Business Credit Education

articles and videos about business credit education

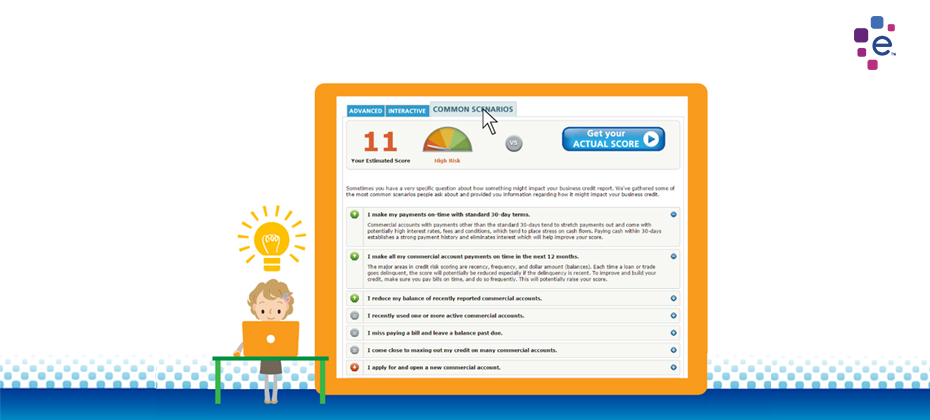

Experian has released a business credit score planner tool to help you run what-if scenarios. It helps you learn behaviors that build strong credit.

According to the Kauffman Foundation Index of Startup Activity, only 0.31 percent of U.S. adults ever starts a business. That's 310 people out of every 100,000. That's a shocking statistic for a country of 325 million people. In fact, new business starts have been in a slow, steady decline since the late 70's. Source: Kauffman Foundation In 2015, just over 600,000 new businesses were established in the United States. These businesses created 3 million jobs, and because the average new business had roughly 4.5 employees, almost all fit the profile of an american small business. In a July hearing by the House Committee on Small Business titled "Reversing the Entrepreneurship Decline", Representative Steve Chabod of Ohio, and ranking member Nydia M. Velazquez of New York, along with members of the house panel, set out to understand why the number of startups is declining by hearing testimony from leading experts on the subject of entreprenurship to identify possible solutions. The panel of experts included Dr. Gregory Crawford, President of Miami University's Farmer's School of Business, who told how Miami gets students involved with local startups by maintaining a permanent presence at Cintrifuse in Cincinnati. Cintrifuse is a start-up catalyst, a public/private partnership that exists to build a sustainable tech-based economy for the Greater Cincinnati region. Also, through the San Francisco Digital Innovation Program, which enables students to spend entire semesters living in Silicon Valley. Four days a week, they are in an apprenticeship at a start-up. Like any nascent entrepreneur, they do everything from ideation to product development to cleaning up the office at the end of the day. It must be working, Forbes recently wrote an article titled "Why Ohio Is The Best State in America To Launch a Startup" featuring two Miami graduates who went on to found OROS Apparel. Karen Kerrigan, President of the Small Business and Entrepreneurship Council cited several trends uncovered in a Gap Analysis study by SBE Chief Economist, Raymond J. Keating. The study found that over the course of the last decade, the economy has developed a gap of roughly 3.7 million businesses, businesses which would have existed, if only people had started them. Joe Schocken, CEO of Broadmart Capital spoke about the effects of globalization and automation. The economy is struggling to absorb the impacts of automation and globalization, and now sees companies disappearing at a faster rate than new companies are forming. A recent study by Forrester Research projects that automation and robotics will displace nearly 25 million jobs, or 17 percent of the workforce by 2027, and cause a net job loss of 9.8 million. During her opening remarks, Representative Velazques pointed out "in New York, nearly half the small businesses are owned by immigrants, and nationally, immigrants make up approximately 30 percent of new entrepreneurs." Nationally, more than half of the startups valued at $1 billion or more were founded by immigrants, and more needs to be done to foster entrepreneurship Access to capital was a constant during this hearing, being mentioned several times as a leading barrier to success in stimulating growth in startup creation. New businesses must spend a great deal of time and energy on finding capital, rather than executing their business plans, and too often this capital is simply unavailable. The problem is particularly pronounced for traditionally disadvantaged demographics such as women and minorities. Representative Velazquez cited one study which noted if minorities started businesses at same rate as non-minorities we would have 1 million additional employers, generating 9.5 million more jobs for our local economy. In recent years there has been a decline in the number of venture firms. Remaining firms have focused their efforts on a few key states. Since the 2008 recession, 50 percent of new businesses have originated in 20 of 3,100 counties scattered across the United States. In California, venture funds increased as a percentage of total U.S. fundraising from 57 percent in 2015 to 66 percent in 2016. More needs to be done in reaching entrepreneurs in other parts of the country. The panel focused on several areas where Government could help, answering questions and offering suggestions. Karen Kerrigan said regulatory relief, tax reform and improving access to capital were key areas where reform could help. An enrepreneur's first touch with regulation mostly begins at the local and state level where they are met with licensing, zoning, registration, fees and other regulations that are often burdensome and costly for starting a business. She also said our tax code needs to be internationally competitive and designed to encourage growth. Growth breeds confidence, optimism and entrepreneurial opportunity. By improving access to capital by relieving community banks of unneeded regulation, and modernizing and streamlining an array of Security and Exchange Commission rules and compliance requirements, small businesses and entrepreneurs will have a wider array of financing options in addition to new ways to finance their venture such as crowdfunding. Mr Schocken offered several ideas focused on streamlining equity crowdfunding, removing barriers and restrictive regulations and also improving inter-agency cooperation on globalization and automation saying, most of the jobs that will replace jobs lost to automation would likely come from small business, so the formation of a special commission focused on the innovation economy would be a great idea. You can watch the full video of the "Reversing the Entrepreneurship Decline" house panel session below.

Business credit scores are vitally important to small businesses. In today’s competitive market, a faulty credit score can dramatically affect the bottom line of any business and can lead to higher interest rates, difficulty in securing loans, and potential problems with suppliers. Conversely, favorable credit history can serve as the linchpin to success. It not only can save a small-business owner a considerable amount of money, but it also can provide access to capital with which to grow the business. So, let’s do a quick review of some common business credit misconceptions. If I have a small business, I automatically have a small-business credit score. FALSE. If a business doesn’t have at least one tradeline and/or one demographic element (such as length of time the business has been credit active, how many employees, etc.), then a credit report and score are not generated. To establish a business credit score, you should ensure that your business vendors are reporting your payment history to the major credit reporting companies. This will help to build your commercial credit profile. There are no drawbacks to using my personal credit score, rather than a business credit score, when attempting to secure funding. FALSE. It’s true that many small-business owners fail to separate their business expenses from their personal expenses. However, the weakness of relying solely on personal credit is clear. If your business ever becomes at risk, your personal credit score becomes at risk as well. Anyone can request and view my business credit score. This is TRUE. Unlike personal credit reports, which are regulated and can be viewed only with the permission of the report holder, business credit reports are available to the public. This means that anyone — including potential lenders and suppliers — can openly view your business’s credit report. Given the public availability of business credit reports, it’s imperative to monitor your business credit score. There are things I can do to improve my business credit score. TRUE. It’s vitally important to be aware of possible inaccuracies or negative credit data on your credit file, should they exist. As the business owner, you may request that the credit reporting companies correct any mistakes to ensure that your credit file is accurate. By simply increasing your awareness of the factors that drive your current company credit score, you can begin to effectively manage your credit behavior. As always, the best thing that you can do is pay all financial obligations on time.

Good credit is the lifeline of your business. Sure, it's a must for obtaining funding for launching or expanding your business. But that's only the beginning. So, here are just a few of the many benefits of building and maintaining a good business credit score. First, it can save you money. Lenders offer better interest rates to businesses with good credit.You can obtain business credit without the need for a personal guarantee. And this reduces your personal liability and protects your personal assets.It can help you stay ahead of your competition. You can pass your interest savings onto your customers or keep a larger margin of profit for yourself.You can make decisions with confidence and get the money you need, which can reduce stress on you and your company. Bottom line. A good credit report and score are essential for getting the money you need to successfully run and grow your business. Business Credit Advantage Enrollment in Experian's Business Credit Advantage unlimited access and monitoring service is the best way to manage and grow your business credit. Unlimited access to your business credit report gives you the tools you need to manage and grow your credit score. And, automatic email alerts provide you the monitoring tools to watch your credit file for any inquires or derogatory filings. For more information on business credit resources, plus articles and tips on this subject, go to BusinessCreditFacts.com.