sdfsad sddfs sdfsdf sdsf sd sfsdfsdf s

asdf sa dsdfdsf ds dsf sdfsdf sdfsd sdf

In this article…

![5 Tips to Avoid a Financial “Burn” On Your Summer Getaway [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

Summer officially arrives on June 21. The busiest travel season of the year is on the horizon, and freecreditscore.com™ wants to help travelers mitigate post-vacation credit debt that can impact their credit long after a vacation ends. Here are five tips to avoid the pitfalls of a post-vacation credit sunburn:

Further evidence of economic recovery throughout the nation, an Experian trends analysis of new mortgages and bankcards from Q1 2013 showed a 16 percent year-over-year increase in mortgage origination volume and a 20 percent increase in bankcard limits. Other insights offered by Experian, include evidence of a strong rebound in the Midwest as well as unprecedented lows in bankcard delinquencies.

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car – huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car – huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Consumers are can now be notified when their personal information is being used in an authentication transaction, allowing them to assess whether or not they recognize and expect their identity to be in review by a business. The service enables consumers to respond to the notification, and in cases of potential fraud, to be directed to seamless and effective resolution assistance.

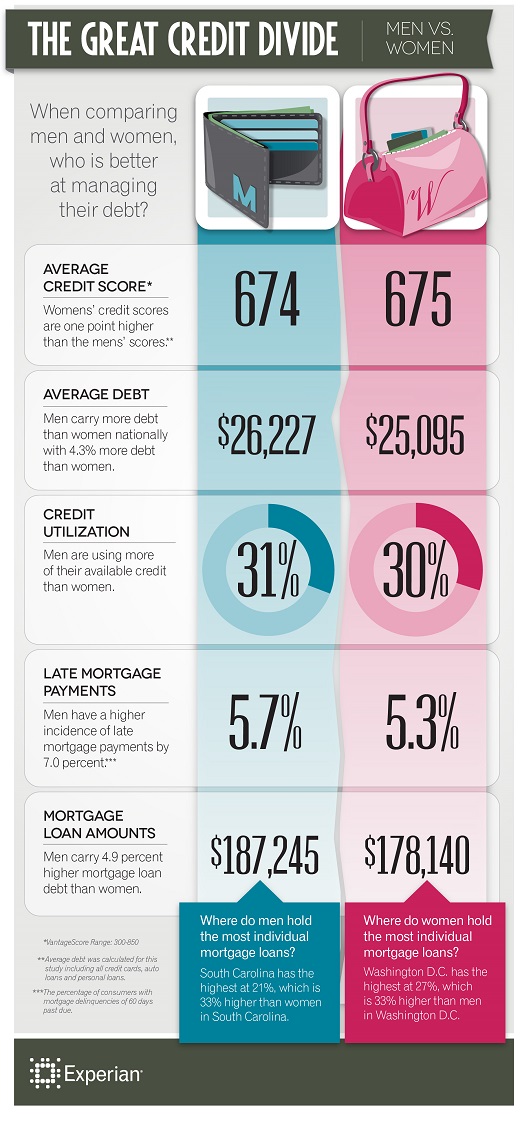

![The Great Credit Divide: Men vs. Women [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt.

test