Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

On September 28 in New York City, Experian and Cloudera Cares hosted a panel discussion about how Big Data can be used in a variety of ways as a force of good. The panel included Adam Fingersh, Senior Vice President, Products and Marketing for Experian, Mike Olson, Co-founder, CSO and Chairman of the Board at Cloudera; Board Member at DataKind, Dr. Richard Bonneau, Associate Professor of Biology, Computer Science and Faculty Director of Bioinformatics, New York University; Ph.D. in Biochemistry and Vlad Dubovskiy, Data Scientist, DonorsChoose.org.

Experian is a finalist in the category of “Data-Driven Transformation” for the launch and deployment of the Experian Marketing Suite. During the last two years, Experian made transformational decisions about their marketing portfolio to unify offerings in data, technology and services into a single platform that allows marketers to create rewarding and relevant customer experiences in any channel via any device. This transformation culminated in July 2014 with the launch of the Experian Marketing Suite, a cloud-based marketing platform that leverages Experian’s customer identity and recognition technology, consumer data (the largest in the world), analytics and interaction technology.

Experian is a finalist in the category of “Data-Driven Transformation” for the launch and deployment of the Experian Marketing Suite. During the last two years, Experian made transformational decisions about their marketing portfolio to unify offerings in data, technology and services into a single platform that allows marketers to create rewarding and relevant customer experiences in any channel via any device. This transformation culminated in July 2014 with the launch of the Experian Marketing Suite, a cloud-based marketing platform that leverages Experian’s customer identity and recognition technology, consumer data (the largest in the world), analytics and interaction technology.

Since Henry Ford invented the assembly line and mass automotive production began, the primary objective of all manufacturers and dealers has been to move new vehicle inventory off the lot year after year. But nowadays finding the right automotive customer can be a challenging task. Where do they live? How old are they? How much do they make? By leveraging data to answer these questions, manufacturers can market to the appropriate audience and manage inventory accordingly.

Since Henry Ford invented the assembly line and mass automotive production began, the primary objective of all manufacturers and dealers has been to move new vehicle inventory off the lot year after year. But nowadays finding the right automotive customer can be a challenging task. Where do they live? How old are they? How much do they make? By leveraging data to answer these questions, manufacturers can market to the appropriate audience and manage inventory accordingly.

There is no doubt data breaches have become a part of the Corporate and consumer consciousness. As data breaches have become more prevalent and companies are in need of assistance to prepare for and respond to a breach, industry analysts have taken notice of the experts in the marketplace like Experian. In its first report on data breach services, we are proud to have been named as a leader in The Forrester Wave™: Customer Data Breach Notification And Response Services, Q3 2015.

Financing my first car was a bittersweet feeling. I was thrilled at the thought of purchasing a new vehicle, yet I was dreading haggling the price with the dealer. As a millennial, I feared the rising prices for new cars, and knew that I needed to find a way to make the vehicle more affordable. That said, I decided to look at used cars.

Clearly, I’m not the only car shopper going through this experience. Many consumers are exploring new options to keep their monthly payments down, whether it’s extending the length of their loan, or turning to leases. Sometimes it’s both.

Financing my first car was a bittersweet feeling. I was thrilled at the thought of purchasing a new vehicle, yet I was dreading haggling the price with the dealer. As a millennial, I feared the rising prices for new cars, and knew that I needed to find a way to make the vehicle more affordable. That said, I decided to look at used cars.

Clearly, I’m not the only car shopper going through this experience. Many consumers are exploring new options to keep their monthly payments down, whether it’s extending the length of their loan, or turning to leases. Sometimes it’s both.

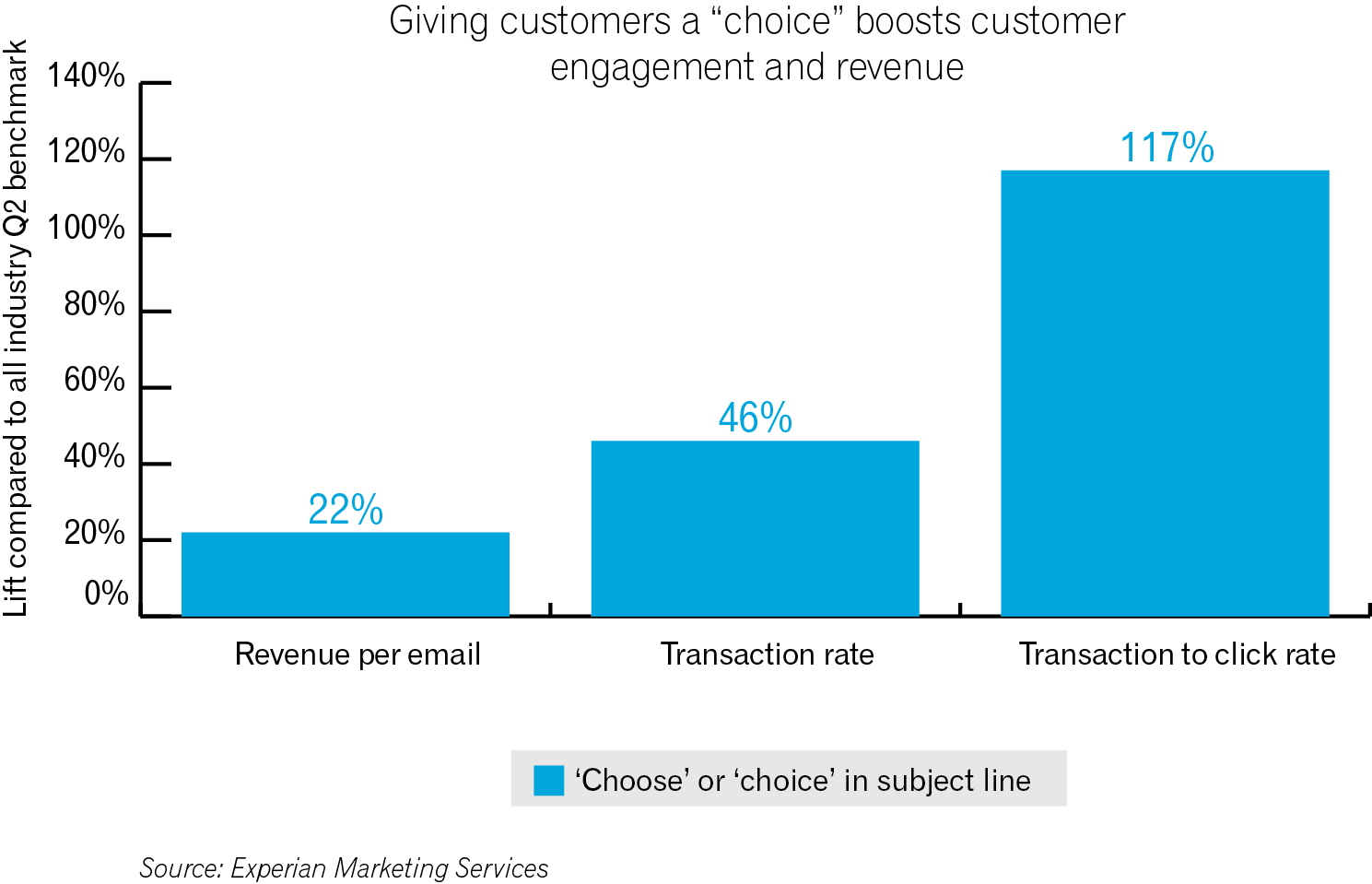

New research from Experian Marketing Services, a recognized leader in data-driven marketing and cloud-based marketing technology, shows that email campaigns using the words “choice” or “choose” in the subject line are driving substantially higher engagement and revenue rates than average.

New research from Experian Marketing Services, a recognized leader in data-driven marketing and cloud-based marketing technology, shows that email campaigns using the words “choice” or “choose” in the subject line are driving substantially higher engagement and revenue rates than average.

Forbes Magazine recently named Experian among the top 100 innovative companies in the world for the second year in a row.

Forbes has a rigorous selection methodology that places an emphasis on what organizations’ investors see as the most innovative today, but also the companies that investors believe will continue to be the most innovative in the future; Forbes calls this methodology the Innovation Premium. Put simply, it’s the expectation that a company will launch new products and services and enter new markets to generate growth.

Forbes Magazine recently named Experian among the top 100 innovative companies in the world for the second year in a row.

Forbes has a rigorous selection methodology that places an emphasis on what organizations’ investors see as the most innovative today, but also the companies that investors believe will continue to be the most innovative in the future; Forbes calls this methodology the Innovation Premium. Put simply, it’s the expectation that a company will launch new products and services and enter new markets to generate growth.

On July 16, the CFPB published its “first ever” monthly report providing a snapshot of complaints filed by consumers through the agency’s complaint portal. For full disclosure, Experian is one of the top three companies that received the most complaints from February through April 2015. But that is absolutely deceiving.

Financier Worldwide moderates a discussion on improving decision-making and increasing value using Big Data analytics between Shanji Xiong at Experian DataLabs, Ken Elliott at HP and Shaheen Dil at Protiviti. FW: To what extent are you seeing an increased demand for Big Data analytics in today’s business environment? What overarching advantages does it offer to companies? Dil: Many organisations have made fundamental investments in Big Data infrastructures and capabilities and are now actively exploring the best ways to achieve return on these investments.