high utilization hurts credit scores and can cause lenders to be reluctant to extend additional credit.

3. Limit the number of inquiries. An inquiry is a record that your credit report was accessed in response to an application you submitted. Inquiries provide insight into your financial situation that the rest of the report may not.

The primary reason inquiries influence credit scores is that they indicate you may have acquired new debt that does not yet appear on your report. Additionally, multiple applications within a short period of time may be a sign that you are having financial difficulties and are seeking credit to stay afloat, or to live beyond your means.

Lenders want to be sure you are not in danger of over extending yourself before agreeing to extend additional credit.

4. Keep balances low on credit cards and other “revolving credit.” High outstanding debt can affect a credit score.

5. Pay your bills on time. Delinquent payments and collections can have a major negative impact on a credit score.

To help raise your credit IQ, visit our Ask Experian column, join our #creditchat or tweet us at @Experian_US to tell us how you are tackling our credit challenge!