How to Improve Your Credit Score

Quick Answer

The steps you take to improve your credit score will depend on your unique credit profile. In general, it's important to understand the factors that influence your score, including your payment history, amounts owed, length of credit history, credit mix and new credit.

There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. But depending on your unique situation, it can be difficult to know where to start.

Whether you're building credit from scratch or rebuilding after some credit missteps, understanding the factors that go into your credit score can help you determine which steps to take. With that in mind, here are seven ways to improve your credit score, how much impact they'll have and how long it can take to start seeing results.

1. Make On-Time Payments

Credit impact: Your debt payment history accounts for 35% of your FICO® ScoreΘ and is the most important credit scoring factor. Payment history includes on-time, late and missed payments, all of which are reported to one or more of the national consumer credit bureaus (Experian, TransUnion and Equifax). Always making payments on time can go the furthest to helping you improve credit.

Actions you can take: If you're having trouble making payments on time, set up autopay for at least the minimum due and create calendar reminders and alerts through your online account. You can also register for Experian Boost®ø and get credit for payments that aren't traditionally reported to the credit bureaus, including eligible rent, utilities, cellphone, insurance and some streaming subscriptions. Adding these payments could instantly increase your credit scores powered by Experian.

How long it takes: You may see a steady rise in your score as you pay your bills on time. If you make a payment over 30 days late, it will remain on your credit report for seven years and hurt your scores, but that negative impact will diminish over time as you get caught up and pay on time going forward.

Learn more: How to Improve Your Payment History

2. Pay Down Revolving Account Balances

Credit impact: How much you owe accounts for 30% of your FICO® Score, and your credit utilization rate—the percentage of available credit you're using on revolving credit accounts such as credit cards—is a major element. While some experts recommend keeping your utilization rate below 30%, there's no hard-and-fast rule. Aim to keep it as low as possible.

Actions you can take: If you have one or more high credit card balances, make paying them off a priority. Consider different ways to pay down your credit card debt, including a:

- Debt repayment strategy, such as the debt snowball or avalanche method

- Debt consolidation loan

- Balance transfer credit card

- Debt management plan

If you regularly pay your credit card bill in full but still have a high utilization rate due to low credit limits, consider paying your bill shortly before your monthly statement date or making multiple payments to keep your balance low throughout the month.

How long it takes: Credit card issuers typically report balance and payment information to the credit bureaus once a month. So, as you pay down your credit card debt, you may start to see the results of your efforts within a few months.

Learn more: How to Pay Off Credit Card Debt

3. Don't Close Your Oldest Account

Credit impact: When you close a credit card account, you immediately lose that card's available credit, which could increase your credit utilization rate and hurt your scores. Additionally, length of credit history makes up 15% of your FICO® Score and is heavily influenced by the age of your oldest and newest accounts and the average age of all of your accounts. While loan accounts are typically closed once you pay off the debt, you can keep credit cards open indefinitely.

Closing a credit card can hurt your credit score, especially if it's one of your only revolving credit accounts. That's because you lose the available credit line, which is an important factor in your credit utilization ratio. If you close the card in good standing (no late payments), that card's payment history will stay on your credit report for 10 years; however, you'll lose the available credit immediately.

Actions you can take: Even if you no longer use your oldest credit card, consider using it every few months or putting a small recurring bill on the card to keep it active. If the card no longer serves your needs or charges an annual fee, check with your card issuer to see if you can upgrade or downgrade the card to one that's a better fit. This may allow you to keep the credit history but switch to a card that works better for you.

How long it takes: If your oldest credit card is also one of your only credit cards and has a high credit limit, it could impact your scores quickly—especially if you carry high balances on your other cards. Also, while it will take a while for the card to fall off your credit report, you're still eventually losing a card that shows a long credit history, which could end up hurting your credit.

Learn more: How Does Length of Credit History Affect Your Credit?

4. Diversify the Types of Credit You Have

Credit impact: Credit mix accounts for 10% of your FICO® Score and involves managing different types of credit. For example, someone with two credit cards, an auto loan and a mortgage loan will have a stronger credit mix than someone with just one credit card.

Note that your credit mix generally won't be a major factor in determining your eligibility for a loan or credit card, but it can help take a good credit score to the next level.

Actions you can take: Your credit mix will likely improve naturally over time as you apply for different types of credit to meet your financial needs. If you're just starting to establish your credit history, it can help to apply for a starter credit card and a credit-builder loan.

Once you get going, however, try to avoid taking on more debt than is necessary just for the sake of building credit.

How long it takes: Because your credit mix has a smaller influence on your credit score, there's no need to rush. Diversifying your credit mix can take several years as you apply for new credit accounts when you need them.

Learn more: What Is Credit Mix and How Can It Help Your Credit Score?

5. Limit New Credit Applications

Credit impact: Virtually every time you apply for credit, the lender will run a hard inquiry on one or more of your credit reports. These inquiries and how long it's been since you've opened a new account make up 10% of your FICO® Score.

Each hard inquiry will typically knock fewer than five points off your credit score, but multiple inquiries in a short period of time, especially when applying for credit cards, could have a compounding negative effect.

Actions you can take: Only apply for credit when you need it to avoid too many hard inquiries. Before you apply for a loan or credit card, check to see if the lender offers prequalification, which can give you an idea of your eligibility and potential terms with a soft credit check, which won't impact your credit score.

If you're shopping around for a mortgage loan, auto loan or student loan, newer FICO® Score versions will combine multiple inquiries into one for scoring purposes as long as you complete the rate-shopping process within a short timeframe, often between 14 and 45 days depending on the version used.

How long it takes: Hard inquiries remain on your credit reports for up to two years, but they only impact your FICO® Score for up to one year.

Learn more: Hard Inquiry vs. Soft Inquiry: What's the Difference?

6. Dispute Inaccurate Information on Your Credit Report

Credit impact: Inaccurate credit report information can have a significant negative impact on your credit score, especially if it's a serious issue like a late payment or a high credit card balance. If you're a victim of identity theft, you may have multiple derogatory marks on your credit reports in the form of fraudulent accounts.

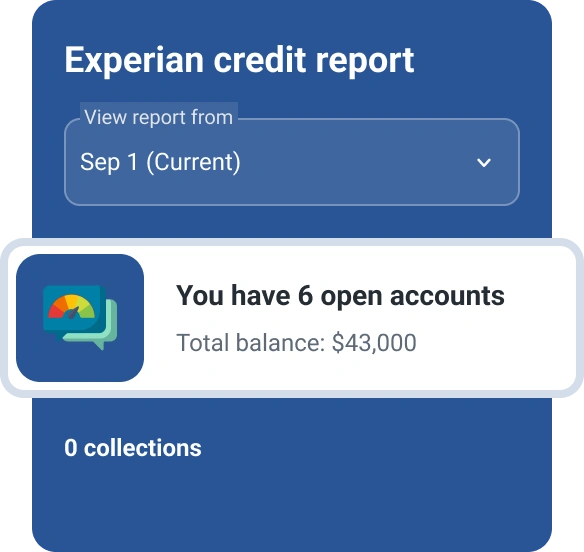

Actions you can take: If you have inaccurate or fraudulent information on your credit reports, you have the right to dispute it with the credit reporting agencies. Start by getting your free Experian credit report, and request your free weekly Equifax and TransUnion credit reports through AnnualCreditReport.com.

Review your reports for any information you don't recognize. If you find inaccurate details, follow the dispute process with Experian and the other credit bureaus to initiate an investigation.

How long it takes: Credit disputes are typically resolved within 30 days. If the credit bureau determines that your dispute is valid, it will correct or remove the negative information.

Learn more: How to Dispute Credit Report Information

7. Become an Authorized User

Credit impact: If you're new to credit or rebuilding your credit score, having a financially responsible loved one add you as an authorized user on their credit card can have an immediate positive impact on your credit score.

That said, the impact can vary depending on how the credit card is managed and the overall makeup of your credit profile.

Actions you can take: Ask a parent or other loved one to add you as an authorized user on their account. Before you do, however, make sure that the account has a positive payment history and a relatively low credit utilization rate.

How long it takes: Once you're added as an authorized user, the card issuer will typically report the full history of the account to the credit bureaus within a month or two.

Learn more: Will Being an Authorized User Help My Credit?

Frequently Asked Questions

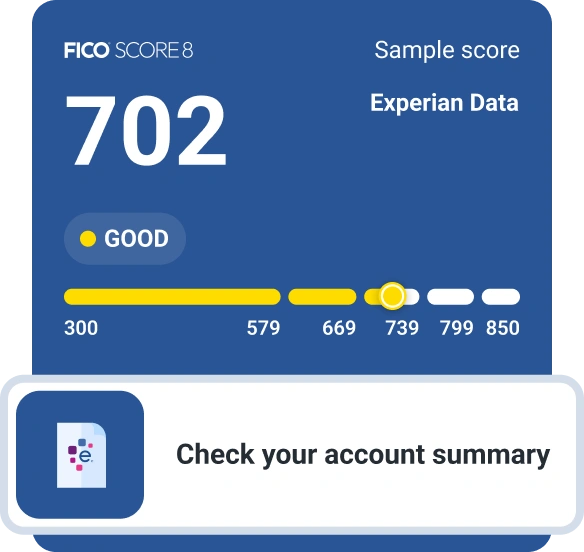

Check Your Credit Score for Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben