Market Trends

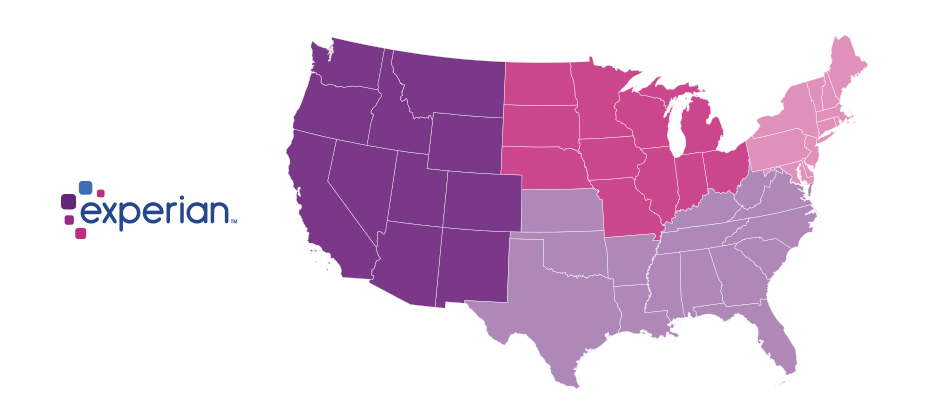

Where are electric vehicles most popular? During the first half of the year, 3.6 percent of all new registrations in California were EVs.

In 2011, data scientists and credit risk managers finally found an appropriate analogy to explain what we do for a living. “You know Moneyball? What Paul DePodesta and Billy Beane did for the Oakland A’s, I do for XYZ Bank.” You probably remember the story: Oakland had to squeeze the most value out of its limited budget for hiring free agents, so it used analytics — the new baseball “sabermetrics” created by Bill James — to make data-driven decisions that were counterintuitive to the experienced scouts. Michael Lewis told the story in a book that was an incredible bestseller and led to a hit movie. The year after the movie was made, Harvard Business Review declared that data science was “the sexiest job of the 21st century.” Coincidence? The importance of data Moneyball emphasized the recognition, through sabermetrics, that certain players’ abilities had been undervalued. In Travis Sawchik’s bestseller Big Data Baseball: Math, Miracles, and the End of a 20-Year Losing Streak, he notes that the analysis would not have been possible without the data. Early visionaries, including John Dewan, began collecting baseball data at games all over the country in a volunteer program called Project Scoresheet. Eventually they were collecting a million data points per season. In a similar fashion, credit data pioneers, such as TRW’s Simon Ramo, began systematically compiling basic credit information into credit files in the 1960s. Recognizing that data quality is the key to insights and decision-making and responding to the demand for objective data, Dewan formed two companies — Sports Team Analysis and Tracking Systems (STATS) and Baseball Info Solutions (BIS). It seems quaint now, but those companies collected and cleaned data using a small army of video scouts with stopwatches. Now data is collected in real time using systems from Pitch F/X and the radar tracking system Statcast to provide insights that were never possible before. It’s hard to find a news article about Game 1 of this year’s World Series that doesn’t discuss the launch angle or exit velocity of Eduardo Núñez’s home run, but just a couple of years ago, neither statistic was even measured. Teams use proprietary biometric data to keep players healthy for games. Even neurological monitoring promises to provide new insights and may lead to changes in the game. Similarly, lenders are finding that so-called “nontraditional data” can open up credit to consumers who might have been unable to borrow money in the past. This includes nontraditional Fair Credit Reporting Act (FCRA)–compliant data on recurring payments such as rent and utilities, checking and savings transactions, and payments to alternative lenders like payday and short-term loans. Newer fintech lenders are innovating constantly — using permissioned, behavioral and social data to make it easier for their customers to open accounts and borrow money. Similarly, some modern banks use techniques that go far beyond passwords and even multifactor authentication to verify their customers’ identities online. For example, identifying consumers through their mobile device can improve the user experience greatly. Some lenders are even using behavioral biometrics to improve their online and mobile customer service practices. Continuously improving analytics Bill James and his colleagues developed a statistic called wins above replacement (WAR) that summarized the value of a player as a single number. WAR was never intended to be a perfect summary of a player’s value, but it’s very convenient to have a single number to rank players. Using the same mindset, early credit risk managers developed credit scores that summarized applicants’ risk based on their credit history at a single point in time. Just as WAR is only one measure of a player’s abilities, good credit managers understand that a traditional credit score is an imperfect summary of a borrower’s credit history. Newer scores, such as VantageScore® credit scores, are based on a broader view of applicants’ credit history, such as credit attributes that reflect how their financial situation has changed over time. More sophisticated financial institutions, though, don’t rely on a single score. They use a variety of data attributes and scores in their lending strategies. Just a few years ago, simply using data to choose players was a novel idea. Now new measures such as defense-independent pitching statistics drive changes on the field. Sabermetrics, once defined as the application of statistical analysis to evaluate and compare the performance of individual players, has evolved to be much more comprehensive. It now encompasses the statistical study of nearly all in-game baseball activities. A wide variety of data-driven decisions Sabermetrics began being used for recruiting players in the 1980’s. Today it’s used on the field as well as in the back office. Big Data Baseball gives the example of the “Ted Williams shift,” a defensive technique that was seldom used between 1950 and 2010. In the world after Moneyball, it has become ubiquitous. Likewise, pitchers alter their arm positions and velocity based on data — not only to throw more strikes, but also to prevent injuries. Similarly, when credit scores were first introduced, they were used only in originations. Lenders established a credit score cutoff that was appropriate for their risk appetite and used it for approving and declining applications. Now lenders are using Experian’s advanced analytics in a variety of ways that the credit scoring pioneers might never have imagined: Improving the account opening experience — for example, by reducing friction online Detecting identity theft and synthetic identities Anticipating bust-out activity and other first-party fraud Issuing the right offer to each prescreened customer Optimizing interest rates Reviewing and adjusting credit lines Optimizing collections Analytics is no substitute for wisdom Data scientists like those at Experian remind me that in banking, as in baseball, predictive analytics is never perfect. What keeps finance so interesting is the inherent unpredictability of the economy and human behavior. Likewise, the play on the field determines who wins each ball game: anything can happen. Rob Neyer’s book Power Ball: Anatomy of a Modern Baseball Game quotes the Houston Astros director of decision sciences: “Sometimes it’s just about reminding yourself that you’re not so smart.”

While electric vehicles remain a relatively niche part of the market, with only 0.9 percent of the total vehicle registrations through June 2018, consumer demand has grown quite significantly over the past few years. As I mentioned in a previous blog post, electric vehicles held just 0.5 percent in 2016. Undoubtedly, manufacturers and retailers will look to capitalize on this growing segment of the population. But, it’s not enough to just dig into the sales number. If the automotive industry really wants to position itself for success, it’s important to understand the consumers most interested in electric vehicles. This level of data can help manufacturers and retailers make the right decisions and improve the bottom line. Based on our vehicle registration data, below is detailed look into the electric vehicle consumer. Home Value Somewhat unsurprisingly, the people most likely to purchase an electric vehicle tend to own more expensive homes. Consumers with homes valued between $450,000-$749,000 made up 25 percent of electric vehicle market share. And, as home values increase, these consumers still make up a significant portion of electric vehicle market. More than 15 percent of the electric vehicle market share was made up by those with homes valued between $750,000-$999,000, and 22.5 percent of the share was made up by those with home values of more than $1 million. In fact, consumers with home values of more than $1 million are 5.9 times more likely to purchase an electric vehicle than the general population. Education Level Breaking down consumers by education level shows another distinct pattern. Individuals with a graduate degree are two times more likely to own an electric vehicle. Those with graduate degrees made up 28 percent of electric vehicle market share, compared to those with no college education, which made up just 11 percent. Consumer Lifestyle Segmentation Diving deeper into the lifestyles of individuals, we leveraged our Mosaic® USA consumer lifestyle segmentation system, which classifies every household and neighborhood in the U.S. into 71 unique types and 19 overachieving groups. Findings show American Royalty, who are described as wealthy, influential couples and families living in prestigious suburbs, led the way with a 17.8 percent share. Following them were Silver Sophisticates at 11.9 percent. Those in this category are described as mature couples and singles living an upscale lifestyle in suburban homes. Rounding out the top three were Cosmopolitan Achiever, described as affluent middle-aged and established couples and families who enjoy a dynamic lifestyle in metro areas. Their share was 10.1 percent. If manufacturers and retailers go beyond just the sales figures, a clearer picture of the electric vehicle market begins to form. They have an opportunity to understand that wealthier, more established individuals with higher levels of education and home values are much more likely to purchase electric vehicles. While these characteristics are consistent, the different segments represent a dynamic group of people who share similarities, but are still at different stages in life, leading different lifestyles and have different needs. As time wears on, the electric vehicle segment is poised for growth. If the industry wants to maximize its potential, they need to leverage data and insights to help make the right decisions and adapt to the evolving marketplace.

This is an exciting time to work in big data analytics. Here at Experian, we have more than 2 petabytes of data in the United States alone. In the past few years, because of high data volume, more computing power and the availability of open-source code algorithms, my colleagues and I have watched excitedly as more and more companies are getting into machine learning. We’ve observed the growth of competition sites like Kaggle, open-source code sharing sites like GitHub and various machine learning (ML) data repositories. We’ve noticed that on Kaggle, two algorithms win over and over at supervised learning competitions: If the data is well-structured, teams that use Gradient Boosting Machines (GBM) seem to win. For unstructured data, teams that use neural networks win pretty often. Modeling is both an art and a science. Those winning teams tend to be good at what the machine learning people call feature generation and what we credit scoring people called attribute generation. We have nearly 1,000 expert data scientists in more than 12 countries, many of whom are experts in traditional consumer risk models — techniques such as linear regression, logistic regression, survival analysis, CART (classification and regression trees) and CHAID analysis. So naturally I’ve thought about how GBM could apply in our world. Credit scoring is not quite like a machine learning contest. We have to be sure our decisions are fair and explainable and that any scoring algorithm will generalize to new customer populations and stay stable over time. Increasingly, clients are sending us their data to see what we could do with newer machine learning techniques. We combine their data with our bureau data and even third-party data, we use our world-class attributes and develop custom attributes, and we see what comes out. It’s fun — like getting paid to enter a Kaggle competition! For one financial institution, GBM armed with our patented attributes found a nearly 5 percent lift in KS when compared with traditional statistics. At Experian, we use Extreme Gradient Boosting (XGBoost) implementation of GBM that, out of the box, has regularization features we use to prevent overfitting. But it’s missing some features that we and our clients count on in risk scoring. Our Experian DataLabs team worked with our Decision Analytics team to figure out how to make it work in the real world. We found answers for a couple of important issues: Monotonicity — Risk managers count on the ability to impose what we call monotonicity. In application scoring, applications with better attribute values should score as lower risk than applications with worse values. For example, if consumer Adrienne has fewer delinquent accounts on her credit report than consumer Bill, all other things being equal, Adrienne’s machine learning score should indicate lower risk than Bill’s score. Explainability — We were able to adapt a fairly standard “Adverse Action” methodology from logistic regression to work with GBM. There has been enough enthusiasm around our results that we’ve just turned it into a standard benchmarking service. We help clients appreciate the potential for these new machine learning algorithms by evaluating them on their own data. Over time, the acceptance and use of machine learning techniques will become commonplace among model developers as well as internal validation groups and regulators. Whether you’re a data scientist looking for a cool place to work or a risk manager who wants help evaluating the latest techniques, check out our weekly data science video chats and podcasts.

Electric vehicles are here to stay – and will likely gain market share as costs reduce, travel ranges increase and charging infrastructure grows.

Vehicle prices are going up, yet consumers seem unfazed. Despite consumers taking out larger loan amounts, they continue to make their monthly payments on time. But, affordability remains a point of industry interest. As vehicle prices hit record highs, how long will consumers have an appetite for them? According to Experian’s latest State of Automotive Finance Market report, delinquency rates continued a downward trend, as 30- and 60-day delinquencies were 2.11 and 0.64 percent, respectively, at the end of Q2. Those numbers demonstrate that car owners are making timely payments despite rising vehicle costs, which is an encouraging sign for the market. The average loan amount for a new vehicle is now $30,958, a $724 increase from last year. Additionally, consumers are now making monthly payments of about $525 on a new car loan, an all-time high that has seen a $20 year over year increase. The auto market shows little to no sign of declining costs, but vehicles aren’t the only cost to consider – interest rates have increased by 56 basis points since last year. When combined with the rising manufacturer costs, long-term affordability is a continued concern within the industry. The data points to consumers offsetting the expense by taking out longer loan terms. In Q2, the most common loan length was 72 months—which equates to six years—for both new and used financing. While this lowers the monthly payment, it leaves them subject to paying higher interest over time, as well as the potential for individuals to be upside down on their loan for a longer period of time. The key takeaway from this data is that costs continue to rise, but consumers appear to be doing a better job of managing their finances. This insight can help OEMs, dealers, and lenders make strategic decisions with a better understanding of consumer borrowing and credit habits, and think about how to make car ownership more inviting, through incentive or loyalty programs. For consumers, continuing to take steps to actively improve your credit score is one of the key ways to ensure that you’re able to negotiate the right deal when it comes to financing. Ultimately, for everyone involved, it comes down to leveraging the power of data to make more informed decisions, which can help make vehicle ownership more accessible and affordable. To learn more about the State of the Automotive Finance Market report, or to watch the webinar, click here.

Big Data is no longer a new concept. Once thought to be an overhyped buzzword, it now underpins and drives billions in dollars of revenue across nearly every industry. But there are still companies who are not fully leveraging the value of their big data and that’s a big problem. In a recent study, Experian and Forrester surveyed nearly 600 business executives in charge of enterprise risk, analytics, customer data and fraud management. The results were surprising: while 78% of organizations said they have made recent investments in advanced analytics, like the proverbial strategic plan sitting in a binder on a shelf, only 29% felt they were successfully using these investments to combine data sources to gather more insights. Moreover, 40% of respondents said they still rely on instinct and subjectivity when making decisions. While gut feeling and industry experience should be a part of your decision-making process, without data and models to verify or challenge your assumptions, you’re taking a big risk with bigger operations budgets and revenue targets. Meanwhile, customer habits and demands are quickly evolving beyond a fundamental level. The proliferation of mobile and online environments are driving a paradigm shift to omnichannel banking in the financial sector and with it, an expectation for a customized but also digitized customer experience. Financial institutions have to be ready to respond to and anticipate these changes to not only gain new customers but also retain current customers. Moreover, you can bet that your competition is already thinking about how they can respond to this shift and better leverage their data and analytics for increased customer acquisition and engagement, share of wallet and overall reach. According to a recent Accenture study, 79% of enterprise executives agree that companies that fail to embrace big data will lose their competitive position and could face extinction. What are you doing to help solve the business problem around big data and stay competitive in your company?

Last Updated: January 2019 Traditional credit data has long been the end-all-be-all ruling the financial services space. Like the staple black suit or that little black dress in your closet, it’s been the quintessential go-to for decades. Sure, the financial industry has some seasonality, but traditional credit data has reigned supreme as the reliable pillar. It’s dependable. And for a long time, it’s all there was to the equation. But as with finance, fashion and all things – evolution has occurred. Specifically, how consumers are managing their money has evolved, which calls for deeper insights that are still defensible and disputable. Alternative credit data is the new black. Alternative credit data is increasingly integrated in credit talks for lenders across the country. Much like that LBD, it is becoming a lending staple – that closet (or portfolio) must-have – to leverage for better decisioning when determining credit worthiness. So, what is alternative credit data? In our data-driven industry, “alternative” data as a whole may best be summed up as FCRA-compliant credit data that is not typically included in traditional credit reports. For traditional data, think loan and inquiry data on bankcards, auto, mortgage and personal loans; typically trades with a term of 12 months or greater. Some examples of alternative credit data include alternative financial services data, rental data, full-file public records and account aggregation. These insights can ultimately improve credit access and decisioning for millions of consumers who may otherwise be overlooked. Alternative or not, every bit of information counts – and consumers are willing to share this data. An Experian survey revealed that 70% of consumers are willing to provide additional financial information to a lender if it increases their chance for approval or improves their interest rate for a mortgage or car loan. In addition, the data also revealed that 71% of lenders believe consumers will increasingly allow access to their data for lending decisions if they are empowered to turn it on and off. FCRA-compliant, user permissioned data allows lenders to easily verify assets and income electronically without consumer permission, thereby giving lenders more confidence in their decision and allowing consumers to gain access to lower-cost financing. From a risk management perspective, alternative credit data can also help identify riskier consumers, by identifying information like the number of payday loans acquired within a year, number of first-payment defaults, number of inquiries within the past 30-90 days and overall stability of an applicant. Alternative credit data can give supplemental insight into a consumer’s stability, ability and willingness to repay that is not available on a traditional credit report that can help lenders avoid risk or price accordingly. From closet finds that refresh your look to that LBD, alternative credit data gives lenders more transparency into their consumers, and gives consumers seeking credit a greater foundation to help their case for creditworthiness. It really is this season’s – and every season’s – must-have. Get Started Today

The August 2018 LinkedIn Workforce Report states some interesting facts about data science and the current workforce in the United States. Demand for data scientists is off the charts, but there is a data science skills shortage in almost every U.S. city — particularly in the New York, San Francisco and Los Angeles areas. Nationally, there is a shortage of more than 150,000 people with data science skills. One way companies in financial services and other industries have coped with the skills gap in analytics is by using outside vendors. A 2017 Dun & Bradstreet and Forbes survey reported that 27 percent of respondents cited a skills gap as a major obstacle to their data and analytics efforts. Outsourcing data science work makes it easier to scale up and scale down as needs arise. But surprisingly, more than half of respondents said the third-party work was superior to their in-house analytics. At Experian, we have participated in quite a few outsourced analytics projects. Here are a few of the lessons we’ve learned along the way: Manage expectations: Everyone has their own management style, but to be successful, you must be proactively involved in managing the partnership with your provider. Doing so will keep them aligned with your objectives and prevent quality degradation or cost increases as you become more tied to them. Communication: Creating open and honest communication between executive management and your resource partner is key. You need to be able to discuss what is working well and what isn’t. This will help to ensure your partner has a thorough understanding of your goals and objectives and will properly manage any bumps in the road. Help external resources feel like a part of the team: When you’re working with external resources, either offshore or onshore, they are typically in an alternate location. This can make them feel like they aren’t a part of the team and therefore not directly tied to the business goals of the project. To help bridge the gap, performing regular status meetings via video conference can help everyone feel like a part of the team. Within these meetings, providing information on the goals and objectives of the project is key. This way, they can hear the message directly from you, which will make them feel more involved and provide a clear understanding of what they need to do to be successful. Being able to put faces to names, as well as having direct communication with you, will help external employees feel included. Drive engagement through recognition programs: Research has shown that employees are more engaged in their work when they receive recognition for their efforts. While you may not be able to provide a monetary award, recognition is still a big driver for engagement. It can be as simple as recognizing a job well done during your video conference meetings, providing certificates of excellence or sending a simple thank-you card to those who are performing well. Either way, taking the extra time to make your external workforce feel appreciated will produce engaged resources that will help drive your business goals forward. Industry training: Your external resources may have the necessary skills needed to perform the job successfully, but they may not have specific industry knowledge geared towards your business. Work with your partner to determine where they have expertise and where you can work together to providing training. Ensure your external workforce will have a solid understanding of the business line they will be supporting. If you’ve decided to augment your staff for your next big project, Experian® can help. Our Analytics on DemandTM service provides senior-level analysts, either onshore or offshore, who can help with analytical data science and modeling work for your organization.

Trivia question: Millennials don’t purchase new vehicles. True or False?

Alternative credit data. Enhanced digital credit marketing. Faster, integrated decisioning. Fraud and identity protections. The latest in technology innovation. These were the themes Craig Boundy, Experian’s CEO of North America, imparted to an audience of 800-plus Vision guests on Monday morning. “Technology, innovation and new sources of data are fusing to create an unprecedented number of new ways to solve pressing business challenges,” said Boundy. “We’re leveraging the power of data to help people and businesses thrive in the digital economy.” Main stage product demos took the shape of dark web scans, data visualization, and the latest in biometric fraud scanning. Additionally, a diverse group of breakout sessions showcased all-new technology solutions and telling stats about how the economy is faring in 2018, as well as consumer credit trends and preferences. A few interesting storylines of the day … Regulatory Under the Trump administration, everyone is talking about deregulation, but how far will the pendulum swing? Experian Sr. Director of Regulatory Affairs Liz Oesterle told audience members that Congress will likely pass a bill within the next few days, offering relief to small and mid-sized banks and credit unions. Under the new regulations, these smaller players will no longer have to hold as much capital to cover losses on their balance sheets, nor will they be required to have plans in place to be safely dismantled if they fail. That trigger, now set at $50 billion in assets, is expected to rise to $250 billion. Fraud Alex Lintner, Experian’s President of Consumer Information Services, reported there were 16.7 million identity theft victims in 2017, resulting in $16.8 billion in losses. Need more to fear? There is also a reported 323k new malware samples found each day. Multiple sessions touched on evolving best practices in authentication, which are quickly shifting to biometrics-based solutions. Personal identifiable information (PII) must be strengthened. Driver’s licenses, social security numbers, date of birth – these formats are no longer enough. Get ready for eye scans, as well as voice and photo recognition. Emerging Consumers The quest to understand the up-and-coming Millennials continues. Several noteworthy stats: 42% of Millennials said they would conduct more online transactions if there weren’t so many security hurdles to overcome. So, while businesses and lenders are trying to do more to authenticate and strengthen security, it’s a delicate balance for Millennials who still expect an easy and turnkey customer experience. Gen Z, also known as Centennials, are now the largest generation with 28% of the population. While they are just coming onto the credit scene, these digital natives will shape the credit scene for decades to come. More than ever, think mobile-first. And consider this … it's estimated that 25% of shopping malls will be closed within five years. Gen Z isn’t shopping the mall scene. Retail is changing rapidly! Economy Mortgage originations are trending up. Consumer confidence, investor confidence, interest rates and home sales are all positive. Unemployment remains low. Bankcard originations have now surpassed the 2007 peak. Experian’s Vice President of Analytics Michele Raneri had glowing remarks on the U.S. economy, with all signs pointing to a positive 2018 across the board. Small business loan volumes are also up 10% year-to-date versus the same time last year. Keynote presenters speculate there could be three to four rate hikes within the year, but after years of no hikes, it’s time. Data There are 2.5 quintillion pieces of data created daily. And 80% of what we know about a consumer today is the result of data generated within the past year. While there is no denying there is a LOT of data, presenters throughout the day talked about the importance of access and speed. Value comes with more APIs to seamlessly connect, as well as data visualization solutions like Tableau to make the data easier to understand. More Vision news to come. Gain insights and news throughout the day by following #ExperianVision on Twitter.

Hispanics are not only the fastest growing minority in the United States, but according to the Hispanic Wealth Project’s (HWP) 2017 State of Hispanic Homeownership Report, they would prefer to own a home rather than rent. Hispanic Millennials—who are entering their home-buying years—are particularly eager for homeownership. This group is educated, are entrepreneurs and business owners that over index on mobile use, and 9 of 10 say wanting to own a home is part of their Hispanic DNA. For them, it’s not a matter of if but when and how they will become homeowners. An optimistic outlook is also a trait of Hispanic Millennials, who generally are more positive about the future than the average Millennial. They are also confident in their ability to handle different types of tasks that are part of their day-to-day lives. And at 35 percent, the share of bilingual Hispanic Millennials with a household income of $100,000 or more is consistent with U.S. Millennials as a whole Homeownership challenges Yet, despite their optimism and goal of homeownership, Hispanic homeownership at 46.2 percent lags when compared to the overall U.S. home ownership rate of 63.9 percent in 2017. There are signs the gap could narrow; Hispanics are the only demographic to have increased their rate of homeownership for the past three years. Moreover, the report shows Hispanics are responsible for 46.5 percent of net U.S. homeownership gains since 2000. Still, the 2017 State of Hispanic Homeownership Report notes that a shortage of affordable housing, prolonged natural disasters in states with a significant Hispanic presence (California, Florida, Texas), and uncertainty over immigration policy could hinder Hispanic homeownership growth. An opportunity to reach Hispanics It seems most Hispanic Millennials will strive for homeownership at some point in their life, as they believe owning a home is best for their family’s future. With no convincing needed, there is a tremendous opportunity for mortgage providers to look deeper into the reasons behind Hispanic Millennials’ optimism to determine how to insert themselves into that dynamic. Research highlights the importance of creating interest in financial advice and making this a potential means of gaining trust. Hispanic Millennials who gain a better understanding of the benefits—not only for them but for generations to come—and costs of owning a home may translate their confidence into action.

With 16.7 million reported victims of identity fraud in 2017 (that’s 6.64 percent of the U.S. population), it was another record year for the number of fraud victims. And as online and mobile transaction growth continued to significantly outpace brick-and-mortar growth, criminal attacks also grew rapidly. This past year, we saw an increase of more than 30 percent in e-commerce fraud attacks compared with 2016. As we’ve done over the past three years, Experian® analyzed millions of online transactions to identify fraud attack rates for both shipping and billing locations across the United States. We looked at several data points, including geography and IP address, to help businesses better understand how and where fraud is being perpetrated so they can better protect against it. The 2017 e-commerce fraud attack rate analysis shows: Delaware and Oregon continue to be the riskiest states for both billing and shipping fraud. Delaware; Oregon; Washington, D.C.; Florida; and Georgia are the top five riskiest states for billing fraud. Delaware, Oregon, Florida, New York and California are the top five riskiest states for shipping fraud, accounting for 50 percent of total fraud attacks. South El Monte, Calif., is the riskiest city overall, with an increase in shipping fraud of approximately 230 percent. Shipping fraud most often occurs near major airports and seaports due to reshippers and freight forwarders that receive domestic goods and often send them overseas. When a transaction originates from an international IP address, shipping fraud is 6.7 times likelier than the average, while billing fraud becomes 7.1 times likelier. Where is e-commerce fraud happening? Typically, the highest-risk areas for fraud are in ZIP™ codes and cities near large ports of entry or airports. These are ideal locations to reship fraudulent merchandise, enabling criminals to move stolen goods more effectively. Top 10 riskiest billing ZIP™ codes Top 10 riskiest shipping ZIP™ codes 97252 Portland, OR 97079 Beaverton, OR 33198 Miami, FL 33122 Miami, FL 33166 Miami, FL 91733 South El Monte, CA 33122 Miami, FL 97251 Portland, OR 77060 Houston, TX 97250 Portland, OR 33195 Miami, FL 33166 Miami, FL 97250 Portland, OR 97252 Portland, OR 97251 Portland, OR 33198 Miami, FL 33191 Miami, FL 33195 Miami, FL 97253 Portland, OR 33192 Miami, FL Source: Experian.com Source: Experian.com What’s more, many of the riskiest ZIP™ codes and cities experience a high volume of transactions originating from international IP addresses. In fact, the top 10 riskiest ZIP codes overall tend to experience fraudulent activity from numerous countries overseas, including China, Venezuela, Taiwan and Hong Kong, and Argentina. These fraudsters tend to implement complex fraud schemes that can cost businesses millions of dollars in fraud losses. Additionally, the analysis shows that traffic coming from a proxy server — which could originate from domestic and international IP addresses — is 74 times riskier than the average transaction. The problem The increase in e-commerce fraud attacks shouldn’t come as a huge surprise. The uptick in data breaches, merchants’ continued adoption of EMV-enabled terminals to protect against counterfeit card fraud and the abundance of consumer data on the dark web means that information is even more accessible to criminals. This enables them to open fraudulent accounts, take over legitimate accounts and submit fraudulent transactions. Another reason for the increase is automation. In the past, criminals needed a strong understanding of fraud methods and technology, but they can now bring down an entire organization by simply downloading a file and automating the submission of thousands of applications or transactions simultaneously. Since fraudsters need to make these transactions appear as normal as possible, they often leverage the cardholder’s actual billing details with slight differences, such as e-mail address or shipping location. Unfortunately, the mass availability of compromised data and the abundance of fraudsters makes it increasingly challenging to identify and separate legitimate customers from attackers across the country. Because of the widespread prevalence of fraud and data compromises, we don’t see billing fraud concentrated in just one region of the country. In fact, the top five states for billing fraud make up only about 18 percent of overall fraud attacks. Top 5 riskiest billing fraud states Top 5 riskiest shipping fraud states State Fraud attack rate State Fraud attack rate Delaware 93.4 Delaware 195.9 Oregon 86.1 Oregon 170.1 Washington, D.C. 46.5 Florida 45.1 Florida 39.2 New York 37.3 Georgia 31.5 California 32.6 Source: Experian.com Source: Experian.com Prevention and protection need to be the priority As businesses get a better understanding of how and where fraud is perpetrated, they can implement proactive strategies to detect and prevent attacks, as well as protect payment information. While no one single strategy can address the entire scope of fraud, there are advanced data sets and technology — such as device intelligence, behavioral and physical biometrics, document verification and entity resolution — that can help businesses make better fraud decisions. Fortunately, consumers can also play a major role in safeguarding their information. In addition to regularly checking their credit reports and bank/credit card statements for fraudulent activity, consumers can limit the data they share on social networking sites, where attackers often begin when perpetrating identity fraud. While we continue to help both organizations and consumers limit their exposure to e-commerce fraud, we anticipate that criminals will attempt more sophisticated fraud schemes. But businesses can stay ahead of the curve. This comes down to having a keen understanding of how fraud is being perpetrated, as well as leveraging data, technology and multiple layered strategies to better recognize legitimate customers and make more precise fraud decisions. View our e-commerce fraud heat map and download the top 100 riskiest ZIP codes in the United States. Experian is a nonexclusive full-service provider licensee of the United States Postal Service®. The following trademark is owned by the United States Postal Service®: ZIP. The price for Experian’s services is not established, controlled or approved by the United States Postal Service.

Millions of Americans placed a credit freeze or restricted access to their credit file in recent months to keep identity thieves at bay. Credit freezes keep any new creditors from seeing a consumer’s credit file, which makes it nearly impossible for hackers to open new accounts fraudulently. But a credit freeze can also be problematic for consumers when they are finally ready to consider new credit products and loans. We’ve heard from credit unions and other lenders about sharing best practices to help streamline the process for consumers who want to permanently or temporarily lift the freeze to apply for a legitimate line of credit. Following are the three ways to help clients with a frozen Experian report quickly and efficiently allow access. Unfreeze account: This will remove the freeze entirely from the consumer’s credit report so that it may be accessed with the consumer’s permission. To do this, the consumer will need to contact Experian online, by phone or mail and provide his unique personal identification number (PIN) code—provided when the consumer froze his account—to un-freeze the report. Thaw account: An action that will temporarily remove the freeze for a timeframe determined by the consumer. The consumer should contact Experian online, by phone, or mail and provide his unique PIN code to thaw the report. Grant a creditor one-time access: A consumer may provide a different/temporary PIN to a lender to access the report just once. The PIN can be emailed to the consumer, presented on screen if the consumer is online, or provided on the phone or by mail. Typically, a consumer’s request to thaw or un-freeze his credit file online or by phone will thaw or un-freeze the file within minutes. Download Checklist Experian can be reached: Online: www.experian.com/freeze Phone: 888-397-3742 Mail: P.O. Box 9554, Allen, Texas 75013 Remember, if a consumer has a frozen credit file with all three credit reporting agencies, he will need to contact each agency to enable access to his report.

I recently sat down with Kathleen Peters, SVP and Head of Fraud and Identity, to discuss the state of fraud and identity, the pace of change in the space and her recent inclusion in the Top 100 influencers in Identity by One World Identity. ----------- Traci: Congratulations on being included on the Top 100 influencers list. What a nice honor. Kathleen: Yes, thank you. It is a nice honor and inspiring to be included among some great innovators in the industry. The list includes entrepreneurs to leaders of large organizations like us. It’s a nice mix across all facets of identity. T: Tell me about your role. How long have you been at Experian? K: I lead the team that defines the product strategy for our global fraud and ID portfolio. I’ve been with Experian just over four years, joining soon after we acquired 41st Parameter®. T: What was your first job? K: My first job out of college was with Motorola in Chicago. I was an electrical engineer, working on advanced cellphone technology. T: They were not able to keep up with the market? K: The entire industry was caught by the introduction of the iPhone. All the major cellphone companies were impacted — Nokia, Ericsson, Siemens and others. Talk about disrupting an industry. T: Yeah. These are great examples of how the disrupters have taken out the initial companies. Certainly, Motorola, Nokia, those companies. Even RIM Blackberry, which redefined the digital or cellular space, has all but disappeared. K: Yes, exactly. It was interesting to watch RIM Blackberry when they disrupted Motorola’s pager business. Motorola had a very robust pager line. Even then they had a two-way pager with a keyboard. They just missed the idea of mobile email completely. It’s really, really fascinating to look back now. T: Changing the subject a little, what motivates you to get out of bed in the morning? K: One of my favorite questions. I’m a very purpose-driven person. One of the things I really like about my role and one of the reasons I came to Experian in the first place is that I could see this huge potential within the company to combine offline and online identity information and transaction information to better recognize people and stop fraud. T: What do you see as the biggest threat to organizations today? K: I would have to say the pace of change. As we were just talking about, major industries can be disrupted seemingly overnight. We’re in the midst of a real digital transformation in how we live, how we work, how we share information and even how we share money. The threat to companies is twofold. One is the “friendly fire” threat, like the pace of change, disrupters to the market, new ways of doing things and keeping pace with that innovation. The second threat is that with digitization comes new types of security and fraud risks. Today, organizations need to be ever-vigilant about their security. T: How do you stay ahead of that pace of change? K: Well, my husband and I have lived in Silicon Valley since 1997. Technology and innovation are all around us. We read about it and we hear about it in the news. We engage with our neighbors and other people who we meet socially and within our networks. You can’t help but be immersed in it all the time. It certainly influences the way we go about our lives and how we think and act and engage as a family. We’re all technically curious. We have two kids, and our neighborhood high school, Homestead High, is the same high school Steve Jobs went to. It’s fun that way. T: Definitely. What are some of the most effective ways for businesses to combat the threat of fraud? K: I firmly believe that nowadays it all needs to start with identity. What we’ve found — and confirmed through research in our recent Global Fraud Report, plus conversations I’ve had with clients and analysts — is that if you can better recognize someone, you’ll go a long way to prevent fraud. And it does more than prevent fraud; it provides a better experience for the people you’re engaged with. Because once you recognize an individual, that initiates a trusted relationship between the two of you. Once people feel they’re in a trusted relationship, whether it’s a social relationship or a financial transaction, whatever the relationship is — once you feel trusted, you feel safe, you feel protected. And you’re more likely to want to engage again in the future. I believe the best thing organizations can do is take a multilayered approach to authenticating and identifying people upfront. There are so many ways to do this digitally without disrupting the consumer, and this is the best opportunity for businesses. If we collectively get that right, we’ll stop fraud. T: What are some of the things Experian is focusing on to help businesses stop fraud? K: We’ve focused on our CrossCore® platform. CrossCore is a common access and decisioning capability platform that allows the combining and layering of many different approaches — some active, some passive — to identify a customer in a transaction. You can incorporate things like biometrics and behavioral attributes. You can incorporate digital information about the device you’re engaging with. You can layer in online and offline identity information, like that from our Precise ID® product. CrossCore also enables you to layer in other digital attributes and alternative data such as email address, phone number and the validity of that phone number. CrossCore provides a great opportunity for us to showcase innovation, whether that comes from a third-party partner or even from our own Experian DataLabs. T: How significant do you see machine learning moving forward? K: Machine learning, it has all kinds of names, right? I think of machine learning, artificial intelligence, data robotics, parallel computing — all these things are related to what we used to call big data processing, but that’s not really the trendy term anymore. The point is that there is so much data today. There’s a wealth of data from all different sources, and as a society we’re producing it in exponential volumes. Having more and more and more data is not useful if you can’t derive insights from it. That’s why machine learning, augmented with human intervention or direction, is the best way forward, because there’s so much data out there available in the world now. No matter what problem we’re trying to solve, there’s a wealth of data we can amass, but we need to make sense of it. And the way to make sense of massive amounts of data in a reasonable amount of time is by using some sort of artificial intelligence, or machine learning. We’re going to see it in all kinds of applications. We already are today. So, while I think of machine learning as a generic term, I do think it’s going to be with us for a while to quickly compute and derive meaningful insights from the massive amounts of data all around us. T: Thanks, okay. Last question, and I hope a little fun. How would you describe yourself in one word? K: Curious. T: Ah, that’s a good choice. K: I am always curious. That’s why I love living where I live. It’s why I like working in technology. I’ve always wondered how things work, how we might improve on them, what’s under the hood. Why people make the decisions they do. How does someone come up with this? I’m always curious. T: Well, thank you for the time, and congrats again on being included in the Top 100 influencers in Identity.